AT&T Exposes Extreme Cost Increase In Broadcom's VMware Acquisition Plan

Table of Contents

Broadcom, a leading semiconductor company, and VMware, a virtualization and cloud computing giant, are both pivotal players in the technology market. Broadcom's proposed acquisition of VMware, initially valued at a staggering sum, has now faced intense scrutiny following AT&T's public expression of concern over the escalating costs.

AT&T's Concerns Regarding the Acquisition Cost

AT&T, a major telecommunications company and a significant VMware customer, has voiced strong objections to the Broadcom VMware acquisition's price, arguing that it significantly overvalues VMware. Their concerns stem from several key factors:

- Overvaluation of VMware: AT&T believes the proposed price significantly exceeds VMware's intrinsic value, representing a substantial overpayment by Broadcom. They argue that the current market conditions do not justify such a high valuation.

- Anti-competitive concerns: The merger could potentially stifle competition, leading to higher prices and reduced innovation for customers, especially in crucial areas like network infrastructure and cloud services. AT&T fears reduced choice and potentially less competitive pricing.

- Potential impact on AT&T's services: The acquisition could negatively affect AT&T's own services and infrastructure, resulting in increased costs for their operations and potentially impacting the quality of their offerings to consumers. This could translate into higher prices for AT&T customers.

AT&T has not yet released specific financial data publicly to support their claims, however, their statement indicates they have significant internal analysis backing their position. They have also hinted at raising regulatory concerns.

Analysis of Broadcom's Proposed Acquisition Strategy

Broadcom aims to acquire VMware to expand its software portfolio and strengthen its position in the enterprise software market. Their rationale likely includes:

- Synergies between Broadcom and VMware: Broadcom anticipates significant synergies by integrating VMware's virtualization technology with its own semiconductor solutions, creating a more comprehensive and integrated offering for enterprise clients.

- Projected ROI: Broadcom's projected return on investment likely considers the potential for cost savings through economies of scale, increased market share, and cross-selling opportunities. However, AT&T's concerns suggest these projections might be overly optimistic.

- Past Acquisition History: Broadcom has a history of significant acquisitions. The success or failure of these previous mergers and acquisitions will likely influence regulatory bodies' assessments of this deal.

However, the high price tag raises questions about the feasibility and sustainability of Broadcom's projected ROI, especially given AT&T's concerns.

Impact on the Tech Industry and Competitors

The Broadcom VMware acquisition, if approved, will have a profound impact on the competitive landscape:

- Shift in Market Share: The combined entity would command a significant portion of the market share in several key areas, potentially leading to reduced competition and increased market dominance.

- Impact on Competitors: Companies like Cisco, Microsoft, and other cloud providers could face increased pressure from a larger, more integrated Broadcom-VMware entity.

- Innovation and Pricing: The acquisition's outcome will influence innovation and pricing strategies within the market segments. Concerns exist that reduced competition could lead to higher prices and slower innovation.

Regulatory Scrutiny and Potential Outcomes

Regulatory bodies, including the FTC in the US and the EU Commission, will play a crucial role in determining the fate of the Broadcom VMware acquisition.

- Regulatory Approval: The likelihood of approval depends on whether the regulators deem the acquisition anti-competitive or believe it could harm consumers.

- Potential Concessions: Broadcom might need to offer concessions, such as divesting certain assets or making commitments to maintain competition, to secure regulatory approval.

- Alternative Acquisition Strategy: If regulatory hurdles prove insurmountable, Broadcom might need to reconsider its strategy, potentially leading to a renegotiation of the acquisition price or even abandoning the deal altogether.

The Future of the Broadcom VMware Acquisition

AT&T's strong opposition to the current cost of the Broadcom VMware acquisition highlights significant concerns regarding overvaluation, anti-competitive practices, and the potential negative impact on the wider tech industry. The potential effects on competitors and the market share are considerable. Regulatory outcomes will be crucial in determining the fate of this massive deal. The uncertainty surrounding regulatory approval and the potential for concessions or alternative strategies remain significant. Stay tuned for further updates on this critical development in the tech industry. The future of the Broadcom VMware acquisition, and its ultimate cost, remains uncertain.

