Apple Stock Forecast: $254 Price Target – Should You Invest At $200?

Table of Contents

The current price of Apple stock hovers around $200, presenting a tempting opportunity for investors. With a predicted $254 price target floating around, many are wondering if now is the time to buy. However, the market is notoriously volatile, and making informed investment decisions requires careful analysis. This article aims to dissect the potential of Apple stock at its current price point, considering the alluring $254 price target forecast and the inherent risks involved. We'll explore Apple's financial health, future projections, and competitive landscape to help you determine if an Apple stock investment at around $200 aligns with your investment strategy.

2. Main Points:

2.1. Apple's Current Financial Performance and Future Projections:

H3: Revenue Growth and Profitability: Apple consistently demonstrates strong financial performance. Recent financial reports reveal impressive revenue growth and healthy net income. For example, year-over-year revenue growth has consistently been in the double digits for the past several quarters. Earnings per share (EPS) are also showing positive growth, indicating a healthy and profitable company. Projected EPS for the next fiscal year suggests continued growth, underpinning the positive Apple stock forecast.

- Bullet points:

- Year-over-year revenue growth consistently above 10% for the last four quarters.

- EPS growth exceeding analyst expectations in the last two quarters.

- Strong positive outlook for future revenue growth based on current market trends.

H3: Product Innovation and Market Share: Apple maintains its leadership in the tech sector through a consistent stream of innovative products. The iPhone continues to dominate the smartphone market, while the iPad, Mac, and wearables segments contribute significantly to overall revenue. Apple's Services division is also a major growth driver, demonstrating the strength and diversification of their business model. The upcoming release of new iPhones and potential advancements in augmented reality technology are likely to further boost future revenue.

- Bullet points:

- Dominant market share in the smartphone market.

- Strong growth in the wearables and services sectors.

- Anticipated new product launches expected to drive further revenue growth.

H3: Economic Factors and Market Sentiment: While Apple is generally considered resilient to economic downturns, macroeconomic factors such as inflation and interest rate hikes can influence investor sentiment and impact the Apple stock price. Currently, the tech sector is experiencing a period of moderate volatility, but Apple's strong financial performance often buffers it from broader market fluctuations. Positive analyst ratings and general investor confidence contribute to a largely positive outlook for Apple stock.

- Bullet points:

- Inflationary pressures and interest rate hikes may affect consumer spending and tech investment.

- Apple's strong financial performance helps to mitigate these risks.

- Positive analyst ratings and investor confidence support a positive outlook.

2.2. Analyzing the $254 Price Target:

H3: Basis for the Price Target: The $254 price target is derived from various sources, including several reputable analyst reports that use sophisticated financial models. These models typically consider projected revenue growth, profitability, and market share. The forecast is based on assumptions such as continued product innovation, strong consumer demand, and a stable macroeconomic environment. However, it's important to note that all forecasts are subject to inherent limitations and unforeseen circumstances.

- Bullet points:

- Several reputable analyst firms have issued reports supporting the $254 price target.

- The price target considers factors like future revenue growth and product launches.

- Unforeseen events could impact the accuracy of this price prediction.

H3: Risk Assessment: Investing in any stock carries inherent risk, and Apple stock is no exception. Market corrections, increased competition, supply chain disruptions, and changes in consumer behavior are potential downsides. While the $254 price target offers a potential upside, realizing that return is not guaranteed. Risk mitigation strategies include diversifying your investment portfolio and having a long-term investment horizon.

- Bullet points:

- Market corrections can significantly impact stock prices.

- Increased competition could erode market share and profitability.

- Supply chain issues could affect product availability and revenue.

2.3. Comparing Apple to Competitors:

H3: Competitive Analysis: Apple faces competition from other tech giants such as Microsoft, Google, and Samsung. However, Apple maintains a strong competitive advantage due to its brand loyalty, premium pricing strategy, and integrated ecosystem. While competitors offer comparable products, Apple often excels in design, user experience, and brand perception. This competitive edge is a key factor contributing to the positive Apple stock forecast.

- Bullet points:

- Strong brand loyalty gives Apple a significant competitive advantage.

- Apple's premium pricing strategy helps to maintain high profit margins.

