Apple Stock: Wedbush's Long-Term Bullish Prediction After Price Target Cut

Table of Contents

Wedbush's Price Target Cut and Rationale

The Lowered Price Target

Wedbush recently lowered its price target for Apple stock from [insert previous price target] to [insert new price target], representing a [insert percentage]% decrease. This adjustment, while seemingly negative, doesn't reflect a change in their overall bullish sentiment towards the company.

-

Reasons for the Price Target Cut: Wedbush cited several factors contributing to the price target reduction. These include:

- Macroeconomic headwinds: Concerns about a potential global recession and its impact on consumer spending influenced the decision.

- Supply chain challenges: Ongoing disruptions in the global supply chain continue to pose risks to Apple's production and sales.

- Potential iPhone sales slowdown: A predicted slight slowdown in iPhone sales growth in the near term also factored into the analysis.

- Increased interest rates: The impact of higher interest rates on consumer borrowing and overall economic activity.

-

Financial Metrics: The decision was influenced by factors including a projected slight dip in quarterly earnings, revised estimates for iPhone unit sales, and concerns about the overall macroeconomic environment.

-

Counterarguments: Despite these concerns, Wedbush emphasized that these are short-term factors and do not fundamentally alter their long-term view of Apple's potential. They pointed to Apple's robust financial position and its diversified revenue streams as mitigating factors.

Maintaining a Bullish Outlook: Why Wedbush Remains Confident

Long-Term Growth Potential

Despite the price target cut, Wedbush maintains a bullish outlook on Apple stock, emphasizing its considerable long-term growth potential.

-

Strong Ecosystem and Services Revenue Growth: Apple's integrated ecosystem, encompassing iPhones, iPads, Macs, and wearables, continues to drive strong customer loyalty and recurring revenue through its services segment. This recurring revenue stream provides stability and predictability, even during economic downturns.

-

Future Growth Drivers: Several factors point to continued growth:

- New product launches: Anticipated releases of new iPhones, Macs, and other devices will continue to fuel sales.

- Expansion into new markets: Apple is continually expanding its reach into emerging markets, offering significant untapped growth potential.

- Augmented and Virtual Reality (AR/VR): Apple's rumored foray into AR/VR could open up entirely new revenue streams.

-

Positive Industry Trends: The ongoing shift towards a digital-first world, the growth of the cloud computing market, and the increasing demand for high-quality consumer electronics all contribute to a positive outlook for Apple.

Analyzing the Market Reaction to the News

Immediate Market Response

The immediate market reaction to Wedbush's announcement was relatively muted. While Apple's stock price experienced a slight dip, it quickly recovered, suggesting that many investors shared Wedbush's long-term perspective.

Investor Sentiment

Despite the price target cut, investor sentiment towards Apple remains largely positive. The overall trading volume didn't show a significant increase or decrease, suggesting that the news wasn't dramatically altering the investment strategies of most investors.

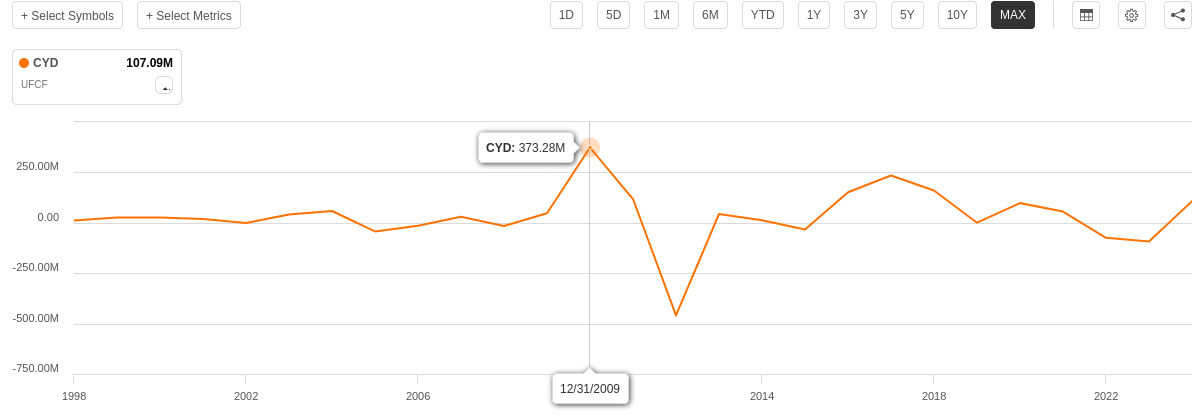

- Stock Price Movement: [Insert chart or graph illustrating the stock price movement after the announcement].

- Analyst Opinions: Many other financial analysts echoed Wedbush's sentiment, highlighting the long-term growth potential of Apple despite short-term challenges.

Risks and Considerations for Apple Stock Investors

Potential Downsides

While Wedbush maintains a bullish outlook, several risks need to be considered:

- Economic Uncertainty: Global economic uncertainty, inflation, and potential recessions could negatively impact consumer spending and Apple's sales.

