Bank Of Canada's April Interest Rate Decision: Impact Of Trump Tariffs

Table of Contents

Understanding the Legacy of Trump Tariffs on the Canadian Economy

The Trump administration's imposition of tariffs on various goods significantly impacted the Canadian economy. These tariffs, targeting key sectors like agriculture and manufacturing, created immediate economic challenges and forced Canadian businesses to adapt. The initial shock was felt across multiple industries.

- Increased costs for imported goods: Tariffs directly increased the price of imported materials and components, leading to higher production costs for Canadian businesses.

- Reduced competitiveness in global markets: Canadian exports faced higher tariffs in the US market, reducing their competitiveness against other nations.

- Shifting trade relationships: Canada sought to diversify its trade relationships, exploring new markets and strengthening alliances with countries outside the US.

- Impact on employment in affected sectors: Industries heavily reliant on US trade experienced job losses and reduced investment as a result of the tariffs.

The Canadian economy, while resilient, underwent a period of adjustment, navigating supply chain disruptions and adapting to a changed trade landscape. The long-term consequences of these adjustments continue to shape economic policy decisions, including those related to interest rates.

Inflationary Pressures and the Bank of Canada's Mandate

The Bank of Canada operates with a dual mandate: maintaining price stability and achieving full employment. The lingering effects of Trump's tariffs exacerbated inflationary pressures, directly challenging this mandate.

Supply chain disruptions caused by tariffs contributed significantly to inflation. Businesses faced rising input costs, which were passed on to consumers in the form of higher prices.

- Rising input costs for businesses: Increased prices for imported materials and components directly impacted the profitability and pricing strategies of many Canadian businesses.

- Increased consumer prices: Higher production costs resulted in increased prices for consumer goods, impacting purchasing power and consumer confidence.

- Impact on consumer spending: Rising inflation led to reduced consumer spending as individuals adjusted to higher prices for essential goods and services.

- The Bank of Canada’s inflation target: The Bank of Canada's inflation target aims for a 2% annual average inflation rate. The inflationary pressures caused by tariffs put pressure on this target.

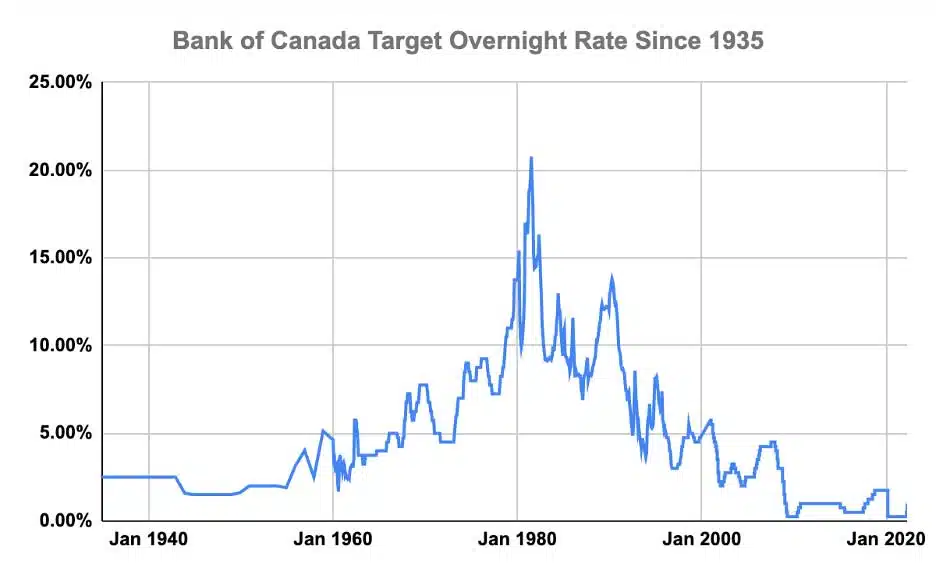

The Bank of Canada's April Interest Rate Decision: A Deep Dive

In April [Insert Year], the Bank of Canada [Insert Action: increased, decreased, or held] its key interest rate to [Insert Rate]. This decision was intricately linked to the ongoing effects of the Trump tariffs, alongside other economic considerations. The Bank's statement emphasized [Insert Key Points from the Bank of Canada's statement explaining the decision, linking it to inflation and the economic effects of tariffs].

