Are High Stock Market Valuations Justified? BofA's Analysis For Investors

Table of Contents

BofA's Bullish Arguments: Why High Valuations Might Be Justified

BofA presents several compelling arguments suggesting that current high stock market valuations may be, at least partially, justified. These arguments hinge on strong corporate performance, favorable monetary policy, and the transformative potential of technological innovation.

Strong Corporate Earnings and Profitability

BofA's data highlights significant growth in corporate earnings and profitability, a key driver of higher stock valuations. Many sectors are exceeding expectations, leading to increased investor confidence and higher price-to-earnings (P/E) ratios.

- Increased profitability in the tech sector driving higher P/E ratios. BofA's analysis shows significant earnings growth in leading technology companies, fueled by strong demand for software, cloud services, and other tech solutions.

- Strong revenue growth exceeding inflation in key sectors. Companies in healthcare, consumer staples, and certain industrials are demonstrating robust revenue growth, even in the face of inflationary pressures. This resilience is supporting higher valuations.

- Improved margins and operational efficiency. Many companies have successfully navigated supply chain disruptions and inflationary pressures, improving margins and boosting profitability. This improved efficiency contributes to higher stock prices.

Low Interest Rates and Abundant Liquidity

The prolonged period of low interest rates and abundant liquidity, largely a result of quantitative easing and other monetary policies, has significantly influenced investor behavior. This environment has reduced the opportunity cost of investing in stocks, driving increased demand and pushing valuations higher.

- Low interest rates reduce the opportunity cost of investing in stocks, driving demand. With low returns on bonds and other fixed-income investments, investors are more inclined to seek higher returns in the stock market.

- Increased liquidity in the market fuels speculation and higher valuations. The ample liquidity provided by central banks has fueled speculation and increased demand for equities, contributing to higher prices.

- Potential risks associated with low interest rates, such as inflation. While low interest rates support market growth, they also create the potential for inflation, which can erode the value of investments over time. This is a crucial risk factor to consider.

Technological Innovation and Growth Prospects

BofA emphasizes the role of technological advancements in driving future economic growth and justifying premium valuations. Disruptive technologies promise to create entirely new markets and growth opportunities.

- Disruptive technologies are creating new markets and growth opportunities, supporting high valuations. Artificial intelligence (AI), cloud computing, and other transformative technologies are reshaping industries and driving significant growth.

- AI and cloud computing drive future earnings growth, justifying higher P/E ratios. BofA's analysis indicates that these technologies will continue to be major drivers of earnings growth in the coming years.

- Long-term growth potential supports premium valuations. The potential for long-term growth in these sectors justifies the premium valuations investors are currently paying.

BofA's Bearish Concerns: Potential Risks of High Valuations

Despite the bullish arguments, BofA also highlights several potential risks associated with the current high stock market valuations. These risks primarily revolve around valuation metrics, macroeconomic factors, and geopolitical uncertainty.

