Are High Stock Market Valuations A Cause For Concern? BofA Weighs In

Table of Contents

BofA's Stance on Current Market Valuations

Bank of America's official stance on current high stock market valuations is nuanced. While they acknowledge the elevated levels, they haven't issued a blanket warning of an imminent market crash. Their analysis typically focuses on a more granular approach, examining specific sectors and asset classes rather than issuing broad pronouncements. BofA's market outlook, reflected in various research reports and analyst commentary, often emphasizes the importance of considering valuation metrics in conjunction with other economic indicators and long-term growth prospects. They haven't provided a single, easily quotable statement summarizing their complete perspective, instead relying on detailed analyses disseminated through multiple channels.

- Key Arguments: BofA's arguments often highlight the ongoing impact of low interest rates and continued corporate earnings growth, which can support current valuations, even at elevated levels. However, they also caution about the potential for increased volatility and the need for careful risk management.

- Vulnerable and Resilient Sectors: BofA's analysis often points to certain sectors as being more vulnerable to a market correction than others. For example, highly valued growth stocks, especially those in the technology sector, might be more susceptible to a pullback. Conversely, sectors with more stable earnings and lower valuations might show greater resilience.

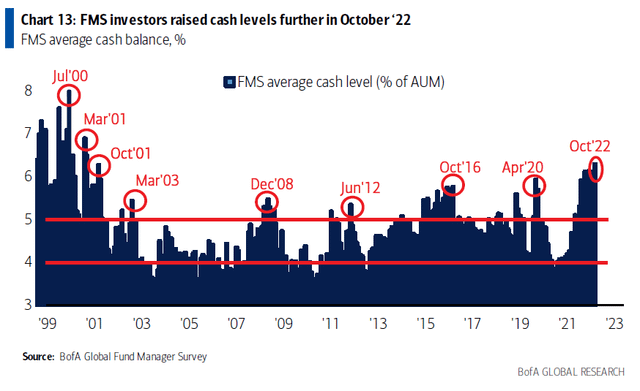

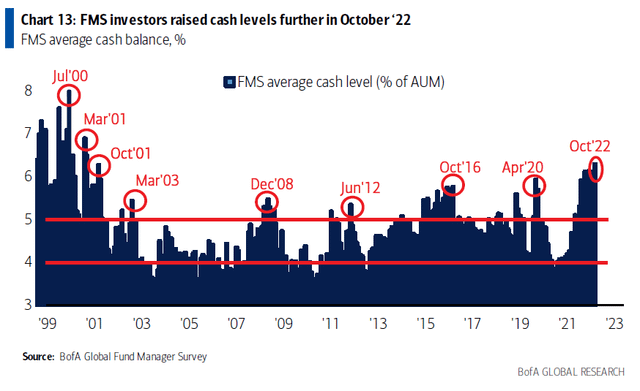

- Valuation Metrics: BofA utilizes various valuation metrics in its analysis, including the Price-to-Earnings (P/E) ratio and the Shiller PE ratio (CAPE). Their assessment of whether valuations are excessively high involves careful consideration of these metrics in context with economic growth forecasts and anticipated interest rate changes.

Factors Contributing to High Stock Market Valuations

Several interconnected factors have contributed to the current high stock market valuations. Understanding these drivers is crucial for investors to assess the sustainability of the current market levels.

- Low Interest Rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, driving up demand and prices. This has made it relatively cheaper to borrow money for businesses and individuals, stimulating economic activity and boosting corporate profits.

- Quantitative Easing and Government Stimulus: Monetary policies like quantitative easing (QE) and fiscal stimulus packages have injected massive amounts of liquidity into the financial system, further fueling stock market growth. This injection of capital has increased the overall money supply, making borrowing easier and further supporting asset prices.

- Corporate Earnings and Profit Growth: Strong corporate earnings and robust profit growth in many sectors have supported higher stock valuations. Companies with consistently strong financial performance attract more investment, which drives up their share prices.

