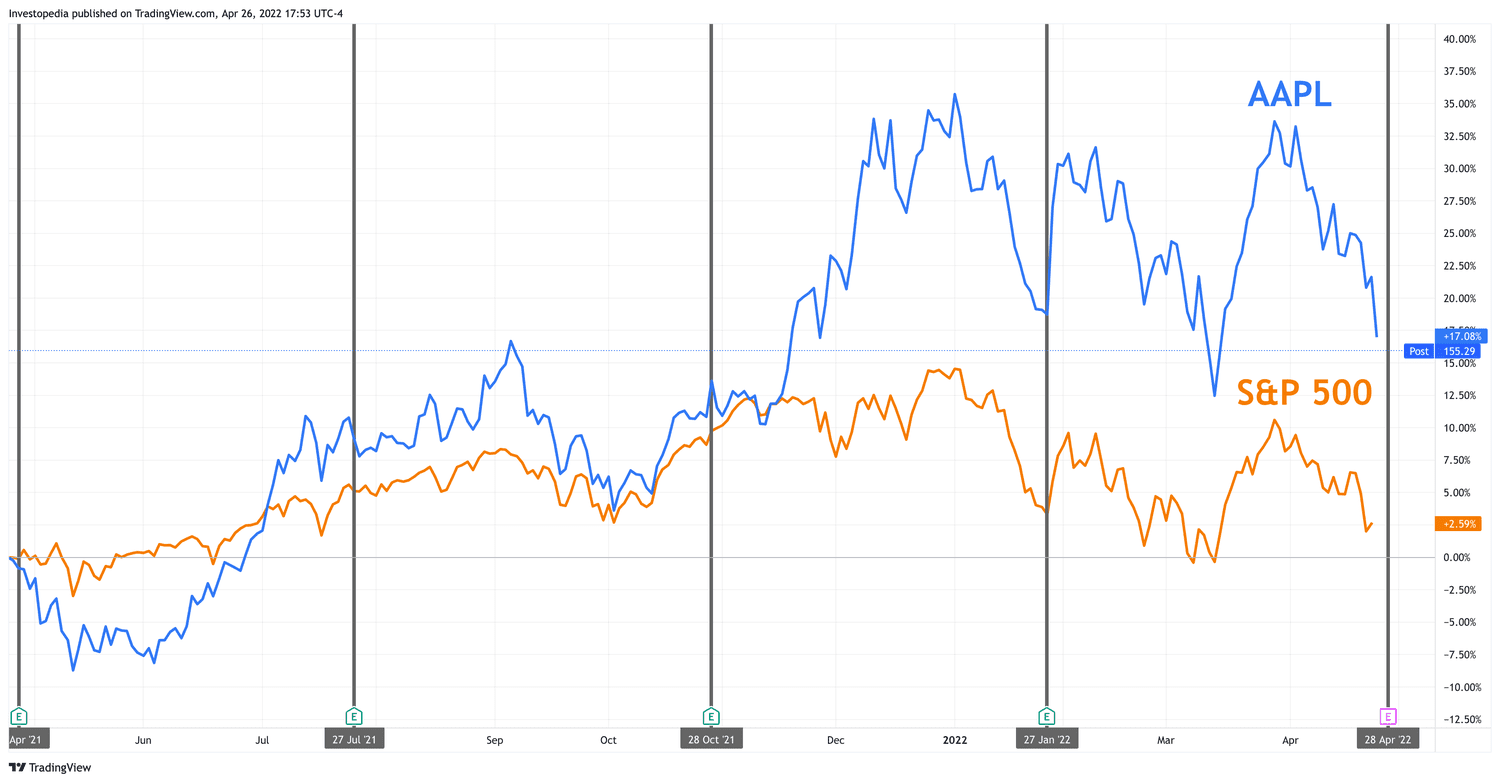

Apple Stock Dips Below Key Levels Before Q2 Earnings Report

Table of Contents

Factors Contributing to the Apple Stock Dip

Several interconnected factors have likely contributed to the recent decline in Apple stock. Understanding these nuances is crucial for investors seeking to navigate this period of uncertainty.

