BBAI Stock: BigBear.ai's Q1 Earnings Miss Expectations, Shares Fall

Table of Contents

BigBear.ai's Q1 Earnings Miss Expectations

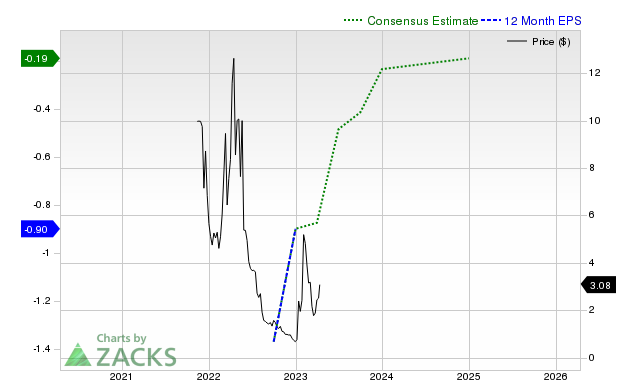

BigBear.ai's Q1 2024 earnings report fell significantly short of analyst expectations, triggering the subsequent BBAI stock price plunge. The financial results revealed several key areas of underperformance:

- Revenue Shortfall: Revenue came in at $XX million, missing projected figures by approximately X%, significantly lower than the $YY million anticipated by analysts. This represents a considerable decline compared to the previous quarter's revenue of $ZZ million.

- EPS Miss: Earnings per share (EPS) were substantially lower than anticipated, clocking in at -$X.XX compared to the projected EPS of $Y.YY. This represents a significant loss for the company, impacting investor confidence.

- Reasons Cited by BigBear.ai: The company attributed the missed expectations to a combination of factors, including delays in several large contract awards and increased competition within the AI solutions market. They also highlighted challenges in transitioning certain projects to profitability.

These disappointing figures paint a concerning picture of BigBear.ai's immediate financial health and contributed directly to the negative BBAI earnings sentiment. The Q1 results clearly highlight a need for strategic adjustments to improve operational efficiency and secure more lucrative contracts.

Market Reaction and Share Price Decline

The market reacted swiftly and negatively to BigBear.ai's Q1 earnings announcement. The BBAI stock price plummeted by X% on the day of the release, closing at $Y.YY per share. Trading volume was unusually high, indicating significant investor activity and a widespread sell-off. Several analysts downgraded their ratings on BBAI stock, further contributing to the negative sentiment. Price targets were also reduced across the board, reflecting the diminished confidence in the company's short-term prospects. The overall investor sentiment following the news was one of fear and uncertainty, prompting many to divest from BBAI stock. This sharp BBAI stock price drop underscores the gravity of the earnings miss and its immediate impact on investor confidence.

Analysis of Contributing Factors to the Earnings Miss

While BigBear.ai cited specific reasons for the Q1 miss, a deeper analysis reveals other potential contributing factors:

- Macroeconomic Factors: Government spending, a crucial element of BigBear.ai's client base, might have experienced reductions or delays, impacting contract awards and revenue streams. This macroeconomic uncertainty played a significant role in the overall market conditions.

- Competitive Landscape: Increased competition from established players and emerging startups in the AI solutions market could be squeezing BigBear.ai's margins and hindering its ability to secure contracts. The company needs a robust strategy to differentiate itself and maintain its competitive edge.

- Company Strategy: A critical examination of BigBear.ai's overall strategic direction is necessary. A reassessment of its go-to-market approach, product portfolio, and resource allocation might reveal areas requiring improvement.

Understanding these broader contributing factors provides a more holistic understanding of the challenges faced by BigBear.ai and the resulting impact on the BBAI stock price.

Future Outlook for BBAI Stock

Despite the significant setback, the long-term outlook for BBAI stock isn't entirely bleak. Several potential catalysts for future growth exist:

- New Contract Awards: Securing substantial new contracts, particularly in the government sector, could significantly boost revenue and improve profitability.

- Product Innovation: The introduction of innovative AI solutions catering to unmet market needs could attract new clients and strengthen BigBear.ai's market position.

- Strategic Partnerships: Collaborations with industry leaders could enhance the company's technological capabilities and broaden its reach.

However, realizing this potential requires BigBear.ai to address the issues highlighted in its Q1 earnings report and implement effective strategies for improvement. Analyst forecasts remain mixed, with some expressing cautious optimism while others remain reserved. The company's ability to execute its long-term strategy and navigate the competitive landscape will be crucial in determining the future trajectory of BBAI stock.

Conclusion: Navigating the BBAI Stock Dip – What's Next?

BigBear.ai's disappointing Q1 earnings report resulted in a significant decline in BBAI stock price, primarily due to a revenue shortfall, missed EPS targets, and delays in contract awards. While macroeconomic factors and increased competition also contributed, the company's internal strategic adjustments will be key to its recovery. The future outlook for BBAI stock remains uncertain, contingent on its ability to secure new contracts, innovate its product offerings, and effectively address existing challenges. While BBAI stock has experienced a setback, understanding the underlying factors is crucial for making informed investment decisions. Conduct your own thorough research before making any trading choices related to BBAI stock.

