Bank Of Canada's Inflation Dilemma: Balancing Growth And Interest Rates

Table of Contents

The Current Inflationary Landscape in Canada

Canadian inflation remains a significant concern. The Consumer Price Index (CPI) has consistently exceeded the Bank of Canada's target of 2%, indicating sustained inflationary pressures. This high Canadian inflation impacts consumers through increased prices for essential goods and services, eroding purchasing power. Businesses face challenges managing costs, potentially impacting investment and hiring.

Several factors contribute to this elevated inflation rate Canada:

- Supply Chain Disruptions: Ongoing global supply chain bottlenecks continue to constrain the availability of goods, pushing prices higher.

- Global Energy Prices: Soaring global energy prices, particularly for oil and natural gas, significantly impact transportation and manufacturing costs, feeding into higher consumer prices.

- Increased Demand: Strong consumer demand, fueled by pent-up savings and government stimulus measures, has put upward pressure on prices.

- Wage Growth: Increased wage growth, while positive for workers, also contributes to inflationary pressure as businesses pass increased labor costs onto consumers.

Statistics Canada provides regular updates on the CPI Canada, offering valuable insights into the evolving inflationary pressures within the Canadian economy. Analyzing this data is crucial for understanding the full scope of the Bank of Canada's challenge.

The Bank of Canada's Tools for Managing Inflation

The Bank of Canada employs various monetary policy tools to manage inflation, with the primary tool being adjustments to the Bank of Canada interest rate, also known as the policy interest rate. By raising the policy interest rate, the Bank increases the cost of borrowing for both consumers and businesses. This, in turn, reduces investment, dampens consumer spending, and ultimately slows down economic activity, helping to curb inflation.

Other monetary policy tools include:

- Quantitative Easing (QE): The Bank can buy or sell government bonds to influence the money supply.

- Forward Guidance: The Bank can communicate its intentions and expectations regarding future interest rate adjustments to manage market expectations.

The effectiveness of these tools depends on various economic factors and their impact on the overall monetary policy Canada. The Bank carefully analyzes various economic indicators before implementing any changes.

The Trade-off Between Economic Growth and Inflation Control

The Bank of Canada faces a significant challenge: raising interest rates to control inflation risks slowing economic growth, potentially leading to a recession risk Canada. Aggressive interest rate hike impact can lead to:

- Job Losses: Slower economic activity can lead to reduced hiring and potential job losses.

- Reduced Investment: Higher borrowing costs discourage businesses from investing in expansion and new projects.

Conversely, inaction in the face of runaway inflation can have severe consequences, with inflation eroding purchasing power and destabilizing the economy. The Bank must carefully weigh the risks of both aggressive action and inaction, seeking to find a balance that minimizes negative consequences while effectively managing inflation. The delicate balance between fostering economic growth Canada and controlling inflation is central to the Bank's current dilemma.

Forecasting and Predicting the Bank of Canada's Next Move

Predicting the Bank of Canada's next move is a complex undertaking. Analysts closely scrutinize the Bank's public statements, considering factors such as:

- Inflation Targets: The Bank's stated inflation targets and its progress toward achieving them.

- Economic Indicators: Key economic indicators such as employment data, consumer confidence, and retail sales figures.

- Global Economic Conditions: Global economic trends and events can also influence the Bank's decisions.

Economists and financial analysts offer their interest rate prediction and Canadian economic outlook, providing diverse perspectives on the Bank's likely actions. Following these analyses, along with the Bank's official communications, offers a clearer picture of the potential trajectory of the Bank of Canada forecast.

The Impact on Canadian Households and Businesses

Changes in the Bank of Canada's interest rate directly impact Canadian households and businesses. Higher interest rates lead to:

- Higher Mortgage Rates Canada: Increasing borrowing costs for homeowners, potentially impacting affordability and housing market activity.

- Higher Business Lending Canada: Increasing borrowing costs for businesses, potentially impacting investment and expansion plans.

- Reduced Consumer Spending Canada: Higher borrowing costs and reduced consumer confidence can lead to decreased consumer spending.

The impact varies across different population segments. Homeowners with variable-rate mortgages are more immediately affected by interest rate changes than those with fixed-rate mortgages. Small businesses are often more vulnerable to increased borrowing costs than larger corporations.

Conclusion: Understanding and Navigating the Bank of Canada's Inflation Dilemma

The Bank of Canada faces a formidable challenge in navigating its inflation dilemma. Balancing economic growth with inflation control requires careful consideration of numerous factors and potential trade-offs. Understanding the complexities involved is crucial for individuals, businesses, and policymakers alike. To effectively manage risk and make informed financial decisions, it's vital to stay updated on the Bank of Canada’s decisions.

Stay updated on the Bank of Canada's inflation dilemma by regularly checking the Bank of Canada's website and following reputable financial news sources. Monitor the Bank of Canada's interest rate decisions and understand the Bank of Canada's inflation strategy to better prepare for the future economic landscape.

Featured Posts

-

Historic Participation 19 Indian Paddlers In Chennais Wtt Star Contender

May 22, 2025

Historic Participation 19 Indian Paddlers In Chennais Wtt Star Contender

May 22, 2025 -

Analiz Rinku Finposlug Ukrayini Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 22, 2025

Analiz Rinku Finposlug Ukrayini Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 22, 2025 -

Abn Amro Kwartaalresultaten Positieve Impact Op Aex

May 22, 2025

Abn Amro Kwartaalresultaten Positieve Impact Op Aex

May 22, 2025 -

The History And Tradition Of Cassis Blackcurrant

May 22, 2025

The History And Tradition Of Cassis Blackcurrant

May 22, 2025 -

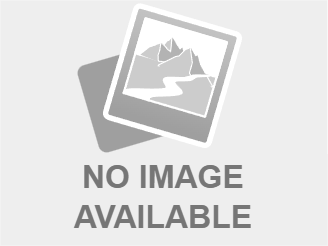

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Latest Posts

-

Virginia Gas Prices Drop Gas Buddy Reports Week Over Week Decline

May 22, 2025

Virginia Gas Prices Drop Gas Buddy Reports Week Over Week Decline

May 22, 2025 -

Investigation Into Franklin County Pa Chicken Barn Fire

May 22, 2025

Investigation Into Franklin County Pa Chicken Barn Fire

May 22, 2025 -

Recent Drop In Virginia Gas Prices Data From Gas Buddy

May 22, 2025

Recent Drop In Virginia Gas Prices Data From Gas Buddy

May 22, 2025 -

Explanation Of Recent Gas Price Increases In Southeast Wisconsin

May 22, 2025

Explanation Of Recent Gas Price Increases In Southeast Wisconsin

May 22, 2025 -

Emergency Response To Large Chicken Barn Fire In Franklin County Pa

May 22, 2025

Emergency Response To Large Chicken Barn Fire In Franklin County Pa

May 22, 2025