Analyzing XRP (Ripple) At Sub-$3 Levels: Buy Or Sell?

Table of Contents

XRP, the native cryptocurrency of Ripple, is currently trading below the $3 mark. This presents a crucial juncture for investors: is this a buying opportunity or a signal to sell? This comprehensive analysis delves into the current market conditions, Ripple's ongoing legal battles, and future projections to help you make an informed decision about whether to buy or sell XRP. We will explore the factors influencing XRP price, weighing the potential risks and rewards before offering a considered perspective – remember, this is not financial advice.

Ripple's Legal Battle with the SEC: Impact on XRP Price

Understanding the SEC Lawsuit

The core of the SEC lawsuit against Ripple centers around the classification of XRP. The SEC argues that XRP is an unregistered security, meaning its sale violated federal securities laws. Ripple counters that XRP is a decentralized digital asset, not a security, and thus not subject to the same regulations. This legal battle significantly impacts XRP's price due to the inherent uncertainty surrounding its outcome.

Potential Outcomes and their Impact on XRP

Several scenarios could unfold, each with a different impact on XRP's price:

-

Scenario 1: SEC Victory: A SEC victory could lead to a significant price drop and increased regulatory uncertainty for XRP, potentially impacting its long-term viability and investor confidence. This could also set a precedent for other cryptocurrency projects.

-

Scenario 2: Ripple Victory: A Ripple victory would likely result in a substantial price surge, boosting investor confidence and potentially attracting new investment into the XRP ecosystem. It could also strengthen the argument for the decentralized nature of many cryptocurrencies.

-

Scenario 3: Settlement: A settlement between Ripple and the SEC might lead to a more moderate price movement. However, lingering regulatory questions and uncertainty could still impact investor sentiment and future XRP price action. The terms of any settlement will be crucial in determining the post-settlement price trajectory.

Market Sentiment and News Coverage

Media coverage and investor sentiment heavily influence XRP's price. Negative news related to the lawsuit can trigger sell-offs, while positive developments, such as partnerships or technological advancements, can lead to price increases. Monitoring news sources and social media sentiment is crucial for understanding the current market perception of XRP.

Ripple's Technological Advancements and Partnerships

RippleNet Adoption and Growth

RippleNet, Ripple's payment network, is experiencing increasing adoption among financial institutions globally. This growth directly impacts XRP's utility as it facilitates cross-border payments.

-

Number of financial institutions using RippleNet: The number of banks and payment providers utilizing RippleNet continues to grow, indicating increased demand for Ripple's technology and potentially boosting XRP's value.

-

Recent partnerships and collaborations: New partnerships with financial institutions expand RippleNet's reach, further solidifying XRP's role in the global payments ecosystem.

-

Geographical expansion of RippleNet: The expansion of RippleNet into new markets increases its global reach and potential, positively influencing XRP's adoption and price.

Technological Innovations in Ripple's Ecosystem

Ripple continually improves its technology, enhancing the speed, scalability, and functionality of its network.

-

Improvements to speed and scalability: Upgrades to the RippleNet infrastructure enhance transaction speeds and scalability, making it more efficient and appealing to financial institutions.

-

New features and functionalities: The introduction of new features expands RippleNet's capabilities and potential use cases, indirectly contributing to XRP's value proposition.

Technical Analysis of XRP: Chart Patterns and Indicators

Price Chart Analysis (Support and Resistance Levels)

Analyzing XRP's price chart reveals key support and resistance levels, which can provide insights into potential price movements. (Note: This section would ideally include charts illustrating these levels). Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels indicate where selling pressure might dominate.

Key Technical Indicators (Moving Averages, RSI, MACD)

Technical indicators like Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help gauge the current market sentiment and predict potential price trends. (Note: This section would benefit from visual representations of these indicators).

Predictive Models and Forecasts (with caveats)

While various analysts offer XRP price predictions, it's crucial to approach them with caution. Cryptocurrency markets are highly volatile, making accurate long-term predictions extremely challenging. Any forecast should be considered with a significant degree of skepticism.

Risk Assessment and Investment Strategy

Volatility of XRP

XRP, like most cryptocurrencies, is highly volatile. Price swings can be dramatic and unpredictable, making it a risky investment.

