Bank Of Canada Rate Cuts: The Impact Of Tariffs On Employment And Economic Growth

Table of Contents

Understanding the Bank of Canada's Rate Cutting Mechanism

How Rate Cuts Influence Monetary Policy

The Bank of Canada uses interest rate adjustments as a key tool to manage monetary policy. Rate cuts aim to stimulate economic activity by making borrowing cheaper. This lower cost of borrowing is intended to encourage businesses to invest more and consumers to increase spending.

- Lower borrowing costs: Reduced interest rates make loans more affordable for businesses and individuals.

- Increased investment: Businesses are more likely to invest in expansion and new projects when borrowing costs are low.

- Stimulated consumer demand: Lower interest rates can lead to increased consumer spending on big-ticket items like houses and cars.

For example, the Bank of Canada's rate cuts in 2020 aimed to mitigate the economic shock of the COVID-19 pandemic, leading to increased borrowing and investment activity (although the effectiveness was debated).

The Role of Inflation in Rate Decisions

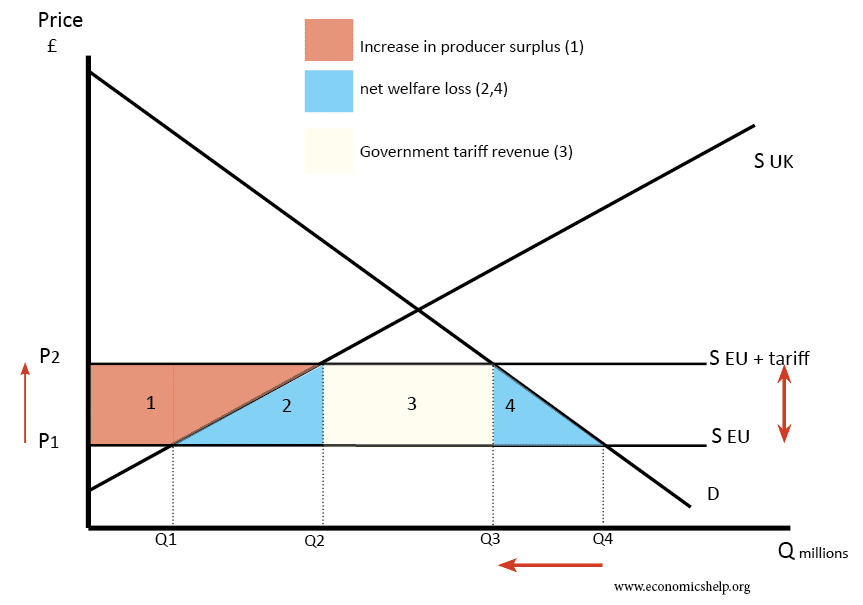

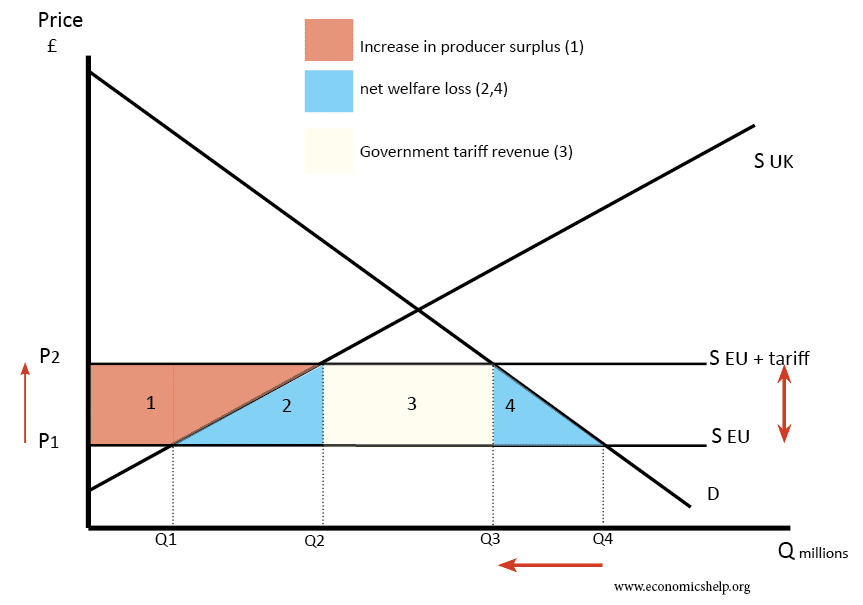

The Bank of Canada's primary mandate is to maintain price stability, typically targeting an inflation rate of around 2%. Inflationary pressures heavily influence rate decisions. Tariffs, however, can significantly impact inflation.

- Inflationary pressures: Tariffs increase the cost of imported goods, leading to higher prices for consumers and businesses.

- Target rates: The Bank of Canada adjusts its target rate to counteract inflationary pressures or stimulate economic growth, depending on the economic climate.

