Apple Stock: A Long-Term Investment Despite Reduced Price Target?

Table of Contents

Analyzing the Reduced Price Target

Several analyst firms have recently lowered their price targets for Apple stock. Understanding the reasons behind these downgrades is crucial for assessing the current market sentiment and the future potential of Apple stock.

Reasons Behind the Downgrade

Analyst reports cite several factors contributing to the reduced price target for Apple. These include:

- Slowing iPhone sales growth: Market saturation and economic uncertainty have impacted iPhone sales, leading to concerns about future revenue streams. [Link to relevant news article about slowing iPhone sales]

- Increased competition in the smartphone market: Intense competition from Android manufacturers, particularly in emerging markets, is putting pressure on Apple's market share. [Link to relevant news article about smartphone market competition]

- Supply chain disruptions: Ongoing global supply chain issues continue to pose challenges to Apple's production and delivery timelines, impacting profitability. [Link to relevant news article about supply chain disruptions]

- Macroeconomic headwinds: Global inflation, recessionary fears, and geopolitical instability are creating uncertainty in the broader market, negatively impacting investor sentiment towards tech stocks, including Apple. [Link to relevant news article about macroeconomic factors]

Counterarguments to the Downgrade

Despite these concerns, several arguments support the continued viability of Apple as a long-term investment:

- Strong brand loyalty and ecosystem: Apple boasts unparalleled brand loyalty, fostering a powerful ecosystem that keeps users locked into its services and devices. This translates to high customer retention rates and predictable recurring revenue.

- Growth potential in Services and wearables: Apple's Services segment, encompassing Apple Music, iCloud, Apple TV+, and more, demonstrates strong growth potential and provides a diversified revenue stream less dependent on hardware sales. The wearables market, dominated by Apple Watch, also offers significant expansion opportunities.

- Innovation pipeline and future product releases: Apple's history of innovation and its ongoing investments in research and development suggest a robust pipeline of future products and services. This includes potential advancements in AR/VR, AI, and other cutting-edge technologies.

Apple's Long-Term Growth Potential

Despite the recent price target reduction, Apple's long-term growth potential remains substantial.

The Power of the Apple Ecosystem

Apple's integrated ecosystem is a significant competitive advantage. The synergy between its devices and services creates a compelling user experience, promoting loyalty and driving recurring revenue.

- Recurring revenue from subscriptions: Apple's subscription services provide a stable and predictable revenue stream, mitigating some of the volatility associated with hardware sales.

- High customer loyalty and retention rates: The strong brand loyalty and ecosystem lock in customers, leading to consistent revenue streams and reduced customer acquisition costs.

- Strong brand recognition and market share: Apple's powerful brand recognition and significant market share in various sectors provide a solid foundation for future growth.

Innovation and Future Product Releases

Apple's consistent track record of innovation is a key driver of its long-term growth potential.

- Potential for significant growth in the AR/VR market: Apple's rumored foray into augmented and virtual reality headsets could open up a new market with significant growth potential.

- Ongoing investments in AI technology could yield substantial returns: Apple's continued investment in artificial intelligence could lead to breakthroughs in various product categories, driving future innovation and revenue.

- Speculation around an Apple Car remains a long-term growth driver: While still speculative, the potential entry into the electric vehicle market represents a significant long-term growth opportunity for Apple. (Disclaimer: This is speculation, and the actual impact remains uncertain.)

Assessing the Risks

While Apple's long-term potential is promising, it's crucial to acknowledge the inherent risks.

Economic Uncertainty and Global Markets

Macroeconomic factors can significantly impact Apple's stock price.

- Global economic uncertainty: Recessionary fears and inflation can negatively affect consumer spending, impacting demand for Apple products.

- Geopolitical instability: Global political tensions and trade disputes can disrupt supply chains and negatively affect Apple's operations.

- Supply chain disruptions and potential shortages: Ongoing supply chain challenges remain a risk factor, potentially impacting production and delivery timelines.

Competition in the Tech Sector

The tech sector is fiercely competitive.

- Intense competition from Android manufacturers: Android manufacturers continue to pose a significant competitive threat, particularly in price-sensitive markets.

- Emerging players in the wearables market: New entrants in the wearables market could erode Apple's market share.

- Increasing pressure on pricing and margins: Competition can put pressure on pricing, potentially squeezing Apple's profit margins.

