Are Stretched Stock Market Valuations Justified? BofA Weighs In

Table of Contents

BofA's Rationale for Stretched Valuations

BofA's analysis points towards several key indicators suggesting stretched stock market valuations. Their arguments are primarily based on traditional valuation metrics, which, when compared to historical averages and current economic conditions, paint a picture of potential overvaluation.

-

Price-to-Earnings (P/E) Ratios: BofA likely cites elevated P/E ratios across various sectors, indicating investors are paying a premium for each dollar of earnings. High P/E ratios can signal over-optimism regarding future earnings growth. A persistently high P/E ratio, exceeding historical averages significantly, raises concerns about stretched valuations.

-

Shiller PE Ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period. A high CAPE ratio, as potentially highlighted by BofA, suggests that current stock prices may be significantly higher than justified by long-term earnings trends.

-

Market Capitalization to GDP Ratio: This metric compares the total market capitalization of all publicly traded companies to the nation's gross domestic product. A historically high ratio, as possibly noted by BofA, may indicate that the stock market is inflated relative to the overall size of the economy.

These metrics, when considered together, form the basis of BofA's concern regarding potentially unsustainable stock market growth. The implication is that a correction, or even a significant downturn, might be necessary to bring valuations back in line with historical norms and fundamental economic realities. Further research into BofA's specific data and charts would provide more concrete details.

Counterarguments and Alternative Perspectives

While BofA's concerns are valid, several counterarguments exist to support the current high valuations.

-

Low Interest Rates: Historically low interest rates make stocks relatively more attractive compared to bonds, potentially driving up demand and valuations. This increased demand could be partially responsible for seemingly high valuations.

-

Strong Corporate Earnings: Many companies have reported strong earnings growth in recent years, justifying, to some extent, higher price-to-earnings multiples. However, the sustainability of this growth remains a key question.

-

Technological Advancements: Breakthroughs in technology, especially in sectors like artificial intelligence and biotechnology, are driving significant innovation and future growth potential, potentially justifying premium valuations for certain companies.

-

Anticipated Future Growth: Investors might be pricing in anticipated future growth, particularly in emerging markets and innovative technologies. This forward-looking approach can lead to current valuations seeming high in the short term.

Other financial institutions may offer differing perspectives. Some might view the current market environment as less concerning than BofA, citing the aforementioned factors or others as justifying the higher valuations. A comparative analysis of various financial institutions' assessments would provide a more complete picture.

The Impact of Inflation and Interest Rate Hikes

Inflation and interest rate hikes significantly impact stock valuations. High inflation erodes purchasing power, impacting corporate earnings and investor confidence. Interest rate increases, implemented by the Federal Reserve to combat inflation, increase borrowing costs for companies and make bonds a more attractive investment compared to stocks.

-

Inflation's Impact: High inflation can squeeze profit margins, leading to lower corporate earnings and potentially causing a decline in stock prices. Companies might struggle to pass increased costs onto consumers.

-

Interest Rate Hikes' Impact: Higher interest rates increase the discount rate used in valuation models, reducing the present value of future earnings and thereby potentially impacting stock prices negatively.

These macroeconomic factors interact dynamically, and different scenarios could play out depending on the severity and duration of inflation and the pace of interest rate hikes. For example, a rapid increase in interest rates coupled with persistent high inflation might lead to a significant correction in the market, lowering inflated valuations.

Investment Strategies in a Market with Stretched Valuations

Given BofA's assessment and the counterarguments, investors need a strategic approach to navigate this potentially overvalued market.

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate risk. Diversification is a key principle of sound investment strategy.

-

Value Investing: Focusing on undervalued companies with strong fundamentals can offer opportunities even in an overvalued market. This strategy requires thorough research and a long-term perspective.

-

Defensive Stocks: Companies in sectors less sensitive to economic downturns (e.g., consumer staples) can offer relative stability. These companies tend to perform better during economic uncertainties.

-

Alternative Investments: Exploring alternative investment options, such as real estate or commodities, can offer diversification benefits. However, these options often require specialized knowledge and may have liquidity challenges.

Individual risk tolerance and long-term investment goals are paramount. Investors should carefully consider their personal circumstances before making any investment decisions.

Conclusion: Navigating Stretched Stock Market Valuations – A Call to Action

BofA's concerns about stretched stock market valuations are significant but not universally accepted. While several factors support the argument for high valuations, the potential risks associated with seemingly inflated prices remain. Understanding whether current valuations are truly stretched is crucial. Don't hesitate to conduct thorough research, consult with a financial professional to develop a personalized strategy that aligns with your risk tolerance and investment goals, and consider diversifying your portfolio to mitigate the risks associated with potentially stretched stock market valuations. Remember, a well-informed approach is key to successful long-term investing.

