Asian Currencies In Turmoil: The Impact Of A Weakening Dollar

Table of Contents

H2: The Mechanics of a Weakening Dollar and its Effect on Asian Currencies

H3: Understanding the Dollar Index (DXY)

The US Dollar Index (DXY) is a measure of the value of the US dollar relative to a basket of other major currencies. A weakening dollar, reflected in a falling DXY, generally indicates that the dollar is losing value compared to these other currencies. This has a direct and often inverse relationship with Asian currencies.

- Factors affecting the DXY:

- Interest Rate Differentials: Higher US interest rates typically strengthen the dollar, attracting foreign investment. Conversely, lower rates can weaken it.

- Inflation Rates: High inflation in the US erodes the dollar's purchasing power, leading to a decline in its value.

- Geopolitical Events: Global political instability or uncertainty can impact investor confidence, affecting the dollar's value.

- Market Sentiment: Overall investor sentiment towards the US economy plays a crucial role in determining the dollar's strength.

The inverse relationship between a strong dollar and Asian currencies means that as the dollar weakens, Asian currencies tend to strengthen (and vice versa). This dynamic creates significant fluctuations in exchange rates, impacting businesses and investors alike.

H3: Impact on Exchange Rates

Fluctuations in the dollar directly influence the exchange rates of major Asian currencies, including the Japanese Yen (JPY), Chinese Yuan (CNY), Indian Rupee (INR), and South Korean Won (KRW).

- Examples of recent exchange rate movements: [Insert recent examples of exchange rate fluctuations between the USD and major Asian currencies, citing reliable sources]. These movements highlight the significant volatility in the market.

- Implications for Importers and Exporters: A weakening dollar can benefit Asian exporters as their goods become cheaper for buyers using US dollars. Conversely, importers in Asia face higher costs for goods priced in USD. This differential impact necessitates careful planning and risk management strategies.

H2: Economic Consequences for Asian Nations

H3: Inflationary Pressures

A weakening dollar can exert upward pressure on inflation in Asian countries, particularly those heavily reliant on imports priced in USD. As the dollar falls, the cost of these imports rises, leading to increased consumer prices.

- Examples of countries more susceptible to imported inflation: Countries with large trade deficits and significant reliance on imported goods are particularly vulnerable.

- Potential government responses to combat inflation: Governments may implement monetary policy adjustments, such as raising interest rates, to curb inflation. Fiscal measures, like subsidies or tax adjustments, may also be employed.

H3: Impact on Investment Flows

A weaker dollar can significantly influence foreign direct investment (FDI) and portfolio investment in Asia.

- Attractiveness of Asian assets to foreign investors during a weak dollar: A weaker dollar can make Asian assets more attractive to foreign investors seeking higher returns, potentially boosting capital inflows.

- Potential capital flight concerns: Conversely, uncertainty surrounding the dollar’s trajectory can lead to capital flight from Asian markets as investors seek safer havens.

H3: Effects on Specific Sectors

The impact of a weakening dollar varies across different economic sectors in Asia.

- Sectors benefiting: Export-oriented sectors like manufacturing and tourism often experience positive effects from a weaker dollar, boosting their competitiveness in the global market.

- Sectors negatively impacted: Import-dependent industries might face challenges due to rising input costs. The technology sector, relying heavily on imported components, could experience increased production costs.

- Need for sector-specific strategies: Businesses need to develop sector-specific strategies to adapt to the changing currency dynamics and mitigate potential risks.

H2: Navigating the Volatility: Strategies for Businesses and Investors

H3: Hedging Strategies

Businesses can employ various hedging techniques to mitigate currency risk exposure.

- Examples of hedging instruments: Forward contracts, options, and futures contracts can help lock in exchange rates, reducing uncertainty.

- Importance of risk management and diversification: A comprehensive risk management strategy, coupled with diversification of investments and sourcing, is crucial for navigating currency volatility.

H3: Investment Opportunities

The weakening dollar also presents potential investment opportunities.

