Analyzing The U.S. Dollar's Trajectory: Potential For A Repeat Of Nixon's Early Presidency

Table of Contents

Nixon Shock Parallels: A Historical Overview

The Nixon Shock of 1971 marked a pivotal moment in global monetary history. President Nixon closed the gold window, ending the Bretton Woods system which pegged the U.S. dollar to gold. This action led to the devaluation of the dollar and ushered in an era of floating exchange rates. Several key economic conditions preceded this dramatic shift. High inflation, fueled by increased government spending (partly due to the Vietnam War) and expansionary monetary policies, eroded the dollar's purchasing power. Simultaneously, growing U.S. trade deficits and a loss of confidence in the dollar's stability contributed to the pressure on the Bretton Woods system. The collapse of this fixed exchange rate system ultimately led to increased global economic uncertainty and volatility.

Current Economic Indicators Mirroring the 1970s:

Are we seeing a repeat of the 1970s? Several current economic indicators bear a striking resemblance to those preceding the Nixon Shock.

-

High Inflation and Potential Stagflation: Current inflation rates in many countries, including the U.S., are at multi-decade highs. The risk of stagflation – a combination of high inflation and slow economic growth – is a significant concern, mirroring the economic landscape of the early 1970s. The Consumer Price Index (CPI) in [insert year] reached [insert percentage], a level not seen since [insert year and percentage]. (Source: [cite reputable source, e.g., Bureau of Labor Statistics])

-

Rising National Debt and Budget Deficits: The U.S. national debt continues to climb, placing a strain on the nation's finances and potentially weakening the dollar. The debt-to-GDP ratio in [insert year] was [insert percentage], compared to [insert percentage] in [insert year from the early 1970s]. (Source: [cite reputable source, e.g., Congressional Budget Office])

-

Geopolitical Instability and its Impact on Global Trade: The war in Ukraine has significantly disrupted global supply chains, leading to higher energy prices and contributing to inflationary pressures. This geopolitical instability mirrors the Cold War tensions that contributed to economic uncertainty in the 1970s.

- The impact of the war in Ukraine on energy prices is evident in the soaring cost of oil and natural gas.

- Supply chain disruptions have led to shortages of various goods, further fueling inflation.

