Aussie Dollar Outperforms Kiwi: Option Traders' Insights On Shifting Market Sentiment

Table of Contents

Analyzing the AUD/NZD Exchange Rate Discrepancy

Understanding the recent outperformance of the Aussie dollar against the Kiwi dollar requires a comprehensive analysis of the AUD/NZD exchange rate fluctuations. This involves examining both fundamental and technical factors influencing this currency pair.

-

Recent Historical AUD/NZD Charts: A review of recent charts clearly illustrates the AUD's upward trajectory against the NZD. This visual representation provides a clear indication of the strength of the Aussie dollar. (Insert chart here). Note the significant appreciation of the AUD over the past [specify timeframe, e.g., three months].

-

Diverging Economic Data: Australia and New Zealand, while geographically close, exhibit differing economic performances. Stronger-than-expected economic indicators in Australia, such as robust employment figures or positive GDP growth, contribute to increased demand for the AUD. Conversely, weaker data from New Zealand can lead to a depreciation of the NZD.

-

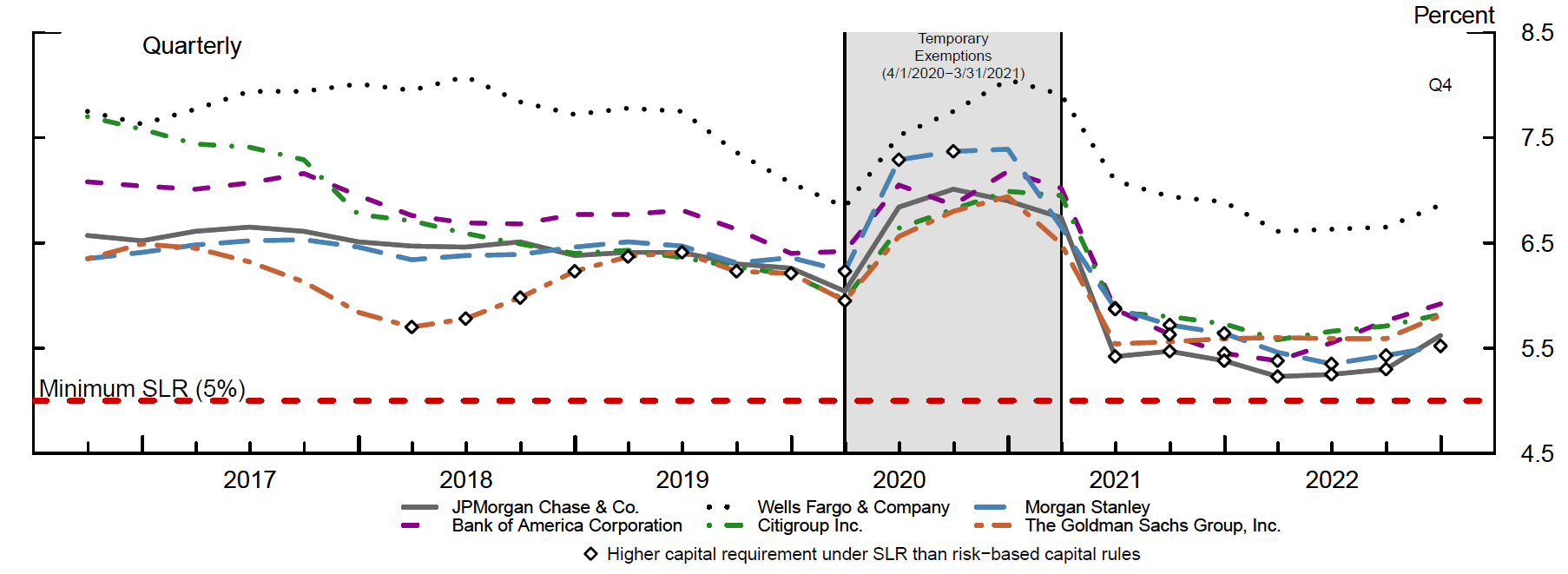

Interest Rate Differentials and Central Bank Policies: The Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) play crucial roles. Differing interest rate policies significantly influence currency values. Higher interest rates in Australia, relative to New Zealand, can attract foreign investment, boosting demand for the AUD.

-

Commodity Price Influence: Australia's economy is heavily reliant on commodity exports, such as gold and iron ore. Strong commodity prices generally bolster the AUD, impacting its value against other currencies, including the NZD.

