Bad Credit? Get Guaranteed Approval Tribal Loans From Direct Lenders

Table of Contents

Understanding Tribal Loans and Direct Lenders

Tribal loans are short-term loans offered by lenders affiliated with Native American tribes. These loans operate under tribal sovereignty, which means they're often subject to different regulatory frameworks than traditional loans. This can affect aspects like interest rates and collection practices. It's crucial to understand the specific regulations governing the lender you choose.

Key Differences from Traditional Loans:

- Regulatory Environment: Tribal loans are governed by tribal law, which may differ from state and federal lending regulations.

- Eligibility Requirements: While credit scores are a factor, tribal lenders often consider other criteria like income and employment history.

- Interest Rates: Interest rates can vary significantly, so careful comparison is essential.

Advantages of Direct Tribal Lenders:

- Faster Processing: By cutting out the middleman, direct lenders often process applications more quickly.

- Potentially Lower Fees: Avoiding third-party intermediaries can translate to lower overall loan costs.

- Streamlined Application: The application process is usually simpler and more direct.

"Guaranteed Approval" Clarification: While many lenders advertise "guaranteed approval," it's crucial to understand that this doesn't mean approval without any financial checks. Lenders still assess your income, employment, and debt-to-income ratio. "Guaranteed approval" usually signifies that the lender is more willing to consider applicants with bad credit than traditional banks. Always review the loan terms carefully.

Eligibility Requirements for Tribal Loans with Bad Credit

Even with bad credit, you'll need to meet specific eligibility requirements for tribal loans. While the standards may be more flexible than traditional lenders, you'll still need to demonstrate financial responsibility.

Factors Lenders Consider:

- Income Verification: Proof of consistent income is essential to show your ability to repay the loan. This may involve providing pay stubs, bank statements, or tax returns.

- Employment History: A stable employment history increases your chances of approval.

- Debt-to-Income Ratio: Lenders evaluate your existing debts relative to your income. A high debt-to-income ratio may hinder your chances.

- Bank Account: An active checking account is usually required for direct deposit of funds and loan repayments.

Remember, even if your credit score is low, demonstrating financial stability through consistent income and responsible debt management significantly improves your chances of approval for a tribal loan.

The Application Process for Guaranteed Approval Tribal Loans

Applying for a tribal loan online is generally a straightforward process:

Steps Involved:

- Find a Reputable Lender: Research and compare different direct tribal lenders, carefully reviewing their terms and conditions.

- Complete the Online Application: Fill out the application form accurately and completely.

- Provide Necessary Documents: This usually includes proof of income, identification, and bank statements.

- Review and Accept the Loan Offer: Once approved, carefully review the loan agreement before accepting.

- Receive Funds: The funds are usually deposited directly into your bank account.

Important Considerations:

- Compare Loan Offers: Don't settle for the first offer you receive. Compare interest rates, fees, and repayment terms from multiple lenders.

- Read the Fine Print: Thoroughly review the loan agreement to understand all terms and conditions before signing.

Responsible Borrowing and Avoiding Predatory Lending

While tribal loans can offer a solution for those with bad credit, responsible borrowing is crucial. High-interest rates can quickly lead to a debt trap if not managed carefully.

Tips for Responsible Borrowing:

- Create a Realistic Budget: Ensure you can comfortably afford the monthly repayments.

- Compare Interest Rates: Choose the loan with the lowest feasible interest rate.

- Understand the Repayment Terms: Know the repayment schedule and stick to it diligently.

- Avoid Predatory Lenders: Be wary of lenders with excessively high fees or unclear terms.

Resources for Help: If you're struggling with debt, seek help from reputable non-profit credit counseling agencies.

Secure Your Financial Future with Guaranteed Approval Tribal Loans from Direct Lenders

Tribal loans from direct lenders can provide a lifeline for individuals with bad credit who need quick access to funds. By understanding the eligibility requirements, carefully comparing lenders, and practicing responsible borrowing, you can navigate the process effectively. Remember, while "guaranteed approval" is often advertised, it's vital to ensure you can comfortably manage the loan repayment. Don't hesitate to explore your options and find the best loan solution for your financial situation. Start your application process today! [Link to a relevant resource or application page (if applicable)]

