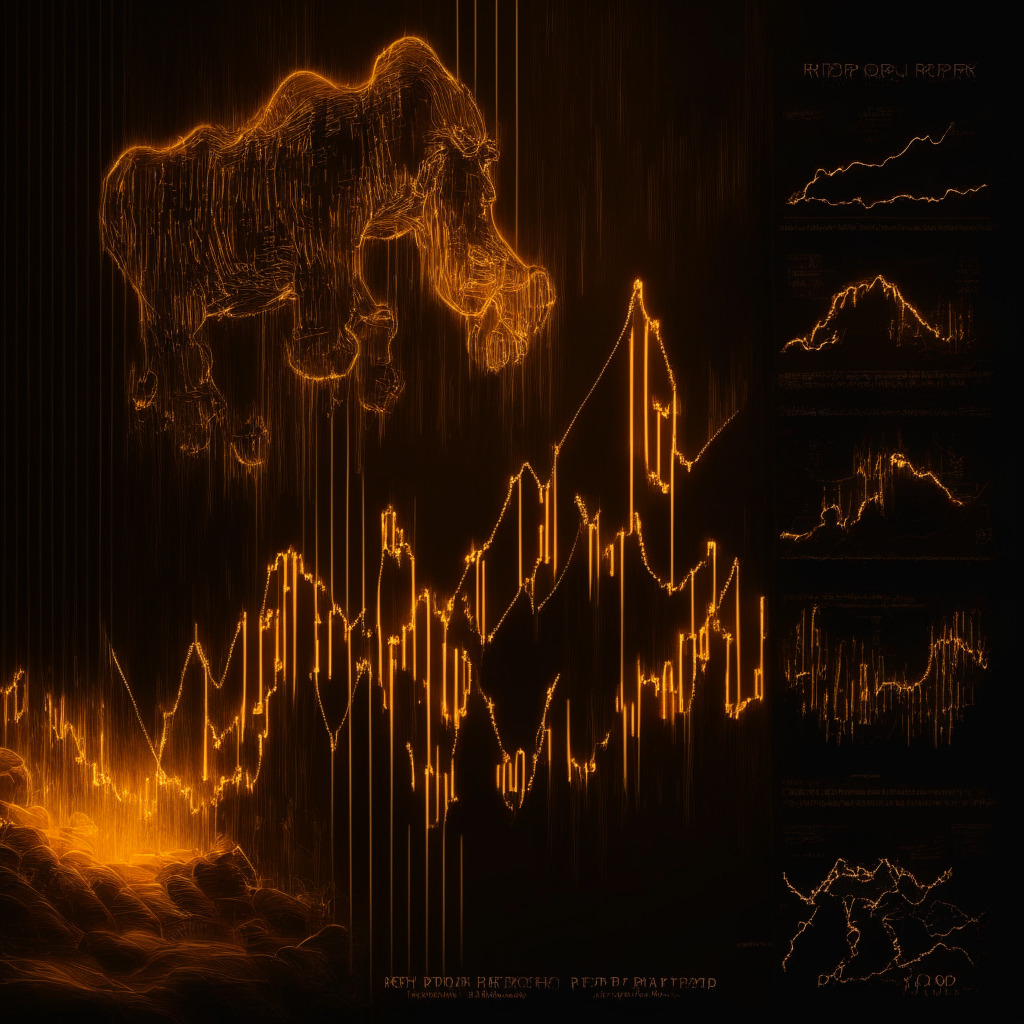

Analyzing XRP (Ripple) At Under $3: A Prudent Investment Strategy?

Table of Contents

XRP, the native cryptocurrency of Ripple, has seen its price fluctuate dramatically in recent times. Currently trading below $3, many investors are questioning whether this represents a compelling buying opportunity or a warning sign. This article delves into a comprehensive analysis of XRP's current market position, exploring the potential risks and rewards to help you determine if investing in XRP at this price point aligns with your investment goals and risk tolerance. We'll examine key factors, including Ripple's ongoing legal battle, technological advancements, market sentiment, and ultimately help you develop a prudent investment strategy around XRP. Keywords: XRP, Ripple, cryptocurrency investment, price analysis, prudent investment, risk assessment, XRP price prediction.