-

Technical Analysis: Technical indicators, like moving averages and RSI (Relative Strength Index), provide further insight into the AUD/NZD trend and potential future movements. (Insert relevant chart illustrating technical indicators).

Option Trader Sentiment and Market Positioning

Option traders, with their sophisticated tools and strategies, offer valuable insight into prevailing market sentiment. Analyzing option market data provides a unique perspective on the AUD/NZD dynamics.

-

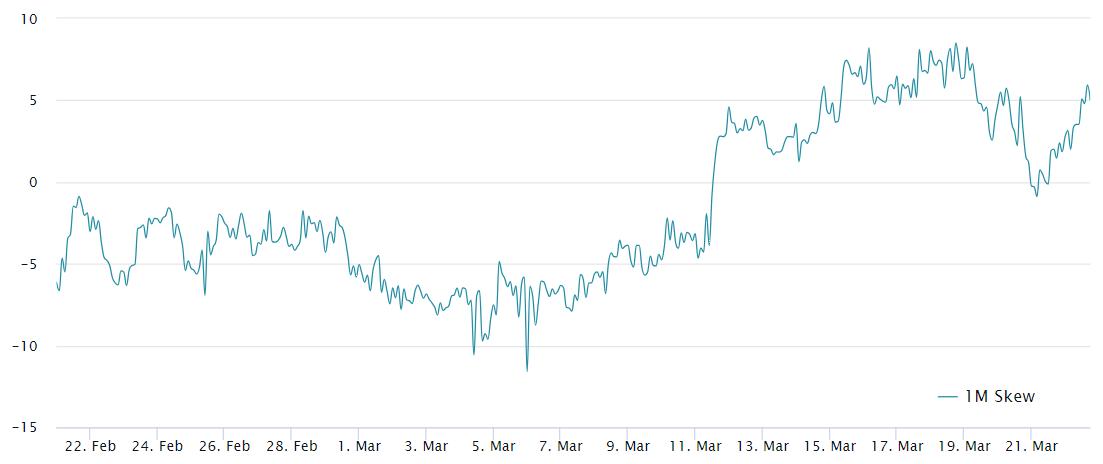

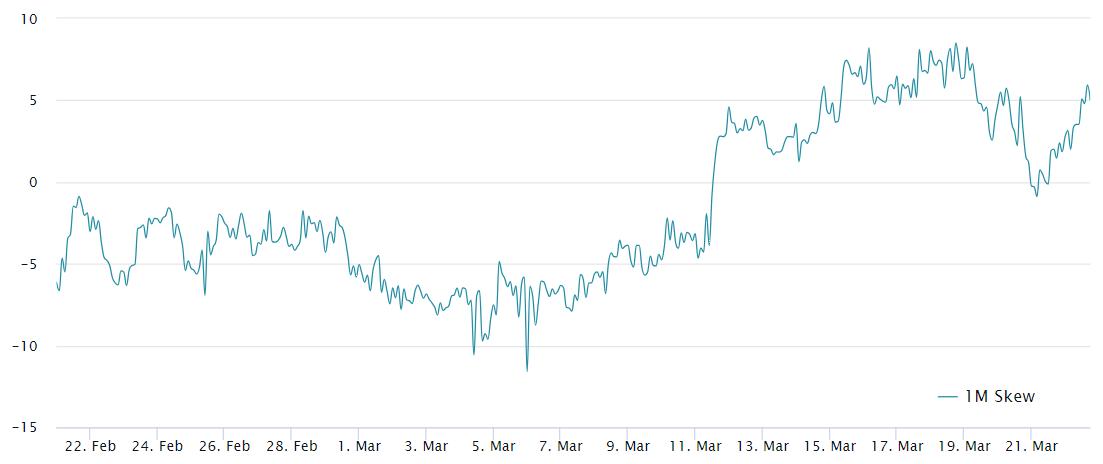

Option Prices and Market Expectations: Option prices reflect market participants' expectations regarding future price movements. High demand for AUD call options (options to buy AUD) indicates bullish sentiment and expectations of further AUD appreciation against the NZD.

-

Implied Volatility: High implied volatility in AUD/NZD options suggests increased uncertainty and potentially larger price swings in the future. This can be both a risk and an opportunity for traders.

-

Put/Call Ratio: The put/call ratio—the ratio of put options (options to sell) to call options—is a key sentiment indicator. A higher call/put ratio generally indicates a bullish bias.

