Assessing Climate Risk Before Applying For A Home Loan

Table of Contents

Understanding Your Property's Vulnerability to Climate Change Impacts

Before you even start browsing properties, understanding the climate risks specific to your desired location is paramount. Failing to do so can lead to unforeseen expenses and decreased property value down the line. Let's delve into the key climate change impacts to assess:

Flood Risk Assessment

Flood zones, as designated by the Federal Emergency Management Agency (FEMA), represent areas with a statistically significant chance of flooding. Checking your property's location within a FEMA flood zone is crucial. High-risk flood zones often require flood insurance, impacting your monthly mortgage payments and overall cost of homeownership.

- How to find your flood zone: Visit the FEMA Flood Map Service Center website (fema.gov) and enter your address.

- Interpreting flood insurance requirements: Understanding your property's flood risk level (low, moderate, high) will determine the type and cost of flood insurance required by your lender.

- Understanding flood risk levels: Higher risk levels usually mean higher premiums and potentially stricter lending requirements. A property in a high-risk flood zone might even be ineligible for a mortgage without sufficient flood insurance.

Check your FEMA flood zone today! Don't wait until it's too late.

Wildfire Risk Assessment

Wildfires pose a significant threat to properties, particularly those located near wildlands or in drought-prone regions. The type of building materials used in construction also plays a significant role in wildfire risk.

- Identifying high-risk areas: Use online tools and resources provided by your local fire department or forestry service to assess wildfire risk in your target area.

- Understanding defensible space: Creating a buffer zone around your property by removing flammable vegetation reduces the risk of wildfire spread.

- Home hardening techniques: Implementing fire-resistant landscaping, installing fire-resistant roofing, and using non-combustible building materials are crucial for mitigating wildfire risk.

Many resources are available online to assess wildfire risk. Consult your local authorities or search "[Your State/Region] Wildfire Risk Assessment" to find relevant information.

Extreme Heat and Drought Risk Assessment

Increased temperatures and water scarcity resulting from climate change significantly impact property values and livability. Consider the long-term implications:

- Impact on landscaping: Drought conditions may necessitate significant changes to your landscaping, potentially increasing maintenance costs.

- Potential for water restrictions: Water scarcity can lead to water restrictions, limiting your ability to water your lawn or garden.

- Increased energy costs from cooling: Higher temperatures demand increased energy consumption for cooling your home, leading to higher utility bills.

Resources like the NOAA (National Oceanic and Atmospheric Administration) provide valuable data on historical and projected temperatures and drought conditions in your area.

The Financial Implications of Climate Risk on Your Home Loan

Ignoring climate risk can have severe financial consequences, impacting your ability to secure a loan and maintain your mortgage in the long term.

Increased Insurance Premiums

Climate risk significantly increases home insurance premiums. Properties in high-risk areas may face exorbitant premiums, or even face difficulty in securing insurance coverage altogether.

- Factors influencing insurance rates: Flood, wildfire, and wind risks heavily influence insurance rates.

- Comparing insurance quotes from different providers: Shop around and compare quotes from multiple insurers to find the best rates, even if you’re just assessing potential homes.

Property Value Depreciation

Climate-related damage can dramatically decrease property values, impacting your equity.

- Examples of how climate events can lower property values: Flood damage, wildfire damage, and even repeated heat waves can reduce property value significantly.

- Importance of long-term property value assessment: Consider potential future climate impacts on your property's value.

Potential for Loan Default

Severe climate-related damage can result in an inability to repay your home loan.

- Understanding mortgage insurance: Consider mortgage insurance to help protect against financial hardship.

- Exploring options for financial protection: Investigate additional financial safeguards to mitigate climate-related risks.

- Impact on credit score: Loan default can severely damage your credit score, making future borrowing difficult.

Resources and Tools for Assessing Climate Risk

Numerous resources are available to help you assess climate risk effectively.

Government Agencies and Websites

Government agencies provide valuable data and tools to assess climate-related risks.

- FEMA (Federal Emergency Management Agency): Provides flood risk information and maps.