2. Understanding XRP's Current Market Position:

H2: Ripple's Ongoing Legal Battle:

The SEC lawsuit against Ripple Labs significantly impacts XRP's price. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this legal battle remains uncertain and carries substantial weight on XRP's future.

- Positive Scenarios: A favorable ruling could send XRP's price soaring, potentially exceeding previous highs. This would likely result in increased institutional adoption and renewed investor confidence.

- Negative Scenarios: An unfavorable ruling could lead to a prolonged price depression, potentially impacting the overall cryptocurrency market. This could result in regulatory uncertainty and reduced investor interest.

- Expert Opinions: While opinions vary widely, some analysts believe a settlement is likely, while others predict a lengthy legal battle. Market sentiment plays a crucial role in shaping these opinions.

H2: Adoption and Technological Advancements:

Despite the legal uncertainty, Ripple's technology continues to gain traction within the financial sector. Many banks and financial institutions utilize RippleNet, a real-time gross settlement system, for cross-border payments.

- Key Partnerships: Ripple has forged partnerships with numerous financial institutions globally, demonstrating the practical application and demand for its technology.

- Successful Implementations: Numerous successful implementations of Ripple's technology highlight its efficiency and reliability in streamlining cross-border transactions.

- Improvements to the XRP Ledger: Ongoing developments and improvements to the XRP Ledger further enhance its scalability, security, and efficiency.

H2: Market Sentiment and Volatility:

Market sentiment towards XRP is currently mixed, reflecting the uncertainty surrounding the SEC lawsuit. The cryptocurrency's price remains highly volatile, exhibiting significant price swings even within short periods.

- Recent Price Trends: Observing recent price trends reveals periods of both sharp increases and decreases, highlighting the inherent volatility of XRP.

- Social Media Sentiment: Analyzing social media sentiment provides valuable insights into the prevailing attitudes and expectations within the crypto community regarding XRP.

- Expert Predictions: Numerous experts offer predictions, yet these should be treated with caution, as accurately predicting cryptocurrency prices remains challenging.

3. Analyzing the Risks and Rewards of Investing in XRP:

H2: Potential Risks:

Investing in cryptocurrencies, including XRP, involves significant risks.

- Market Volatility: The cryptocurrency market is inherently volatile, and XRP is no exception. Price fluctuations can be dramatic and unpredictable.

- Regulatory Risks: The ongoing SEC lawsuit highlights the regulatory uncertainty surrounding XRP and other cryptocurrencies. Changes in regulations can significantly impact the price and accessibility of XRP.

- Security Risks: Like all cryptocurrencies, XRP is susceptible to hacking and security breaches. It's crucial to use secure wallets and exchanges.

- Technological Risks: Technological advancements in the cryptocurrency space could render XRP obsolete or less competitive.

H2: Potential Rewards:

Despite the risks, investing in XRP offers potential rewards.

- Potential Price Appreciation: If the SEC lawsuit is resolved favorably or market sentiment improves significantly, XRP's price could surge.

- Technological Disruption Potential: Ripple's technology has the potential to disrupt the traditional financial system, creating significant long-term growth opportunities.

- Diversification Benefits: Including XRP in a diversified investment portfolio can help reduce overall portfolio risk.

4. Developing a Prudent Investment Strategy for XRP:

H2: Diversification and Risk Management:

A prudent investment strategy necessitates diversification and risk management.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals helps mitigate the risk associated with market volatility.

- Setting Stop-Loss Orders: Stop-loss orders automatically sell your XRP if the price falls below a predetermined level, limiting potential losses.

- Only Investing What You Can Afford to Lose: Never invest more than you can afford to lose. Cryptocurrency investments are highly speculative.

H2: Research and Due Diligence:

Thorough research and due diligence are paramount before investing in XRP or any cryptocurrency.

- Reputable News Sources: Consult reputable news sources and financial analysis websites for up-to-date information and expert opinions.

- Financial Analysts' Opinions: Review the opinions of various financial analysts and experts, noting that these opinions vary considerably.