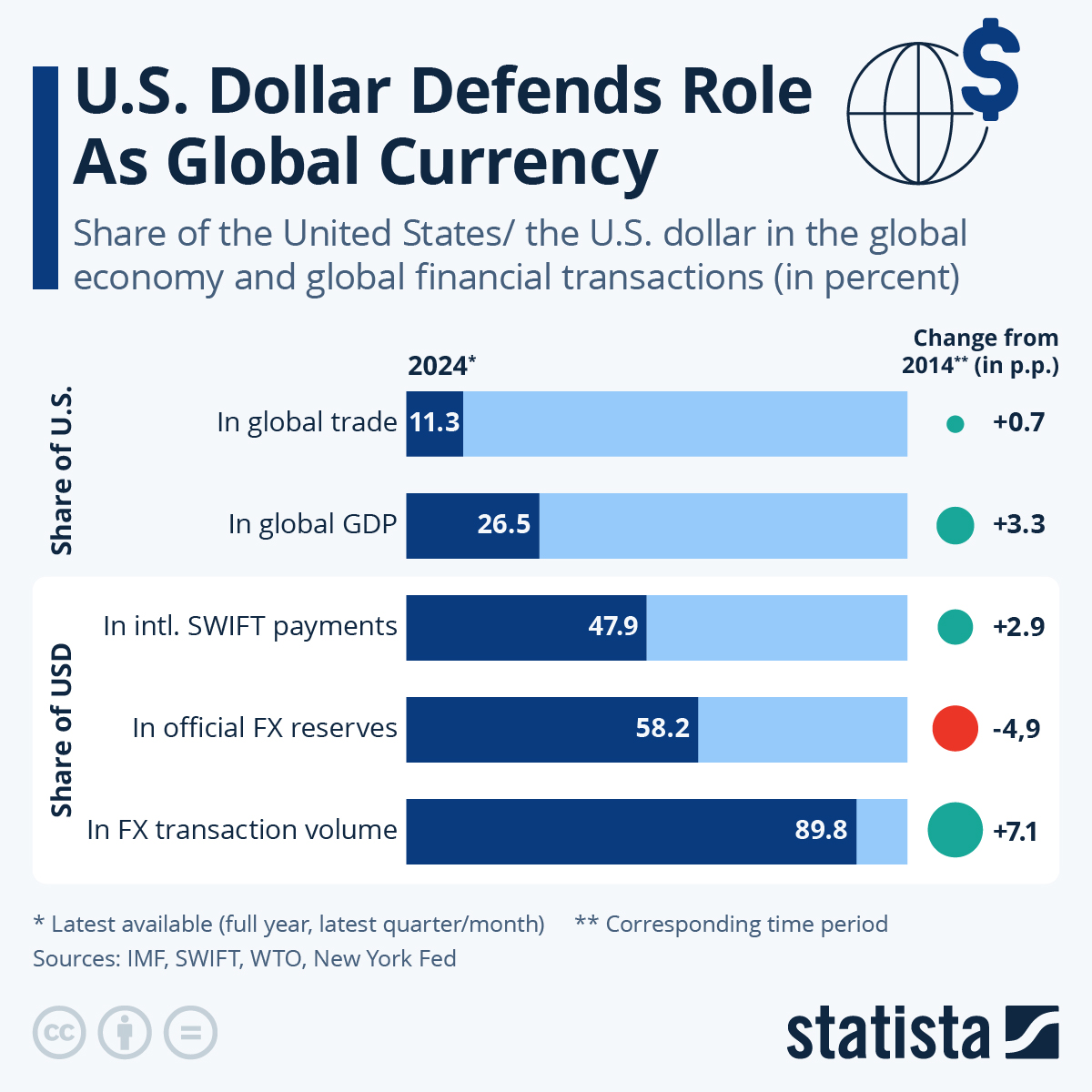

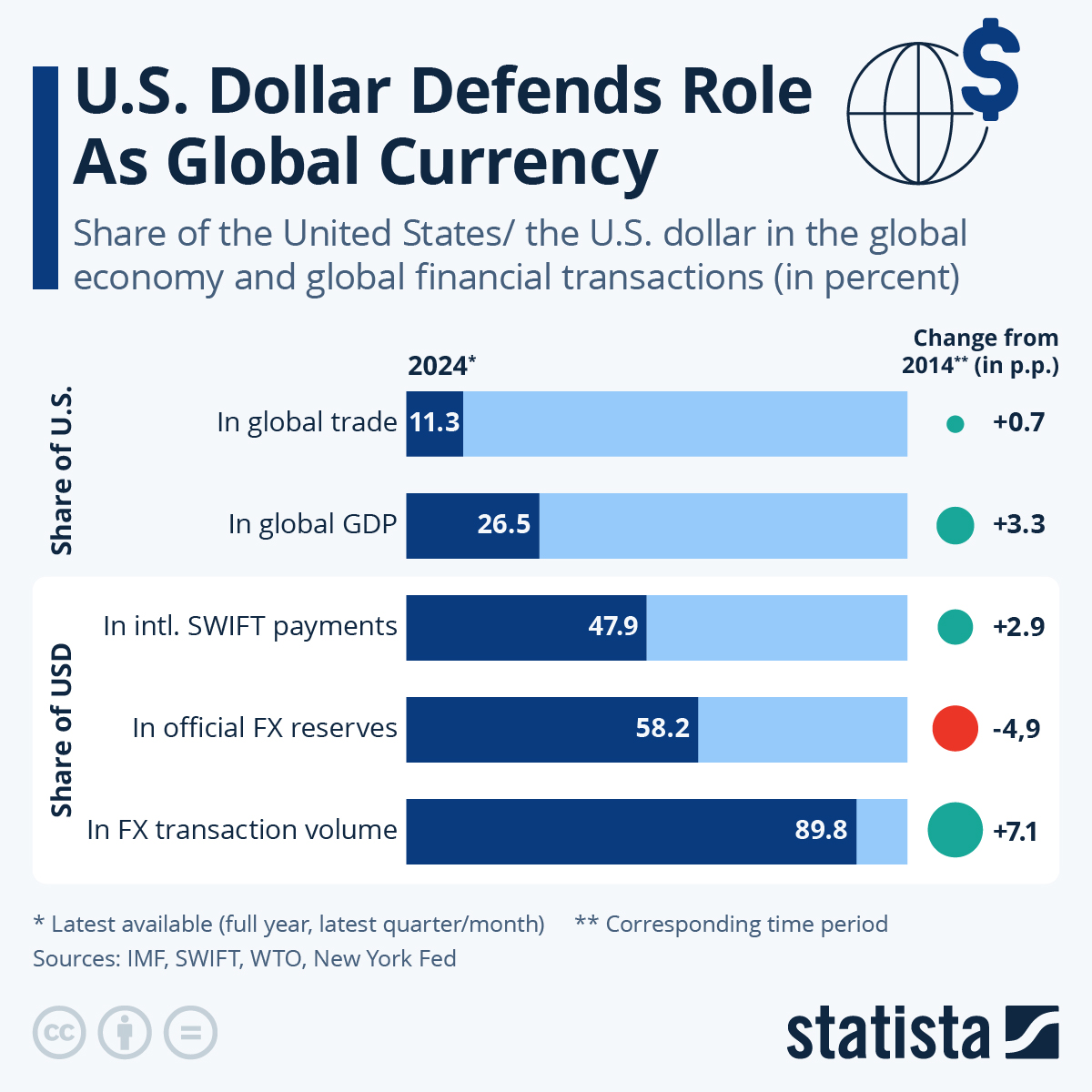

Analyzing the Current U.S. Dollar Trajectory

The U.S. dollar's strength relative to other major currencies has fluctuated considerably in recent years. While it has shown periods of strength, driven by factors such as higher U.S. interest rates, it also faces pressure from factors like rising inflation and growing national debt. The Federal Reserve's monetary policy plays a crucial role in influencing the dollar's value. Interest rate hikes, aimed at curbing inflation, can strengthen the dollar in the short term by attracting foreign investment, but they can also slow economic growth, potentially weakening it in the long run.

Factors Influencing the Dollar's Future:

Several factors will shape the U.S. dollar's future trajectory:

-

Interest Rate Hikes: Continued aggressive interest rate hikes by the Federal Reserve might strengthen the dollar but could also trigger a recession.

-

Global Economic Growth (or Slowdown): A global economic slowdown could weaken demand for the dollar, while robust global growth could support its value.

-

U.S. Trade Deficits and National Debt: Persistent large trade deficits and a soaring national debt continue to exert downward pressure on the dollar.

-

Political Instability and Government Policy: Political uncertainty or significant changes in U.S. government economic policies could significantly impact the dollar's value.

Investment Strategies in a Volatile Dollar Environment

Navigating a volatile dollar environment requires a diversified investment strategy. Investors should consider spreading their investments across different asset classes to mitigate the risks associated with dollar fluctuations.

Protecting Your Portfolio from Dollar Volatility:

-

Diversification: Invest in assets denominated in different currencies, such as the Euro, Yen, or British Pound.

-

Gold: Gold often serves as a safe haven asset during periods of economic uncertainty and dollar weakness.

-

