Assessing Risk: Is This Novel Investment Approach Safe For Retirement?

Table of Contents

Understanding the Novel Investment Approach: Fractional Real Estate

Defining the Investment Strategy:

Fractional real estate allows investors to own a share of a larger, typically high-value property, such as a multi-family building or a commercial property, without the need to purchase the entire asset. This approach democratizes access to real estate investments, traditionally out of reach for many. It offers diversification benefits over investing in a single property and is considered an alternative investment, adding another layer of complexity.

Mechanism and Potential Returns:

Fractional real estate operates through platforms that manage the investment process, from property acquisition and management to distributing rental income and eventual sale proceeds to investors. Potential returns include rental income (proportionate to ownership share), capital appreciation upon the eventual sale of the property, and potential tax benefits. For example, a $10,000 investment in a $1 million property might generate a return comparable to a higher-risk, higher-return investment, albeit with a slower appreciation curve than some high-return investments.

- Underlying Assets: Shares in income-generating real estate properties (apartments, commercial buildings, etc.).

- Typical Investment Timeframe: Medium to long-term (5-10+ years), although some platforms offer more liquid options.

- Potential Returns: Rental income (typically 4-8% annually depending on the property and location), plus capital appreciation (variable, dependent on market conditions).

Assessing the Risks Involved

Volatility and Market Sensitivity:

While real estate is generally considered a less volatile asset class than stocks, fractional real estate is still subject to market fluctuations. Local market conditions, interest rate changes, and economic downturns can impact property values and rental income, creating market risk and downside risk. Volatility can be higher in niche real estate markets or properties with limited liquidity.

Liquidity and Accessibility:

Liquidity is a critical factor. Unlike publicly traded stocks, accessing your investment in fractional real estate may not be instantaneous. The process often involves selling your shares on a secondary market, which might have limited buyers or require a time commitment. This is referred to as liquidity risk. Your investment horizon should be aligned with the property's holding period.

Regulatory and Legal Risks:

Fractional real estate platforms are relatively new, and the regulatory landscape is still evolving. There's regulatory compliance risk related to the platform itself and legal risks concerning property ownership and liability. Investors should thoroughly investigate the platform's legal structure and compliance with relevant regulations.

- Specific Examples of Potential Risks: Platform insolvency, property damage, tenant issues, unexpected maintenance costs, market downturns.

- Quantifying Risks: While hard to quantify precisely, historical data on real estate market performance in the relevant region can offer insights.

- Risk Mitigation Strategies: Diversifying across multiple properties and platforms, thorough due diligence, careful consideration of the investment timeline.

Comparing to Traditional Retirement Investments

Traditional Options:

Traditional retirement investments include 401(k)s, IRAs, annuities, and pensions. These offer varying levels of risk and return, with 401(k)s and IRAs often including stock market exposure, leading to higher volatility potential compared to more conservative options like annuities.

Risk-Return Profile Comparison:

Fractional real estate generally offers a moderate risk-return profile. It may present higher returns than traditional, low-risk savings accounts but potentially lower returns than some high-risk stock investments. The risk-adjusted return needs careful evaluation based on your risk tolerance. Diversification across asset classes is key to achieving a balance.

- Comparison Table: A detailed table comparing key metrics (average annual return, volatility, liquidity, fees) for fractional real estate versus traditional options would be beneficial here.

- Advantages/Disadvantages: Fractional real estate advantages: diversification, potential for higher returns than savings accounts. Disadvantages: illiquidity, potential for market downturns. Traditional options: familiarity, regulatory protection (in many cases). Disadvantages: potentially lower returns, market risk in some cases (stocks).

- Diversification Strategies: Combining fractional real estate with traditional retirement plans can enhance portfolio diversification, mitigating overall risk.

Safeguarding Your Retirement with a Novel Investment Approach

Diversification Strategies:

The core principle of risk management is diversification. By spreading your investment across different asset classes (stocks, bonds, real estate, etc.), you can reduce your exposure to losses in any single area. A well-diversified portfolio is essential for portfolio diversification and effective asset allocation.

Due Diligence and Professional Advice:

Before investing in any novel investment strategy, conduct thorough due diligence. Research the platform, its track record, fees, and legal structure. Consult with a qualified financial advisor or investment advisor to ensure the investment aligns with your financial goals, risk tolerance, and retirement timeline.

