Belgium: Securing Funding For A 270MWh Battery Energy Storage System

Table of Contents

Understanding the Belgian Energy Landscape and BESS Opportunities

Government Policy and Incentives

Belgium's government actively promotes the development of renewable energy and recognizes the critical role of Battery Energy Storage Systems (BESS) in achieving its climate goals. Several national and regional (Flanders, Wallonia, Brussels) programs offer substantial incentives for energy storage projects. These incentives include:

- Subsidies: Direct financial support based on project size and technology.

- Tax breaks: Reductions in corporate income tax or VAT for eligible investments.

- Grants: Funding for feasibility studies, research and development, and project implementation.

- Feed-in tariffs: Guaranteed prices for energy supplied to the grid from BESS discharging.

Relevant legislation, such as the "Energy Act" and regional decrees, provides the regulatory framework for BESS deployment, outlining grid connection procedures, safety standards, and permitting processes. Successful BESS projects in Belgium have leveraged these incentives, demonstrating the viability of securing significant funding for large-scale energy storage deployments.

- Example 1: [Insert example of a successful BESS project in Belgium and the funding secured].

- Example 2: [Insert another example, highlighting a different funding source].

Specific Government Programs (Illustrative Examples):

- Flanders: [Name of Flemish program], offering [type of incentive] for [project criteria]. Application deadline: [Date].

- Wallonia: [Name of Walloon program], providing [type of incentive] for [project criteria]. Eligibility criteria: [List key criteria].

- Brussels: [Name of Brussels program], focused on [specific aspect of BESS projects].

Market Demand and Investment Opportunities

The Belgian electricity grid faces increasing challenges in balancing supply and demand due to the growing share of renewable energy. This creates a significant market demand for energy storage solutions like BESS, offering several economic benefits:

- Grid stabilization: BESS can provide frequency regulation and voltage support, enhancing grid stability and reliability.

- Peak demand management: BESS can reduce peak demand, optimizing grid infrastructure and lowering operational costs.

- Arbitrage opportunities: BESS can buy energy at low prices and sell it during peak demand periods, generating revenue.

The private sector recognizes the potential ROI in large-scale BESS projects in Belgium. Investment banks and private equity firms are increasingly investing in this sector, driven by:

- High returns: Strong potential for profitability due to market demand and government incentives.

- Environmental, Social, and Governance (ESG) factors: Investment in BESS aligns with sustainability goals.

- Technological advancements: Continuous improvements in battery technology are driving down costs and improving efficiency.

Key Market Drivers and Potential ROI:

- Increased penetration of renewable energy sources.

- Stringent emission reduction targets.

- Growing electricity demand.

- Technological advancements lowering BESS costs.

Exploring Funding Sources for a 270MWh BESS Project

Public Funding Opportunities

Securing funding for a 270MWh BESS project requires exploring various public funding sources at the national and regional levels in Belgium, as well as from the European Union:

- National Government: [Mention specific Belgian government programs and their application processes].

- Regional Governments (Flanders, Wallonia, Brussels): Each region offers its own programs tailored to regional energy priorities. [Provide brief descriptions and links if available].

- European Union: The EU offers substantial funding opportunities through programs such as Horizon Europe (for R&D) and the Connecting Europe Facility (for infrastructure projects). [Provide links and examples].

Examples of Public Funding Programs and Funding Amounts (Illustrative):

- [Program Name]: Up to [amount] EUR in grants for BESS projects exceeding [MWh] capacity.

- [Program Name]: Subsidies of [percentage]% of eligible project costs.

- [Program Name]: Funding available for feasibility studies, with a maximum grant amount of [amount] EUR.

Private Financing Options

Private financing plays a crucial role in funding large-scale BESS projects. Several options are available:

- Bank loans: Traditional bank financing, often requiring strong project financials and collateral.

- Project finance: Structured financing specifically designed for large-scale infrastructure projects, involving multiple lenders and investors.

- Private equity investments: Investment from private equity firms seeking long-term returns.

- Corporate Power Purchase Agreements (PPAs): Long-term contracts with corporations to purchase energy from the BESS.

