April 2024: U.S. Customs Duties Hit Record $16.3 Billion

Table of Contents

Factors Contributing to the Record-High U.S. Customs Duties

Several interconnected factors contributed to the record-breaking $16.3 billion in U.S. customs duties collected in April 2024. Understanding these factors is crucial for navigating the complexities of import duties and tariffs in the current economic climate.

Increased Import Volume

A significant driver of the increased U.S. customs duties is the substantial rise in import volume. Strong consumer spending and ongoing adjustments within global supply chains have fueled a surge in imported goods.

- Specific Sectors: The electronics sector witnessed a particularly sharp increase, with imports from East Asia rising by an estimated 15%. Similarly, the automotive industry saw a notable uptick in imported parts and vehicles. Consumer goods, ranging from apparel to household items, also contributed significantly to the overall import volume increase.

- Reasons for Increased Imports: Robust consumer demand following the pandemic recovery, coupled with ongoing efforts to diversify supply chains away from single-source reliance, are key contributors to this surge in imports.

Impact of Existing Tariffs and Trade Policies

Pre-existing tariffs and trade policies played a crucial role in the revenue generated. While some tariffs were implemented years ago, their ongoing impact on import costs directly translates to higher customs duty collections.

- Key Trade Agreements: The effects of ongoing trade negotiations and agreements, including existing tariffs on specific goods from certain countries, significantly influenced the overall duty revenue. Changes in these agreements, even minor adjustments, can dramatically impact import costs and, subsequently, U.S. customs duties.

- Recent Tariff Adjustments: While no major tariff changes were implemented immediately preceding April 2024, the cumulative effect of existing tariffs, coupled with increased import volumes, led to this record-breaking collection.

Strengthening of the U.S. Dollar

The relative strength of the U.S. dollar against other major currencies also contributed to the higher customs duties. A stronger dollar makes imports cheaper in dollar terms, but the value of the import remains the same, leading to a higher duty assessment.

- Dollar's Performance: The U.S. dollar strengthened against several key trading partners' currencies in the lead-up to April 2024. This strengthened position increased the dollar value of imported goods, subsequently resulting in higher import duty payments.

- Mechanism of Impact: When the dollar strengthens, importers pay more in their domestic currency for the same quantity of imported goods, thus increasing the base upon which customs duties are calculated.

Implications of the Record Customs Duties Collection

The record-high U.S. customs duties have far-reaching implications across various sectors of the economy and international relations.

Impact on Businesses

The substantial increase in customs duties directly impacts businesses involved in importing and exporting goods.

- Price Increases for Consumers: Importers may pass on the increased costs to consumers, leading to higher prices for various goods and potentially dampening consumer demand.

- Reduced Profitability for Importers: Higher duties reduce the profitability of import businesses, forcing them to adapt their strategies. Some may choose to absorb the costs while others might explore alternative sourcing options or adjust pricing strategies.

- Supply Chain Shifts: Businesses may be forced to re-evaluate their supply chains, potentially seeking alternative sources of goods from countries with lower tariffs or more favorable trade agreements.

Government Revenue and Spending

The increased customs duties provide the U.S. government with substantially higher revenue.

- Potential Uses of Revenue: This influx of funds could be allocated towards various government initiatives, such as infrastructure development, debt reduction, or investments in specific sectors.

- Economic Impact: The efficient allocation of these funds can positively impact the economy by stimulating growth, creating jobs, and improving infrastructure. However, misallocation can negate these benefits.

International Trade Relations

The record customs duties could strain U.S. trade relations with other countries.

- Potential Retaliatory Measures: Other countries might implement retaliatory measures, such as imposing their own tariffs or trade restrictions on U.S. goods, potentially leading to trade disputes.

- Impact on Global Trade: Escalating trade tensions could negatively impact global trade flows, potentially slowing down economic growth worldwide.

Conclusion

The record-breaking $16.3 billion in U.S. customs duties collected in April 2024 is a significant event with wide-ranging implications. Increased import volume, existing tariffs, and the strength of the U.S. dollar all contributed to this surge. The consequences include higher prices for consumers, challenges for businesses, increased government revenue, and potential impacts on international trade relations. Staying informed about the latest developments in U.S. customs duties and their impact on the economy is crucial for businesses and consumers alike. Stay updated on the latest developments in U.S. customs duties and their impact on your business by subscribing to our newsletter or following our blog for in-depth analysis of U.S. import duties and international trade.

