Assessing Google's AI Capabilities: A Look At Investor Sentiment

Table of Contents

Google's AI Investments and Technological Advancements

Google's massive investment in artificial intelligence is evident in its diverse portfolio of AI-related projects and technologies. Two key areas significantly impact investor confidence: DeepMind's groundbreaking research and the seamless integration of AI into Google's core products.

DeepMind's Impact

DeepMind, a Google subsidiary, has made significant strides in AI research, garnering significant attention and shaping investor sentiment. Its achievements, such as AlphaGo (defeating a world champion Go player) and AlphaFold (predicting protein structures), demonstrate its cutting-edge capabilities.

- Examples of DeepMind's successes and their market relevance: AlphaFold's protein structure predictions have revolutionized drug discovery and biological research, potentially creating massive future revenue streams. AlphaGo's victory showcased the power of reinforcement learning, influencing various AI applications.

- Potential investor concerns regarding DeepMind's profitability or long-term strategic fit within Google: While DeepMind's achievements are impressive, its profitability remains a concern for some investors. Questions around its long-term strategic alignment with Google's overall business model also persist. Concerns about the return on investment for such a research-intensive operation are valid.

Google AI's Product Integration

Google strategically integrates AI into its existing products, enhancing user experience and driving revenue growth. This integration is a key factor influencing investor perception of Google's AI capabilities.

- Examples of AI-powered features in Google products: Google Search uses AI for better search results and understanding user intent. Google Assistant leverages natural language processing for voice commands and information retrieval. Google Cloud offers powerful AI/ML tools for businesses.

- Impact of these features on user engagement and potential revenue growth: AI-powered features enhance user engagement, leading to increased usage and potential for monetization through targeted advertising and premium services.

- Competitive advantages or disadvantages compared to competitors like Microsoft or OpenAI: While Google holds a strong position with its integrated AI approach, competitors like Microsoft (with Bing AI) and OpenAI (with ChatGPT) are aggressively pursuing advancements in generative AI, presenting a competitive challenge. The race to develop and integrate the next generation of AI is impacting investor confidence in all players.

Market Analysis and Competitive Landscape

Analyzing investor sentiment requires examining various market indicators and comparing Google's AI strategy against its main competitors.

Investor Sentiment Gauges

Several metrics reflect investor sentiment towards Google's AI capabilities.

- Key performance indicators (KPIs) relevant to Google's AI investments: Revenue generated from AI-powered services, user engagement metrics for AI-integrated products, and market share in cloud AI services are crucial KPIs.

- Stock price fluctuations related to AI announcements: Positive news about Google's AI advancements usually leads to positive stock price movements, while negative news can have the opposite effect.

- Relevant financial news articles and analyst reports: Analyzing financial news and analyst reports provides insights into how investors perceive Google's AI progress and its impact on the company's overall valuation.

Comparison with Competitors

Comparing Google's AI capabilities with those of Microsoft and OpenAI reveals both strengths and weaknesses.

- Strengths and weaknesses of each company's AI strategy: Google excels in integrating AI into existing products and its vast data resources. Microsoft benefits from its strong enterprise relationships and the integration of AI into Bing. OpenAI focuses on cutting-edge research and generative AI models.

- Market share and investor confidence in each competitor: The market share and investor confidence in each company fluctuate based on their AI advancements and market positioning. The competitive landscape is dynamic and fast-changing.

Future Projections and Potential Risks

Assessing Google's AI future requires considering both growth opportunities and potential risks.

Growth Opportunities

Google's AI advancements pave the way for significant future growth.

- Emerging AI technologies and their potential integration into Google's ecosystem: Integration of advancements in areas like generative AI, robotics, and quantum computing hold immense potential.

- Potential new revenue streams generated by Google's AI: New revenue streams may arise from advanced AI-powered services offered to businesses and consumers.

Ethical Concerns and Regulatory Hurdles

Ethical concerns and regulatory hurdles pose potential challenges to Google's AI development.