- Impact of tariffs on inflation: Tariffs contribute to inflationary pressures, potentially forcing the Bank of Canada to raise interest rates to combat inflation, counteracting the stimulative effect of rate cuts.

The Impact of Tariffs on Employment

Tariff-Induced Job Losses in Specific Sectors

Tariffs disproportionately affect specific industries. Sectors reliant on imports or exports, such as manufacturing and agriculture, often face significant job losses due to reduced competitiveness and decreased demand.

- Examples of job losses: The Canadian manufacturing sector has witnessed job losses due to tariffs imposed on its products in various international markets. Similarly, the agricultural sector has experienced challenges due to retaliatory tariffs on Canadian exports.

- Ripple effect: Job losses in one sector can trigger a domino effect, impacting related industries and causing broader economic hardship. For instance, reduced demand in the manufacturing sector can lead to job losses in transportation and logistics.

The Effectiveness of Rate Cuts in Mitigating Job Losses

The effectiveness of rate cuts in offsetting tariff-induced job losses is debatable. While rate cuts may stimulate some economic activity, they might not be sufficient to compensate for the direct impact of tariffs on specific sectors.

- Arguments for effectiveness: Rate cuts can encourage investment and spending, potentially creating new jobs in other sectors and offsetting some job losses.

- Arguments against effectiveness: Rate cuts might not directly address the structural issues caused by tariffs in specific industries; the effects of rate cuts may be delayed and not always targeted at the affected sectors.

- Alternative government policies: Government intervention, such as targeted support programs for affected industries (e.g., retraining programs, subsidies), is often necessary to complement rate cuts and mitigate job losses.

The Impact of Tariffs on Economic Growth

Reduced Consumer Spending and Investment

Tariffs lead to higher prices for goods and services, reducing consumer purchasing power and dampening consumer confidence. This, in turn, can negatively impact business investment due to uncertainty about future demand.

- Reduced purchasing power: Higher prices for imported goods reduce disposable income, leading to less consumer spending.

- Decreased business confidence: Uncertainty about future demand and increased input costs discourage business investment.

- Impact on GDP: Reduced consumer spending and investment directly impact economic growth, leading to lower GDP growth.

- Impact on different income groups: Lower-income households are disproportionately affected by tariff-induced price increases, exacerbating income inequality.

The Role of Global Trade in Economic Growth

Global trade plays a crucial role in economic growth. Trade wars and protectionist policies, such as tariffs, disrupt established supply chains, reduce efficiency, and increase prices for consumers and businesses.

- Reduced efficiency: Tariffs hinder specialization and comparative advantage, leading to less efficient production.

- Higher prices: Consumers and businesses face higher prices due to reduced competition and increased import costs.

- Impact on global supply chains: Tariffs disrupt established global supply chains, causing delays and increased uncertainty.

- Interaction with rate cuts: The effectiveness of rate cuts is diminished in an environment of global uncertainty and trade tensions.

Forecasting Future Economic Trends Based on Bank of Canada Rate Cuts and Tariffs

Economic Modeling and Predictions

Economists use econometric models to forecast future economic trends, considering variables like Bank of Canada rate cuts, tariff levels, global economic growth, and other relevant indicators.

- Key economic indicators to watch: Inflation rates, unemployment rates, GDP growth, consumer confidence, business investment.

- Potential scenarios: Models can generate optimistic, pessimistic, and most likely scenarios depending on various assumptions about future policy decisions and global economic conditions.

- Limitations of predictions: Economic forecasting is inherently uncertain, and models are only as good as the data and assumptions they are based on.

Policy Recommendations and Mitigation Strategies

To mitigate the negative economic effects of tariffs, policymakers can implement several strategies:

- Fiscal stimulus: Government spending on infrastructure projects or tax cuts can stimulate demand and boost economic growth.

- Diversification of trade partners: Reducing reliance on specific trading partners can lessen the impact of trade disputes.

- Support for affected industries: Targeted government support programs can help affected industries adapt and remain competitive.

Conclusion: Bank of Canada Rate Cuts and the Path Forward

In conclusion, tariffs have a significant impact on employment and economic growth in Canada. While Bank of Canada rate cuts can play a role in mitigating these effects, they are not a panacea. The effectiveness of rate cuts is often limited and can be counteracted by persistent inflationary pressures caused by tariffs. Furthermore, the global economic context and the uncertainty surrounding trade policies significantly influence the effectiveness of monetary policy tools. To navigate this complex economic landscape successfully, a combination of monetary policy adjustments and targeted government interventions is crucial.

Stay informed about future Bank of Canada rate cuts and their implications for the Canadian economy by regularly consulting reputable economic sources like the Bank of Canada website and Statistics Canada. Understanding these complex interactions is crucial for businesses and individuals to make informed decisions and navigate the evolving economic landscape effectively.