Diversification and Risk Management

Diversifying your investment portfolio across different asset classes is crucial to mitigate risk. Avoid investing more than you can afford to lose in any single cryptocurrency.

Long-Term vs. Short-Term Investment Strategies

Consider your investment horizon when deciding whether to buy or sell XRP. Long-term investors might tolerate greater volatility, while short-term traders need to be more attuned to market fluctuations.

Conclusion

Analyzing XRP at sub-$3 levels requires careful consideration of Ripple's legal battles, technological progress, technical indicators, and inherent risks. The SEC lawsuit presents significant uncertainty, while RippleNet adoption and technological advancements offer potential upside. Technical analysis provides short-term insights, but long-term forecasts remain highly speculative. Remember, cryptocurrency investment carries significant risk.

Buy or Sell Recommendation (with caveats): Given the inherent uncertainties and volatility, providing a definitive "buy" or "sell" recommendation would be irresponsible. Thorough due diligence and risk assessment are paramount.

Call to Action: Continue researching XRP, understand the risks involved, and develop your own informed investment strategy before making any decisions regarding buying or selling XRP. Remember to conduct thorough due diligence before investing in any cryptocurrency.

Featured Posts

-

Nikki Burdine Announces New Projects With Former Co Host Neil Orne

May 02, 2025

Nikki Burdine Announces New Projects With Former Co Host Neil Orne

May 02, 2025 -

Army Chyf Ka Kshmyr Pr Htmy Fyslh Mzyd Jng Ky Tyaryan

May 02, 2025

Army Chyf Ka Kshmyr Pr Htmy Fyslh Mzyd Jng Ky Tyaryan

May 02, 2025 -

Hazing Investigation 11 Syracuse Lacrosse Players Avoid Kidnapping Charges

May 02, 2025

Hazing Investigation 11 Syracuse Lacrosse Players Avoid Kidnapping Charges

May 02, 2025 -

Fortnites New Icon Series Skin Revealed

May 02, 2025

Fortnites New Icon Series Skin Revealed

May 02, 2025 -

Digital Exclusive Tracking Tulsas Winter Weather With Travis And Stacia

May 02, 2025

Digital Exclusive Tracking Tulsas Winter Weather With Travis And Stacia

May 02, 2025

Latest Posts

-

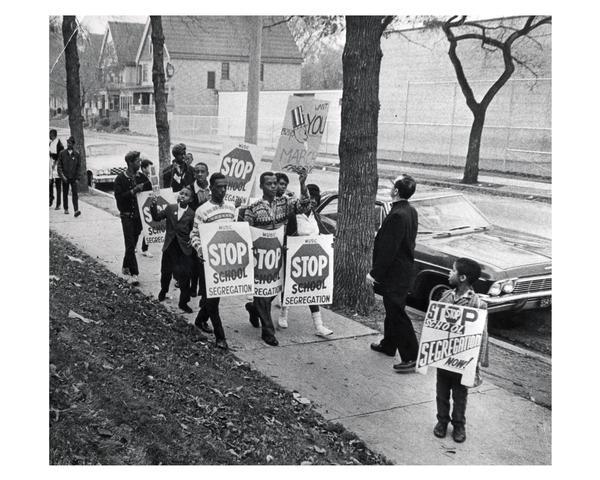

The End Of A Desegregation Order A Turning Point In School Integration

May 02, 2025

The End Of A Desegregation Order A Turning Point In School Integration

May 02, 2025 -

Edinburgh Fringe 2025 Pussy Riots Maria Alyokhina Stages New Play

May 02, 2025

Edinburgh Fringe 2025 Pussy Riots Maria Alyokhina Stages New Play

May 02, 2025 -

Maria Alyokhinas Riot Day Play Edinburgh Fringe 2025 Debut

May 02, 2025

Maria Alyokhinas Riot Day Play Edinburgh Fringe 2025 Debut

May 02, 2025 -

The Fallout From The Justice Departments School Desegregation Decision

May 02, 2025

The Fallout From The Justice Departments School Desegregation Decision

May 02, 2025 -

School Desegregation Order Ended Analysis And Future Outlook

May 02, 2025

School Desegregation Order Ended Analysis And Future Outlook

May 02, 2025