- Competitive Landscape: Intense competition from other technology companies, particularly in the smartphone and wearable markets, could impact Apple's market share.

- Geopolitical Risks: Global political instability and trade tensions could disrupt supply chains or impact Apple's operations in certain regions.

- Regulatory Hurdles: Increased regulatory scrutiny in various markets could also pose challenges for Apple.

Conclusion: Wedbush's Bullish Prediction: A Long-Term Perspective on Apple Stock

Wedbush's revised price target for Apple stock, while lower than before, reflects a cautious approach to short-term market uncertainties. However, their maintained bullish stance underscores their confidence in Apple's long-term growth potential, driven by a strong ecosystem, robust services revenue, and exciting future product launches. The key takeaway is that despite near-term headwinds, Apple's fundamental strength and long-term prospects remain attractive.

Key Takeaways:

- Wedbush remains bullish on Apple stock despite a price target cut.

- Short-term concerns are outweighed by long-term growth potential.

- Apple's strong ecosystem and services revenue provide stability.

Should you invest in Apple stock? This article provides valuable insights, but it's crucial to conduct thorough research, understand your own risk tolerance, and consider seeking professional financial advice before making any investment decisions. Learn more about Apple stock investing and analyze the Apple stock outlook for yourself to make informed choices.

Featured Posts

-

Apple Stock Key Levels Breached Ahead Of Q2 Financial Results

May 25, 2025

Apple Stock Key Levels Breached Ahead Of Q2 Financial Results

May 25, 2025 -

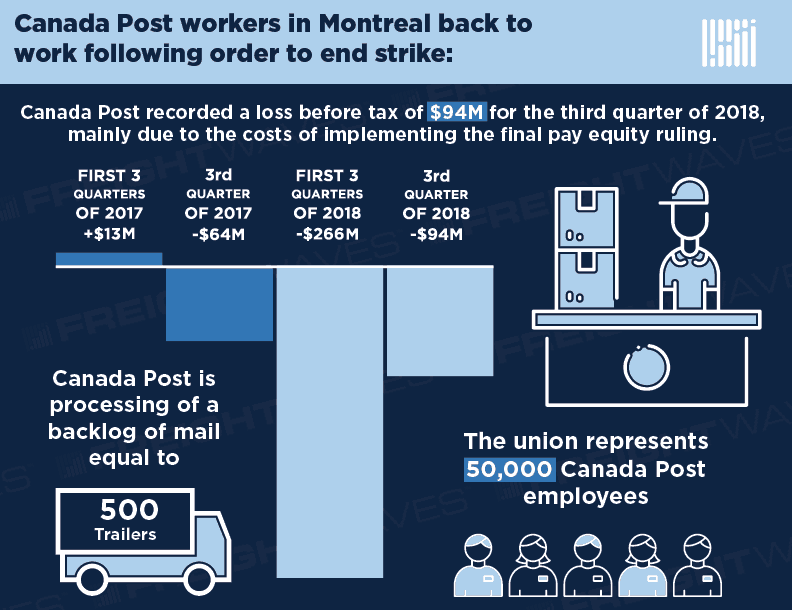

Will A Canada Post Strike Drive Customers To Competitors

May 25, 2025

Will A Canada Post Strike Drive Customers To Competitors

May 25, 2025 -

Economic Slowdown Hits Paris Luxury Market Decline Impacts Budget

May 25, 2025

Economic Slowdown Hits Paris Luxury Market Decline Impacts Budget

May 25, 2025 -

Strengthening Canada Mexico Trade Relations In A Changing North American Market

May 25, 2025

Strengthening Canada Mexico Trade Relations In A Changing North American Market

May 25, 2025 -

Hospodarsky Pokles V Nemecku Dopady Na Trh Prace A Prehlad Prepustania Na H Nonline Sk

May 25, 2025

Hospodarsky Pokles V Nemecku Dopady Na Trh Prace A Prehlad Prepustania Na H Nonline Sk

May 25, 2025

Latest Posts

-

Southern Tourist Destination Disputes Safety Concerns Following Violence

May 25, 2025

Southern Tourist Destination Disputes Safety Concerns Following Violence

May 25, 2025 -

Popular Southern Vacation Spot Responds To Safety Rating Downgrade Post Shooting

May 25, 2025

Popular Southern Vacation Spot Responds To Safety Rating Downgrade Post Shooting

May 25, 2025 -

Southern Vacation Destination Addresses Safety Concerns Following Shooting

May 25, 2025

Southern Vacation Destination Addresses Safety Concerns Following Shooting

May 25, 2025 -

One Dead Eleven Injured In Myrtle Beach Police Shooting Sled Investigation Underway

May 25, 2025

One Dead Eleven Injured In Myrtle Beach Police Shooting Sled Investigation Underway

May 25, 2025 -

Southern Vacation Hotspot Rebuts Negative Safety Rating After Shooting Incident

May 25, 2025

Southern Vacation Hotspot Rebuts Negative Safety Rating After Shooting Incident

May 25, 2025