Apple Stock Performance: Below Key Levels Ahead Of Q2 Report

Table of Contents

Technical Analysis: Key Support and Resistance Levels Breached

Recent Apple stock chart movements reveal a concerning trend. The AAPL stock has breached several key support and resistance levels, suggesting potential further declines. Technical indicators paint a mixed picture, but the overall trend appears bearish in the short term.

- Key Support Breach: Apple stock recently broke below the crucial $150 support level, triggering significant sell-offs and increasing volatility in trading volume. This breakdown signals a weakening of investor confidence.

- Bearish Crossover: The 50-day moving average has crossed below the 200-day moving average, a classic bearish signal often indicating further downward pressure. This technical indicator reinforces the negative short-term outlook for Apple stock performance.

- Lack of Strong Rebound: Attempts at a rebound have been weak, suggesting a lack of buying pressure and potentially indicating continued selling pressure. Monitoring trading volume during these attempts will be critical in gauging the strength of the potential recovery.

Fundamental Factors Influencing Apple Stock Performance

Beyond technical analysis, several fundamental factors are contributing to Apple's underperformance. These include macroeconomic headwinds, concerns about iPhone sales, and competitive pressures.

- Slowing iPhone Sales Growth: Concerns about slowing iPhone sales growth are weighing heavily on investor sentiment. While the iPhone remains a dominant product, signs of saturation in certain markets and increased competition are causing apprehension.

- Macroeconomic Headwinds: Rising inflation and the potential for a global economic slowdown are impacting consumer spending on discretionary items like Apple products. Interest rate hikes also increase borrowing costs for businesses and consumers alike.

- Supply Chain Issues (Lingering Effects): Although supply chain issues have eased, lingering effects and the potential for new disruptions could impact Apple's production and profitability, thus influencing Apple stock price and the Apple investor outlook.

- Competitive Landscape: Intensifying competition from Android manufacturers, particularly in emerging markets, puts pressure on Apple's market share and revenue growth, thus impacting Apple financials.

Analyst Predictions and Expectations for Q2 Earnings

Analyst predictions for Apple's Q2 earnings vary, but a consensus of cautious optimism prevails. Many analysts have lowered their price targets for Apple stock due to concerns about weakening demand and macroeconomic uncertainties.

- Lowered EPS Estimates: Several analysts have lowered their earnings per share (EPS) projections for Q2, reflecting concerns about reduced iPhone sales and the impact of macroeconomic factors on overall revenue projections.

- Impact of an Earnings Surprise: A positive earnings surprise could potentially push the stock price above key resistance levels, boosting investor confidence. Conversely, a negative surprise could exacerbate the current downward trend and further depress the Apple stock price.

- Analyst Ratings: While some maintain a "buy" rating on AAPL stock, others have downgraded their ratings, reflecting the diverse opinions within the analyst community.

Investor Sentiment and Market Reaction

Current investor sentiment towards Apple and the broader tech sector is cautious. Market volatility is elevated, and risk appetite appears subdued.

- Cautious Outlook: Recent investor surveys indicate a cautious outlook on Apple's near-term prospects, reflecting concerns about economic uncertainties and competitive pressures.

- Potential Market Reactions: The market reaction to Apple's Q2 earnings will depend heavily on the results. A strong earnings report could trigger a short-term rally, but sustained gains will likely depend on broader market conditions and the overall economic outlook.

- Tech Sector Performance: The performance of the broader tech sector will also influence investor sentiment toward Apple. A broader tech sector downturn could negatively impact Apple stock performance, regardless of its own Q2 results.

Conclusion: Monitoring Apple Stock Performance Post-Q2 Report

Several key factors, including technical indicators, fundamental challenges, and analyst predictions, are affecting Apple's current stock performance. The upcoming Q2 earnings report is crucial for determining the future trajectory of the Apple stock price. Investors should carefully monitor Apple stock performance and stay informed about the company’s financial performance and broader market trends.