Featured Posts

-

Man City Transfer Battle Viana Challenges Napoli For Serie A Star

May 28, 2025

Man City Transfer Battle Viana Challenges Napoli For Serie A Star

May 28, 2025 -

Temporary Let Ban Could It Be Reversed

May 28, 2025

Temporary Let Ban Could It Be Reversed

May 28, 2025 -

Osimhen Ingiliz Kulueplerinin Hedefi 45 Milyon Euro Degerindeki Yildiz

May 28, 2025

Osimhen Ingiliz Kulueplerinin Hedefi 45 Milyon Euro Degerindeki Yildiz

May 28, 2025 -

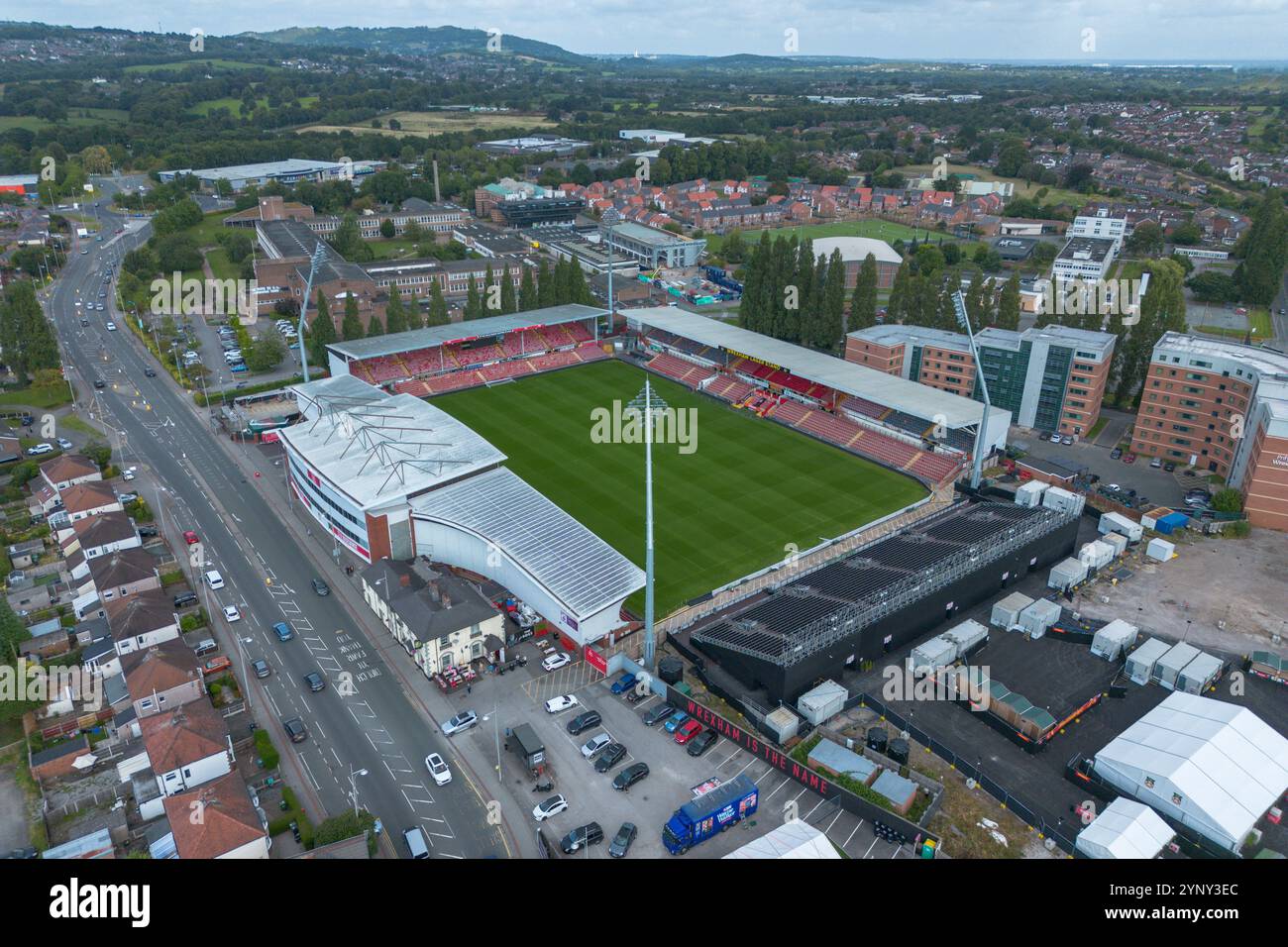

Welcome To Wrexham Planning Your Visit To The Racecourse Ground

May 28, 2025

Welcome To Wrexham Planning Your Visit To The Racecourse Ground

May 28, 2025 -

Haliburtons Girlfriends Post Game 1 Comment Goes Viral

May 28, 2025

Haliburtons Girlfriends Post Game 1 Comment Goes Viral

May 28, 2025

Latest Posts

-

Kyriaki 11 5 Ti Na Deite Stin Tileorasi

May 30, 2025

Kyriaki 11 5 Ti Na Deite Stin Tileorasi

May 30, 2025 -

Ti Na Deite Stin Tileorasi To Savvato 10 5

May 30, 2025

Ti Na Deite Stin Tileorasi To Savvato 10 5

May 30, 2025 -

Odigos Programmatos Kyriakis 11 5

May 30, 2025

Odigos Programmatos Kyriakis 11 5

May 30, 2025 -

Odigos Programmatos Savvatoy 10 5

May 30, 2025

Odigos Programmatos Savvatoy 10 5

May 30, 2025 -

Tileoptikes Metadoseis Savvatoy 10 Maioy

May 30, 2025

Tileoptikes Metadoseis Savvatoy 10 Maioy

May 30, 2025