Weakening Consumer Demand

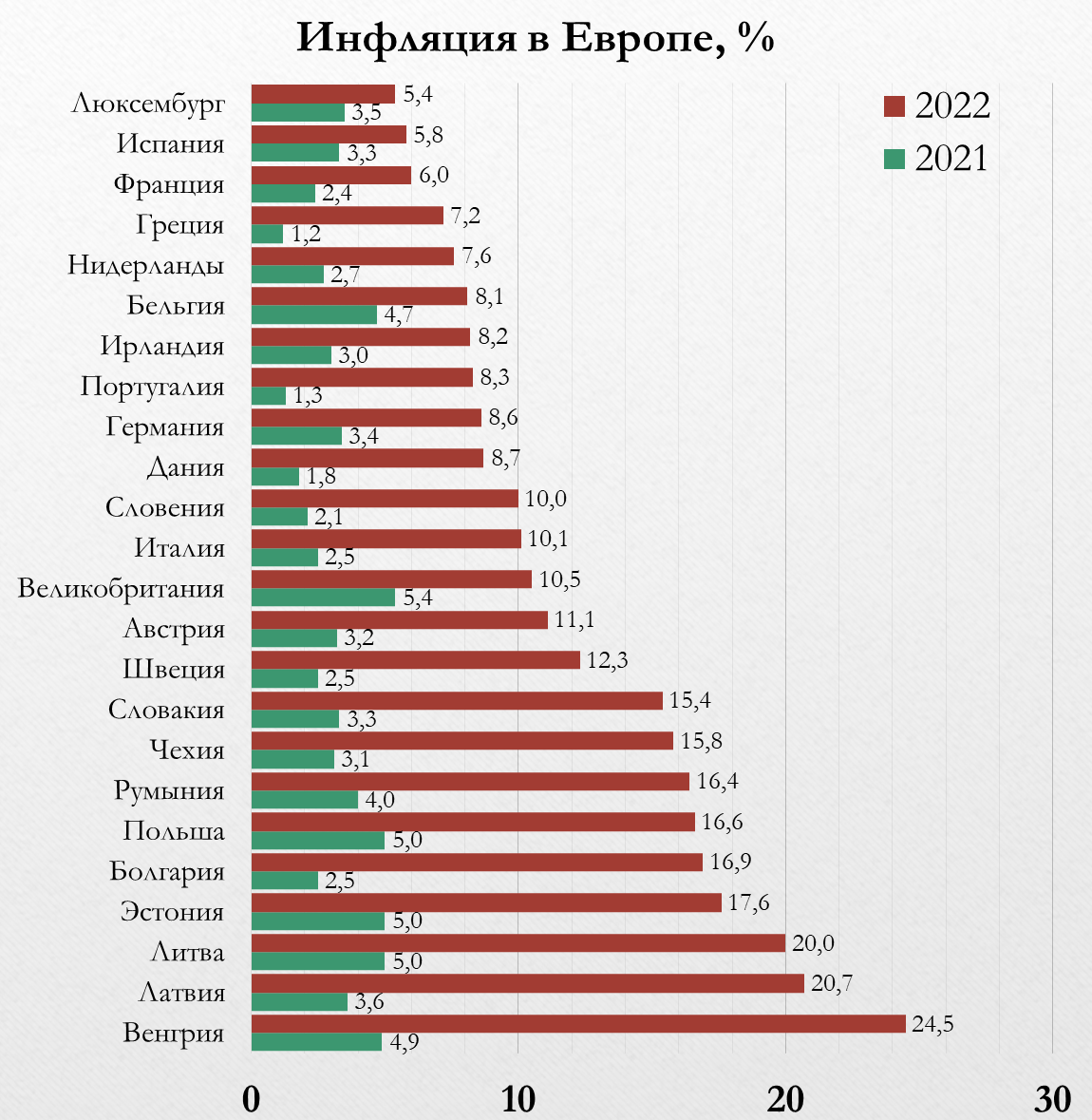

Global economic headwinds are significantly impacting consumer spending. Inflationary pressures and recessionary fears are leading to decreased discretionary spending, particularly on high-value electronics. This translates directly into reduced demand for Apple products.

- Decreased iPhone sales projections: Several analyst firms have lowered their projections for iPhone sales in Q2, citing weakening consumer demand as a primary driver.

- Lower demand for other Apple products: The impact extends beyond iPhones. Sales of iPads, Macs, and wearables are also expected to be affected by the current economic climate.

