Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Rationale for Predicted Bank of Canada Rate Cuts

Desjardins' prediction of three additional Bank of Canada rate cuts stems from a careful analysis of several key economic indicators. Their reasoning suggests a more cautious approach is needed to navigate the current economic climate. The bank anticipates that further interest rate reductions are necessary to stimulate economic growth and counteract emerging challenges.

-

Weakening economic growth projections: Recent data suggests a slowdown in GDP growth, falling short of earlier predictions. This weaker-than-expected performance fuels concerns about a potential recession. The Bank of Canada's own forecasts have also been revised downwards in recent months.

-

Persistently high unemployment figures: Despite some recent marginal improvements, unemployment rates remain stubbornly high in certain sectors, signaling a need for further stimulus to boost job creation. This persistent unemployment adds to concerns about weakening consumer confidence and spending.

-

Concerns about a potential recession: The confluence of slowing economic growth, high inflation, and persistent unemployment significantly increases the risk of a recession. Preventive measures, such as rate cuts, are seen as crucial to mitigate this risk.

-

Analysis of the impact of previous interest rate hikes: Desjardins’ analysts have assessed the effects of previous interest rate increases. They conclude that the desired impact on inflation hasn’t been fully realized, prompting a call for a different approach.

-

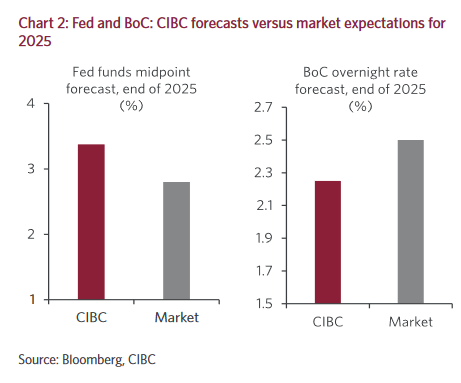

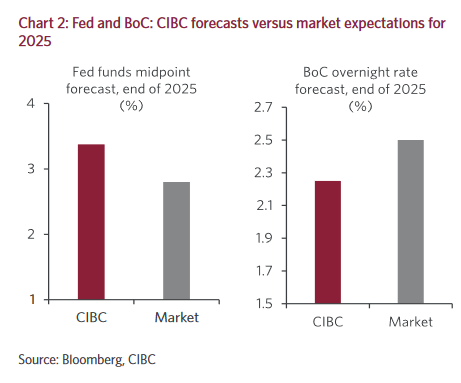

Comparison with other central bank predictions and actions globally: Desjardins’ analysis incorporates a global perspective, comparing the Bank of Canada's potential actions to those of other central banks worldwide. Many global central banks are taking a more dovish stance, suggesting a broader trend towards easing monetary policy.

Potential Impacts of Further Bank of Canada Rate Cuts

Further Bank of Canada rate cuts could have profound effects across various sectors and on individual Canadians. While aiming to boost the economy, these cuts carry both potential benefits and risks.

-

Impact on mortgage rates and home affordability: Lower interest rates would likely lead to decreased mortgage rates, potentially boosting the housing market and increasing home affordability.

-

Effect on consumer spending and borrowing costs: Reduced borrowing costs could encourage increased consumer spending, potentially stimulating economic activity. However, it could also lead to increased household debt if not managed responsibly.

-

Influence on business investment and economic growth: Lower interest rates can make borrowing more attractive for businesses, potentially increasing investment and driving economic growth. This could lead to job creation and expansion.

-

Potential implications for the Canadian dollar exchange rate: Rate cuts might weaken the Canadian dollar relative to other currencies, impacting both imports and exports. This could make Canadian goods more competitive internationally but also increase the cost of imports.

-

Analysis of potential risks and benefits associated with rate cuts: While aiming to stimulate growth, rate cuts also carry risks such as increased inflation, asset bubbles, and potential exacerbation of existing economic imbalances.

Impact on Mortgage Rates and Home Affordability

A significant impact of Bank of Canada rate cuts would be on mortgage rates and, consequently, home affordability. Lower interest rates translate directly into lower monthly mortgage payments, making homeownership more accessible for many Canadians.

-

Potential for increased demand in the housing market: Lower mortgage rates typically fuel increased demand in the housing market, potentially driving up house prices in certain areas.

-

Impact on variable vs. fixed-rate mortgages: Variable-rate mortgages would see immediate reductions, while fixed-rate mortgages might see a more gradual decrease as new mortgages are issued.

-

Changes in affordability calculations: Lower interest rates will significantly alter affordability calculations, potentially widening the pool of eligible homebuyers.

-

Potential for renewed speculation in the real estate sector: The increased affordability could lead to renewed speculation in the real estate market, particularly in areas already experiencing high demand.

Alternative Views and Counterarguments

While Desjardins' prediction carries weight, it's essential to acknowledge alternative viewpoints and counterarguments. Not all economists agree on the necessity or effectiveness of further Bank of Canada rate cuts.

-

Mention other economists' or institutions' forecasts: Some economists believe the current economic slowdown is temporary and that further rate cuts would be inflationary without stimulating sufficient growth.

-

Discuss potential counterarguments against further rate cuts: Concerns exist that additional rate cuts could fuel inflation, particularly if consumer spending increases significantly. There are also concerns about the potential for increased household debt.

-

Highlight the uncertainty surrounding economic projections: Economic forecasting is inherently complex and uncertain. Unforeseen global events or domestic policy changes could significantly impact the accuracy of any prediction.

-

Explain the complexities involved in predicting central bank policy: Central bank decisions are influenced by numerous factors, making it challenging to accurately predict future policy moves.

