AT&T Sounds Alarm On Broadcom's VMware Acquisition: A 1050% Price Hike

Table of Contents

The Staggering 1050% Price Increase: Details and Implications

AT&T's claim of a 1050% increase in VMware's networking solution pricing post-acquisition is a seismic event. While the exact calculations behind this figure haven't been publicly disclosed by AT&T in full detail, the implication is clear: a previously manageable cost has become prohibitively expensive. This drastic jump represents a massive shift in the cost structure for AT&T's network operations.

The impact on AT&T's bottom line is potentially severe. Such a substantial increase in operational expenditure (OPEX) directly eats into profitability. Consider these key consequences:

- Increased Operational Expenditure (OPEX): The 1050% price hike represents a dramatic surge in AT&T's annual spending on VMware networking solutions, potentially impacting budgets across multiple departments.

- Potential Impact on AT&T's Services Pricing and Competitiveness: To absorb this cost, AT&T may be forced to increase the prices of its services to consumers and businesses, potentially impacting its competitiveness in a crowded market.

- Risk of Reduced Profit Margins: The increased costs associated with VMware's solutions could significantly reduce AT&T's profit margins, impacting shareholder returns and potentially hindering future investments.

Broadcom's Acquisition Strategy and Potential Antitrust Concerns

Broadcom's acquisition of VMware, valued at over $61 billion, is a strategic move to expand its presence in the enterprise software market. By acquiring VMware, Broadcom aims to bolster its portfolio of networking and infrastructure solutions, potentially creating a dominant force in the industry. This raises significant antitrust concerns.

- Broadcom's Market Dominance and Potential for Monopolistic Practices: The combined entity's market share could lead to monopolistic practices, limiting competition and potentially harming innovation.

- Regulatory Scrutiny from bodies like the FTC and EU Commission: Regulators are closely scrutinizing the acquisition to assess its impact on competition and consumer prices. Potential legal challenges and investigations could significantly delay or even prevent the deal from closing.

- Potential for Legal Challenges and Delays in the Acquisition Process: The significant price increases reported by AT&T could fuel further investigations and legal challenges, delaying the completion of the acquisition or even leading to its unraveling.

Impact on Other Telecom Companies and the Broader Market

AT&T's experience is likely not an isolated incident. Other telecom companies relying on VMware's networking solutions could face similar dramatic price hikes. This potential ripple effect has far-reaching implications for the broader technology industry:

- Potential for Industry-Wide Price Increases for VMware Products and Services: The acquisition may set a precedent for aggressive pricing strategies, leading to increased costs for enterprise solutions across various sectors.

- Increased Pressure on Telecom Companies to Find Cost-Effective Alternatives: Facing substantial price increases, telecom companies will be pressured to explore alternative networking solutions and vendors, potentially accelerating innovation in competing technologies.

- Potential for Innovation in Competing Technologies and Platforms: The price hike could spur the development and adoption of more affordable and competitive networking solutions, ultimately benefiting consumers and businesses.

AT&T's Response and Future Strategies

AT&T has publicly expressed its concerns regarding the significant price increase imposed by Broadcom post-acquisition. While specific details of their response remain undisclosed, the company is likely exploring several options:

- Negotiation Strategies with Broadcom: AT&T may attempt to renegotiate its contracts with Broadcom to secure more favorable pricing terms.

- Exploration of Alternative Networking Solutions: The company might be actively evaluating alternative vendors and technologies to reduce its reliance on VMware's solutions.

- Potential Impact on AT&T's Investment and Expansion Plans: The increased costs could force AT&T to reassess its investment and expansion plans, potentially delaying or scaling back certain projects.

Conclusion: Navigating the Wake of the Broadcom-VMware Deal

The 1050% price hike faced by AT&T following Broadcom's acquisition of VMware is a watershed moment. It highlights the potential for significant disruption in the enterprise software and networking sectors, raising critical antitrust concerns and forcing companies to rethink their strategies. The implications extend far beyond AT&T, impacting other telecom companies and the broader technology industry. This situation underscores the need for regulatory oversight and the importance of exploring alternative solutions to maintain a competitive and innovative marketplace. Stay tuned for updates on how the Broadcom VMware acquisition impacts pricing and competition. Follow us for further analysis of the VMware price hike and its ramifications. Keywords: Broadcom VMware acquisition, AT&T price increase, enterprise software costs, networking solutions, antitrust implications.

Featured Posts

-

Kshmyr Ywm Ykjhty Jdhbat Tqrybat Awr Mtalbat

May 01, 2025

Kshmyr Ywm Ykjhty Jdhbat Tqrybat Awr Mtalbat

May 01, 2025 -

Channel 4 And Michael Sheen Face Legal Action Over Documentary

May 01, 2025

Channel 4 And Michael Sheen Face Legal Action Over Documentary

May 01, 2025 -

Yankees Vs Guardians Bibees Resilience Judges Home Run 3 2 Thriller

May 01, 2025

Yankees Vs Guardians Bibees Resilience Judges Home Run 3 2 Thriller

May 01, 2025 -

Juridische Strijd Kampen Dagvaardt Enexis Voor Stroomnetaansluiting

May 01, 2025

Juridische Strijd Kampen Dagvaardt Enexis Voor Stroomnetaansluiting

May 01, 2025 -

Analyze Dragons Den Pitches A Framework For Effective Presentations

May 01, 2025

Analyze Dragons Den Pitches A Framework For Effective Presentations

May 01, 2025

Latest Posts

-

Lempron Tzeims 50 000 Pontoi Mia Istoriki Epidosi

May 01, 2025

Lempron Tzeims 50 000 Pontoi Mia Istoriki Epidosi

May 01, 2025 -

Becciu Condannato Risarcimento Di 40 000 Euro Agli Accusatori

May 01, 2025

Becciu Condannato Risarcimento Di 40 000 Euro Agli Accusatori

May 01, 2025 -

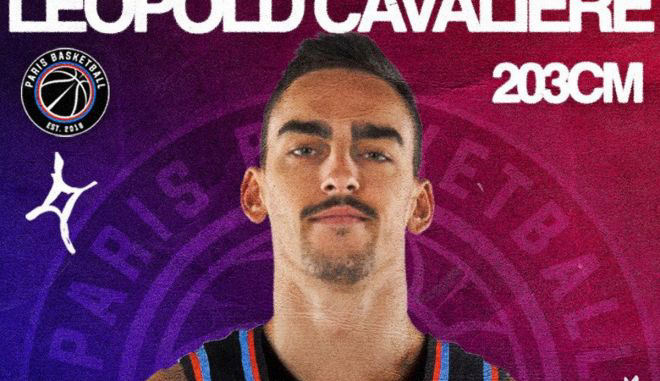

Episimos I Pari Stin Euroleague Kai Tin Epomeni Xronia

May 01, 2025

Episimos I Pari Stin Euroleague Kai Tin Epomeni Xronia

May 01, 2025 -

I Pari Sen Zermen Paramenei Stin Euroleague Epivevaiosi Gia Tin Epomeni Sezon

May 01, 2025

I Pari Sen Zermen Paramenei Stin Euroleague Epivevaiosi Gia Tin Epomeni Sezon

May 01, 2025 -

Will The Portland Trail Blazers Secure A Play In Spot

May 01, 2025

Will The Portland Trail Blazers Secure A Play In Spot

May 01, 2025