Financial institutions and investment banks specializing in renewable energy and infrastructure finance are key players in securing private funding for BESS projects. The financing structure will depend on project risk, investor appetite, and the availability of public funding.

Types of Financing and Their Pros and Cons:

| Financing Type | Pros | Cons |

|---|---|---|

| Bank Loans | Relatively straightforward, lower fees | Requires strong creditworthiness, collateral |

| Project Finance | Allows for risk sharing, larger projects | Complex structuring, longer approval process |

| Private Equity | Access to significant capital | Loss of control, potential dilution |

| PPAs | Revenue stream certainty | Dependent on contract terms and counterparty risk |

Blending Public and Private Funding

Combining public and private funding is a common and effective strategy for securing financing for BESS projects. Public grants can de-risk the project, making it more attractive to private investors.

Advantages of Blended Finance:

- Reduced project risk for private investors.

- Access to larger funding amounts.

- Enhanced project feasibility and sustainability.

Strategies for Securing Blended Finance:

- Develop a strong business plan highlighting the project's economic viability and social impact.

- Secure a letter of intent or pre-approval from public funding agencies.

- Demonstrate strong private investor interest.

Navigating the Application Process and Key Considerations

Developing a Compelling Business Plan

A well-structured business plan is essential for securing funding, outlining:

- Executive Summary: A concise overview of the project.

- Market Analysis: Demonstrating market demand and potential ROI.

- Technical Description: Details on the BESS technology, site selection, and grid connection.

- Financial Projections: A detailed financial model demonstrating project viability and return on investment.

- Management Team: Highlighting the experience and expertise of the project team.

- Risk Assessment and Mitigation: Identifying potential risks and outlining mitigation strategies.

Environmental and Regulatory Approvals

Obtaining necessary permits and approvals is crucial. This involves:

- Environmental Impact Assessment (EIA): Demonstrating the environmental sustainability of the project.

- Grid connection approval: Securing permission from Elia (the Belgian high-voltage transmission system operator) to connect the BESS to the grid.

- Building permits: Obtaining all necessary permits for construction and operation of the BESS facility.

Selecting the Right Technology and Partners

Choosing the appropriate battery technology and partnering with experienced companies is vital:

- Battery Technology: Factors to consider include battery chemistry (Lithium-ion is currently dominant), capacity, lifecycle, and cost.

- Technology Providers: Selecting reputable suppliers with proven track records and strong warranties is essential.

- EPC Contractors: Engaging an experienced EPC contractor to handle the engineering, procurement, and construction of the BESS project can streamline the process.

Conclusion

Securing funding for a 270MWh Battery Energy Storage System in Belgium presents both challenges and significant opportunities. A thorough understanding of the Belgian energy landscape, available funding sources, and the regulatory framework is paramount. By developing a strong business plan, securing necessary permits, and effectively navigating the application process, developers can unlock substantial funding for large-scale BESS projects, significantly contributing to Belgium’s renewable energy transition. This guide provides a foundation; however, seeking expert advice is highly recommended. Start planning your Belgium Battery Energy Storage System project today!

Featured Posts

-

The Future Of Darjeeling Tea A Look At Current Challenges

May 04, 2025

The Future Of Darjeeling Tea A Look At Current Challenges

May 04, 2025 -

Wb Weather Update Met Department Forecasts Rain In North Bengal

May 04, 2025

Wb Weather Update Met Department Forecasts Rain In North Bengal

May 04, 2025 -

Strathdearn Community Project Reaches Milestone Affordable Housing Groundbreaking

May 04, 2025

Strathdearn Community Project Reaches Milestone Affordable Housing Groundbreaking