Stay tuned for our in-depth analysis of Apple's Q2 earnings report and continue to monitor Apple stock performance with us. Understanding the interplay of technical and fundamental factors is crucial for navigating the complexities of Apple stock and making informed investment decisions.

Featured Posts

-

Macrons Policies Face Criticism From Former French Pm

May 25, 2025

Macrons Policies Face Criticism From Former French Pm

May 25, 2025 -

Appeal Filed Ftc Challenges Microsofts Activision Blizzard Acquisition

May 25, 2025

Appeal Filed Ftc Challenges Microsofts Activision Blizzard Acquisition

May 25, 2025 -

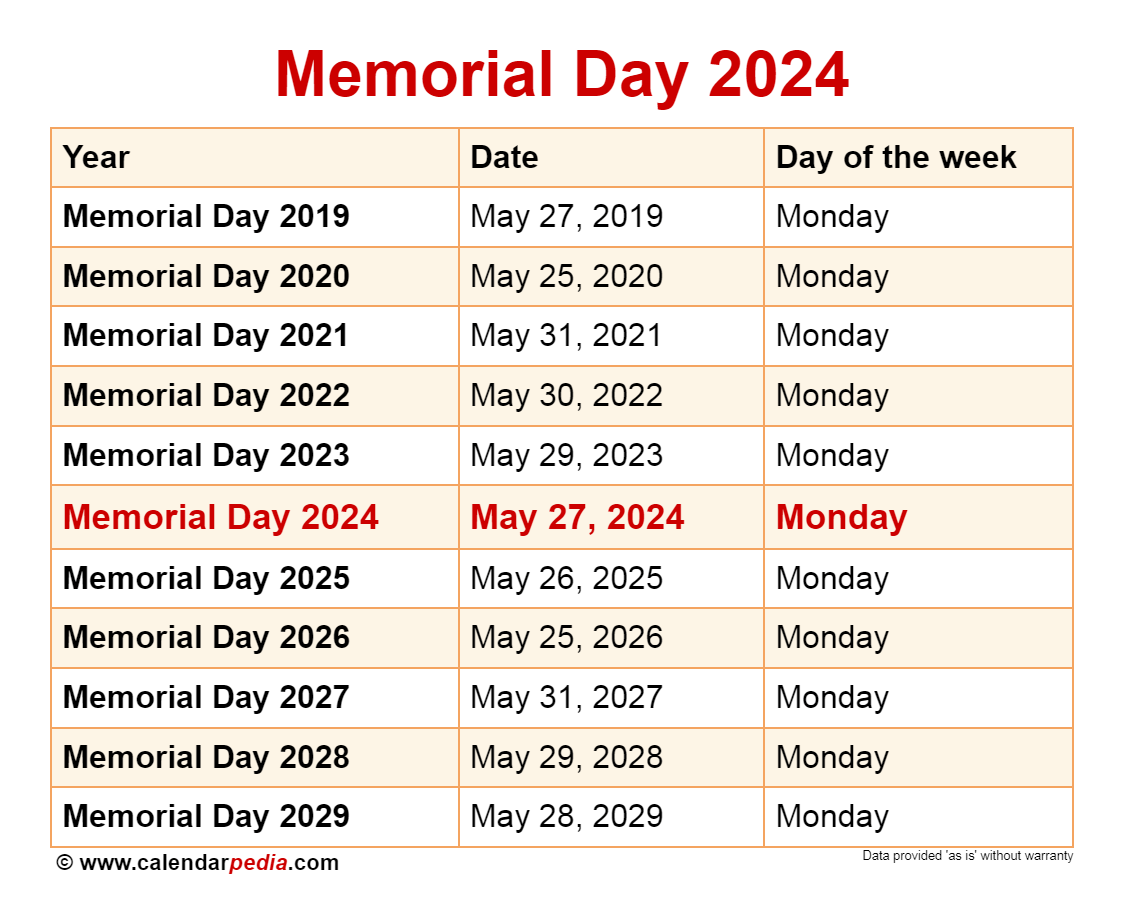

Flying During Memorial Day 2025 Your Guide To The Busiest Travel Days

May 25, 2025

Flying During Memorial Day 2025 Your Guide To The Busiest Travel Days

May 25, 2025 -

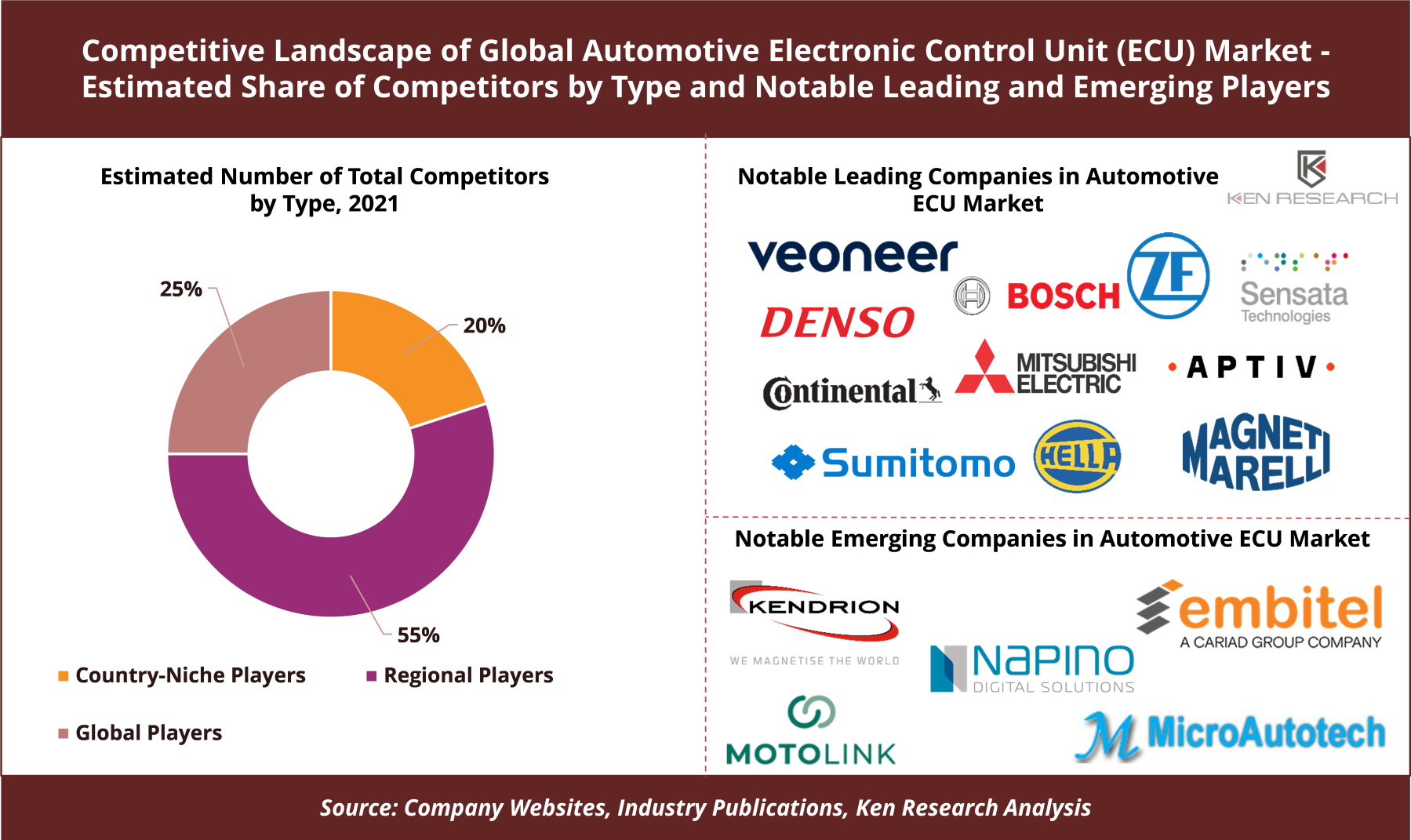

