Avoid These 3 Financial Blunders: A Guide For Women

Table of Contents

Underestimating Retirement Savings

Many women underestimate the amount of money they'll need for a comfortable retirement. This is often exacerbated by several factors, leading to a significant shortfall later in life.

The Gender Pay Gap and its Impact

The persistent gender pay gap significantly impacts women's retirement savings. This means women often earn less over their lifetime than their male counterparts.

- Lower lifetime earnings: The smaller paycheck translates directly to less money available for saving and investing.

- Career interruptions: Women frequently take career breaks to raise children or care for family members, disrupting their earning potential and retirement contributions.

- Underrepresentation in high-paying roles: Women are often underrepresented in leadership and high-paying positions, further diminishing their earning potential.

Actionable Advice: Start saving early, even if it's just a small amount. Take full advantage of employer-sponsored retirement plans and their matching contributions. Consider investing in high-growth options to maximize your returns.

Ignoring Compound Interest

Compound interest is the snowball effect of earning interest on your interest. It's a powerful tool for long-term growth, yet many women overlook its importance.

- The power of time: The longer your money is invested, the more dramatically compound interest works its magic. For example, investing $5,000 annually for 30 years at a 7% return yields significantly more than investing the same amount over 20 years.

- Consistency is key: Regular contributions, even small ones, allow compound interest to work its magic over time.

Actionable Advice: Make regular contributions to your retirement accounts, even if they're small. Choose low-fee investment vehicles to maximize your returns. Avoid withdrawing from your retirement accounts early, unless absolutely necessary.

Failing to Plan for Healthcare Costs

Healthcare costs in retirement can be surprisingly high. Many women underestimate these expenses, leaving them unprepared for the financial burden.

- Rising healthcare premiums: Health insurance premiums increase significantly with age, potentially creating a significant drain on retirement funds.

- Long-term care: The need for long-term care, whether at home or in a facility, can result in substantial expenses.

Actionable Advice: Explore long-term care insurance options to protect yourself from these potentially devastating costs. Build an emergency fund specifically for unexpected healthcare expenses.

Neglecting Financial Literacy and Education

Many women lack the financial knowledge and confidence needed to make informed decisions. This can lead to costly mistakes and hinder their financial progress.

Lack of Knowledge about Investing

Fear and a lack of understanding about investing often prevent women from participating fully in the markets.

- Fear of loss: The fear of losing money can be paralyzing, preventing women from taking the necessary steps to build wealth.

- Lack of understanding: The complexities of investing can be daunting, leading women to avoid it altogether.

- Over-reliance on others: Women may rely too heavily on others for financial advice without fully understanding the implications.

Actionable Advice: Seek professional financial advice from a qualified advisor. Use online resources and educational materials to improve your understanding of investing. Start with small, manageable investments to gain experience and build confidence.

Avoiding Difficult Financial Conversations

Open communication about finances is crucial, yet many women avoid these discussions.

- Budgeting and debt management: Openly discussing budgeting and debt management strategies with partners and family members is essential.

- Financial goals alignment: Aligning financial goals with your partner can lead to a more unified and successful approach to wealth building.

Actionable Advice: Schedule regular budget reviews with your partner or family. Seek professional help for debt management strategies. Create a shared financial plan with your partner to ensure you're both on the same page.

Underestimating the Impact of Debt

High-interest debt can severely hinder financial progress, limiting your ability to save and invest.

- Credit card debt: High-interest credit card debt can quickly spiral out of control.

- Student loan debt: Student loan repayments can strain your budget, leaving less money for savings and investments.

- High-interest personal loans: These loans can have very high interest rates, making it difficult to pay them off.

Actionable Advice: Prioritize high-interest debt repayment strategies such as the debt snowball or avalanche method. Explore debt consolidation options to potentially lower your interest rates.

Ignoring Estate Planning and Insurance

Estate planning and adequate insurance coverage are crucial for protecting your assets and ensuring your loved ones' financial security.

