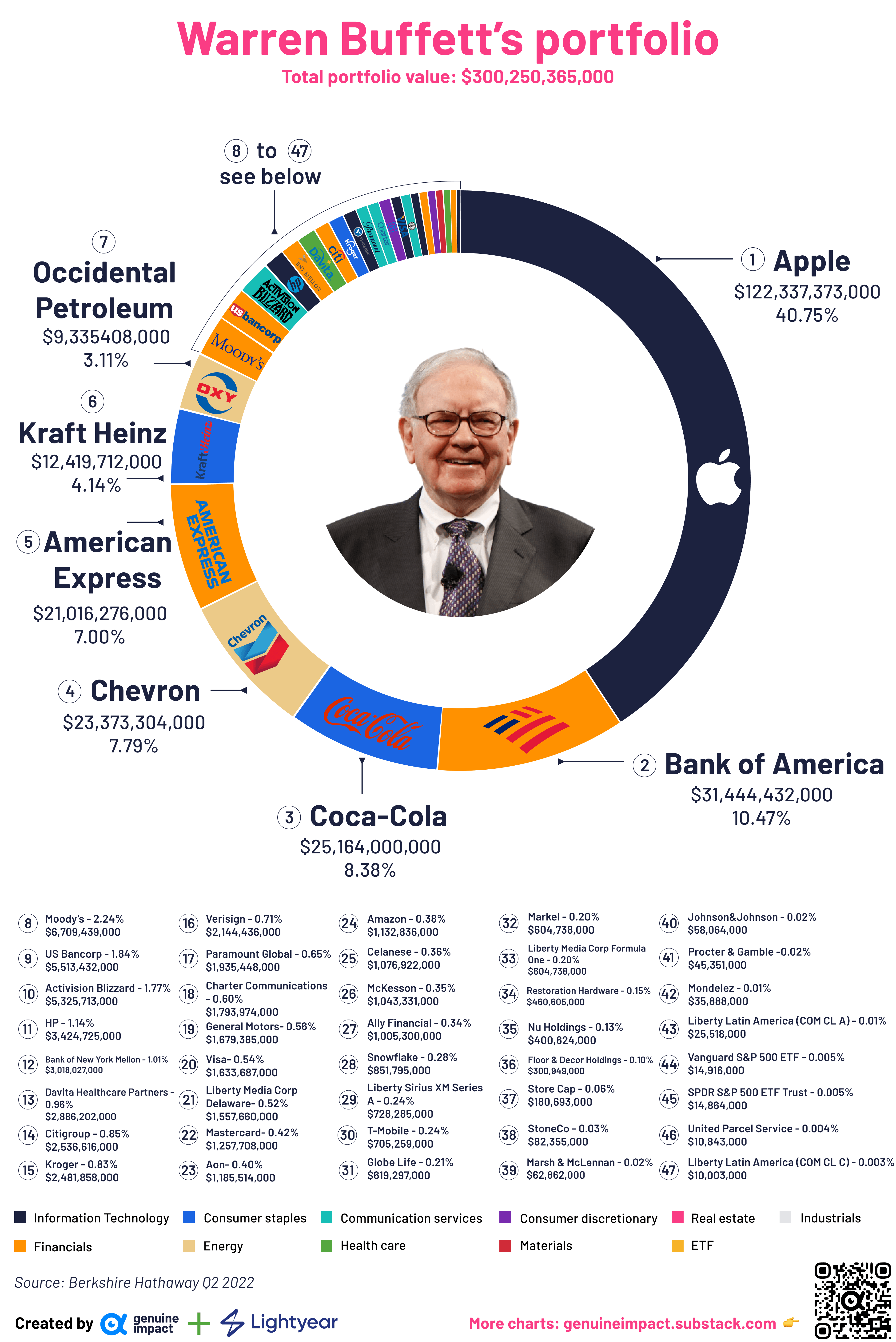

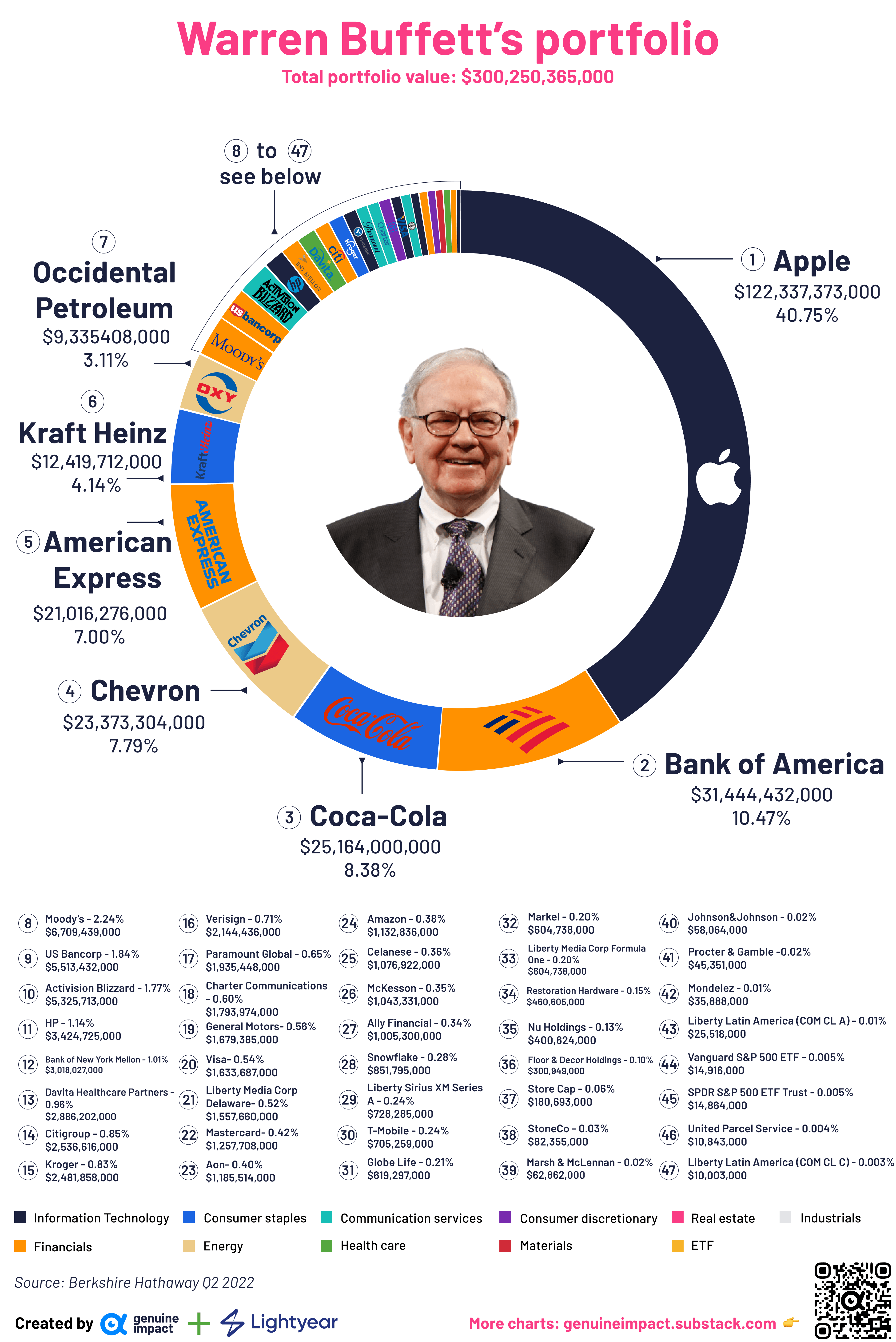

Analyzing Warren Buffett's Investment Portfolio: Hits, Misses, And Insights

Table of Contents

Warren Buffett's Greatest Investment Hits

Buffett's investment prowess is evident in his remarkable track record. His portfolio is a masterclass in long-term value investing, showcasing the power of patience and astute company selection. Let's examine some of his most successful investments:

Coca-Cola (KO): A Classic Case Study of Value Investing

Buffett's investment in Coca-Cola stands as a textbook example of his value investing philosophy. He began acquiring Coca-Cola shares in the late 1980s, recognizing the enduring power of its brand and its consistent profitability. His belief in the company's long-term prospects proved incredibly lucrative. The consistent dividends and the significant appreciation in share price over decades have generated massive returns.

- Investment Timeline: Late 1980s – Present

- Initial Investment Amount: Not publicly disclosed, but estimated to be in the hundreds of millions of dollars.

- Current Holdings Value: Billions of dollars, representing a significant portion of Berkshire Hathaway's portfolio.

- Annualized Return: Substantially above market averages over the long term.

This investment exemplifies Buffett's focus on identifying companies with strong brands, durable competitive advantages, and consistent earnings power. He understood that Coca-Cola's global reach and brand recognition would translate into sustained growth and value creation.