- Technological Advancements and Disruptive Innovation: The rapid pace of technological advancements and disruptive innovation has created significant growth opportunities, attracting investors to companies leading these advancements. The expectation of continued growth in these sectors has supported high valuations for many technology-related stocks.

- Geopolitical Factors: While geopolitical events can create volatility, in some cases they can also inadvertently contribute to higher stock valuations. For example, periods of global uncertainty can cause investors to seek safer havens, driving capital into already established and successful companies.

Potential Risks Associated with High Valuations

While high stock market valuations can signal strong economic conditions, they also present significant risks. Investors must be aware of these potential downsides:

- Market Corrections and Crashes: High valuations often make markets more vulnerable to corrections or even crashes. A sudden shift in investor sentiment or an unexpected economic downturn could lead to a sharp decline in stock prices.

- Reduced Potential for Future Returns: When valuations are high, the potential for future returns tends to be lower than when valuations are more moderate. High valuations mean investors are paying a premium for current earnings, thus reducing the margin for future growth.

- Inflation Eroding Gains: Rising inflation can significantly erode investment gains, especially when valuations are already stretched. If inflation outpaces the growth in stock prices, investors may experience a decline in their purchasing power.

- Rising Interest Rates: Increases in interest rates can put downward pressure on stock valuations. Higher interest rates make borrowing more expensive for companies, potentially slowing down economic growth and reducing corporate profits.

Strategies for Navigating High Valuations

Investors can employ several strategies to mitigate the risks associated with high stock market valuations:

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, alternative investments) can help reduce overall portfolio risk. This strategy minimizes exposure to any single asset class and helps protect against significant losses in any one area.

- Value Investing: Value investing focuses on identifying undervalued companies with strong fundamentals. This approach seeks companies trading below their intrinsic worth, offering potential for greater returns.

- Risk Management: Implementing a robust risk management plan is crucial. This includes setting clear investment goals, defining your risk tolerance, and regularly monitoring your portfolio's performance.

- Defensive Investing: Defensive investing involves selecting companies with stable earnings and consistent dividends, typically less affected by market volatility. These are often large, established companies with proven track records.

- Portfolio Rebalancing: Regularly rebalancing your portfolio ensures you maintain your desired asset allocation. This helps to avoid overexposure to any single asset class and takes advantage of market fluctuations to buy low and sell high.

Conclusion

BofA's perspective on high stock market valuations, while not overtly alarmist, underscores the need for careful consideration and proactive risk management. While strong corporate earnings and low interest rates have supported current levels, the potential for market corrections, reduced future returns, and the impact of inflation and rising interest rates remain significant concerns. A diversified portfolio, a focus on value, and a robust risk management plan are crucial for navigating this complex environment. While high stock market valuations present challenges, they don't necessarily signal an immediate catastrophe. Stay informed on the latest updates on high stock market valuations and continue to research before making any investment decisions. Consider seeking professional financial advice to tailor a strategy that aligns with your individual risk tolerance and financial goals.

Featured Posts

-

Ariana Grandes Transformation A Look At Hair Tattoos And The Value Of Professional Expertise

Apr 27, 2025

Ariana Grandes Transformation A Look At Hair Tattoos And The Value Of Professional Expertise

Apr 27, 2025 -

Will The Premier League Secure A Fifth Champions League Spot A Likely Scenario

Apr 27, 2025

Will The Premier League Secure A Fifth Champions League Spot A Likely Scenario

Apr 27, 2025 -

Alberto Ardila Olivares Tu Garantia Para El Logro De Objetivos

Apr 27, 2025

Alberto Ardila Olivares Tu Garantia Para El Logro De Objetivos

Apr 27, 2025 -

Local Jeweler Assists Nfl Players In Fresh Starts

Apr 27, 2025

Local Jeweler Assists Nfl Players In Fresh Starts

Apr 27, 2025 -

Assessing The Economic Fallout The Canadian Travel Boycotts Impact On The Us

Apr 27, 2025

Assessing The Economic Fallout The Canadian Travel Boycotts Impact On The Us

Apr 27, 2025

Latest Posts

-

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025 -

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025 -

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025 -

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025