The Importance of a Will

A will is a legal document that outlines how your assets will be distributed after your death. Failing to have one can lead to complications and unintended consequences.

- Protecting assets: A will protects your assets from probate, a lengthy and expensive legal process.

- Inheritance distribution: A will ensures your assets are distributed according to your wishes, avoiding potential family conflicts.

- Guardianship for children: If you have children, a will allows you to designate guardians to care for them.

Actionable Advice: Consult with an estate planning attorney to draft a will that reflects your wishes and circumstances. Review and update your will periodically, especially after major life events.

Life Insurance and Disability Insurance

Life insurance protects your family financially if you die prematurely, while disability insurance provides income if you become unable to work.

- Protecting dependents: These insurance policies protect your dependents' financial well-being in the event of your death or disability.

Actionable Advice: Evaluate your current life and disability insurance coverage to ensure it's adequate for your needs. Consider increasing your coverage as your responsibilities and financial circumstances change.

Long-Term Care Planning

Long-term care can be incredibly expensive, and planning for it is crucial.

- Long-term care insurance: This insurance helps cover the costs of long-term care services.

- Medicaid eligibility: Understanding Medicaid eligibility requirements can be crucial in accessing long-term care assistance.

- Family support: Discuss long-term care plans with family members to ensure everyone understands your wishes and potential support networks.

Actionable Advice: Explore long-term care insurance options to mitigate the potential costs of long-term care. Discuss your long-term care plans with family members to ensure they understand your wishes and potential support roles.

Conclusion

To recap, avoiding these three key financial blunders—underestimating retirement savings, neglecting financial literacy, and ignoring estate planning—is crucial for women's financial well-being. By taking proactive steps to address these areas, you can build a secure financial future and achieve true financial independence. Remember to start saving early, actively seek financial education, and plan for your future. Take control of your financial destiny by using the information in "Avoid These 3 Financial Blunders: A Guide for Women." Your future self will thank you!

