Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff Hit: A Detailed Breakdown

The $900 million figure represents Apple's estimated increased costs due to newly imposed tariffs, primarily stemming from its significant manufacturing base in China. These tariffs, largely impacting imported goods, directly increase Apple's manufacturing costs, affecting its profit margins and ultimately its bottom line. Understanding the specifics of this tariff impact is crucial for analyzing the Apple stock price fluctuations.

-

Breakdown of tariff costs per product category: While Apple hasn't released a precise product-by-product breakdown, the impact is spread across its product lines. iPhones, being the flagship product, likely bear the brunt of the increased costs, followed by iPads, Macs, and other accessories. The exact percentage increase in cost varies depending on the specific components and the tariff rates applied.

-

Analysis of the impact on Apple's profit margins: The increased manufacturing costs directly reduce Apple's profit margins. This squeeze on profitability is a major factor contributing to investor concern and the subsequent Apple stock price decline. Analysts are closely scrutinizing Apple's financial reports to gauge the true extent of this impact.

-

Comparison to previous tariff impacts on Apple's financial performance: This isn't the first time Apple has faced tariff-related challenges. Comparing the current situation to previous instances helps gauge the magnitude of the present impact and predict potential future effects on the Apple stock. Historical data allows for a more informed assessment of Apple's resilience to these economic pressures.

-

Discussion of Apple's potential strategies to mitigate these costs: Apple is exploring various strategies to mitigate these increased costs. This includes potentially shifting some manufacturing operations outside of China, negotiating with suppliers, and potentially adjusting product pricing – although the latter could negatively affect consumer demand. The success of these strategies will significantly influence the future trajectory of the Apple stock price.

Impact on Apple's Stock Price and Investor Sentiment

The announcement of the substantial tariff impact immediately sent shockwaves through the stock market. The resulting Apple stock price drop reflects a significant decline in investor confidence. Analyzing the market's response is vital for understanding the ongoing situation and predicting future trends.

-

Chart showing Apple's stock price fluctuations around the tariff announcement: (Insert a relevant chart here showing Apple stock price fluctuations. This visual representation greatly enhances understanding and provides compelling data.)

-

Analysis of analyst ratings and predictions following the tariff announcement: Many financial analysts have downgraded their ratings for Apple stock in response to the tariff news, reflecting a more pessimistic outlook on the company's short-term prospects. Their predictions offer valuable insight into potential future price movements.

-

Comparison of Apple's stock performance to other tech companies affected by tariffs: Comparing Apple's performance to other tech companies similarly impacted by tariffs provides valuable context. This comparison can reveal whether the Apple stock slump is industry-wide or specific to the company's circumstances.

-

Discussion of the potential for further stock price declines or recovery: Predicting future stock price movement is challenging. However, by analyzing various factors, including Apple's response strategies, overall market conditions, and consumer demand, we can assess the potential for further declines or a market recovery.

Long-Term Implications for Apple and the Tech Industry

The long-term implications of these tariffs extend far beyond Apple's immediate financial performance. They represent a larger shift in the global tech landscape and highlight the increasing geopolitical risks affecting the industry.

-

Potential for increased prices for consumers: Increased manufacturing costs are likely to translate into higher prices for consumers, potentially dampening demand for Apple products. This price sensitivity could significantly impact Apple's future revenue streams.

-

Apple's potential response strategies (e.g., product diversification, price adjustments): Apple might respond by diversifying its manufacturing base, focusing on higher-margin products, or implementing innovative cost-cutting measures. These actions will shape its long-term competitiveness and, consequently, the Apple stock performance.

-

Impact on innovation and technological advancement due to increased production costs: Higher production costs could potentially stifle innovation by reducing the resources available for research and development. This could have a long-term impact on the competitiveness of the entire tech industry.

-

The broader implications of the trade war for the global tech industry: The current trade tensions represent a significant challenge for the global tech industry, with many companies facing similar tariff-related pressures. This broader context is crucial when evaluating the long-term outlook for Apple stock.

Strategies for Investors Navigating the Apple Stock Slump

The current situation demands a thoughtful approach to investing in Apple stock. Risk management and diversification are crucial to mitigate potential losses.

-

Recommendation to diversify investments beyond Apple stock: Investing heavily in a single stock, especially during periods of uncertainty, is risky. Diversifying your portfolio across various asset classes and sectors minimizes potential losses.