Featured Posts

-

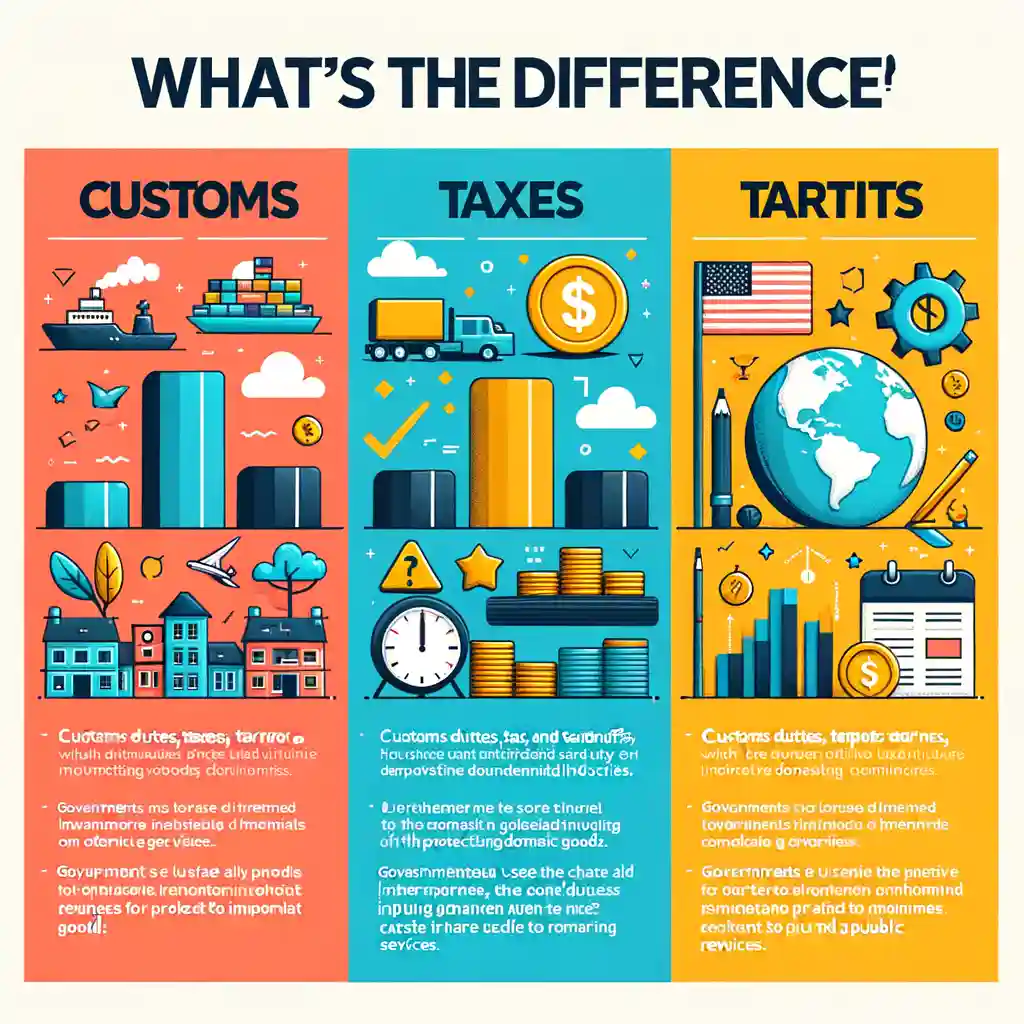

The Unexpected Truth About Leonardo Di Caprios Latest Relationship

May 13, 2025

The Unexpected Truth About Leonardo Di Caprios Latest Relationship

May 13, 2025 -

Foto Galeriya 10 Aktori I Tekhnite Deystviya Za Spasyavane Na Zhivot

May 13, 2025

Foto Galeriya 10 Aktori I Tekhnite Deystviya Za Spasyavane Na Zhivot

May 13, 2025 -

Can You Name The Nba Draft Lottery Winners Since 2000

May 13, 2025

Can You Name The Nba Draft Lottery Winners Since 2000

May 13, 2025 -

2025 Nhl Draft Lottery Islanders Sharks And Blackhawks Secure Top 3 Picks

May 13, 2025

2025 Nhl Draft Lottery Islanders Sharks And Blackhawks Secure Top 3 Picks

May 13, 2025 -

David Alan Grier Funeral Owners Elsbeth Episode A Closer Look

May 13, 2025

David Alan Grier Funeral Owners Elsbeth Episode A Closer Look

May 13, 2025

Latest Posts

-

Stream Captain America Brave New World Where To Watch

May 14, 2025

Stream Captain America Brave New World Where To Watch

May 14, 2025 -

Watch Captain America Brave New World Online A Complete Streaming Guide For Marvel Fans

May 14, 2025

Watch Captain America Brave New World Online A Complete Streaming Guide For Marvel Fans

May 14, 2025 -

How To Watch Captain America Brave New World Online Streaming Guide

May 14, 2025

How To Watch Captain America Brave New World Online Streaming Guide

May 14, 2025 -

Watch Captain America Brave New World Best Pvod Streaming Services

May 14, 2025

Watch Captain America Brave New World Best Pvod Streaming Services

May 14, 2025 -

Where To Stream Captain America Brave New World Digital And Disney Release Dates

May 14, 2025

Where To Stream Captain America Brave New World Digital And Disney Release Dates

May 14, 2025