Belgium's 270MWh BESS: Navigating The Complexities Of Merchant Market Financing

Table of Contents

Understanding the Merchant Market Model for BESS

The merchant model for BESS operates on the principle of buying and selling energy based on market price fluctuations. This involves leveraging the battery's ability to store energy during periods of low demand and release it when prices are high (energy arbitrage). Additionally, merchant BESS projects can provide frequency regulation and other ancillary services to grid operators, generating further revenue streams.

- Energy Arbitrage: Capitalizing on price differences between peak and off-peak hours.

- Frequency Regulation: Providing crucial grid stabilization services, earning revenue through contracts with grid operators.

- Ancillary Services: Offering a range of services such as voltage support and black start capabilities.

However, this model is fraught with uncertainties. Accurate price forecasting is crucial but challenging, as energy markets are inherently volatile. Unexpected price swings and unforeseen market events can significantly impact revenue projections, representing a substantial market risk for investors. Keywords: Merchant BESS, Energy Arbitrage, Frequency Regulation, Ancillary Services, Revenue Streams, Market Risk.

The Financial Landscape for Large-Scale BESS Projects

Constructing a 270MWh BESS represents a substantial capital expenditure (CAPEX). The financial landscape for such projects is complex, with various financing options available.

- Debt Financing: Securing loans from banks or financial institutions.

- Equity Financing: Attracting investments from private equity firms or other investors.

- Project Finance: A specialized financing structure tailored to the specific risks and cash flows of the project.

- Public Funding: Utilizing government grants, subsidies, or other forms of public support (often crucial for large-scale projects with significant public benefits).

Securing financing requires navigating a complex web of financial institutions, investors, and government agencies. Government incentives, such as tax breaks or feed-in tariffs, can play a vital role in making these projects financially viable. Keywords: BESS Financing, CAPEX, Debt Financing, Equity Financing, Project Finance, Government Incentives, Energy Storage Investment.

Key Challenges in Securing Merchant Market Financing for BESS

Despite the potential for significant returns, merchant BESS projects face several challenges in securing financing.

- Price Volatility: Fluctuations in energy prices introduce significant uncertainty into revenue projections.

- Regulatory Uncertainty: Changes in energy regulations or grid codes can impact the profitability of BESS operations.

- Difficulty in Predicting Long-Term Revenue Streams: The inherent unpredictability of energy markets makes it difficult to guarantee long-term returns, affecting investor confidence.

- Securing Long-Term Power Purchase Agreements (PPAs): PPAs can mitigate price risk but are often difficult to negotiate and secure, especially for new technologies.

These risks, coupled with the relatively nascent nature of large-scale BESS deployment, can make it difficult to attract investors. Keywords: BESS Risk Assessment, Price Volatility, Regulatory Uncertainty, Power Purchase Agreements (PPAs), Investor Confidence, Energy Storage Risk Mitigation.

Strategies for Mitigating Financial Risks and Securing Funding

Mitigating the financial risks associated with merchant BESS projects is crucial for securing funding.

- Hedging: Employing financial instruments to reduce exposure to price volatility.

- Revenue Diversification: Exploring multiple revenue streams beyond energy arbitrage, such as ancillary services.

- Robust Forecasting Models: Utilizing advanced analytical tools to improve the accuracy of revenue projections.

- Strong Project Development Team: Assembling a team with expertise in BESS technology, energy markets, and project finance.

- Experienced Financial Advisors: Engaging professionals with deep understanding of energy storage investment and financing structures.

- Innovative Financing Structures: Exploring creative financing options, such as blended finance models combining debt and equity.

- Partnerships: Collaborating with experienced players in the energy sector to share risks and leverage expertise.

By adopting these strategies, developers can significantly enhance the attractiveness of their projects to investors. Keywords: Risk Mitigation, Revenue Diversification, Financial Modeling, Project Development, Financing Structures, Partnerships, Energy Storage Solutions.

Case Study: Financing Models for Similar BESS Projects

Analyzing successful financing models from similar large-scale BESS projects around the globe provides valuable insights. These case studies highlight best practices and lessons learned, illustrating how different strategies can effectively address the challenges of merchant market financing. Keywords: BESS Case Studies, Successful BESS Projects, Energy Storage Best Practices. (Specific examples of successful projects would be included here in a full-length article.)

Conclusion: Navigating the Future of Belgium's BESS and Merchant Market Financing

Financing merchant BESS projects presents significant challenges, including price volatility, regulatory uncertainty, and the difficulty in predicting long-term revenue streams. However, with robust financial planning, effective risk mitigation strategies, and innovative financing structures, these challenges can be overcome. The future of large-scale energy storage, including Belgium's ambitious 270MWh BESS project, hinges on the ability to secure reliable and sustainable financing. By learning from past successes and continuing to innovate, the energy storage industry can unlock the full potential of BESS technology. To learn more about the intricacies of Belgium BESS and merchant market financing, and to explore financing options for your own energy storage projects, [insert link to relevant resources here].