Featured Posts

-

Matt Lucas And David Walliams Cliff Richard Musical One Big Snag

May 21, 2025

Matt Lucas And David Walliams Cliff Richard Musical One Big Snag

May 21, 2025 -

Understanding The Love Monster Exploring The Dynamics Of Intense Romantic Love

May 21, 2025

Understanding The Love Monster Exploring The Dynamics Of Intense Romantic Love

May 21, 2025 -

Understanding Nadiem Amiris Rise In German Football

May 21, 2025

Understanding Nadiem Amiris Rise In German Football

May 21, 2025 -

Huuhkajien Yllaettaevae Avauskokoonpano Kaellman Ja Kaksi Muuta Ulos

May 21, 2025

Huuhkajien Yllaettaevae Avauskokoonpano Kaellman Ja Kaksi Muuta Ulos

May 21, 2025 -

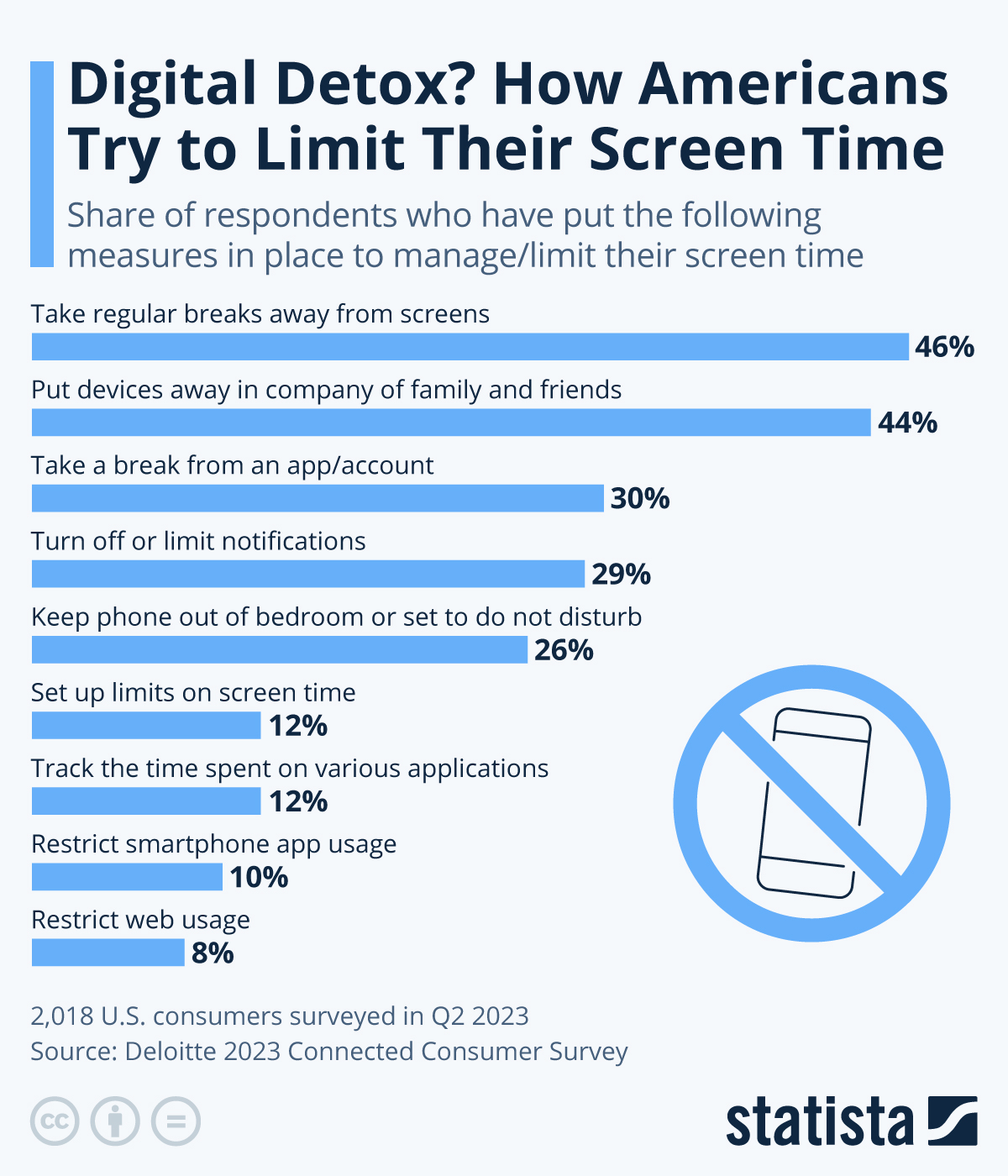

Digital Detox For Families Your Screen Free Week Roadmap

May 21, 2025

Digital Detox For Families Your Screen Free Week Roadmap

May 21, 2025

Latest Posts

-

Is Beenie Man Disrupting The New York It Scene

May 22, 2025

Is Beenie Man Disrupting The New York It Scene

May 22, 2025 -

Vybz Kartels Exclusive Interview Life In Prison And Beyond

May 22, 2025

Vybz Kartels Exclusive Interview Life In Prison And Beyond

May 22, 2025 -

Beenie Mans New York Takeover Is This The Next Big Thing In It

May 22, 2025

Beenie Mans New York Takeover Is This The Next Big Thing In It

May 22, 2025 -

Exclusive Vybz Kartel On Prison Freedom And His New Music

May 22, 2025

Exclusive Vybz Kartel On Prison Freedom And His New Music

May 22, 2025 -

Vybz Kartel A Landmark Performance In New York

May 22, 2025

Vybz Kartel A Landmark Performance In New York

May 22, 2025