- Specific rate change: [State the specific change in the interest rate].

- Bank of Canada's statement explaining the decision: [Summarize the key points from the official statement].

- Market reactions to the announcement: [Describe market responses – stock market changes, currency fluctuations].

- Short-term and long-term economic forecasts: [Summarize the Bank's short-term and long-term forecasts for economic growth and inflation].

Alternative Economic Scenarios and Future Projections

It's crucial to consider alternative economic scenarios. Had the Trump tariffs been different or absent, the Canadian economy likely would have experienced a different trajectory. The absence of tariffs would likely have led to lower inflation and potentially different interest rate decisions.

- "What if" scenarios regarding tariff impacts: Analyzing counterfactual scenarios helps understand the specific impact of the tariffs.

- Analysis of current economic indicators: Examining current indicators like GDP growth, employment rates, and inflation helps predict future trends.

- Predictions for future interest rate adjustments: The Bank of Canada's future decisions will hinge on ongoing economic data and the evolving global economic climate.

- Long-term economic outlook for Canada: The long-term effects of the tariffs and their influence on future interest rate policies remain to be seen.

Conclusion: The Bank of Canada's April Interest Rate Decision and the Enduring Shadow of Trump Tariffs

The Bank of Canada's April interest rate decision clearly demonstrated the lingering impact of the Trump-era tariffs on the Canadian economy. Understanding the complex interplay between trade policy and monetary policy decisions is crucial for navigating the economic landscape. The legacy of these tariffs continues to shape economic conditions and will influence future Bank of Canada interest rate announcements.

To stay informed about future Bank of Canada interest rate announcements and their implications for the Canadian economy, subscribe to our newsletter, follow the Bank of Canada's website, or consult reputable financial news sources for updates on Canadian monetary policy. Understanding Bank of Canada interest rate decisions is crucial for making informed financial decisions.

Featured Posts

-

Nhl Milestone Clayton Keller Of Missouri Reaches 500 Points

May 02, 2025

Nhl Milestone Clayton Keller Of Missouri Reaches 500 Points

May 02, 2025 -

Understanding Sonys New Play Station Beta Program

May 02, 2025

Understanding Sonys New Play Station Beta Program

May 02, 2025 -

Australias Rugby Struggle A Former Wallabys Perspective Phipps

May 02, 2025

Australias Rugby Struggle A Former Wallabys Perspective Phipps

May 02, 2025 -

Fortnite Lawless Update Server Status And Downtime Information

May 02, 2025

Fortnite Lawless Update Server Status And Downtime Information

May 02, 2025 -

Justice Departments Decision To End School Desegregation Analysis And Reactions

May 02, 2025

Justice Departments Decision To End School Desegregation Analysis And Reactions

May 02, 2025

Latest Posts

-

Epl Havertz Yet To Deliver For Arsenal Souness

May 02, 2025

Epl Havertz Yet To Deliver For Arsenal Souness

May 02, 2025 -

Understanding The Recent Row At The Heart Of The Reform Uk Party

May 02, 2025

Understanding The Recent Row At The Heart Of The Reform Uk Party

May 02, 2025 -

The Current Crisis In Reform Uk Whats Behind The Intense In Fighting

May 02, 2025

The Current Crisis In Reform Uk Whats Behind The Intense In Fighting

May 02, 2025 -

Sounesss Double Channel Swim A Testament To Islas Strength

May 02, 2025

Sounesss Double Channel Swim A Testament To Islas Strength

May 02, 2025 -

Reform Uks Internal Divisions Causes And Consequences Of The Recent Dispute

May 02, 2025

Reform Uks Internal Divisions Causes And Consequences Of The Recent Dispute

May 02, 2025