April 8th Treasury Market Recap: Understanding The Night's Events

Table of Contents

Key Treasury Yield Movements on April 8th

April 8th witnessed notable shifts across the Treasury yield curve. Yields, which represent the return on investment for Treasury bonds, moved in response to various factors influencing investor demand. This section summarizes the significant changes observed across different maturities.

-

Overall Movement: The Treasury market experienced a general increase in yields across the curve. This upward movement suggests a shift towards higher interest rate expectations.

-

Specific Yield Changes:

- 2-Year Treasury Note: Yields rose by approximately 0.08%, closing at [Insert Closing Yield Percentage].

- 5-Year Treasury Note: Yields increased by approximately 0.12%, closing at [Insert Closing Yield Percentage].

- 10-Year Treasury Note: Yields saw a more pronounced increase of 0.15%, closing at [Insert Closing Yield Percentage].

- 30-Year Treasury Bond: Yields rose by approximately 0.10%, closing at [Insert Closing Yield Percentage].

-

Comparison to Previous Day: Compared to the previous day's closing yields, all maturities showed an increase, reflecting the overall upward trend in the Treasury market. The magnitude of these increases indicates a notable shift in investor sentiment and expectations. [Insert Comparative Data].

-

Unusual Spikes or Drops: While the overall trend was upward, [Mention any specific unusual spikes or drops in yields during the day and possible reasons]. This highlights the dynamic nature of the Treasury market and the responsiveness of yields to changing market conditions.

Impact of Economic Data Releases on Treasury Market

Several significant economic data releases on April 8th directly influenced Treasury yields. The market's reaction to these releases played a pivotal role in shaping the day's volatility.

-

Specific Economic Data: [List and describe the key economic data released on April 8th, e.g., CPI, PPI, employment data, etc. Include actual numerical data wherever possible].

-

Investor Sentiment: [Explain the market's reaction to each data point. Did the data support or contradict existing expectations? For instance, stronger-than-expected inflation data typically pushes yields higher as investors anticipate potential interest rate hikes by the Federal Reserve].

-

Correlation Between Data and Yield Movements: [Analyze the relationship between specific data points and observed changes in Treasury yields. For example, a higher-than-expected inflation figure often leads to a rise in yields as investors demand higher returns to compensate for the erosion of purchasing power].

Influence of Federal Reserve Actions (if applicable)

[If applicable, discuss any Federal Reserve announcements or actions on April 8th and their impact on the Treasury market. This section should include:]

-

Fed Statements or Actions: [Summarize any press releases, speeches, or policy decisions made by the Federal Reserve].

-

Market Anticipation vs. Reality: [Compare market expectations leading up to the Fed's announcement with the actual outcome. How did the market react to the difference between expectations and reality? This often determines the direction of yield movements].

-

Effect on Interest Rate Expectations: [Explain how the Fed's actions influenced investors' expectations about future interest rate changes. Did the Fed's communication reinforce existing expectations, or did it trigger a surprise reaction in the market?].

Analysis of Trading Volume and Market Sentiment

Understanding trading volume and market sentiment provides further context for interpreting the April 8th Treasury market movements.

-

Trading Volume: [State whether trading volume on April 8th was higher or lower than average. Was it unusually high or low, and what might account for these variations? High volume often suggests increased investor activity and potentially greater price volatility].

-

Market Sentiment: [Describe the prevailing market sentiment (bullish, bearish, or neutral). Provide evidence such as the VIX index (a measure of market volatility), investor surveys, or analysis of trading patterns to support your claim].

-

Investor Behavior and Strategies: [Discuss how investor behavior and trading strategies might have contributed to the observed market movements. Did investors react defensively, aggressively, or cautiously based on their assessment of the economic outlook?].

Conclusion: Recap and Future Outlook for Treasury Markets

The April 8th Treasury market recap reveals a day of significant volatility driven by a combination of economic data releases, potential Federal Reserve actions, and prevailing market sentiment. The upward movement in Treasury yields across all maturities reflects a shift towards higher interest rate expectations. Understanding these market dynamics is critical for investors seeking to navigate the complexities of the bond market and make informed decisions regarding investing in Treasuries.

The implications of these events for future Treasury market performance are significant. Continued economic data releases and potential future actions by the Federal Reserve will continue to shape investor sentiment and influence Treasury yields. Sustained inflation or further interest rate increases may lead to further increases in yields, potentially impacting bond prices.

Stay informed about future Treasury market trends by regularly checking our insightful recaps and analysis. Understanding Treasury market dynamics is key to effective investment strategies. Regularly reviewing market recaps, like this April 8th Treasury Market Recap, will help you refine your understanding of Treasury bonds, Treasury yields, and interest rate fluctuations.

Featured Posts

-

You Tubes Growing Popularity Among Older Viewers A Trend Analysis

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Trend Analysis

Apr 29, 2025 -

Khazna Data Centers Saudi Arabia Expansion Plans Following Silver Lake Investment

Apr 29, 2025

Khazna Data Centers Saudi Arabia Expansion Plans Following Silver Lake Investment

Apr 29, 2025 -

2025 Porsche Cayenne Interior And Exterior Detailed Photo Gallery

Apr 29, 2025

2025 Porsche Cayenne Interior And Exterior Detailed Photo Gallery

Apr 29, 2025 -

Lgbt Legal History A Timeline Of Landmark Cases And Figures

Apr 29, 2025

Lgbt Legal History A Timeline Of Landmark Cases And Figures

Apr 29, 2025 -

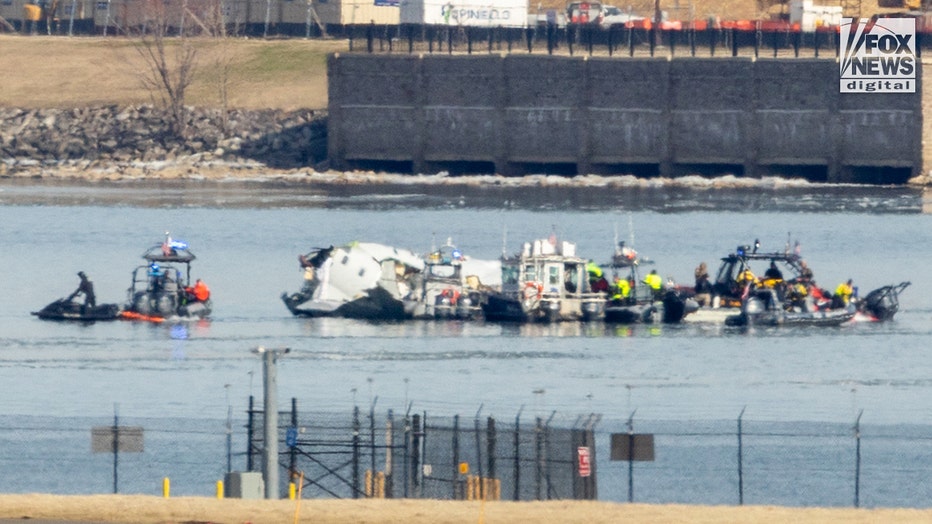

The Spread Of Misinformation The D C Plane Crash And Social Media

Apr 29, 2025

The Spread Of Misinformation The D C Plane Crash And Social Media

Apr 29, 2025