-

Professional Trader Positioning: The positions held by professional option traders often provide valuable insight into the market's direction. Large accumulations of AUD call options by institutional investors could suggest a further upward trend.

-

Hedging with Options: Options contracts can be used to hedge against AUD/NZD fluctuations. Importers or exporters can use options to mitigate currency risk associated with their transactions.

Geopolitical Factors and their Influence

Geopolitical events can significantly impact currency markets. The AUD/NZD pair is no exception.

-

Global Economic Outlook: A global economic slowdown can negatively impact both the Australian and New Zealand economies, affecting the AUD/NZD exchange rate. However, the impact may be different for each economy depending on their specific exposures.

-

Risk Aversion: During periods of global uncertainty or increased risk aversion, investors might move towards perceived "safe haven" currencies. While neither the AUD nor the NZD are typically considered safe havens in the same way as the USD or JPY, the AUD may benefit from higher risk aversion compared to the NZD depending on market perception.

-

Trade Relations: Trade relations between Australia, New Zealand, and their major trading partners (e.g., China, the US) can significantly impact their economies and currencies. Changes in trade policies or trade disputes can influence the AUD/NZD exchange rate.

-

Political Stability: Political instability in either Australia or New Zealand can negatively impact investor confidence, potentially leading to currency depreciation.

Future Outlook and Trading Strategies

Predicting future movements in the AUD/NZD exchange rate is inherently challenging. However, based on our analysis, a cautious outlook is warranted.

-

Cautious Outlook: While the AUD has recently outperformed the NZD, future movements will depend on the interplay of various economic and geopolitical factors.

-

Potential Trading Strategies: Depending on the prevailing market sentiment and option pricing, traders may consider various strategies, such as long AUD/NZD positions, or options strategies like bull call spreads or covered call writing.

-

Risk Management: Effective risk management is crucial in forex trading. Employing stop-loss orders and proper position sizing are essential to protect capital.

-

Technical Indicators: Technical indicators such as moving averages, MACD (Moving Average Convergence Divergence), and Bollinger Bands can help traders identify potential entry and exit points.

Conclusion

The recent outperformance of the Aussie dollar against the Kiwi dollar reflects a complex interplay of economic data, interest rate differentials, central bank policies, commodity prices, and prevailing market sentiment. Option traders' insights provide valuable perspectives on this dynamic currency pair. By monitoring market sentiment, economic indicators, and geopolitical events, traders can make more informed decisions. Remember to always practice effective risk management. Stay informed on the ever-changing dynamics of the AUD/NZD currency pair to capitalize on future opportunities in this dynamic market. Continue to monitor market sentiment, option pricing, and economic indicators to make informed trading decisions. Learn more about effective Aussie dollar and Kiwi dollar trading strategies to capitalize on future opportunities in this dynamic market.

Featured Posts

-

The Future Of Marvel Course Correction For Movies And Shows

May 05, 2025

The Future Of Marvel Course Correction For Movies And Shows

May 05, 2025 -

The Count Of Monte Cristo A Comprehensive Book Review

May 05, 2025

The Count Of Monte Cristo A Comprehensive Book Review

May 05, 2025 -

Kato Rejects Using Us Treasury Sales As Trade Leverage

May 05, 2025

Kato Rejects Using Us Treasury Sales As Trade Leverage

May 05, 2025 -

Romania Election Runoff Far Right Vs Centrist Mayor

May 05, 2025

Romania Election Runoff Far Right Vs Centrist Mayor

May 05, 2025 -

Albaneses Economic Agenda A Post Election Analysis

May 05, 2025

Albaneses Economic Agenda A Post Election Analysis

May 05, 2025

Latest Posts

-

Where To Watch The Celtics Vs Heat Game Live Stream And Tv

May 06, 2025

Where To Watch The Celtics Vs Heat Game Live Stream And Tv

May 06, 2025 -

Watch Celtics Vs Heat Live Tv Channels And Streaming Services

May 06, 2025

Watch Celtics Vs Heat Live Tv Channels And Streaming Services

May 06, 2025 -

How To Watch The Celtics Vs Knicks Game Online And On Tv

May 06, 2025

How To Watch The Celtics Vs Knicks Game Online And On Tv

May 06, 2025 -

Where To Watch Celtics Vs Knicks Live Stream And Tv Broadcast Details

May 06, 2025

Where To Watch Celtics Vs Knicks Live Stream And Tv Broadcast Details

May 06, 2025 -

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025