Featured Posts

-

Declaraciones Del Piloto Argentino De F1 Generan Controversia Es Provincia Nuestra

May 11, 2025

Declaraciones Del Piloto Argentino De F1 Generan Controversia Es Provincia Nuestra

May 11, 2025 -

John Wick 5 Keanu Reeves Speaks Out On The Future Of The Franchise

May 11, 2025

John Wick 5 Keanu Reeves Speaks Out On The Future Of The Franchise

May 11, 2025 -

Payton Pritchard Elevates His Game Analysis Of Celtics Playoff Opener

May 11, 2025

Payton Pritchard Elevates His Game Analysis Of Celtics Playoff Opener

May 11, 2025 -

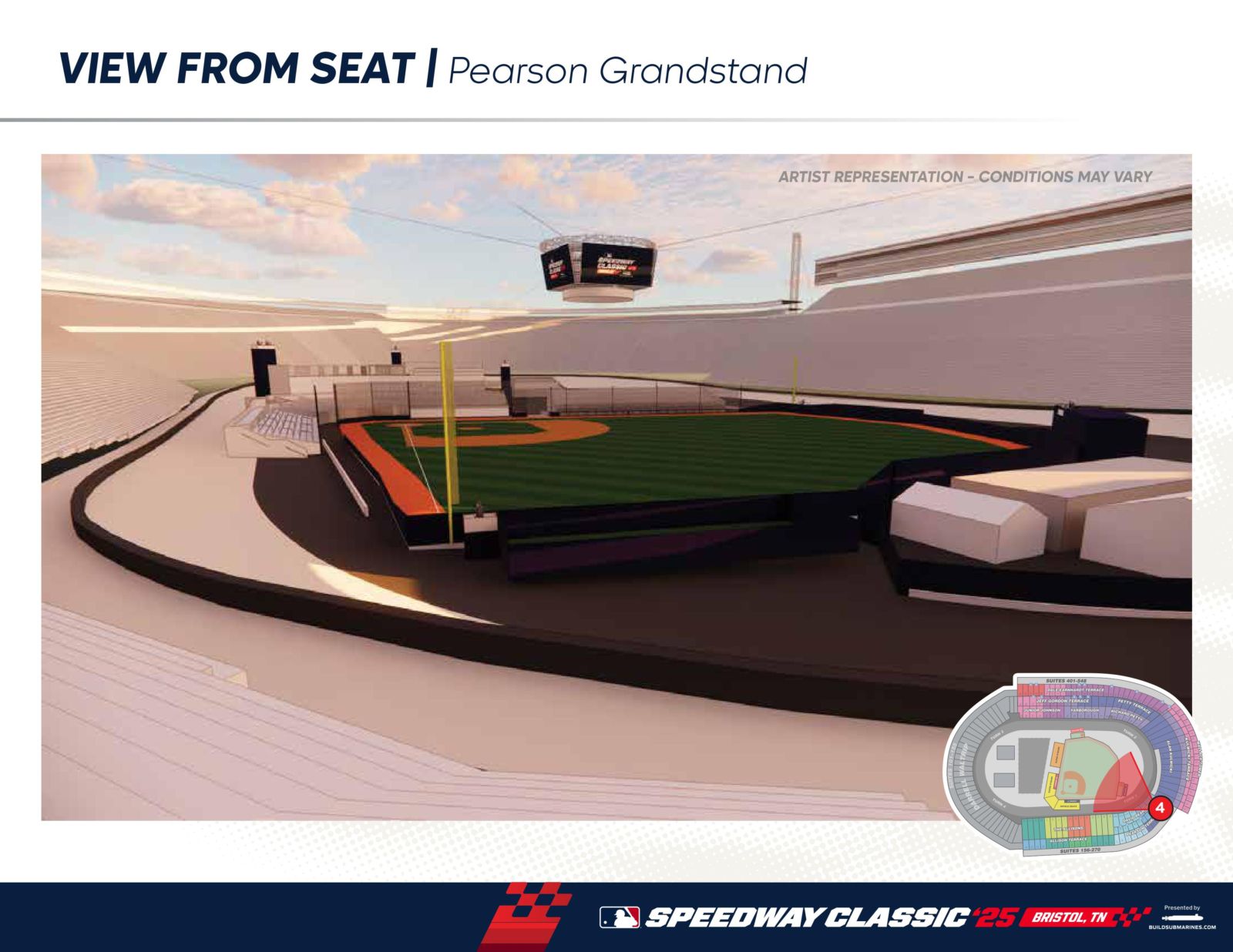

Manfreds Take A Deep Dive Into The Mlb Speedway Classic

May 11, 2025

Manfreds Take A Deep Dive Into The Mlb Speedway Classic

May 11, 2025 -

Mls

May 11, 2025

Mls

May 11, 2025