Are High Stock Market Valuations Justified? BofA's Analysis

Table of Contents

BofA's Key Findings on Current Market Valuations

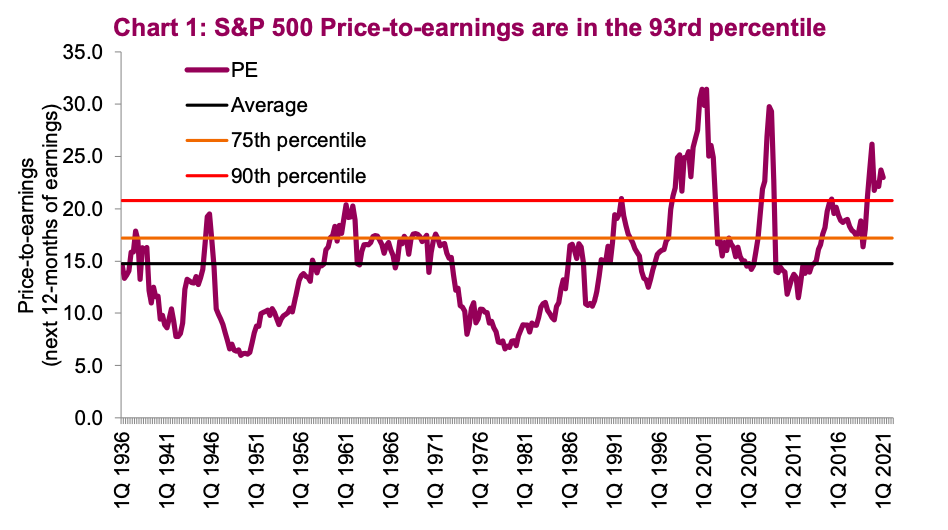

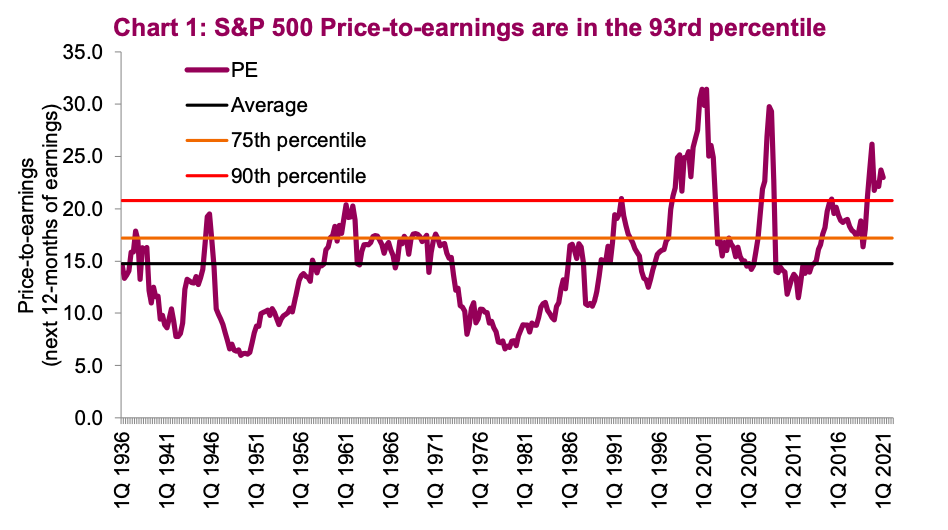

BofA's analysis of current market valuations paints a complex picture. While specific numbers fluctuate based on the exact date of the report, their general conclusions typically center around whether current valuations are elevated compared to historical averages. They employ a variety of valuation metrics to reach their conclusions.

- Specific valuation metrics: BofA utilizes a range of metrics including price-to-earnings ratios (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various other fundamental and technical indicators to gauge market valuation. They often compare these metrics to historical averages and those of other global markets.

- BofA's assessment: BofA's assessment often indicates that while valuations are higher than historical averages, they might not necessarily represent a bubble. The justification often hinges on factors like low interest rates and strong corporate earnings growth. However, they clearly flag elevated risk associated with these higher valuations.

- Sector-specific analysis: BofA's reports usually provide insights into specific sectors. Some sectors might be deemed overvalued based on their P/E ratios and growth prospects, while others may be identified as relatively undervalued, presenting potentially better investment opportunities. This nuanced analysis is crucial for investors seeking sector-specific exposure.