Conclusion

While the reduced price target presents a cause for consideration, Apple stock remains a potentially lucrative long-term investment for those with a diversified portfolio and a long-term perspective. The strength of its ecosystem, recurring revenue streams, and potential for innovation all contribute to its long-term growth prospects. However, macroeconomic uncertainties and competitive pressures must be carefully considered. Conduct thorough research and consider consulting a financial advisor before making any investment decisions regarding Apple stock.

Featured Posts

-

Blue Origin Cancels Rocket Launch Vehicle Subsystem Issue

May 25, 2025

Blue Origin Cancels Rocket Launch Vehicle Subsystem Issue

May 25, 2025 -

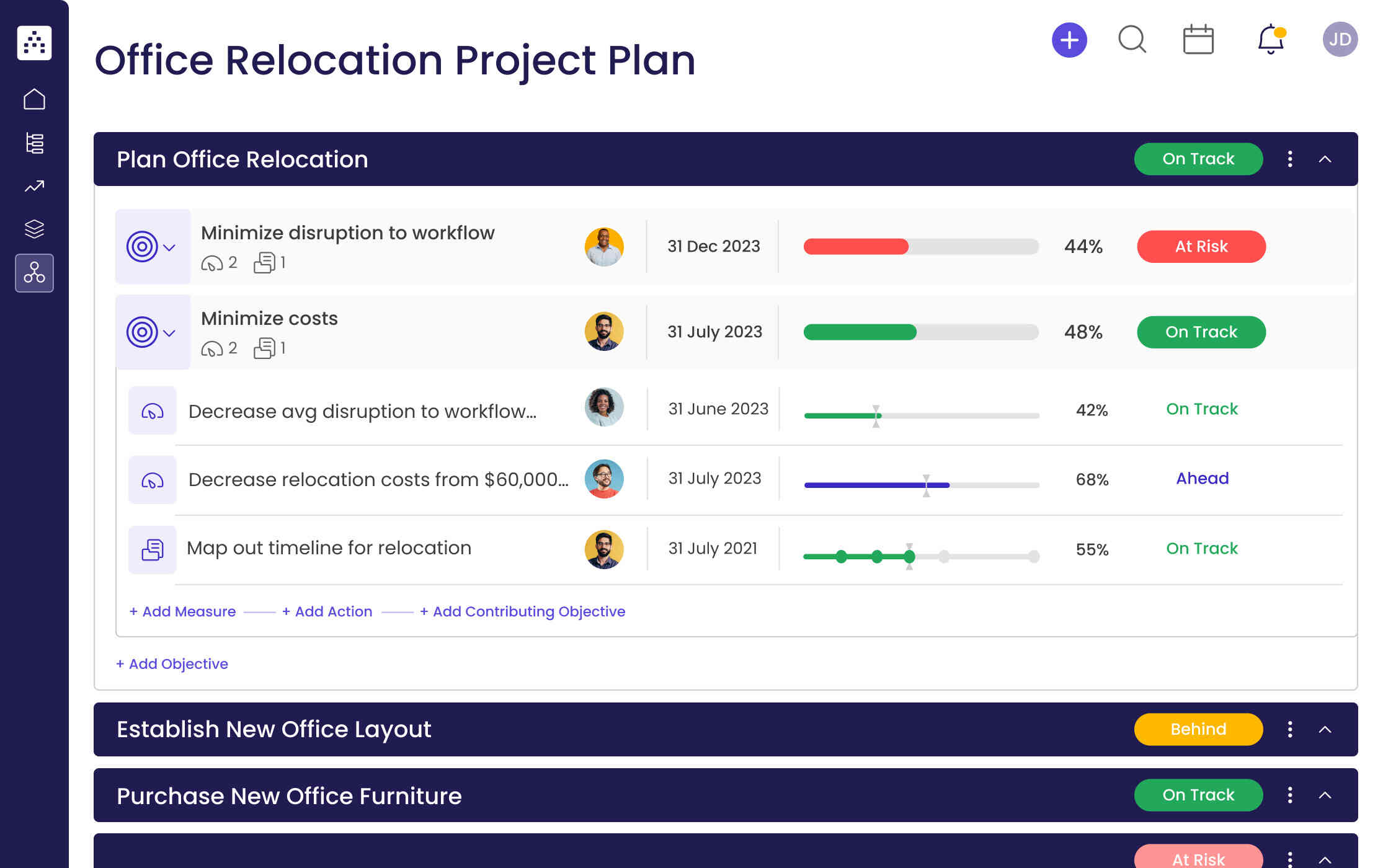

Escape To The Countryside A Step By Step Relocation Plan

May 25, 2025

Escape To The Countryside A Step By Step Relocation Plan

May 25, 2025 -

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 25, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 25, 2025 -