American Express (AXP): Capitalizing on Market Panic

Buffett's investment in American Express during the 1960s Salad Oil scandal showcases his contrarian approach and his ability to capitalize on market panic. When other investors fled, Buffett saw an opportunity to buy a fundamentally sound company at a significantly discounted price. His confidence in American Express's long-term prospects paid off handsomely, illustrating the potential rewards of buying when others are fearful.

- Market Conditions at the Time of Investment: Significant market turmoil and negative sentiment surrounding American Express due to the Salad Oil scandal.

- Investment Strategy Employed: Buying shares at a discounted price based on his assessment of the company's intrinsic value.

- Eventual ROI: Extremely high, demonstrating the benefits of contrarian investing.

This investment underscores the importance of independent thinking and the ability to look beyond short-term market fluctuations to identify long-term value.

Berkshire Hathaway (BRK.A, BRK.B): The Ultimate Long-Term Bet

Buffett's acquisition and development of Berkshire Hathaway itself is arguably his most successful investment. He didn't just invest in the company; he transformed it into a diversified investment holding company, leveraging its platform to acquire other businesses and build a vast and diverse portfolio. This demonstrates the power of long-term ownership and value creation.

- Key Acquisitions: See's Candies, Geico, Dairy Queen, and many more.

- Growth in Shareholder Value: Remarkable growth in Berkshire Hathaway's stock price over decades.

- Long-Term Investment Strategy: A testament to the power of a focused long-term approach to investment.

Berkshire Hathaway stands as a monument to Buffett’s investment philosophy, illustrating how a patient, long-term approach, combined with shrewd acquisitions, can generate extraordinary wealth.

Analyzing Warren Buffett's Notable Investment Misses

Even Warren Buffett has experienced investment setbacks. Analyzing these misses provides crucial insights into risk management and the limitations of even the most successful investment strategies.

US Air (UAL): A Costly Lesson in Industry Dynamics

Buffett's investment in US Air proved to be a costly mistake, highlighting the importance of understanding industry dynamics and competitive pressures. The airline industry's inherent volatility, fierce competition, and susceptibility to external factors (e.g., fuel prices) ultimately led to significant losses.

- Reasons for Investment Failure: Underestimation of the industry's cyclical nature and competitive challenges.

- Financial Losses: Significant losses for Berkshire Hathaway.

- Lessons Learned: The importance of thoroughly understanding the industry landscape and potential risks before investing.

This investment serves as a cautionary tale, emphasizing the need for careful industry analysis and risk assessment.

Dexter Shoe Company: A Missed Opportunity?

Buffett's investment in Dexter Shoe Company also ended in disappointment. While the initial investment seemed promising, operational issues and changing market dynamics led to underperformance. This underscores the importance of robust due diligence and the potential influence of managerial issues on a company's success.

- Investment Timeline: [Insert timeline]

- Reasons for Underperformance: Operational inefficiencies, increased competition, changing consumer preferences.

- Sale Price Compared to Initial Investment: A loss compared to the initial investment.

Dexter Shoe serves as a reminder that even with thorough research, unforeseen circumstances can impact investment outcomes.

Learning from Mistakes

Buffett’s investment misses weren't failures in the sense that they didn't teach valuable lessons. He openly acknowledges his mistakes, using them to refine his investment approach and avoid repeating the same errors. This highlights the continuous learning process integral to successful investing.

Key Insights and Investment Principles from Buffett's Portfolio

Buffett's portfolio provides numerous valuable insights for investors of all levels:

Value Investing

Buffett's success rests heavily on his commitment to value investing – identifying companies trading below their intrinsic value. This involves thorough fundamental analysis, focusing on a company's financial health, competitive landscape, and long-term prospects.

Long-Term Perspective

Buffett consistently emphasizes the importance of a long-term investment horizon. He isn't swayed by short-term market fluctuations and focuses on companies with sustainable competitive advantages and enduring value.

Understanding Business Fundamentals

Buffett stresses the importance of thoroughly understanding a company's business model, financial statements, and competitive positioning before investing. This requires more than simply looking at stock charts; it necessitates digging deep into the company's financials and operations.

Margin of Safety

Buffett always aims to buy assets with a "margin of safety," meaning he aims to purchase them at a price significantly below his assessment of their intrinsic value. This provides a cushion against unforeseen events or miscalculations.

Managing Risk

Buffett employs a conservative approach to risk management, focusing on diversification and avoiding investments he doesn't fully understand. While he takes calculated risks, he does so with a thorough understanding of the potential downsides.