- NOAA (National Oceanic and Atmospheric Administration): Offers data on weather patterns, sea-level rise, and other climate change indicators.

Utilize the specific tools and datasets offered on each website to evaluate your property’s climate vulnerability.

Private Sector Climate Risk Assessment Tools

Several private sector companies offer climate risk assessment services.

- Examples of companies and services: Many real estate and environmental consulting firms provide in-depth climate risk assessments.

- Advantages and disadvantages: While these services can provide detailed analyses, they may come with costs.

Consulting with Experts

Seeking professional advice from real estate professionals or environmental consultants is often beneficial.

- Benefits of professional assessments: Experts can provide tailored assessments of your specific property and location.

- When to seek expert help: Consider professional assistance if you are unsure how to interpret government data or need a detailed assessment.

Conclusion

Assessing climate risk is a critical step before applying for a home loan. By understanding your property’s vulnerability to floods, wildfires, extreme heat, and drought, you can make informed decisions and protect your financial investment. Utilize the available resources and tools to thoroughly evaluate climate risks, and don't hesitate to seek expert advice. Proactive planning and thorough assessment of climate risk will help ensure a secure and sustainable homeownership experience. Don't underestimate the importance of assessing climate risk before securing your mortgage. Start your climate risk assessment today!

Featured Posts

-

Mexican And Colombian Femicides The Violent Deaths Of An Influencer And Model Ignite Public Anger

May 20, 2025

Mexican And Colombian Femicides The Violent Deaths Of An Influencer And Model Ignite Public Anger