- Impact on consumer confidence: A decline in consumer confidence, fueled by economic uncertainty, further dampens the willingness to make significant purchases like new Apple products. This translates directly into lower Apple product sales.

Supply Chain Disruptions

Despite easing somewhat, global supply chain disruptions continue to pose challenges for Apple's production and profitability. These disruptions lead to increased production costs and impact the timely delivery of products.

- Manufacturing constraints: Continued factory closures and labor shortages in key manufacturing regions can limit Apple's production capacity.

- Component shortages: The scarcity of essential components, such as semiconductors, can delay the production and shipment of Apple devices.

- Logistical delays: Port congestion, shipping container shortages, and other logistical hurdles contribute to delays and increased transportation costs.

- Increased production costs: The cumulative effect of these disruptions drives up the overall cost of producing Apple products, squeezing profit margins.

Increased Competition

Apple faces increasingly fierce competition in the tech market, particularly in the smartphone and wearable sectors. Competitors are offering compelling alternatives, impacting Apple's market share and pricing power.

- Competition from Android manufacturers: Android manufacturers are consistently improving their offerings, providing strong competition to iPhones in terms of features and price.

- Challenges in the smart watch market: Apple's dominance in the smartwatch market is being challenged by competitors offering similar functionality at more competitive price points.

- Pricing pressure: The intensified competition is putting pressure on Apple's pricing strategy, potentially impacting profit margins.

Analyst Predictions and Market Sentiment

The anticipation surrounding Apple's Q2 earnings report has led to a wide range of analyst predictions and fluctuating market sentiment.

Pre-Earnings Report Speculation

Analyst predictions for Apple's Q2 performance are varied, reflecting the uncertainty in the market.

- Summary of bullish and bearish predictions: While some analysts remain bullish on Apple's long-term prospects, others express concerns about the impact of the aforementioned headwinds.

- Consensus estimates for earnings and revenue: Consensus estimates for earnings and revenue have been revised downward in recent weeks, reflecting the concerns about weakening consumer demand.

- Impact on investor confidence: This uncertainty has led to a decline in investor confidence, contributing to the recent dip in Apple stock.

Market Volatility and Investor Behavior

The overall market volatility also plays a significant role in influencing Apple's stock price.

- Impact of broader market trends: A general downturn in the stock market can negatively impact even strong performers like Apple.

- Risk aversion among investors: In times of economic uncertainty, investors often become more risk-averse, leading them to sell off stocks perceived as less secure.

- Impact of other tech stock performance: The performance of other tech stocks can also influence investor sentiment towards Apple.

What to Expect from the Q2 Earnings Report

The upcoming Q2 earnings report will be crucial in determining the future trajectory of Apple stock. Investors will closely scrutinize several key performance indicators.

Key Metrics to Watch

Investors will focus on several key metrics to gauge Apple's performance and future outlook.

- Revenue growth: The rate of revenue growth will be a critical indicator of Apple's ability to navigate the current economic challenges.

- Earnings per share (EPS): EPS will reflect Apple's profitability and efficiency in managing costs.

- iPhone sales figures: The performance of iPhone sales will be particularly closely watched, given their significance to Apple's overall revenue.

- Services revenue: The growth of Apple's services revenue stream will be another key focus area.

- Guidance for future quarters: Apple's guidance for future quarters will offer valuable insights into its expectations for the remainder of the year.

Potential Outcomes and Their Impact on Apple Stock

The Q2 earnings report could lead to several potential outcomes, each with its own impact on Apple's stock price.

- Positive surprise (beating expectations): If Apple manages to exceed expectations, it could lead to a significant rally in the stock price.

- Negative surprise (missing expectations): Conversely, a negative surprise could trigger further declines in Apple stock.

- Potential market reactions: The market reaction will depend on the magnitude of the surprise (positive or negative) and the overall market sentiment at the time.

Conclusion

The recent dip in Apple stock below key levels before the Q2 earnings report highlights the complex factors influencing the tech giant's performance. Weakening consumer demand, supply chain disruptions, and increased competition all play a role. While analyst predictions vary, investors will be closely watching key metrics such as revenue growth and iPhone sales. The upcoming earnings report will be critical in determining the future trajectory of Apple stock. Stay informed and continue monitoring Apple stock for updates on this developing situation. Understanding these key factors will help you make informed decisions regarding your Apple stock investments. Keep an eye out for our next analysis on Apple's Q2 earnings and the subsequent market reaction.

