Assessing The Economic Risks Of Large-Scale Offshore Wind Projects

Table of Contents

High Capital Expenditure and Financing Challenges

Offshore wind farms require massive upfront investments, making them susceptible to financing difficulties, especially in volatile economic climates. The sheer scale of these projects necessitates substantial capital expenditure, often exceeding billions of dollars. This high initial investment poses significant challenges in securing the necessary funding.

- High initial investment costs: Turbines, foundations, subsea cables, and grid connections all contribute to the substantial upfront costs. The cost of these components can fluctuate based on material prices and global supply chains.

- Dependence on project financing: Successful development hinges on securing project financing from a variety of sources, including banks, private investors, and government subsidies or loan guarantees. Competition for funding can be intense, especially during periods of economic uncertainty.

- Cost overruns: Unforeseen technical challenges, adverse weather conditions delaying construction, or changes in regulatory requirements can easily lead to significant cost overruns, jeopardizing project profitability. Detailed risk assessments and contingency planning are crucial to mitigate this.

- Interest rate risk: The cost of borrowing is a significant factor influencing project feasibility. Fluctuations in interest rates can dramatically impact the overall cost of financing, potentially rendering a project uneconomical. Hedging strategies can help manage this risk.

These challenges highlight the crucial need for robust financial planning and sophisticated risk management strategies when undertaking offshore wind projects. Understanding the complexities of offshore wind financing is paramount for success.

Revenue Uncertainty and Price Volatility

The profitability of offshore wind projects is heavily dependent on power purchase agreements (PPAs) and prevailing energy prices, both of which are subject to considerable uncertainty. While the long-term outlook for renewable energy is positive, short-term market volatility can significantly impact revenue streams.

- Fluctuations in wholesale electricity prices: The price of electricity can fluctuate significantly based on supply and demand, seasonal variations, and geopolitical factors. This makes revenue forecasting challenging and increases the risk of lower-than-anticipated returns.

- Securing favorable PPAs: Power Purchase Agreements are essential for guaranteeing a consistent revenue stream. However, negotiating favorable long-term PPAs with offtakers can be challenging, especially in competitive energy markets. The length and pricing of these agreements significantly influence project economics.

- Competition from other energy sources: Offshore wind farms face competition from other renewable energy sources like solar power and from traditional fossil fuel-based power generation. This competitive landscape can impact the price of electricity and the demand for offshore wind energy.

- Government policies and subsidies: Government policies, including subsidies, tax incentives, and carbon pricing mechanisms, play a significant role in shaping the energy market. Changes in these policies can have a profound impact on project profitability.

Managing electricity price volatility and securing reliable PPAs are critical aspects of mitigating economic risks in the offshore wind sector.

Operational and Maintenance Costs

The remote location of offshore wind farms necessitates significant operational and maintenance expenditure, impacting long-term profitability. The harsh marine environment and the complexity of the technology involved create unique challenges.

- High maintenance costs: Specialized vessels and highly skilled technicians are required for regular maintenance and repairs, significantly increasing operational expenditure (OPEX). The cost of transporting personnel and equipment to offshore locations adds further expense.

- Weather-related challenges: Harsh weather conditions, including storms and high waves, can disrupt maintenance operations and lead to unexpected equipment failures, increasing downtime and repair costs.

- Equipment failures: Offshore wind turbines are complex pieces of machinery, and unexpected equipment failures can result in costly repairs and lost revenue. Regular inspections and preventative maintenance are vital to minimize this risk.

- Long-term asset management: Developing a comprehensive asset management strategy is essential to optimizing the performance and extending the lifespan of the wind farm, minimizing long-term operational expenditure (OPEX).

Effective offshore wind maintenance planning and asset management are crucial to ensuring the long-term economic viability of these projects.

Regulatory and Permitting Hurdles

Navigating the complex regulatory landscape and obtaining necessary permits can lead to significant delays and increased costs, delaying project completion and impacting the overall return on investment.

- Time-consuming permitting processes: Environmental impact assessments and obtaining the necessary permits from various regulatory bodies can be a lengthy and complex process, adding considerable time and expense to project development.

- Legal challenges and appeals: Projects can face legal challenges and appeals from stakeholders concerned about environmental impacts or other aspects of the project. These challenges can delay the project and add significant legal costs.

- Changes in government regulations: Changes in government regulations or policies can impact the viability of projects mid-development, requiring costly adjustments or even rendering the project uneconomical. This necessitates careful consideration of regulatory risk.

- Grid connection challenges: Connecting the offshore wind farm to the electricity grid can be a significant technical and logistical challenge, adding to the overall cost and potentially causing delays. Ensuring secure and efficient grid connection is paramount.

Effectively managing offshore wind permitting and navigating the regulatory landscape is crucial for minimizing risks and ensuring project success.

Conclusion

Large-scale offshore wind projects, while vital for a sustainable energy future, present considerable economic risks that need careful consideration. From substantial capital expenditures and revenue uncertainty to operational challenges and regulatory hurdles, a thorough understanding of these risks is crucial for successful project development. By proactively addressing these challenges through robust financial planning, risk mitigation strategies, and careful consideration of the regulatory environment, investors and developers can increase the likelihood of successful and profitable offshore wind projects. Further research and analysis into the specific economic risks of offshore wind projects are essential to unlock the full potential of this crucial renewable energy source.