Featured Posts

-

Jeff Goldblums Wife Emilie Livingstons Age Children And Their Story

Apr 29, 2025

Jeff Goldblums Wife Emilie Livingstons Age Children And Their Story

Apr 29, 2025 -

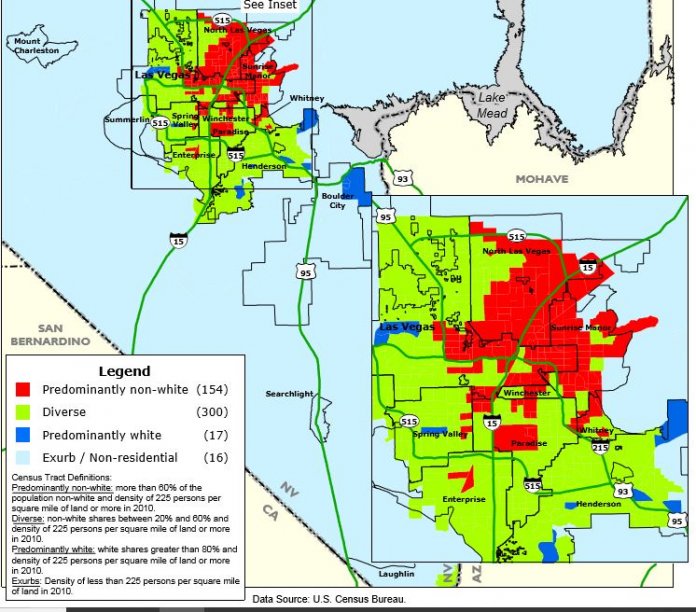

British Paralympian Missing In Las Vegas Search Intensifies After Over A Week

Apr 29, 2025

British Paralympian Missing In Las Vegas Search Intensifies After Over A Week

Apr 29, 2025 -

Air Traffic Control And Pilot Communication Failures The Black Hawk American Airlines Incident

Apr 29, 2025

Air Traffic Control And Pilot Communication Failures The Black Hawk American Airlines Incident

Apr 29, 2025 -

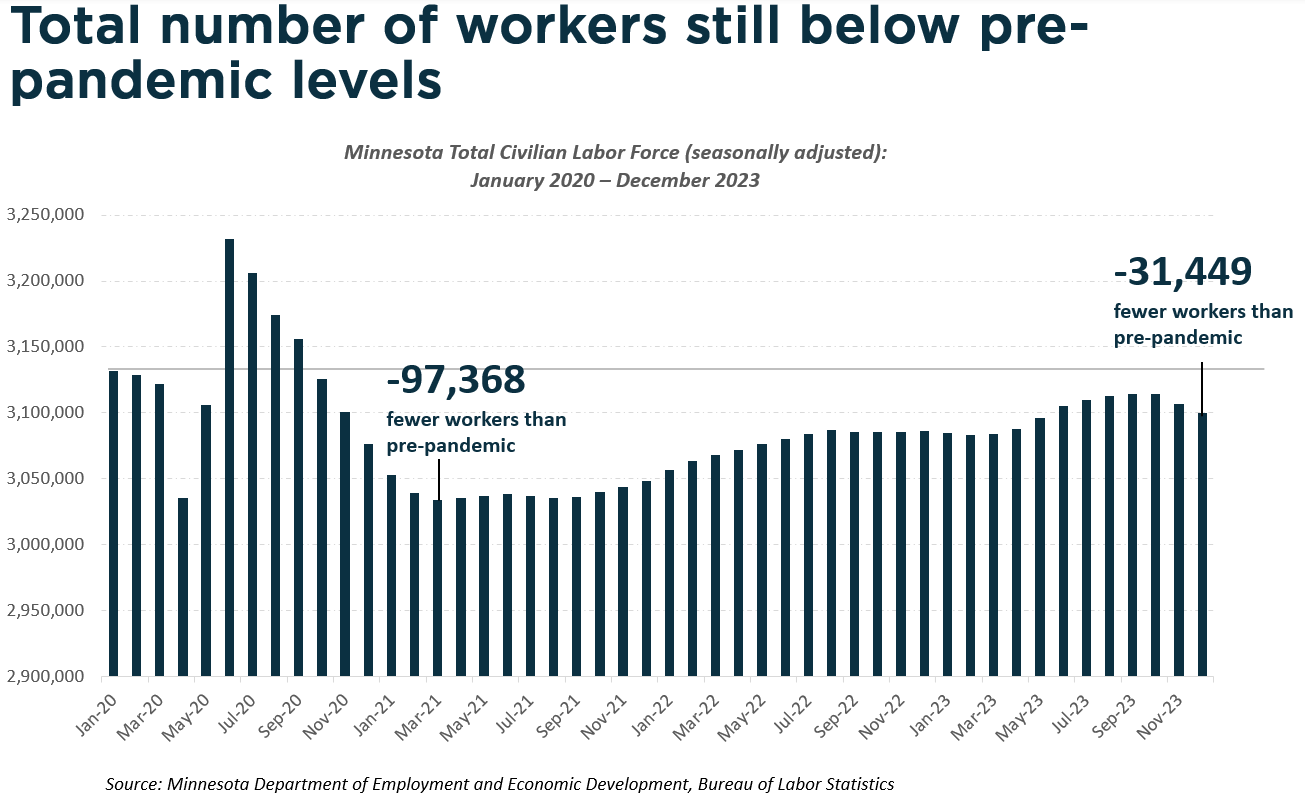

Study Reveals Positive Shift In Minnesota Immigrant Employment

Apr 29, 2025

Study Reveals Positive Shift In Minnesota Immigrant Employment

Apr 29, 2025 -

Adhd

Apr 29, 2025

Adhd

Apr 29, 2025