Apple Stock (AAPL): Key Price Levels To Watch

Table of Contents

Identifying Key Support Levels for AAPL Stock

What are Support Levels?

In technical analysis, support levels represent price points where buying pressure is strong enough to prevent a further price decline. They act as a floor for the stock price. When the price approaches a support level, it often bounces back up, offering a buying opportunity for investors. Conversely, a break below a significant support level can signal a more substantial downward trend.

-

Identifying Support Levels: Support levels are identified using various methods. Chart patterns often reveal historical support areas where the price has previously bounced. Technical indicators like moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI) can also help pinpoint potential support zones.

-

Historical AAPL Support: Historically, Apple stock has shown strong support around the $150 and $170 levels. These levels have acted as significant barriers to further price decreases in the past.

-

Psychological Significance: Round numbers, like $150, $160, and $170, often hold psychological significance. Investors may be more inclined to buy at these round numbers, creating additional support.

-

Recent Examples: For instance, in [insert recent date/period], AAPL stock tested the $160 support level. The price initially dipped below it but quickly rebounded, demonstrating the level's strength. [Insert specific chart/data reference if possible].

Pinpointing Key Resistance Levels for AAPL Stock

Understanding Resistance Levels

Resistance levels are price points where selling pressure is strong enough to prevent further price increases. They act as a ceiling for the stock price. When the price approaches a resistance level, it often stalls or reverses, presenting a potential selling opportunity. A break above a significant resistance level can signal a strong upward trend.

-

Identifying Resistance Levels: Similar to support levels, resistance levels can be identified using chart patterns and technical indicators. Previous highs, as well as moving averages and RSI, can help pinpoint these areas.

-

Historical AAPL Resistance: AAPL has historically shown resistance around $180 and $200. These levels have previously capped price increases.

-

Psychological Resistance: Just like support, round numbers like $180, $200, and $220 act as significant psychological resistance levels for AAPL.

-

Recent Examples: In [insert recent date/period], AAPL stock approached the $180 resistance level and experienced a price pullback. This highlights the level's strength in halting upward momentum. [Insert specific chart/data reference if possible].

Factors Influencing AAPL Stock Price Levels

Macroeconomic Conditions

Broader economic trends significantly impact AAPL stock. Factors such as interest rate hikes, inflation, and recessionary fears can influence investor sentiment and overall market performance, affecting the AAPL price. High inflation, for example, could reduce consumer spending and affect Apple's sales.

Company-Specific News

Apple's product launches, financial reports (Apple earnings), and overall business performance directly influence its stock price. Positive news, such as strong sales figures or innovative product releases, usually leads to price increases. Conversely, disappointing earnings or negative product reviews can trigger price declines.

Market Sentiment

Investor sentiment and overall market trends play a crucial role in AAPL stock price fluctuations. Positive market sentiment often boosts the price, even in the absence of significant company-specific news. Negative sentiment can lead to sell-offs, regardless of the company's fundamentals.

Using Technical Analysis for AAPL Stock Price Predictions

Chart Patterns

Recognizing common chart patterns, such as head and shoulders, triangles, and double tops/bottoms, can provide insights into potential price movements. These patterns, combined with other indicators, can increase the accuracy of predictions.

Indicators

Technical indicators like the Moving Average Convergence Divergence (MACD), Bollinger Bands, and RSI can help identify potential trend reversals, overbought/oversold conditions, and momentum shifts. Analyzing these indicators in conjunction with chart patterns can enhance forecasting capabilities.

Disclaimer: It's crucial to remember that technical analysis is not foolproof. It should be used alongside fundamental analysis and sound investment strategies. Market conditions can change rapidly, and unforeseen events can significantly impact stock prices.

Conclusion

Successfully navigating the complexities of the Apple stock (AAPL) market requires a keen eye on key price levels. By monitoring support and resistance levels, understanding influencing factors, and employing technical analysis tools responsibly, investors can improve their decision-making process. Remember, this information is for educational purposes only, and it's crucial to conduct thorough research and consider your own risk tolerance before making any investment decisions in Apple stock (AAPL) or any other security. Start analyzing the key price levels of AAPL stock today and make informed investment choices!

