April 23, 2024 Oil Market Update: Prices, News, And Analysis

Table of Contents

Oil Price Movements on April 23, 2024

Brent Crude Oil Price

Brent crude, the global benchmark for oil prices, closed at $85.50 per barrel on April 23, 2024. This represents a 2.5% increase compared to the previous day's closing price and a 4% increase from the week's opening. The price experienced significant volatility throughout the day, peaking at $86.20 following news of the Caspian pipeline disruption before settling slightly lower.

WTI Crude Oil Price

West Texas Intermediate (WTI) crude, the benchmark for US oil, closed at $82.00 per barrel. This is a 2% increase from the previous day and a 3.5% increase compared to the beginning of the week. Similar to Brent, WTI experienced intraday fluctuations, reflecting the market's reaction to the geopolitical developments.

- Factors Driving Price Changes: The primary driver of the price increase was the aforementioned pipeline closure in the Caspian Sea region, which immediately tightened global supply. Further contributing factors included ongoing geopolitical uncertainty in the Middle East and a weaker US dollar, making oil more affordable for buyers using other currencies.

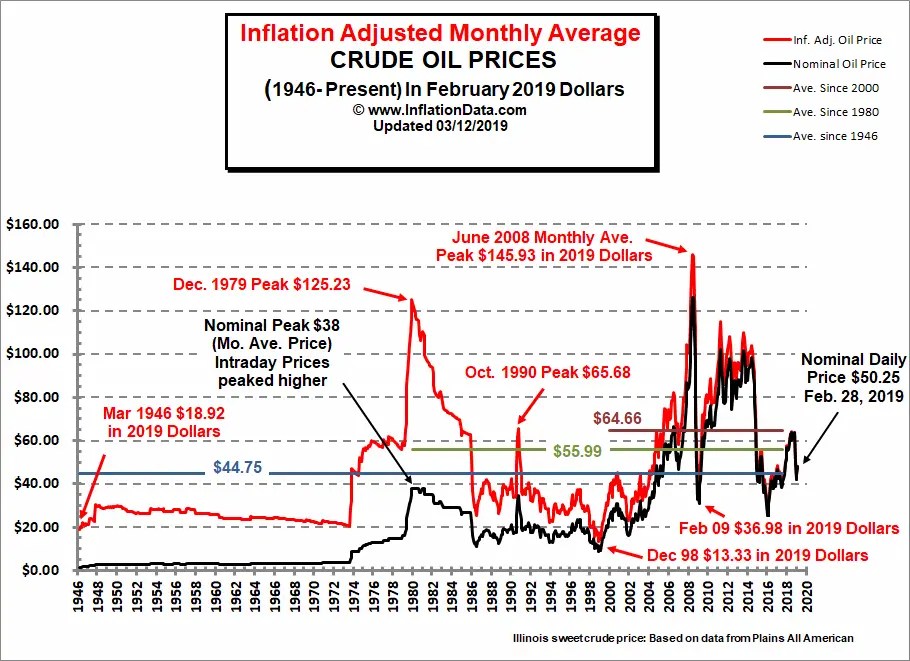

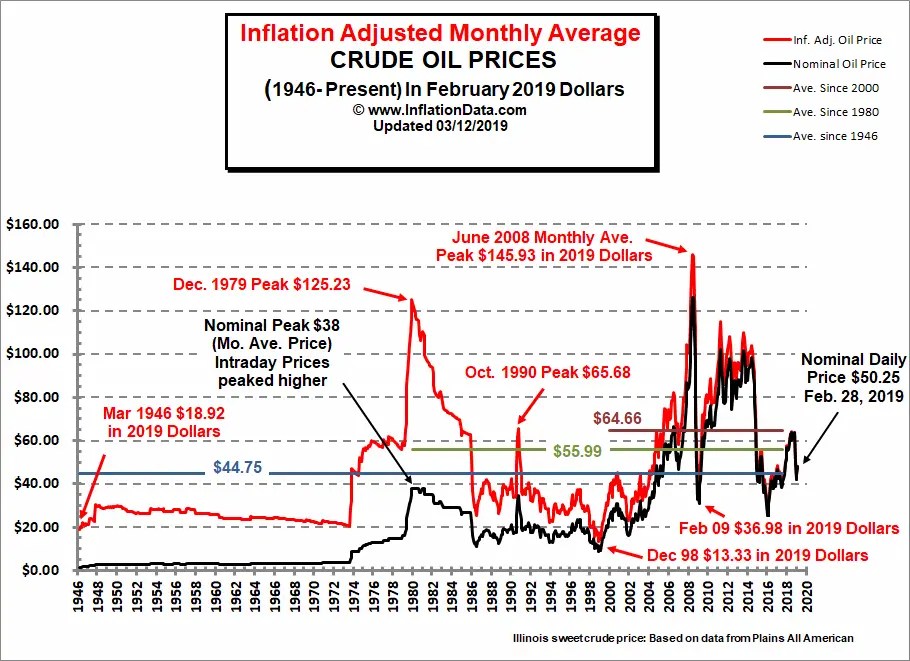

- Price Comparison: These prices are higher than the 6-month average of $78 for Brent and $74 for WTI, indicating a tightening market.

