Australian Asset Rally Expected Post-Election: Analyst Predictions

Table of Contents

Key Factors Driving the Predicted Australian Asset Rally

Several converging factors are fueling the anticipated Australian asset rally post-election. These include revised government policy expectations, an improved economic outlook, and positive influences from the global market.

Government Policy Expectations

The newly elected government's policy platform is expected to significantly influence the Australian market. Changes in fiscal and monetary policy are anticipated to stimulate growth and boost investor confidence.

- Infrastructure Spending: Increased investment in infrastructure projects is projected to create jobs, stimulate economic activity, and positively impact related sectors like construction and engineering. This could lead to strong performance in related equities.

- Tax Reforms: Potential tax cuts or adjustments to tax incentives could boost consumer spending and business investment, further driving economic growth. This may particularly benefit consumer discretionary stocks.

- Interest Rate Adjustments: The Reserve Bank of Australia's (RBA) monetary policy decisions will play a crucial role. Predictions vary, but some analysts, like [insert analyst name and source if available], forecast potential interest rate cuts, making borrowing cheaper and potentially boosting asset prices, particularly in real estate.

However, it's crucial to acknowledge potential risks. Unforeseen policy changes or delays in implementation could dampen the expected positive impact.

Improved Economic Outlook

Australia's economic climate is showing signs of improvement, bolstering the post-election market outlook. Key indicators point towards a positive trajectory.

- GDP Growth: Projected GDP growth rates are [insert projected rates and source], suggesting a healthy economic expansion.

- Inflation Rates: While inflation remains a concern, [insert projected inflation rates and source] suggest it's within manageable levels, reducing the risk of aggressive interest rate hikes.

- Unemployment Figures: Falling unemployment rates [insert unemployment figures and source] indicate a tightening labor market and increased consumer confidence.

Despite this positive outlook, external factors like global economic slowdowns could impact Australia's growth trajectory.

Global Market Influences

Global economic conditions and events will inevitably influence the Australian market. Positive global developments can amplify the expected Australian asset rally.

- Commodity Prices: Australia's strong commodity export sector is sensitive to global demand. Sustained or rising commodity prices, particularly for iron ore and coal, will benefit related companies and contribute to economic growth.

- International Trade Agreements: The progress and outcomes of international trade negotiations can significantly impact Australian businesses and trade flows. Positive developments here would further enhance the outlook.

Asset Classes Poised for Growth

The predicted Australian asset rally is expected to impact various asset classes, creating opportunities for diversified portfolios.

Australian Equities

The Australian equities market is expected to see significant gains, with some sectors outperforming others.

- Mining: Strong global demand for commodities is expected to drive growth in mining stocks.

- Technology: The tech sector is poised for growth, driven by continued innovation and increasing digitalization.

- Infrastructure: Government investment in infrastructure projects will boost related companies. Specific stocks like [insert examples, if available] are anticipated to perform well. Projected return rates are [insert projected return rates and source, if available], but investors should be aware of sector-specific risks.

Australian Real Estate

The Australian real estate market is predicted to see continued growth, though at potentially a slower pace than in previous years.

- Residential Property: Population growth and low interest rates (if predictions hold) could continue to support residential property prices, particularly in high-demand areas.

- Commercial Property: Strong economic growth could drive demand for commercial real estate, especially in major cities. However, oversupply in certain sectors could dampen growth in some areas.

Australian Bonds

Australian government and corporate bonds are also anticipated to perform well, although returns might be more moderate than equities.

- Government Bonds: If interest rates remain low or fall, government bond yields could be attractive to income-seeking investors.

- Corporate Bonds: Strong corporate earnings could enhance the creditworthiness of corporate bonds, making them an appealing investment option.

Risks and Considerations for Investors

While the outlook for an Australian asset rally is positive, investors must acknowledge potential risks.

- Inflation: Unexpected surges in inflation could lead to higher interest rates, impacting asset valuations.

- Geopolitical Uncertainty: Global geopolitical events could create market volatility and negatively influence investor sentiment.

- Unexpected Policy Shifts: Changes in government policy that deviate from current expectations could negatively affect specific sectors or asset classes.

To mitigate these risks, investors should prioritize diversification, conduct thorough due diligence, and consider consulting with a financial advisor before making any significant investment decisions.