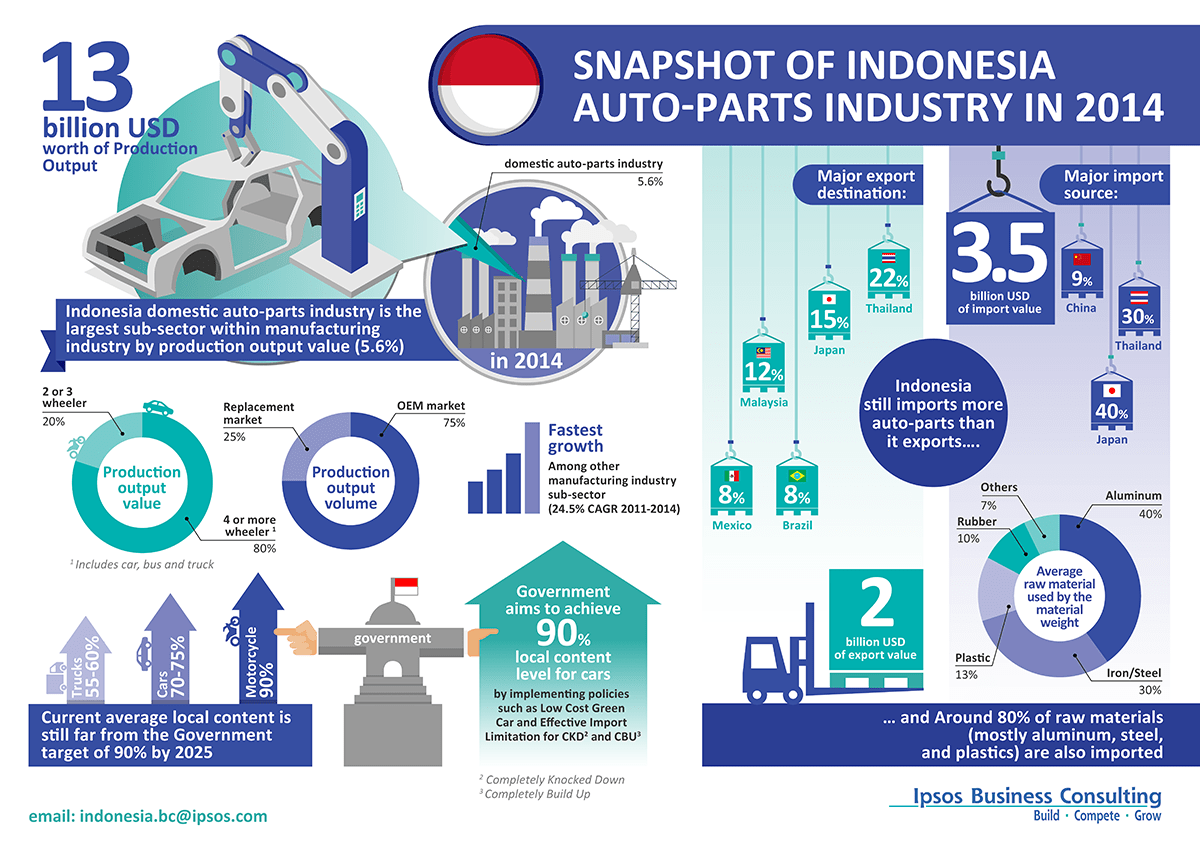

Chinas Automotive Landscape A Shifting Market For Global Players

May 25, 2025

Chinas Automotive Landscape A Shifting Market For Global Players

May 25, 2025 -

Investment In Amundi Djia Ucits Etf Factors Affecting Its Net Asset Value Nav

May 25, 2025

Investment In Amundi Djia Ucits Etf Factors Affecting Its Net Asset Value Nav

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025