May 04, 2025 -

Anna Kendricks Nonverbal Cues A Fan Interpretation Of A Recent Interview

May 04, 2025

Anna Kendricks Nonverbal Cues A Fan Interpretation Of A Recent Interview

May 04, 2025 -

Nhl Playoff Standings Whats At Stake In Fridays Games

May 04, 2025

Nhl Playoff Standings Whats At Stake In Fridays Games

May 04, 2025

Latest Posts

-

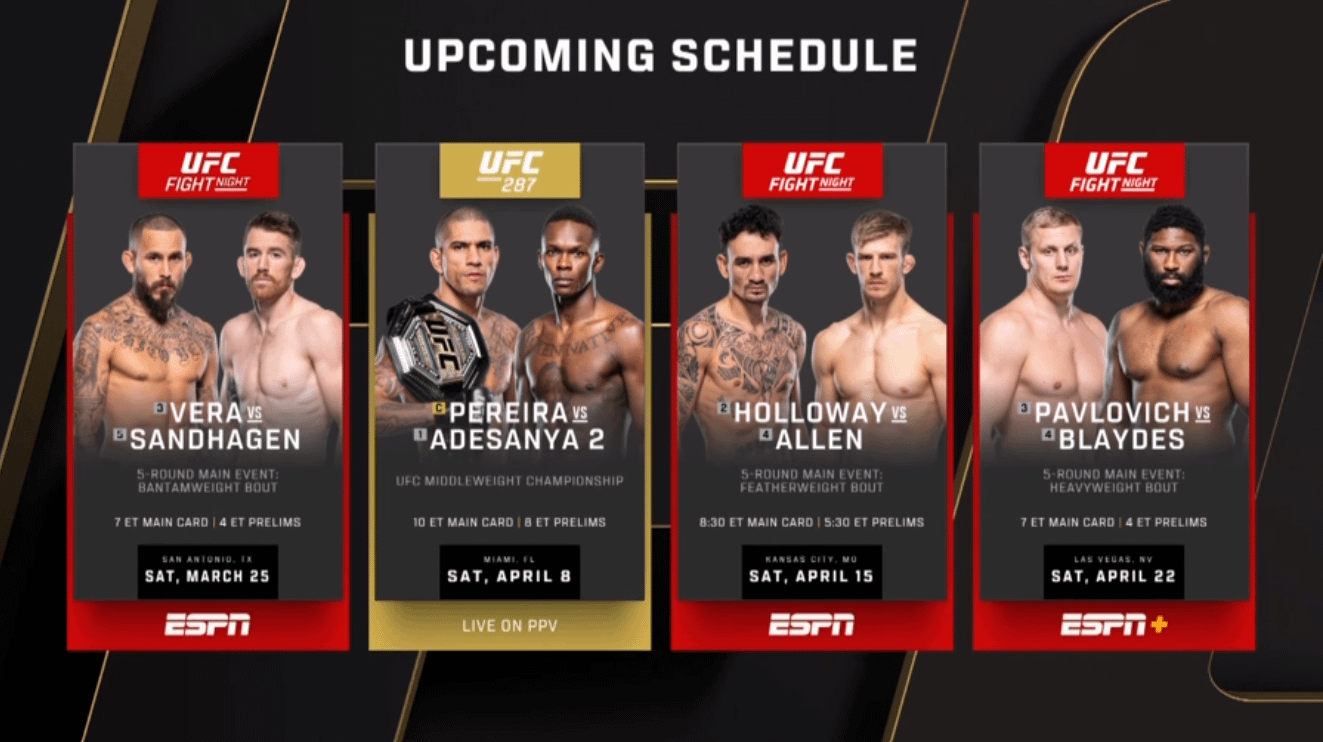

Ufc Fight Night Sandhagen Vs Figueiredo A Comprehensive Preview And Predictions

May 04, 2025

Ufc Fight Night Sandhagen Vs Figueiredo A Comprehensive Preview And Predictions

May 04, 2025 -

Ufc 313 Predictions Fights And Analysis

May 04, 2025

Ufc 313 Predictions Fights And Analysis

May 04, 2025 -

Ufc 313 Pereira Vs Ankalaev Dfs Picks And Winning Predictions

May 04, 2025

Ufc 313 Pereira Vs Ankalaev Dfs Picks And Winning Predictions

May 04, 2025 -

Ufc 313 Preview And Predictions A Fight Night Breakdown

May 04, 2025

Ufc 313 Preview And Predictions A Fight Night Breakdown

May 04, 2025 -

Ufc 313 Picks Pereira Vs Ankalaev Dfs Preview And Predictions

May 04, 2025

Ufc 313 Picks Pereira Vs Ankalaev Dfs Preview And Predictions

May 04, 2025