-

Strategies for managing risk in a volatile market: Strategies like dollar-cost averaging (investing fixed amounts at regular intervals) can help reduce the impact of market volatility. Understanding your risk tolerance is also critical.

-

Long-term outlook for Apple stock, considering the potential for recovery: Despite the current slump, Apple remains a strong company with a loyal customer base. The long-term outlook for Apple stock depends on how effectively it navigates these challenges and capitalizes on future growth opportunities.

-

Potential alternative investment options within the tech sector: Exploring alternative investments within the tech sector can provide diversification and exposure to other growth opportunities.

Conclusion

The $900 million tariff impact on Apple has caused a significant slump in its stock price, reflecting the vulnerability of even tech giants to global trade tensions. Understanding the detailed breakdown of the tariff's impact, the market's reaction, and the long-term implications is crucial for both investors and industry analysts. The Apple stock price remains sensitive to ongoing trade developments.

Call to Action: Stay informed about the evolving situation regarding Apple stock and the impact of tariffs. Regularly monitor market updates and consider diversifying your investment portfolio to mitigate risks associated with the ongoing trade war. Understanding the nuances of the Apple stock slump is essential for making informed investment decisions.

Featured Posts

-

Law Enforcement Cracks Down On Gun Trafficking 18 Brazilian Nationals Arrested In Massachusetts

May 25, 2025

Law Enforcement Cracks Down On Gun Trafficking 18 Brazilian Nationals Arrested In Massachusetts

May 25, 2025 -

Day 5 Staying Safe During Severe Weather Focus On Flood Prevention And Response

May 25, 2025

Day 5 Staying Safe During Severe Weather Focus On Flood Prevention And Response

May 25, 2025 -

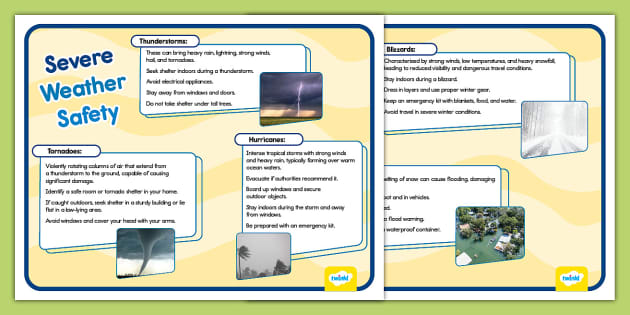

Delayed Launch Blue Origin Identifies Subsystem Problem

May 25, 2025

Delayed Launch Blue Origin Identifies Subsystem Problem

May 25, 2025 -

Hakem Takla Atti Atletico Madrid In Espanyol Engeline Takilmasi

May 25, 2025

Hakem Takla Atti Atletico Madrid In Espanyol Engeline Takilmasi

May 25, 2025 -

Explore The 2025 Porsche Cayenne High Resolution Interior And Exterior Images

May 25, 2025

Explore The 2025 Porsche Cayenne High Resolution Interior And Exterior Images

May 25, 2025

Latest Posts

-

Soerloth Un La Liga Firtinasi Ilk 30 Dakikada 4 Gol

May 25, 2025

Soerloth Un La Liga Firtinasi Ilk 30 Dakikada 4 Gol

May 25, 2025 -

Real Madrid Doert Yildiz Oyuncu Hakkinda Sorusturma Baslatildi

May 25, 2025

Real Madrid Doert Yildiz Oyuncu Hakkinda Sorusturma Baslatildi

May 25, 2025 -

Atletico Madrid In Sevilla Zaferi 1 2 Lik Sonuc Ve Mac Oezeti

May 25, 2025

Atletico Madrid In Sevilla Zaferi 1 2 Lik Sonuc Ve Mac Oezeti

May 25, 2025 -

Bueyuek Sok Real Madrid De Doert Yildiza Sorusturma

May 25, 2025

Bueyuek Sok Real Madrid De Doert Yildiza Sorusturma

May 25, 2025 -

Uefa Dan Arda Gueler Ve Real Madrid E Ait Kritik Sorusturma Aciklamasi

May 25, 2025

Uefa Dan Arda Gueler Ve Real Madrid E Ait Kritik Sorusturma Aciklamasi

May 25, 2025