Featured Posts

-

Bangladeshs European Expansion Collaboration For Economic Growth

May 25, 2025

Bangladeshs European Expansion Collaboration For Economic Growth

May 25, 2025 -

Mia Farrows Future Ronan Farrows Influence

May 25, 2025

Mia Farrows Future Ronan Farrows Influence

May 25, 2025 -

Evrovidenie Sudby Pobediteley Za Poslednee Desyatiletie

May 25, 2025

Evrovidenie Sudby Pobediteley Za Poslednee Desyatiletie

May 25, 2025 -

Annual General Meeting Of Philips Shareholders Results And Future Outlook

May 25, 2025

Annual General Meeting Of Philips Shareholders Results And Future Outlook

May 25, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

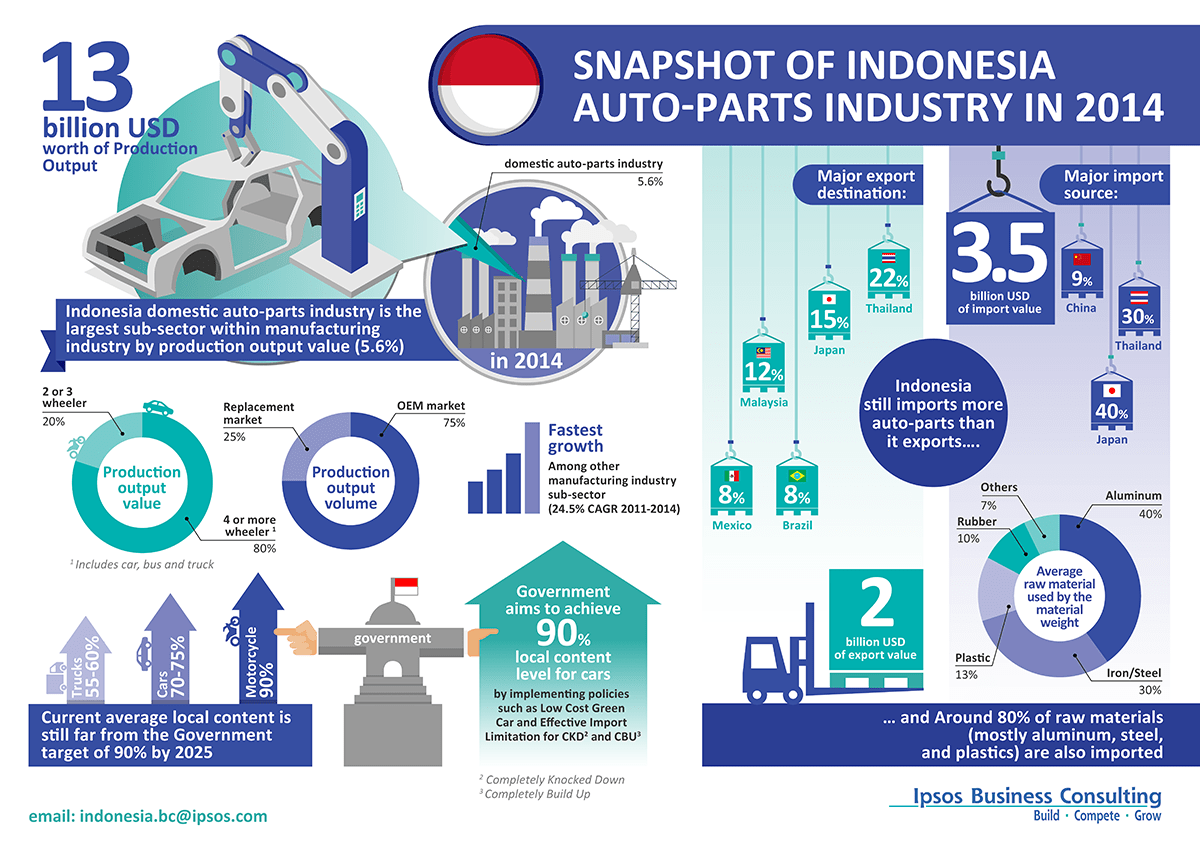

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025