- The integrated Apple ecosystem enhances customer loyalty and engagement.

3. Conclusion: Should You Invest in Apple Stock at $200? A Final Verdict

Based on our analysis of Apple's financial performance, future projections, and competitive landscape, the $254 price target presents a potentially attractive upside for investors. However, it's crucial to acknowledge the inherent risks associated with any stock investment. Whether investing in Apple stock at around $200 is advisable depends entirely on your individual risk tolerance and investment goals. A long-term investment horizon generally reduces the impact of short-term market fluctuations.

Consider your risk tolerance and investment goals before investing in Apple stock. Conduct thorough due diligence, including further research into Apple stock forecast and Apple stock analysis, to make a fully informed investment decision. Remember, this analysis does not constitute financial advice.

Featured Posts

-

M62 Westbound Planned Resurfacing Closure Manchester Warrington

May 24, 2025

M62 Westbound Planned Resurfacing Closure Manchester Warrington

May 24, 2025 -

Annie Kilners Diamond Ring Confirmation Of Engagement After Kyle Walker Sighting

May 24, 2025

Annie Kilners Diamond Ring Confirmation Of Engagement After Kyle Walker Sighting

May 24, 2025 -

Planning Your Escape To The Country A Practical Guide

May 24, 2025

Planning Your Escape To The Country A Practical Guide

May 24, 2025 -

Silence Impose La Mainmise De La Chine Sur Les Dissidents En France

May 24, 2025

Silence Impose La Mainmise De La Chine Sur Les Dissidents En France

May 24, 2025 -

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025

Latest Posts

-

New Southwest Airlines Policy Portable Charger Restrictions For Carry On Luggage

May 24, 2025

New Southwest Airlines Policy Portable Charger Restrictions For Carry On Luggage

May 24, 2025 -

Analysis Trumps Exclusive Insight Into Putins War In Ukraine

May 24, 2025

Analysis Trumps Exclusive Insight Into Putins War In Ukraine

May 24, 2025 -

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 24, 2025

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 24, 2025 -

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025 -

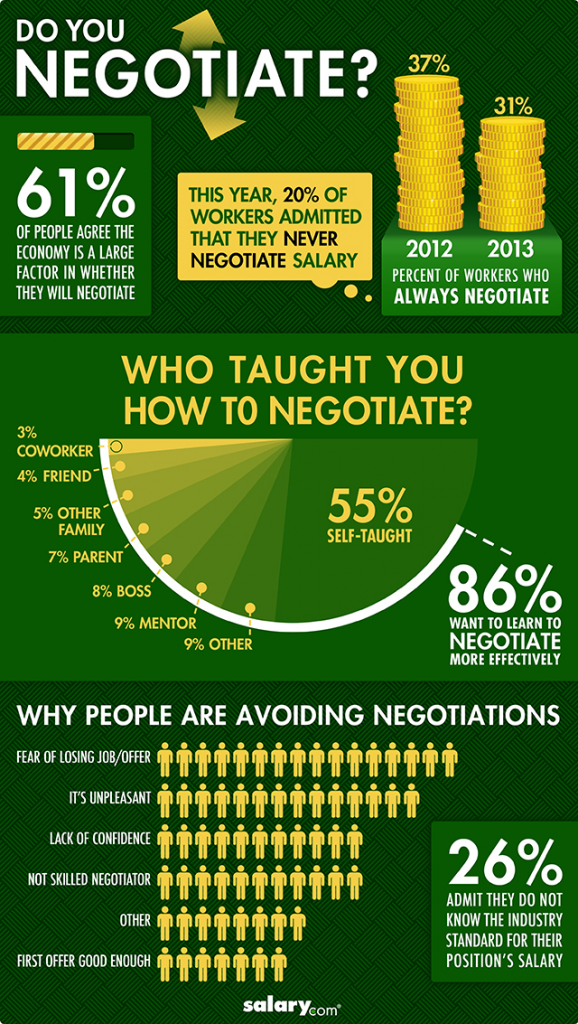

Is A Best And Final Job Offer Really Final Negotiation Strategies

May 24, 2025

Is A Best And Final Job Offer Really Final Negotiation Strategies

May 24, 2025