Factors Contributing to High Stock Market Valuations (According to BofA)

Several factors, as highlighted by BofA, contribute to the current high stock market valuations:

- Low interest rates: Historically low interest rates have made borrowing cheaper for companies and driven investors towards higher-yielding assets like stocks. This has created a supportive environment for higher stock prices. Lower interest rates also decrease the opportunity cost of investing in equities.

- Strong corporate earnings growth: Sustained, or at least expected, corporate earnings growth provides a strong foundation for higher stock valuations. BofA's analysis likely considers both reported earnings and future earnings forecasts.

- Increased investor confidence and risk appetite: A generally optimistic outlook among investors can lead to higher stock prices, as increased demand pushes valuations upward. This is often reflected in higher market volumes and increased participation from retail and institutional investors.

- Quantitative easing and monetary policies: Monetary policies, such as quantitative easing (QE), inject liquidity into the market, potentially contributing to higher asset prices. BofA’s analysis would consider the impact of these policies on overall market liquidity and investor behavior.

- Technological advancements: Technological disruptions and innovations in various sectors often fuel higher valuations, as investors bet on future growth prospects. This is especially apparent in the technology sector itself but also has ripple effects on other industries.

BofA's Assessment of Risks Associated with High Valuations

While BofA may point to factors justifying current valuations, they also acknowledge substantial risks:

- Vulnerability to interest rate hikes: An increase in interest rates could significantly impact stock valuations, as higher borrowing costs can reduce corporate profitability and make bonds a more attractive investment.

- Market corrections or crashes: High valuations naturally increase the potential for market corrections or even crashes. BofA's analysis would likely incorporate scenarios of market downturns to highlight potential downside risks.

- Geopolitical risks: Geopolitical events, such as international conflicts or trade wars, can create uncertainty and negatively impact market sentiment and valuations.

- Inflationary pressures: Rising inflation erodes the purchasing power of earnings, potentially leading to a decline in stock valuations. BofA’s analysis would weigh the impact of inflation on corporate profitability and investor expectations.

- Unexpected economic downturns: An unexpected economic downturn could trigger a significant market correction, impacting valuations regardless of underlying fundamentals.

BofA's Outlook and Predictions for Future Market Performance

BofA's outlook on future market performance often involves a range of scenarios, acknowledging the uncertainty inherent in market forecasting.

- Predicted trajectory: BofA's predictions for stock market indices vary depending on their specific reports. They will often provide a range of potential outcomes rather than a single point prediction.

- Interest rate forecasts: Their forecasts for interest rate changes are critical, as they directly impact stock valuations. These forecasts are often tied to macroeconomic predictions and central bank policy expectations.

- Market performance scenarios: They generally outline potential scenarios, including bullish (continued upward trend), bearish (significant decline), and sideways (consolidation) market movements.

- Recommendations: BofA often provides recommendations for investors, which might range from maintaining a balanced portfolio to increasing exposure to specific sectors or asset classes, based on their analysis of the risks and rewards associated with the high valuations.

Conclusion: Justified or Not? Understanding High Stock Market Valuations with BofA's Help

BofA's analysis of high stock market valuations reveals a nuanced picture. While factors like low interest rates and strong earnings growth provide some justification for elevated prices, the significant risks associated with these high valuations cannot be ignored. Whether these high stock market valuations are truly justified remains a complex question, with the answer heavily dependent on future economic and geopolitical developments.

Key Takeaways:

- High valuations are present, but whether they are unsustainable is a matter of ongoing debate.

- BofA's analysis considers a wide range of factors, including macroeconomic conditions, corporate earnings, and investor sentiment.

- Risk management is crucial, given the potential for market corrections or crashes.

Understanding whether current high stock market valuations are justified is crucial for informed investing. Review BofA's complete analysis to make well-informed decisions about your portfolio, considering the potential risks and opportunities associated with these high valuations. Remember to diversify your investments and seek professional advice to create a strategy aligned with your risk tolerance.

Featured Posts

-

The Versatile Uses Of Rosemary And Thyme In Cooking

May 31, 2025

The Versatile Uses Of Rosemary And Thyme In Cooking

May 31, 2025 -

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025 -

Rising Covid 19 Cases A New Variants Potential Role Who Update

May 31, 2025

Rising Covid 19 Cases A New Variants Potential Role Who Update

May 31, 2025 -

A Fast Read Key Takeaways From Molly Jongs Memoir

May 31, 2025

A Fast Read Key Takeaways From Molly Jongs Memoir

May 31, 2025 -

Crepes Salados Para Merienda Cena 8 Variedades Exquisitas

May 31, 2025

Crepes Salados Para Merienda Cena 8 Variedades Exquisitas

May 31, 2025