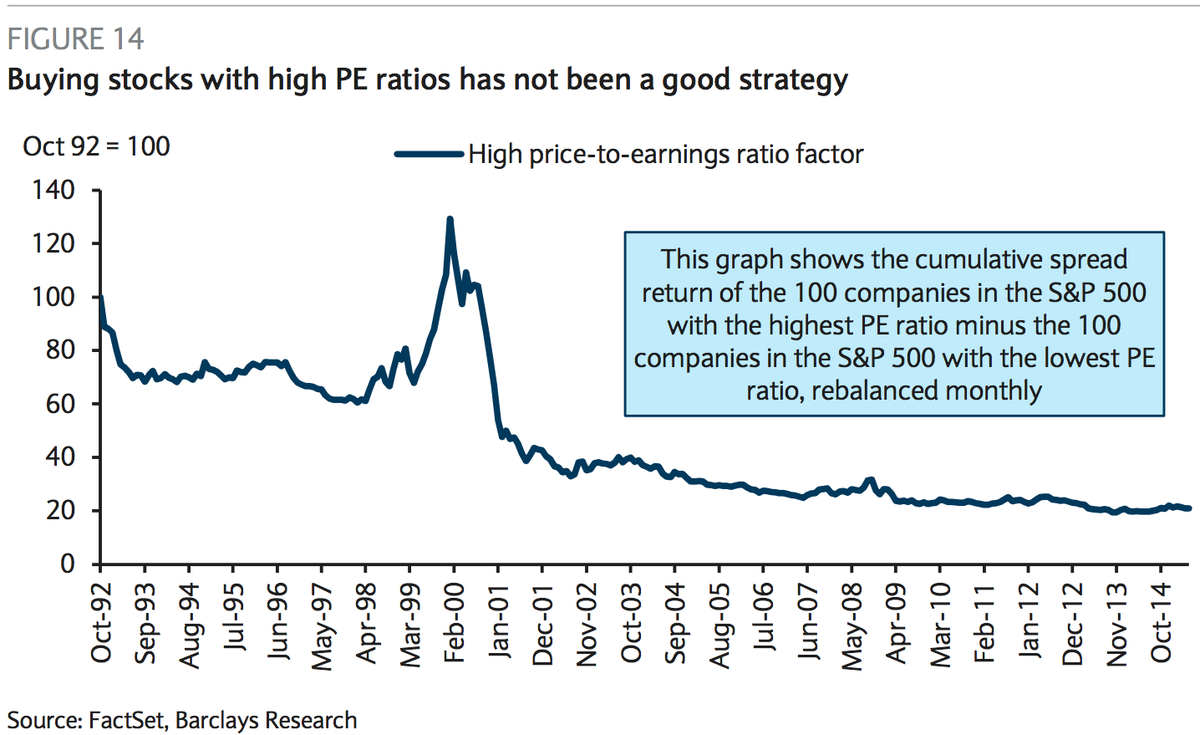

Elevated Price-to-Earnings Ratios (P/E)

BofA's analysis shows that current P/E ratios are significantly above historical averages in many sectors. This suggests that investors are paying a premium for future growth, increasing vulnerability to market corrections if growth expectations are not met.

- High P/E ratios indicate that investors are paying a premium for future growth, increasing vulnerability to market corrections. If future earnings growth fails to meet expectations, these high valuations could become unsustainable.

- Current P/E ratios are significantly above historical averages, raising concerns about market overvaluation. This disparity suggests a potential for a market correction to bring valuations back in line with historical norms.

- Understanding P/E ratios and their limitations in assessing market valuations is crucial. While P/E ratios are a valuable tool, they should be used in conjunction with other valuation metrics and qualitative factors.

Inflationary Pressures and Rising Interest Rates

Rising inflation and subsequent interest rate hikes pose significant risks to stock valuations. Higher interest rates increase borrowing costs for businesses, potentially impacting earnings growth, while inflation erodes purchasing power and reduces the attractiveness of high valuations.

- Rising interest rates increase borrowing costs for businesses, potentially impacting earnings growth. Higher interest rates can make it more expensive for companies to expand and invest, potentially slowing down economic growth.

- Inflation erodes purchasing power and reduces the attractiveness of high valuations. Inflation reduces the real value of future earnings, making high valuations less attractive to investors.

- BofA's predictions for inflation and interest rate hikes are crucial to consider when evaluating market risks. Understanding the potential magnitude and duration of these factors is essential for assessing the potential impact on stock valuations.

Geopolitical Risks and Market Uncertainty

Geopolitical factors such as trade wars, political instability, and global conflicts contribute significantly to market uncertainty. These uncertainties can lead to increased volatility and potentially trigger market corrections.

- Geopolitical instability introduces uncertainty, increasing volatility and potentially leading to market corrections. Unexpected events can significantly impact investor sentiment and lead to sharp market swings.

- Trade wars and political tensions can impact global economic growth and negatively affect stock valuations. Disruptions to global trade and supply chains can negatively affect corporate earnings and lead to lower stock prices.

- The importance of diversification and risk management in light of these uncertainties cannot be overstated. A well-diversified investment portfolio can help mitigate the risks associated with geopolitical uncertainty.

Conclusion: Navigating High Stock Market Valuations with BofA's Guidance

BofA's analysis provides a valuable framework for understanding the complexities of high stock market valuations. While strong corporate earnings, low interest rates, and technological innovation offer support for current prices, significant risks remain, including elevated P/E ratios, inflationary pressures, and geopolitical uncertainties. Investors must carefully weigh these competing factors when assessing their investment strategies. It is crucial to conduct thorough research, consult with financial advisors, and make informed decisions regarding high stock market valuations based on a comprehensive understanding of the current market environment and BofA’s analysis. Carefully analyze market trends, assess your investment strategy, and make informed decisions regarding high stock market valuations to protect your portfolio.

Featured Posts

-

Increased Tornado Risk As Trumps Budget Cuts Impact Disaster Preparedness

Apr 24, 2025

Increased Tornado Risk As Trumps Budget Cuts Impact Disaster Preparedness

Apr 24, 2025 -

Oblivion Remastered Official Release Date And Details From Bethesda

Apr 24, 2025

Oblivion Remastered Official Release Date And Details From Bethesda

Apr 24, 2025 -

John Travolta Reassures Fans Following Controversial Home Photo

Apr 24, 2025

John Travolta Reassures Fans Following Controversial Home Photo

Apr 24, 2025 -

Report Nba Investigating Ja Morant Following Latest Incident

Apr 24, 2025

Report Nba Investigating Ja Morant Following Latest Incident

Apr 24, 2025 -

Elite Universities Facing Funding Challenges Under Trump Administration

Apr 24, 2025

Elite Universities Facing Funding Challenges Under Trump Administration

Apr 24, 2025