Featured Posts

-

New Us Vaccine Watchdog Program Addresses Growing Measles Concern

May 03, 2025

New Us Vaccine Watchdog Program Addresses Growing Measles Concern

May 03, 2025 -

Lotto Plus 1 And Lotto Plus 2 Check Todays Winning Numbers

May 03, 2025

Lotto Plus 1 And Lotto Plus 2 Check Todays Winning Numbers

May 03, 2025 -

Christina Aguileras Photoshopped Images Spark Online Debate

May 03, 2025

Christina Aguileras Photoshopped Images Spark Online Debate

May 03, 2025 -

New Poll Shows Farage Ahead Of Starmer For Uk Prime Minister In Majority Of Constituencies

May 03, 2025

New Poll Shows Farage Ahead Of Starmer For Uk Prime Minister In Majority Of Constituencies

May 03, 2025 -

Dont Miss Out Free Cowboy Bebop Skins And Items In Fortnite

May 03, 2025

Dont Miss Out Free Cowboy Bebop Skins And Items In Fortnite

May 03, 2025

Latest Posts

-

Rossiysko Cheshskie Ekonomicheskie Otnosheniya Itogi Peregovorov

May 03, 2025

Rossiysko Cheshskie Ekonomicheskie Otnosheniya Itogi Peregovorov

May 03, 2025 -

Ekonomicheskoe Sotrudnichestvo Mezhdu Rossiey I Chekhiey Perspektivy Razvitiya

May 03, 2025

Ekonomicheskoe Sotrudnichestvo Mezhdu Rossiey I Chekhiey Perspektivy Razvitiya

May 03, 2025 -

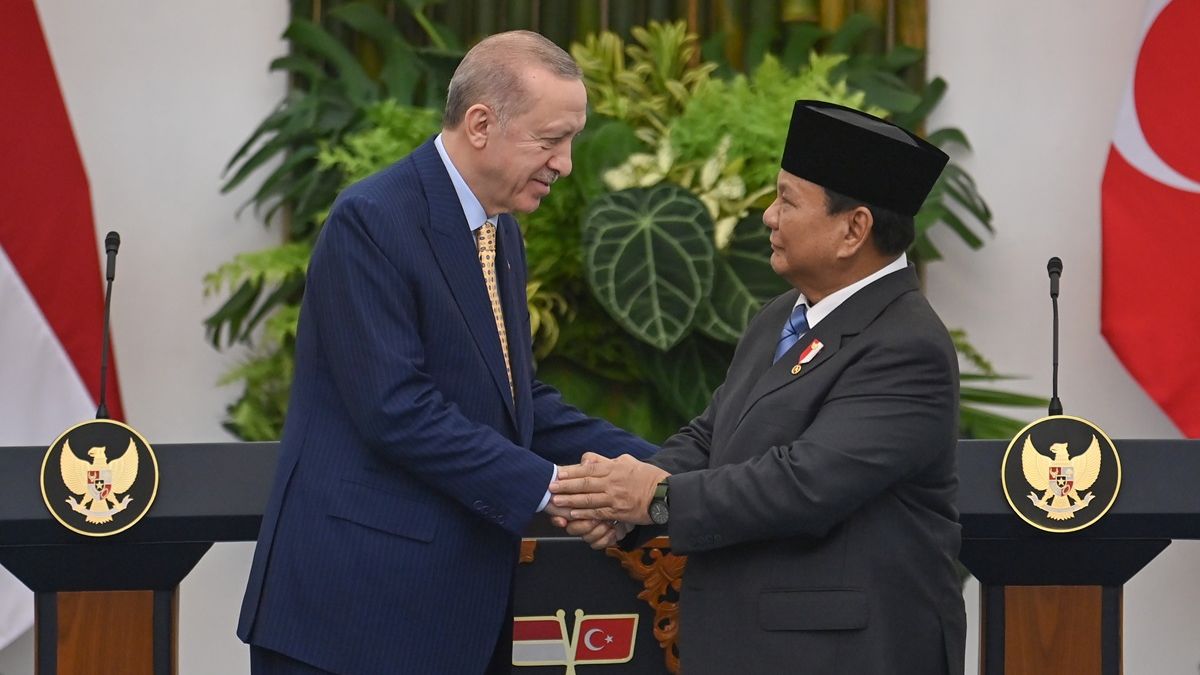

Presiden Erdogan Di Indonesia Kerja Sama Bilateral Yang Menguntungkan Kedua Negara 13 Poin

May 03, 2025

Presiden Erdogan Di Indonesia Kerja Sama Bilateral Yang Menguntungkan Kedua Negara 13 Poin

May 03, 2025 -

13 Kesepakatan Kerja Sama Ri Turkiye Suksesnya Kunjungan Presiden Erdogan Ke Indonesia

May 03, 2025

13 Kesepakatan Kerja Sama Ri Turkiye Suksesnya Kunjungan Presiden Erdogan Ke Indonesia

May 03, 2025 -

Indonesia Turkiye Perkuat Kerja Sama 13 Poin Kesepakatan Kunjungan Presiden Erdogan

May 03, 2025

Indonesia Turkiye Perkuat Kerja Sama 13 Poin Kesepakatan Kunjungan Presiden Erdogan

May 03, 2025