May 20, 2025 -

Proryv V Tennise Kto Takaya Novaya Sharapova

May 20, 2025

Proryv V Tennise Kto Takaya Novaya Sharapova

May 20, 2025 -

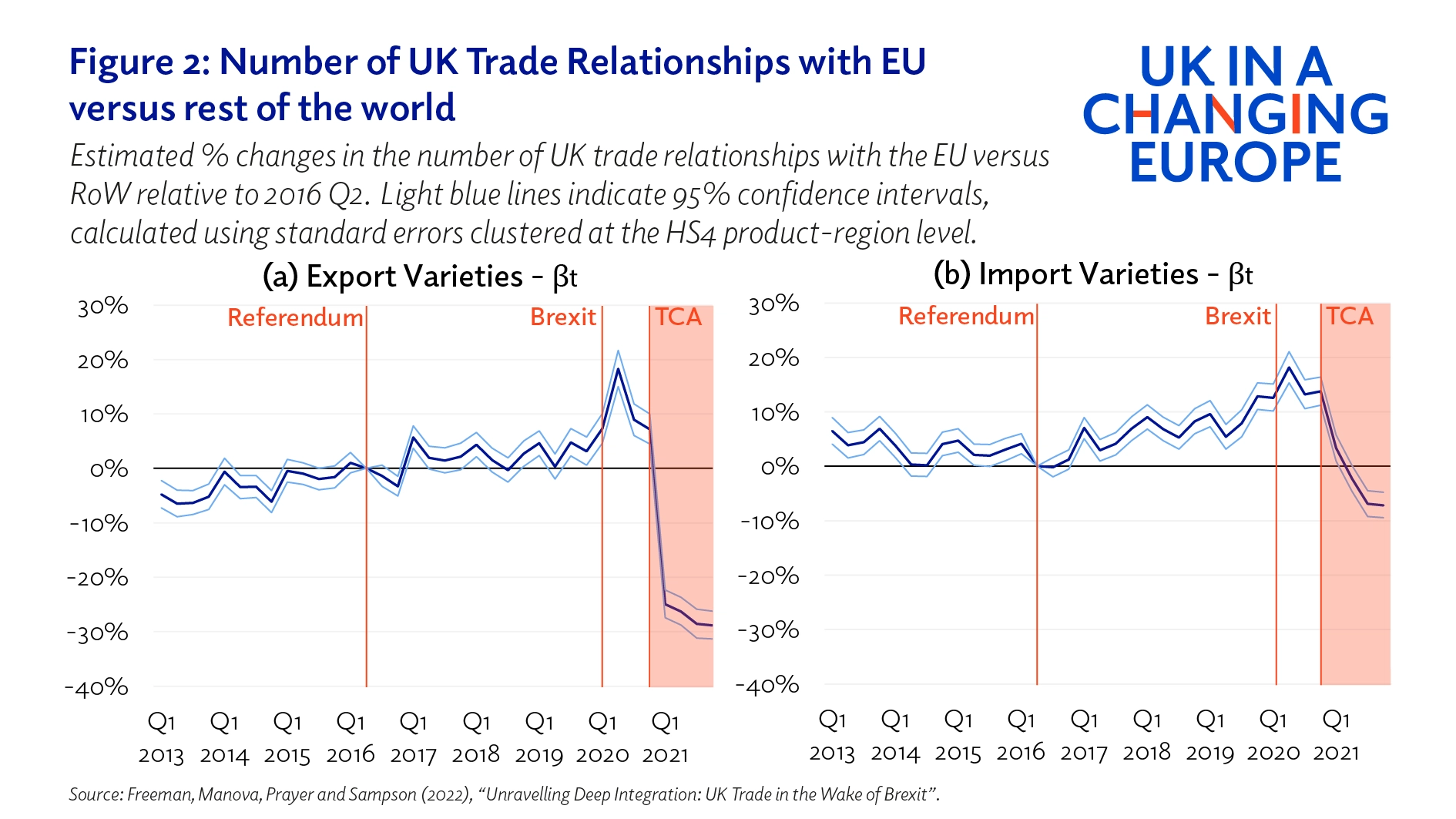

Slowdown In Uk Luxury Exports To The Eu A Brexit Analysis

May 20, 2025

Slowdown In Uk Luxury Exports To The Eu A Brexit Analysis

May 20, 2025 -

Hmrc Sending Nudge Letters Are You Affected

May 20, 2025

Hmrc Sending Nudge Letters Are You Affected

May 20, 2025 -

Dusan Tadic Dalya Hedefi Ve Tarihi Basarilar

May 20, 2025

Dusan Tadic Dalya Hedefi Ve Tarihi Basarilar

May 20, 2025

Latest Posts

-

Understanding Ftv Lives A Hell Of A Run Narrative

May 20, 2025

Understanding Ftv Lives A Hell Of A Run Narrative

May 20, 2025 -

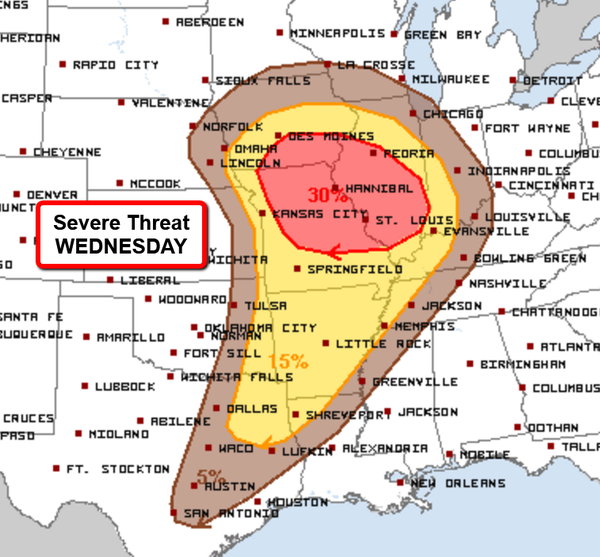

Fast Moving Storms And Their Destructive Winds A Comprehensive Guide

May 20, 2025

Fast Moving Storms And Their Destructive Winds A Comprehensive Guide

May 20, 2025 -

Mainz Secure Top Four Spot With Dominant Gladbach Victory

May 20, 2025

Mainz Secure Top Four Spot With Dominant Gladbach Victory

May 20, 2025 -

A Hell Of A Run Examining The Ftv Live Report

May 20, 2025

A Hell Of A Run Examining The Ftv Live Report

May 20, 2025 -

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025