Featured Posts

-

Aimscap World Trading Tournament Wtt Strategies For Success

May 22, 2025

Aimscap World Trading Tournament Wtt Strategies For Success

May 22, 2025 -

Love Monster Activities Engaging Children With Creative Play And Learning

May 22, 2025

Love Monster Activities Engaging Children With Creative Play And Learning

May 22, 2025 -

Cassis Blackcurrant Liqueur A Connoisseurs Guide To Selection And Enjoyment

May 22, 2025

Cassis Blackcurrant Liqueur A Connoisseurs Guide To Selection And Enjoyment

May 22, 2025 -

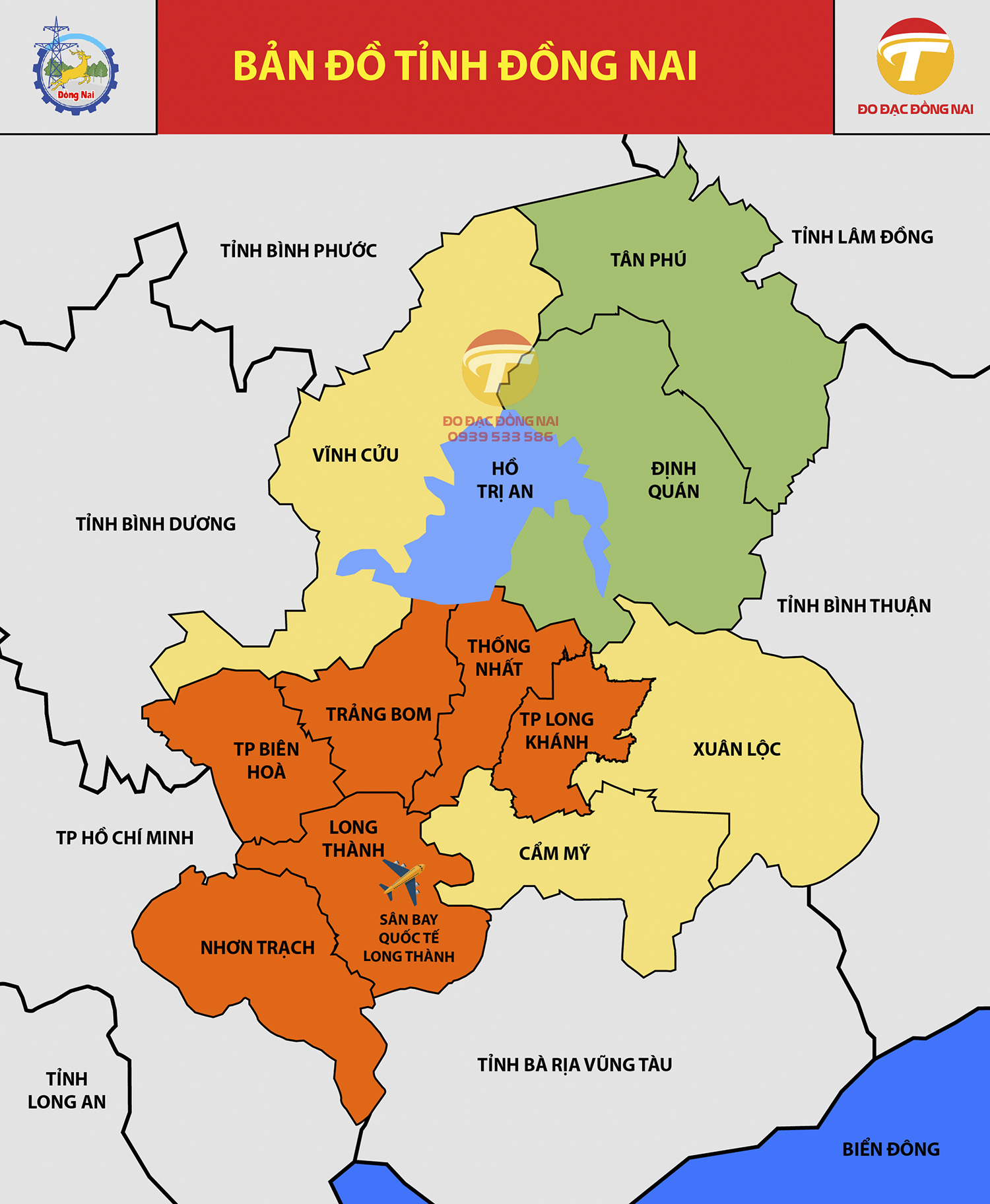

Xay Dung Cau Ma Da Ket Noi Giao Thong Hai Tinh Dong Nai

May 22, 2025

Xay Dung Cau Ma Da Ket Noi Giao Thong Hai Tinh Dong Nai

May 22, 2025 -

Millions In Losses Office365 Executive Accounts Compromised In Major Data Breach

May 22, 2025

Millions In Losses Office365 Executive Accounts Compromised In Major Data Breach

May 22, 2025

Latest Posts

-

Box Truck Accident Leads To Significant Route 581 Closure

May 22, 2025

Box Truck Accident Leads To Significant Route 581 Closure

May 22, 2025 -

Route 581 Traffic At Standstill Box Truck Involved In Crash

May 22, 2025

Route 581 Traffic At Standstill Box Truck Involved In Crash

May 22, 2025 -

Traffic Delays On Route 581 Following Box Truck Accident

May 22, 2025

Traffic Delays On Route 581 Following Box Truck Accident

May 22, 2025 -

Firefighters Respond To Major Used Car Lot Fire

May 22, 2025

Firefighters Respond To Major Used Car Lot Fire

May 22, 2025 -

Crews Battle Blaze At Used Car Dealership

May 22, 2025

Crews Battle Blaze At Used Car Dealership

May 22, 2025