- Key Questions to Ask: What are the platform's fees? What is the process for selling my shares? What is the platform's track record? What are the potential risks involved?

- Resources for Due Diligence: Review independent financial news sources, check regulatory compliance records, consult with financial professionals.

- Value of Professional Advice: A financial advisor can help you assess your risk tolerance, create a diversified portfolio, and navigate the complexities of fractional real estate investments.

Conclusion: Making Informed Decisions about Novel Investment Approaches for Retirement

Fractional real estate investing presents an interesting alternative for retirement savings, offering the potential for higher returns than traditional savings accounts. However, it's crucial to understand the inherent risks, including potential illiquidity and market sensitivity. This "Novel Investment Approach Retirement Safety" depends heavily on your risk tolerance, investment horizon, and the careful consideration of diversification strategies. Thorough due diligence, professional financial planning, and a balanced approach combining traditional and novel investment strategies are critical components of securing a comfortable retirement. Remember to carefully assess your risk tolerance and seek professional guidance before investing in any novel investment approach for retirement. Plan wisely for your retirement safety and secure your financial future!

Featured Posts

-

Metas Monopoly Defense Begins After Ftc Concludes Case

May 18, 2025

Metas Monopoly Defense Begins After Ftc Concludes Case

May 18, 2025 -

Space Defense Sector Expands Voyager Technologies Ipo Announcement

May 18, 2025

Space Defense Sector Expands Voyager Technologies Ipo Announcement

May 18, 2025 -

Trump Condemns Springsteens Treasonous Remark

May 18, 2025

Trump Condemns Springsteens Treasonous Remark

May 18, 2025 -

Unpacking The Numbers A Critical Examination Of Trumps Aerospace Deals

May 18, 2025

Unpacking The Numbers A Critical Examination Of Trumps Aerospace Deals

May 18, 2025 -

Kanye Westas Ir Bianca Censori Nauja Sokiruojanti Nuotrauka

May 18, 2025

Kanye Westas Ir Bianca Censori Nauja Sokiruojanti Nuotrauka

May 18, 2025

Latest Posts

-

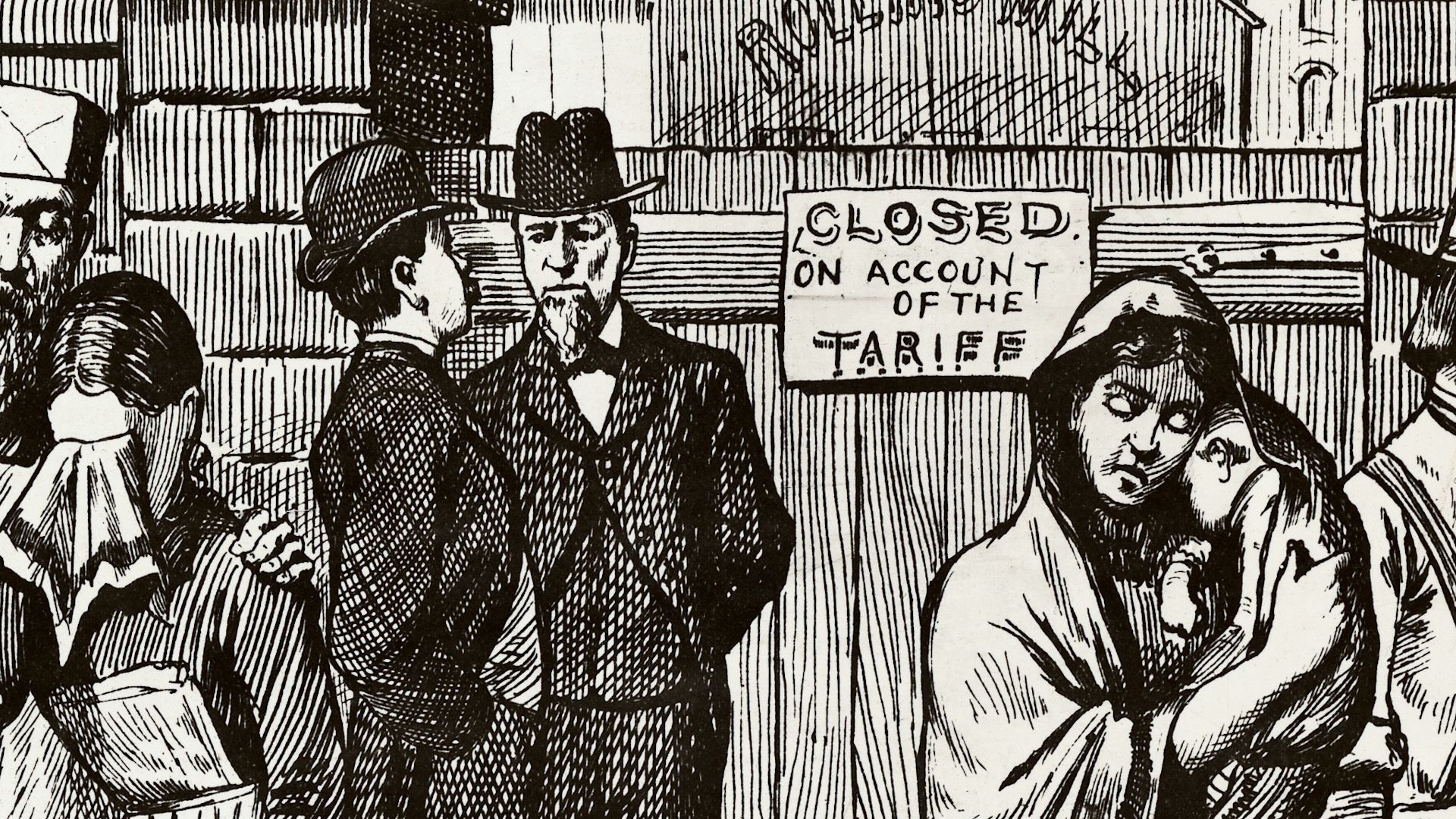

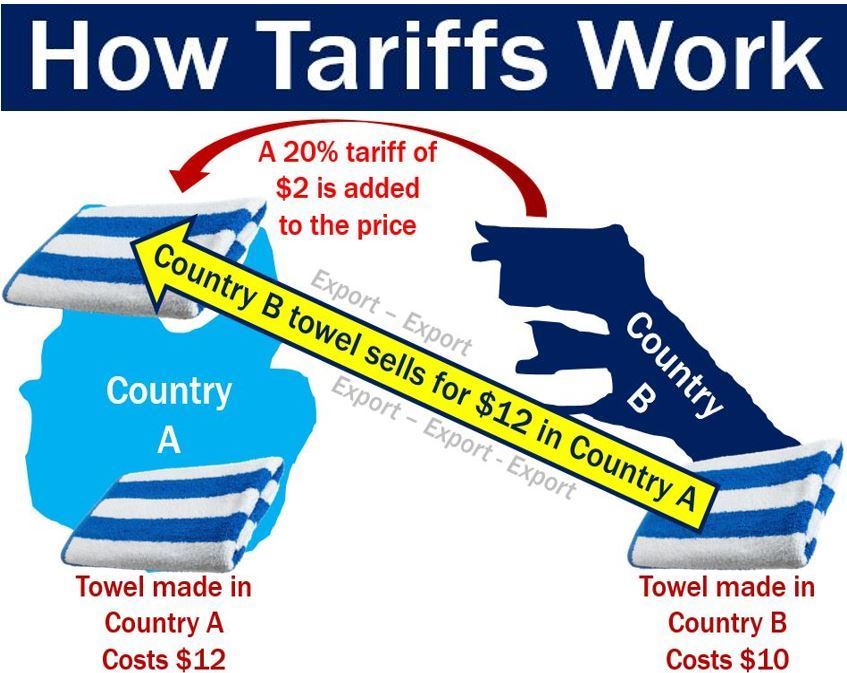

Southwest Washingtons Economic Future Navigating The Tariff Challenge

May 18, 2025

Southwest Washingtons Economic Future Navigating The Tariff Challenge

May 18, 2025 -

The Impact Of Tariffs On Southwest Washingtons Economy

May 18, 2025

The Impact Of Tariffs On Southwest Washingtons Economy

May 18, 2025 -

Tariffs Hit Southwest Washington Businesses Brace For Impact

May 18, 2025

Tariffs Hit Southwest Washington Businesses Brace For Impact

May 18, 2025 -

Analyzing The Financial Success Of Major Music Festivals

May 18, 2025

Analyzing The Financial Success Of Major Music Festivals

May 18, 2025 -

Economic Benefits Of Large Scale Music Events A Case Study

May 18, 2025

Economic Benefits Of Large Scale Music Events A Case Study

May 18, 2025