- Examples of investment strategies: Currency trading, investing in emerging market funds focused on Asian economies, and direct investment in Asian companies can offer attractive returns, but carry inherent risks.

- Importance of thorough research and due diligence: Investors should conduct thorough research and due diligence before making any investment decisions, considering the inherent volatility of Asian currencies.

3. Conclusion

The weakening dollar is undeniably impacting Asian currencies and economies in significant ways. This volatility creates both risks and opportunities. While some sectors might benefit from increased export competitiveness, others face challenges from rising import costs and inflationary pressures. Investors need to carefully consider the implications for their portfolios and implement appropriate risk mitigation strategies.

To successfully navigate this turbulent landscape, stay informed about the fluctuations in Asian currencies and develop a robust strategy for managing the impact of a weakening dollar. Learn more about navigating the challenges of a weakening dollar in the Asian markets by consulting financial experts and staying updated on economic news and market analysis. Understanding the intricacies of the DXY and its correlation with Asian exchange rates is paramount for making informed decisions in this dynamic environment.

Featured Posts

-

Understanding The Shift To A Lifetime Revenue Share For Shopify Developers

May 05, 2025

Understanding The Shift To A Lifetime Revenue Share For Shopify Developers

May 05, 2025 -

Cult Members Jailed For Childs Disturbing Death

May 05, 2025

Cult Members Jailed For Childs Disturbing Death

May 05, 2025 -

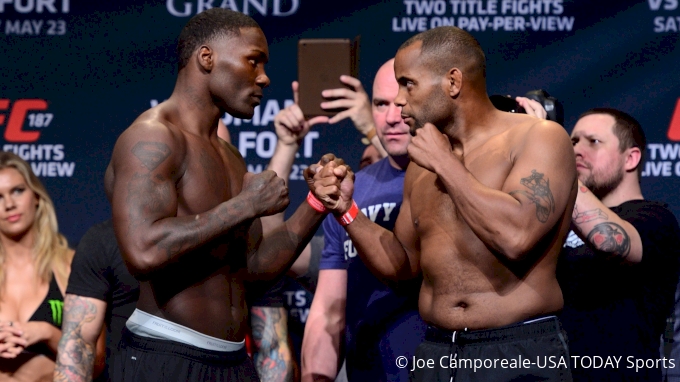

Ufc 314 Volkanovski Vs Lopes Fight Card Breakdown

May 05, 2025

Ufc 314 Volkanovski Vs Lopes Fight Card Breakdown

May 05, 2025 -

North Bengal Rain Alert Met Departments Latest Weather Prediction

May 05, 2025

North Bengal Rain Alert Met Departments Latest Weather Prediction

May 05, 2025 -

Cormier Vs Johnson 2 At Ufc 210 Fight Breakdown And Predictions

May 05, 2025

Cormier Vs Johnson 2 At Ufc 210 Fight Breakdown And Predictions

May 05, 2025

Latest Posts

-

New The Librarians Sequel Series Tnt Releases Trailer Poster And Premiere Date

May 06, 2025

New The Librarians Sequel Series Tnt Releases Trailer Poster And Premiere Date

May 06, 2025 -

The Librarians The Next Chapter New Trailer Poster And Premiere Date Announced By Tnt

May 06, 2025

The Librarians The Next Chapter New Trailer Poster And Premiere Date Announced By Tnt

May 06, 2025 -

Tnts The Librarians The Next Chapter Premiere Date Trailer And Poster Revealed

May 06, 2025

Tnts The Librarians The Next Chapter Premiere Date Trailer And Poster Revealed

May 06, 2025 -

Hos Kokunun Oetesinde Ueruen Kalitesi Ve Itibar

May 06, 2025

Hos Kokunun Oetesinde Ueruen Kalitesi Ve Itibar

May 06, 2025 -

1 1 Billion At Stake Warner Bros Discovery And The Absence Of Nba Advertising

May 06, 2025

1 1 Billion At Stake Warner Bros Discovery And The Absence Of Nba Advertising

May 06, 2025