Featured Posts

-

The Goldbergs Why The Show Remains Relevant Today

May 22, 2025

The Goldbergs Why The Show Remains Relevant Today

May 22, 2025 -

Huizenprijzen Stijgen Ondanks Economische Tegenwind Abn Amro Prognose

May 22, 2025

Huizenprijzen Stijgen Ondanks Economische Tegenwind Abn Amro Prognose

May 22, 2025 -

The Goldbergs Behind The Scenes And Production Details

May 22, 2025

The Goldbergs Behind The Scenes And Production Details

May 22, 2025 -

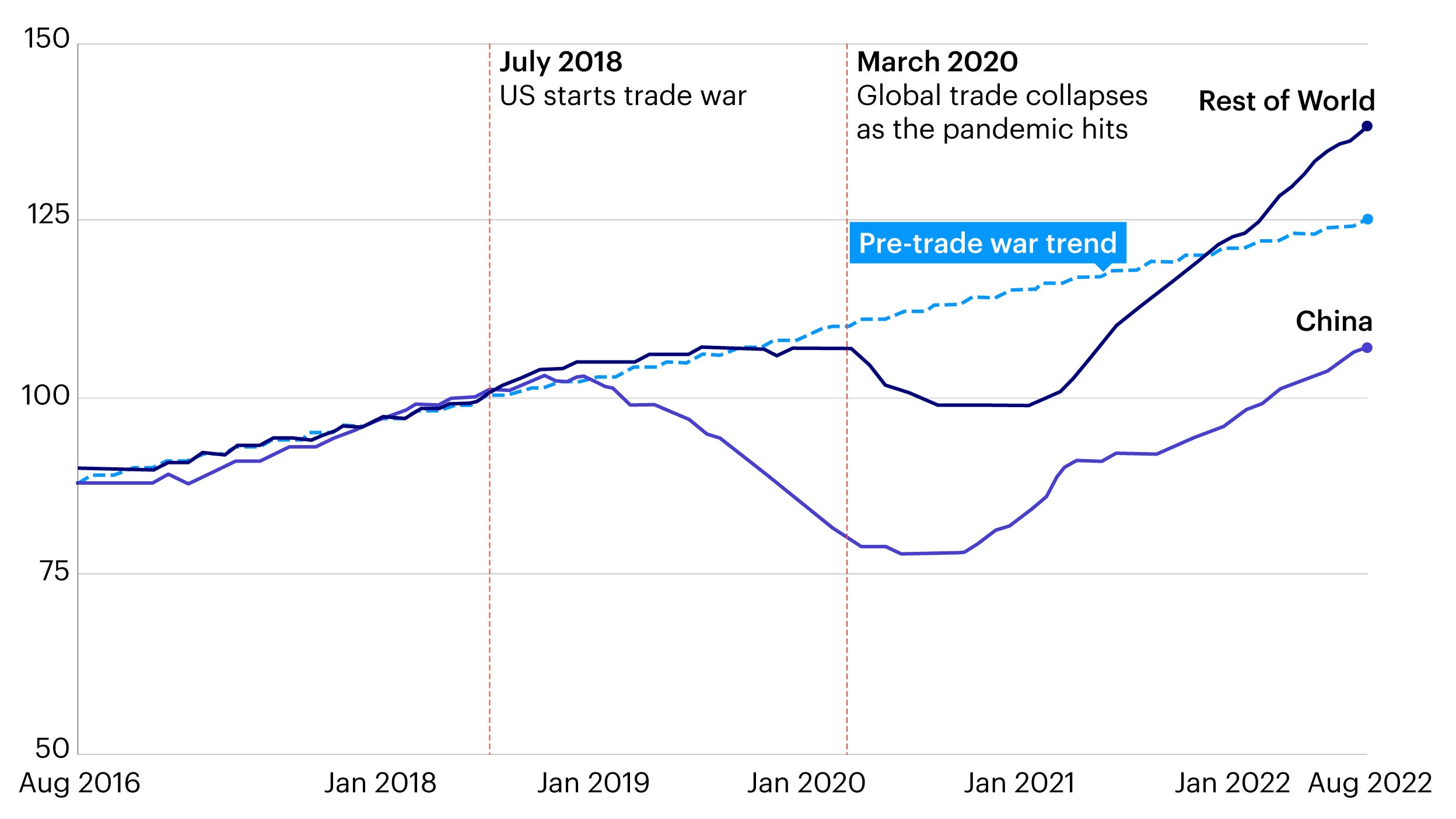

China And Us Trade A Race Against The Clock To Meet Trade Agreement

May 22, 2025

China And Us Trade A Race Against The Clock To Meet Trade Agreement

May 22, 2025 -

Peppa Pigs Real Name A Surprise For Longtime Fans

May 22, 2025

Peppa Pigs Real Name A Surprise For Longtime Fans

May 22, 2025

Latest Posts

-

Box Truck Accident Leads To Significant Route 581 Closure

May 22, 2025

Box Truck Accident Leads To Significant Route 581 Closure

May 22, 2025 -

Route 581 Traffic At Standstill Box Truck Involved In Crash

May 22, 2025

Route 581 Traffic At Standstill Box Truck Involved In Crash

May 22, 2025 -

Traffic Delays On Route 581 Following Box Truck Accident

May 22, 2025

Traffic Delays On Route 581 Following Box Truck Accident

May 22, 2025 -

Firefighters Respond To Major Used Car Lot Fire

May 22, 2025

Firefighters Respond To Major Used Car Lot Fire

May 22, 2025 -

Crews Battle Blaze At Used Car Dealership

May 22, 2025

Crews Battle Blaze At Used Car Dealership

May 22, 2025