- (Insert Chart/Graph Here): A visual representation of Brent and WTI price movements throughout April 23, 2024, would enhance this section.

Key News and Events Impacting the Oil Market

Geopolitical Developments

The closure of the Caspian Sea pipeline due to unforeseen circumstances significantly impacted market sentiment. Concerns about potential further disruptions to oil supply from this region dominated the news cycle. Other geopolitical tensions, such as ongoing conflicts in various parts of the world, continue to contribute to uncertainty in the oil market.

OPEC+ Decisions

OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) has not made any major announcements regarding production quotas in recent days. However, the market is closely watching for any potential adjustments in response to the recent supply disruptions and overall market dynamics. Any shift in OPEC+ policy could drastically alter the oil price trajectory.

Economic Indicators

Recent economic data points to a mixed picture. While some indicators suggest continued global economic growth, others point to potential slowdowns in key economies. This uncertainty regarding future demand influences investor sentiment and impacts oil prices. For instance, rising inflation rates in certain regions could lead to decreased demand for oil.

- Summary of News Events: The Caspian pipeline closure is the most impactful recent event. Geopolitical tensions and economic data create a complex backdrop for oil price forecasting.

- Impact on Oil Prices and Market Sentiment: The pipeline closure drove prices up significantly due to immediate supply concerns. The overall sentiment is cautiously optimistic, with traders balancing supply fears against potential demand weakening.

- (Include Links to Credible News Sources): [Link 1], [Link 2], [Link 3] (Replace with actual links to relevant news articles)

Oil Market Analysis and Forecast

Supply and Demand Dynamics

The current oil market is characterized by a relatively tight balance between supply and demand. While overall production remains reasonably robust, unexpected disruptions, such as the Caspian pipeline issue, can quickly lead to price spikes. The demand side is influenced by global economic growth and the ongoing energy transition.

Market Sentiment and Investor Behavior

Investor sentiment is currently mixed, with some investors expressing concerns over geopolitical risks and potential demand slowdowns, while others remain optimistic about the long-term outlook for oil demand, especially considering the increasing global energy consumption. Volatility is expected to remain high in the short term.

Short-Term and Long-Term Outlook

In the short term (next few weeks), oil prices are likely to remain volatile, influenced by further news on the Caspian pipeline situation and developments in the broader geopolitical landscape. The long-term outlook is more uncertain, depending on factors such as global economic growth, OPEC+ policy, and the pace of the energy transition.

- Supporting Data and Evidence: Data on oil production, consumption, and inventory levels should support this analysis.

- Assumptions Made: This forecast assumes no major unexpected geopolitical events and a relatively stable global economic environment.

- Potential Risks and Uncertainties: Geopolitical risks, unexpected supply disruptions, changes in OPEC+ policy, and variations in global economic growth are significant uncertainties.

Conclusion: Stay Informed on Future Oil Market Trends

This April 23, 2024 oil market update highlighted the significant impact of the Caspian pipeline disruption on Brent and WTI crude prices. We analyzed key news events, assessed the current supply and demand dynamics, and provided a short-term and long-term outlook, acknowledging inherent uncertainties. Monitoring the oil market is crucial for investors and consumers alike. Check back regularly for future updates on oil market analysis, and subscribe to receive email alerts on crude oil price changes. Further reading on related topics like energy market trends and OPEC news can provide deeper insights. The dynamic nature of the oil market necessitates continuous monitoring and informed decision-making.

Featured Posts

-

Credit Card Spending Slowdown A New Reality For Issuers

Apr 24, 2025

Credit Card Spending Slowdown A New Reality For Issuers

Apr 24, 2025 -

Tajni Projekt Zasto Tarantino Ne Zeli Gledati Film S Johnom Travoltom

Apr 24, 2025

Tajni Projekt Zasto Tarantino Ne Zeli Gledati Film S Johnom Travoltom

Apr 24, 2025 -

Understanding Google Fis New 35 Unlimited Data Plan

Apr 24, 2025

Understanding Google Fis New 35 Unlimited Data Plan

Apr 24, 2025 -

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 24, 2025

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 24, 2025 -

Kci Johna Travolte Odrasla U Prekrasnu Zenu

Apr 24, 2025

Kci Johna Travolte Odrasla U Prekrasnu Zenu

Apr 24, 2025