Featured Posts

-

Annual General Meeting Of Philips Shareholders Results And Future Outlook

May 25, 2025

Annual General Meeting Of Philips Shareholders Results And Future Outlook

May 25, 2025 -

K 100 Letiyu Innokentiya Smoktunovskogo Film Menya Vela Kakaya To Sila

May 25, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Film Menya Vela Kakaya To Sila

May 25, 2025 -

2025 Memorial Day Airfare When To Book For The Best Prices And Least Crowds

May 25, 2025

2025 Memorial Day Airfare When To Book For The Best Prices And Least Crowds

May 25, 2025 -

The Hollywood Strike Understanding The Actors And Writers Demands

May 25, 2025

The Hollywood Strike Understanding The Actors And Writers Demands

May 25, 2025 -

Dazi E Borse L Unione Europea Pronta A Reazioni Forti

May 25, 2025

Dazi E Borse L Unione Europea Pronta A Reazioni Forti

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

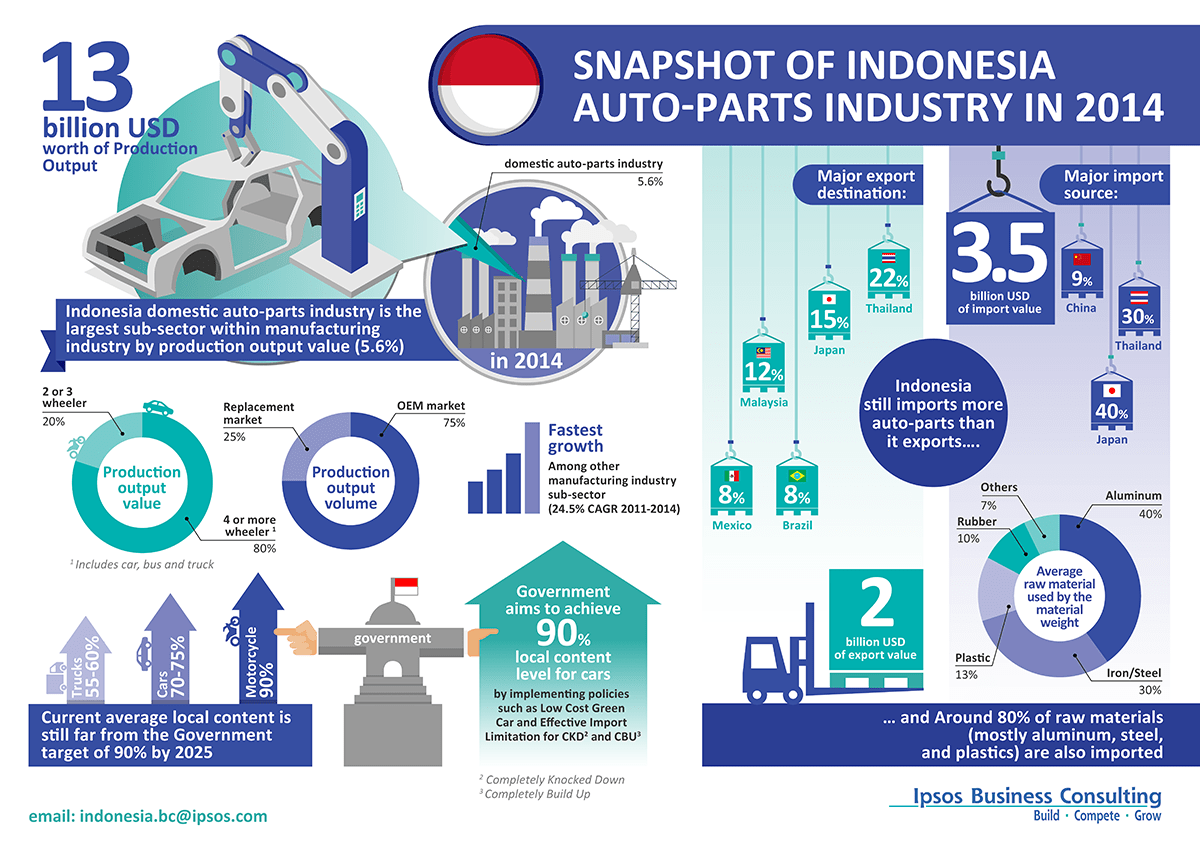

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025