- Understanding White Papers: Familiarize yourself with Ripple's white paper to understand the technology behind XRP and its potential applications.

5. Conclusion: Is XRP Below $3 a Buying Opportunity?

Analyzing XRP at its current price point below $3 requires careful consideration of the risks and rewards. While the ongoing legal battle presents significant uncertainty, the potential for long-term growth driven by technological advancements and increased adoption remains. A prudent investment strategy includes thorough research, diversification, risk management techniques like dollar-cost averaging and stop-loss orders, and only investing what you can afford to lose. Is investing in XRP below $3 a prudent investment for you? Conduct thorough research and consider the factors discussed before making any decisions. Remember, this is not financial advice. Always conduct your own research before making any investment decisions.

Featured Posts

-

Frances Convincing Six Nations Win Implications For Ireland

May 01, 2025

Frances Convincing Six Nations Win Implications For Ireland

May 01, 2025 -

The Nothing Phone 2 Modular Design Meets Modern Technology

May 01, 2025

The Nothing Phone 2 Modular Design Meets Modern Technology

May 01, 2025 -

Savor The Flavors Culinary Delights On A Windstar Cruise

May 01, 2025

Savor The Flavors Culinary Delights On A Windstar Cruise

May 01, 2025 -

Arc Raider Returns Tech Test 2 Date Announced Console Players Invited

May 01, 2025

Arc Raider Returns Tech Test 2 Date Announced Console Players Invited

May 01, 2025 -

Analyzing Ziaire Williams Performance Capitalizing On A Second Opportunity

May 01, 2025

Analyzing Ziaire Williams Performance Capitalizing On A Second Opportunity

May 01, 2025

Latest Posts

-

Parkland School Board Necessary Changes But Not A Revolution

May 01, 2025

Parkland School Board Necessary Changes But Not A Revolution

May 01, 2025 -

Completing The Story Hudsons Bay Artifacts In Manitobas Museums

May 01, 2025

Completing The Story Hudsons Bay Artifacts In Manitobas Museums

May 01, 2025 -

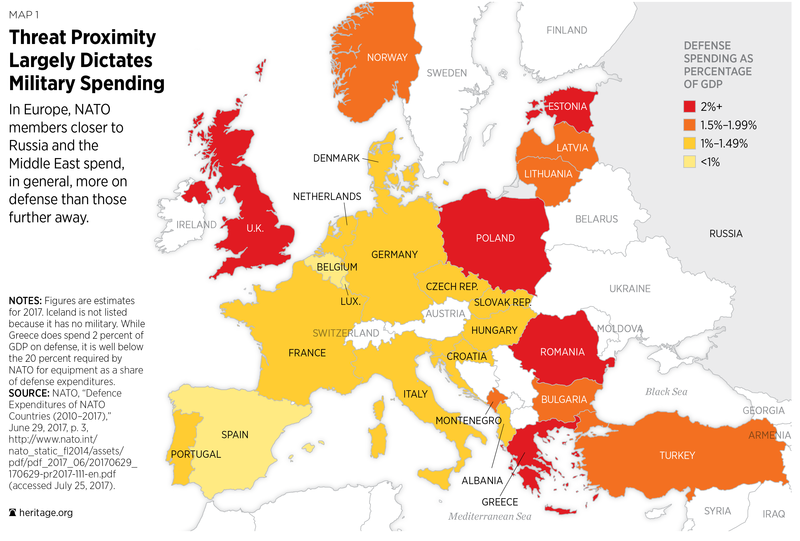

Military Expenditure Soars Globally The Impact Of The Ukraine Conflict

May 01, 2025

Military Expenditure Soars Globally The Impact Of The Ukraine Conflict

May 01, 2025 -

Proposed Acquisition Hudsons Bay Artifacts For Manitobas Collection

May 01, 2025

Proposed Acquisition Hudsons Bay Artifacts For Manitobas Collection

May 01, 2025 -

Europes Rising Military Spending A Reaction To The Russian Threat

May 01, 2025

Europes Rising Military Spending A Reaction To The Russian Threat

May 01, 2025