- Potential biases in AI algorithms and their impact: Addressing bias in AI algorithms is crucial to maintaining fairness and avoiding discriminatory outcomes.

- Potential governmental regulations impacting AI development and deployment: Regulations regarding data privacy, algorithmic transparency, and responsible AI development can significantly influence Google's AI strategy.

Conclusion

Investor sentiment towards Google's AI capabilities is complex, reflecting both the company's significant technological advancements and the competitive pressures within the rapidly evolving AI landscape. While Google boasts impressive research capabilities and widespread AI integration, concerns about profitability, competition, ethical considerations, and regulatory hurdles must be considered. The future of Google's AI success hinges on its ability to navigate this complex landscape effectively. Stay informed about the ongoing developments in Google's AI advancements and their impact on investor sentiment. Continue researching and analyzing Google's AI capabilities to make informed investment decisions. Follow future updates on Google's AI capabilities and their market impact.

Featured Posts

-

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025 -

Understanding Kartels Impact On Rum Culture A Stabroek News Analysis

May 22, 2025

Understanding Kartels Impact On Rum Culture A Stabroek News Analysis

May 22, 2025 -

Hands On With Googles New Ai Smart Glasses Prototype

May 22, 2025

Hands On With Googles New Ai Smart Glasses Prototype

May 22, 2025 -

Premier Essai Alfa Romeo Junior 1 2 Turbo Speciale Par Le Matin Auto

May 22, 2025

Premier Essai Alfa Romeo Junior 1 2 Turbo Speciale Par Le Matin Auto

May 22, 2025 -

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025

Latest Posts

-

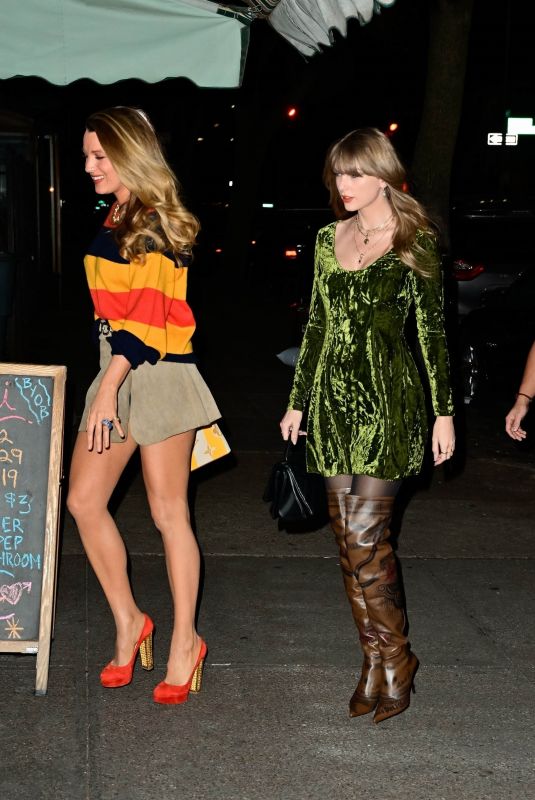

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025 -

Blake Lively And Taylor Swift Friendship On The Rocks After Subpoena Report

May 22, 2025

Blake Lively And Taylor Swift Friendship On The Rocks After Subpoena Report

May 22, 2025 -

Exclusive Understanding Taylor Swift And Blake Livelys Stance On The It Ends With Us Adaptation

May 22, 2025

Exclusive Understanding Taylor Swift And Blake Livelys Stance On The It Ends With Us Adaptation

May 22, 2025 -

Rossiya I Nato Ugroza Kaliningradu I Otvet Patrusheva

May 22, 2025

Rossiya I Nato Ugroza Kaliningradu I Otvet Patrusheva

May 22, 2025 -

Blake Lively And Taylor Swift Amidst It Ends With Us Legal Battle An Exclusive Update

May 22, 2025

Blake Lively And Taylor Swift Amidst It Ends With Us Legal Battle An Exclusive Update

May 22, 2025