Innokentiy Smoktunovskiy Dokumentalniy Film K Stoletiyu So Dnya Rozhdeniya

May 25, 2025

Innokentiy Smoktunovskiy Dokumentalniy Film K Stoletiyu So Dnya Rozhdeniya

May 25, 2025 -

Guccis Massimo Vian Departs Supply Chain Shake Up

May 25, 2025

Guccis Massimo Vian Departs Supply Chain Shake Up

May 25, 2025

Latest Posts

-

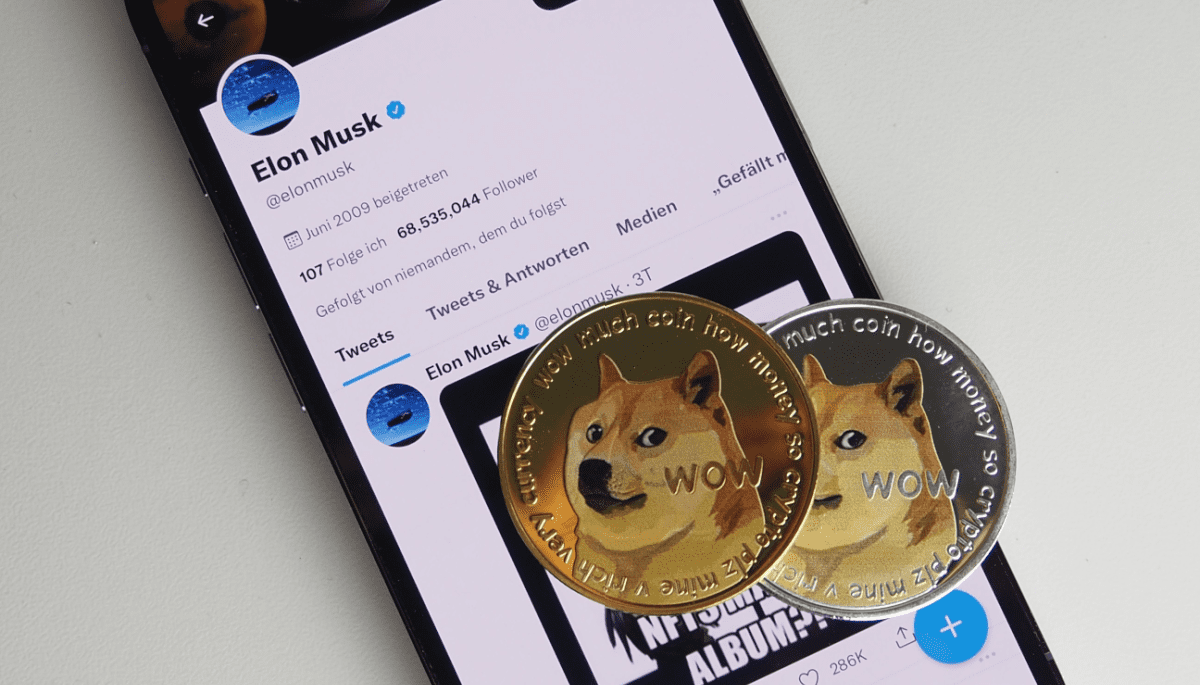

Elon Musk And Dogecoin Whats The Latest

May 25, 2025

Elon Musk And Dogecoin Whats The Latest

May 25, 2025 -

Fujifilm X Half Whimsical Refreshing And Fun To Use

May 25, 2025

Fujifilm X Half Whimsical Refreshing And Fun To Use

May 25, 2025 -

The Cost Of Power Presidential Seals Expensive Watches And High End Events

May 25, 2025

The Cost Of Power Presidential Seals Expensive Watches And High End Events

May 25, 2025 -

Their Journey To Dc A Love And Loss Story

May 25, 2025

Their Journey To Dc A Love And Loss Story

May 25, 2025 -

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 25, 2025

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 25, 2025