Conclusion

Analyzing Warren Buffett's investment portfolio reveals a wealth of knowledge for both novice and seasoned investors. His successes highlight the power of long-term value investing, understanding business fundamentals, and recognizing opportunities during market downturns. His misses serve as valuable reminders of the importance of diligent due diligence, adapting to industry changes, and accepting that not every investment will be a winner. By studying both his hits and misses, investors can glean invaluable insights into building a successful and sustainable investment strategy. Start analyzing your own portfolio today, incorporating the principles learned from Warren Buffett’s journey, and remember to always practice diligent Warren Buffett investment analysis.

Featured Posts

-

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025 -

Assessing The Risks Investigating Pollution In Abandoned Gold Mines

May 06, 2025

Assessing The Risks Investigating Pollution In Abandoned Gold Mines

May 06, 2025 -

Newark Airports 7 Day Delay A Consequence Of Staffing Issues

May 06, 2025

Newark Airports 7 Day Delay A Consequence Of Staffing Issues

May 06, 2025 -

Celtics Vs Knicks Game 1 Playoff Prediction Betting Analysis And Picks

May 06, 2025

Celtics Vs Knicks Game 1 Playoff Prediction Betting Analysis And Picks

May 06, 2025 -

Budget Friendly Buys Top Picks That Deliver

May 06, 2025

Budget Friendly Buys Top Picks That Deliver

May 06, 2025

Latest Posts

-

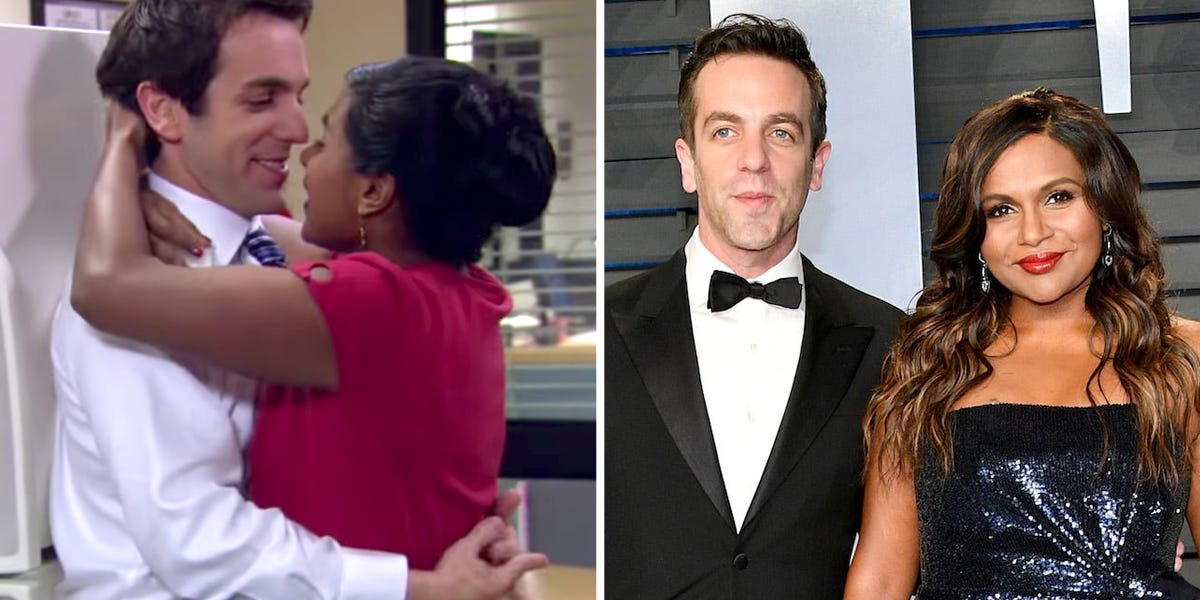

The Men In Mindy Kalings Life A Complete Relationship Timeline

May 06, 2025

The Men In Mindy Kalings Life A Complete Relationship Timeline

May 06, 2025 -

Mindy Kalings Love Life Past Relationships And Current Status

May 06, 2025

Mindy Kalings Love Life Past Relationships And Current Status

May 06, 2025 -

Mindy Kalings Peplum Look At Hollywood Walk Of Fame Ceremony

May 06, 2025

Mindy Kalings Peplum Look At Hollywood Walk Of Fame Ceremony

May 06, 2025 -

Understanding The Public Perception Of Bj Novak And Delaney Rowes Romance

May 06, 2025

Understanding The Public Perception Of Bj Novak And Delaney Rowes Romance

May 06, 2025 -

Bj Novak And Delaney Rowes Relationship Public Reaction And Analysis

May 06, 2025

Bj Novak And Delaney Rowes Relationship Public Reaction And Analysis

May 06, 2025