Featured Posts

-

Millions Made From Exec Office 365 Data Breach Federal Investigation

May 03, 2025

Millions Made From Exec Office 365 Data Breach Federal Investigation

May 03, 2025 -

Understanding And Resolving Fortnite Matchmaking Error 1

May 03, 2025

Understanding And Resolving Fortnite Matchmaking Error 1

May 03, 2025 -

Is Fortnite Down Server Status Downtime Schedule And Update 34 20 Details

May 03, 2025

Is Fortnite Down Server Status Downtime Schedule And Update 34 20 Details

May 03, 2025 -

Canadian Dollar Rises Impact Of Trumps Statement On Carney

May 03, 2025

Canadian Dollar Rises Impact Of Trumps Statement On Carney

May 03, 2025 -

House Fires And Rescues Tulsa Fire Departments Response To Winter Storm

May 03, 2025

House Fires And Rescues Tulsa Fire Departments Response To Winter Storm

May 03, 2025

Latest Posts

-

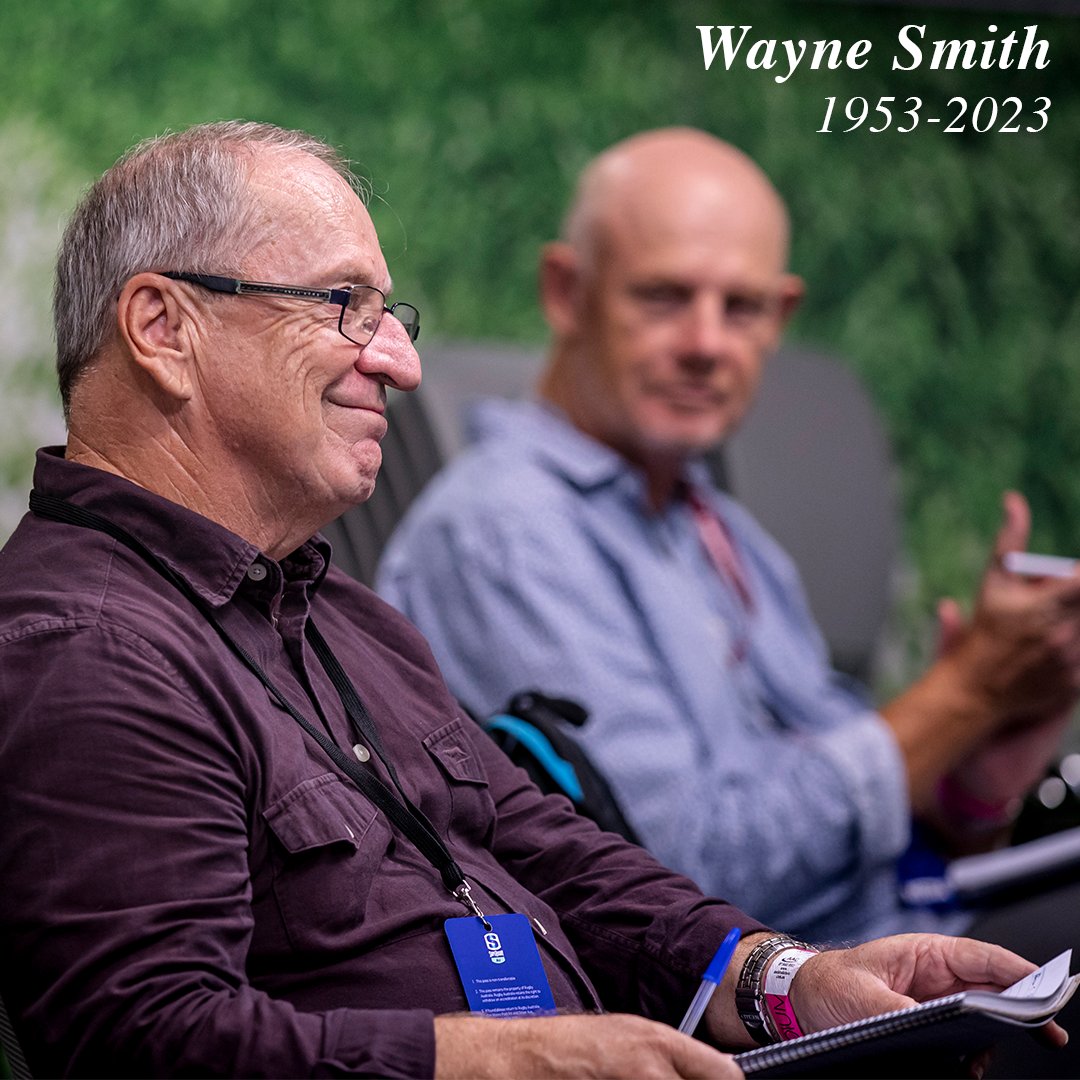

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025 -

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025 -

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025 -

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025 -

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025