Hedging Strategies: Utilize hedging techniques to mitigate currency risks in international investments. Consult with a financial advisor to determine the best strategy for your specific needs.

-

Further Research: Explore resources from reputable financial institutions and investment firms to enhance your understanding of currency trading and investment strategies.

Conclusion

The parallels between the economic conditions of Nixon's early presidency and the current situation are striking. High inflation, rising national debt, and geopolitical instability all point to a potential for a significant shift in the U.S. dollar's trajectory. Careful monitoring of key economic indicators and proactive adjustments to investment strategies are crucial for navigating this period of potential uncertainty. Understanding the U.S. dollar trajectory and its potential for further volatility is paramount for sound financial planning. Stay informed about the evolving U.S. dollar trajectory and adapt your investment strategy accordingly to navigate this period of potential uncertainty. Understanding the potential for a repeat of past economic events is crucial for effective financial planning. Continue your research into U.S. dollar trajectory analysis to make informed decisions.

Featured Posts

-

1 050 V Mware Price Hike At And T Sounds The Alarm On Broadcoms Proposal

Apr 29, 2025

1 050 V Mware Price Hike At And T Sounds The Alarm On Broadcoms Proposal

Apr 29, 2025 -

Experience Willie Nelsons 4th Of July Picnic A Texas Tradition

Apr 29, 2025

Experience Willie Nelsons 4th Of July Picnic A Texas Tradition

Apr 29, 2025 -

Prevalence Of Adhd In Adults With Autism And Intellectual Disability Findings From A New Study

Apr 29, 2025

Prevalence Of Adhd In Adults With Autism And Intellectual Disability Findings From A New Study

Apr 29, 2025 -

Louisville Community Remembers Past Tragedy During Shelter In Place Order

Apr 29, 2025

Louisville Community Remembers Past Tragedy During Shelter In Place Order

Apr 29, 2025 -

Capital Summertime Ball 2025 Your Guide To Dates Tickets And Venue

Apr 29, 2025

Capital Summertime Ball 2025 Your Guide To Dates Tickets And Venue

Apr 29, 2025