What to Expect Next and How to Prepare

While the future remains uncertain, staying informed is crucial. Individuals and businesses should actively monitor the situation and adjust their strategies accordingly.

-

Advice on reviewing financial plans in anticipation of rate changes: Review your existing financial plan to assess its resilience to potential rate changes. Adjust your savings and investment strategies as needed.

-

Strategies for managing debt in a lower-interest-rate environment: If you have debt, consider consolidating higher-interest debt to take advantage of lower rates. Focus on paying down debt strategically.

-

Recommendations for investors considering changes in their portfolios: Consult a financial advisor to assess your portfolio's performance and adjust your investment strategy accordingly.

-

Suggestions for businesses adapting to potential shifts in economic activity: Businesses should analyze the potential impact on their operations and plan accordingly, ensuring they can weather any economic downturn.

Conclusion

Desjardins' forecast of three more Bank of Canada rate cuts highlights the complexities facing the Canadian economy. This prediction, driven by concerns about slowing growth, high unemployment, and a potential recession, could have significant implications for mortgage rates, consumer spending, and business investment. While the prediction offers a valuable perspective, alternative viewpoints and the inherent uncertainties of economic forecasting should be considered. Staying informed about future Bank of Canada rate cuts and their potential impacts is vital for making sound financial decisions. Monitor news sources for updates on the Bank of Canada's monetary policy decisions and consider seeking professional financial advice to navigate these changes effectively. Understanding the implications of Bank of Canada rate cuts is crucial for your financial well-being.

Featured Posts

-

Best Of Bangladesh In Europe 2nd Edition Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Collaboration And Growth

May 24, 2025 -

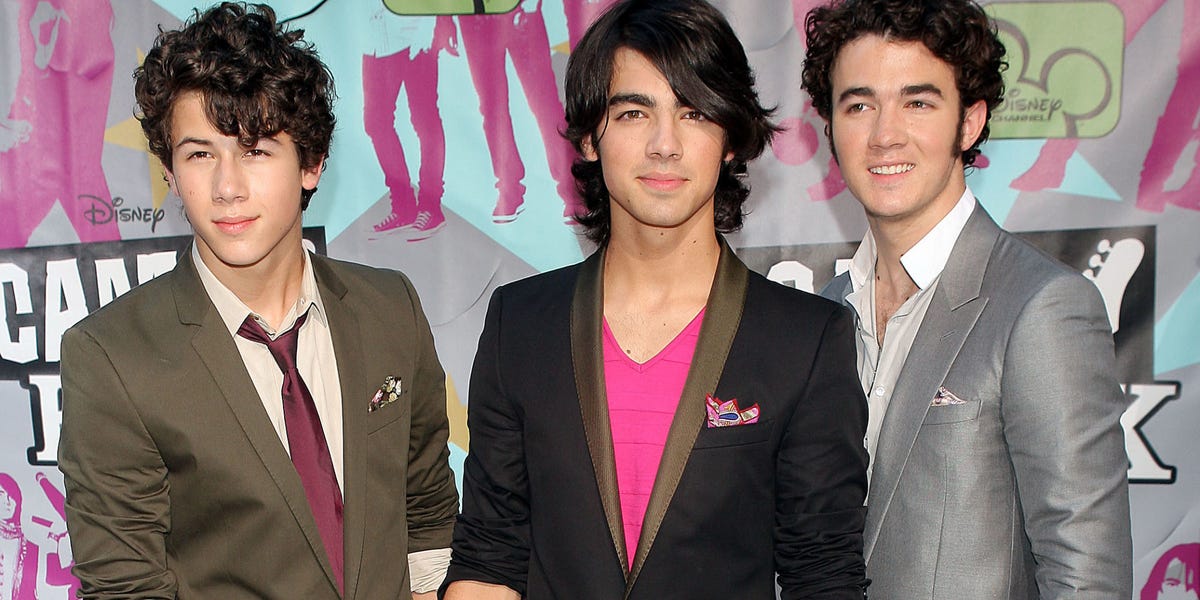

How Joe Jonas Handled A Couple Arguing Over Him

May 24, 2025

How Joe Jonas Handled A Couple Arguing Over Him

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value

May 24, 2025 -

Kyle Walker Milan Night Out With Serbian Models After Wifes Return

May 24, 2025

Kyle Walker Milan Night Out With Serbian Models After Wifes Return

May 24, 2025 -

Live Marktgegevens Kapitaalmarktrentes Stijgen Euro Sterker Dan 1 08

May 24, 2025

Live Marktgegevens Kapitaalmarktrentes Stijgen Euro Sterker Dan 1 08

May 24, 2025

Latest Posts

-

The Jonas Brothers Joe And The Couples Unexpected Argument

May 24, 2025

The Jonas Brothers Joe And The Couples Unexpected Argument

May 24, 2025 -

The Jonas Brothers Drama A Couples Fight And Joes Reaction

May 24, 2025

The Jonas Brothers Drama A Couples Fight And Joes Reaction

May 24, 2025 -

How Joe Jonas Handled A Couples Argument About Him

May 24, 2025

How Joe Jonas Handled A Couples Argument About Him

May 24, 2025 -

Joe Jonass Unexpected Reaction To A Marital Dispute

May 24, 2025

Joe Jonass Unexpected Reaction To A Marital Dispute

May 24, 2025 -

How Joe Jonas Handled A Couple Arguing Over Him

May 24, 2025

How Joe Jonas Handled A Couple Arguing Over Him

May 24, 2025