Conclusion

The post-election period in Australia presents a promising outlook for a significant Australian asset rally. Positive economic indicators, anticipated government policies, and favourable global market conditions are converging to create potentially lucrative opportunities across various asset classes, including Australian equities, real estate, and bonds. While potential risks exist, the overall consensus among analysts points towards substantial growth potential.

Are you ready to capitalize on the predicted Australian asset rally? Don't miss out on these potentially lucrative investment opportunities. Conduct your own thorough research and consult with a financial advisor to make informed decisions regarding your Australian investments. Stay informed about the evolving Australian market and seize the potential for substantial growth.

Featured Posts

-

Google Search Ai Data Usage And User Opt Out Options

May 05, 2025

Google Search Ai Data Usage And User Opt Out Options

May 05, 2025 -

Fleetwood Macs Rumours At 48 Behind The Hits A Story Of Personal Turmoil

May 05, 2025

Fleetwood Macs Rumours At 48 Behind The Hits A Story Of Personal Turmoil

May 05, 2025 -

Lizzo Returns With A Fiery New Track Is She Still Bad

May 05, 2025

Lizzo Returns With A Fiery New Track Is She Still Bad

May 05, 2025 -

Betting On Ufc 314 Examining The Volkanovski Vs Lopes Odds

May 05, 2025

Betting On Ufc 314 Examining The Volkanovski Vs Lopes Odds

May 05, 2025 -

How Much Do Lizzos In Real Life Tour Tickets Cost

May 05, 2025

How Much Do Lizzos In Real Life Tour Tickets Cost

May 05, 2025

Latest Posts

-

Podcast Creation Utilizing Ai To Process Repetitive Scatological Documents

May 06, 2025

Podcast Creation Utilizing Ai To Process Repetitive Scatological Documents

May 06, 2025 -

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcast Content

May 06, 2025

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcast Content

May 06, 2025 -

Turning Trash To Treasure An Ai Powered Podcast From Scatological Documents

May 06, 2025

Turning Trash To Treasure An Ai Powered Podcast From Scatological Documents

May 06, 2025 -

The Ryujinx Emulator Development Stopped Due To Nintendo

May 06, 2025

The Ryujinx Emulator Development Stopped Due To Nintendo

May 06, 2025 -

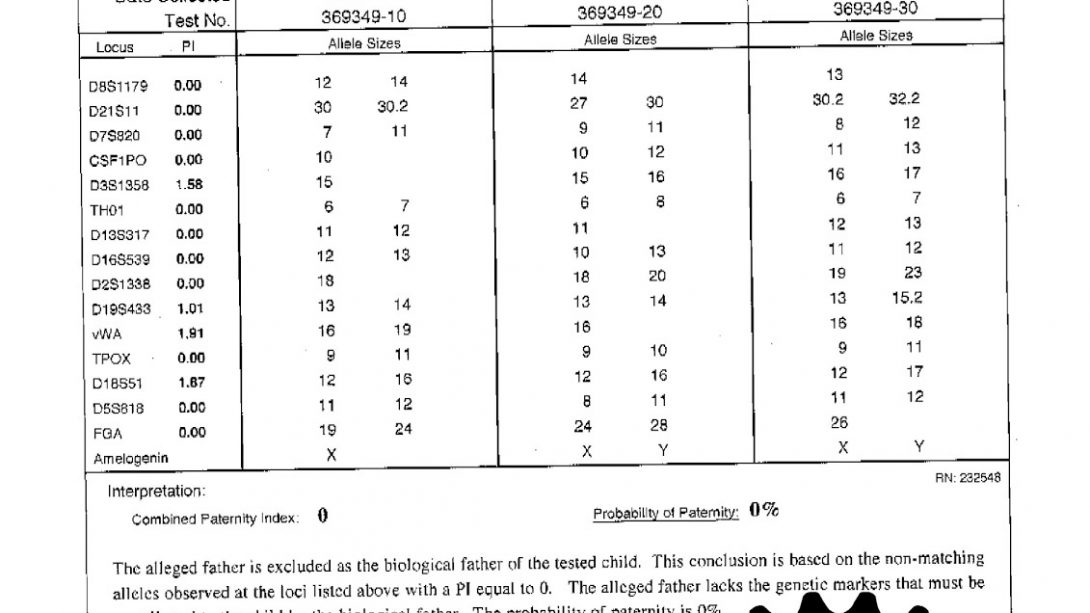

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

May 06, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

May 06, 2025