Berkshire Hathaway's Apple Stock: Impact Of Buffett's Retirement

Table of Contents

Berkshire Hathaway's Current Apple Investment

The Scale of the Investment

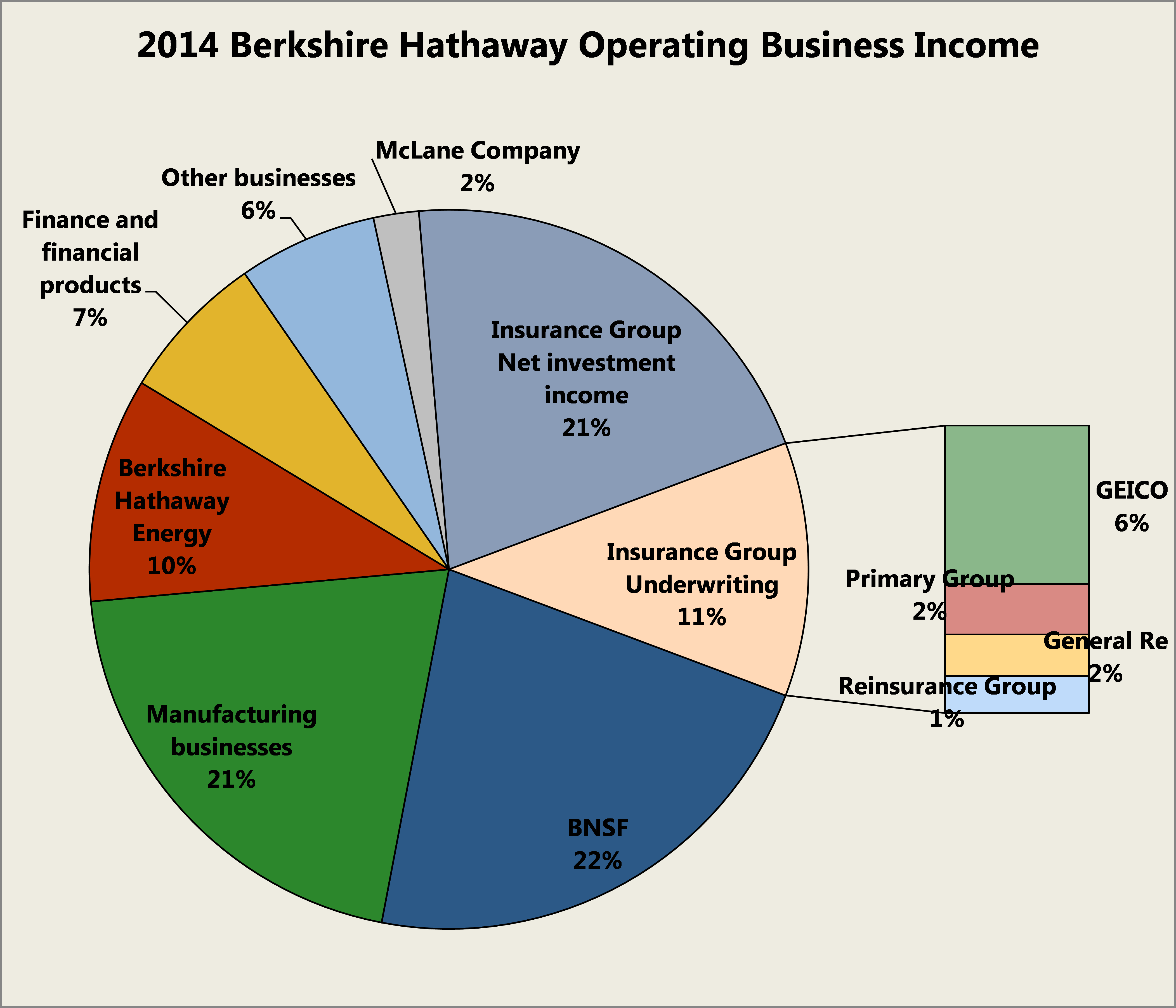

Berkshire Hathaway's Apple investment is colossal. It represents a significant portion of Berkshire's overall portfolio, holding hundreds of millions of shares. The sheer size of this investment underscores its importance to Berkshire's financial health and overall investment strategy.

- Quantify Berkshire's Apple shares: As of [Insert Date], Berkshire Hathaway holds approximately [Insert Number] shares of Apple stock. (This number needs to be updated regularly).

- Calculate the percentage of Berkshire's portfolio represented by Apple: Apple's stake currently comprises approximately [Insert Percentage]% of Berkshire Hathaway's total portfolio value. This figure fluctuates with market conditions but consistently remains substantial.

- Mention the current market value of this investment: The current market value of Berkshire's Apple holdings is in the range of [Insert Dollar Amount] (this needs to be updated regularly). This represents a massive investment and a significant source of Berkshire's wealth.

- Include a brief history of Buffett's Apple investment strategy: Buffett's gradual acquisition of Apple stock, initially viewed with some surprise given his typical investment style, demonstrates a shift towards technology and consumer brands. His long-term, value-investing philosophy has proven exceptionally successful in this instance.

Potential Succession Plans and Investment Strategies

The Role of Greg Abel and Ajit Jain

The future of Berkshire Hathaway's Apple investment largely hinges on the investment philosophies of Greg Abel and Ajit Jain, the leading candidates to succeed Buffett. While both are highly respected within Berkshire, their investment approaches may differ subtly from Buffett's. Will they continue the substantial Apple holdings, or might they opt for a more diversified approach?

- Brief biographies of Abel and Jain: Both Abel and Jain have extensive experience within Berkshire, with Abel heading non-insurance operations and Jain managing insurance operations. Their track records offer insights into their investment preferences.

- Analysis of their past investment decisions: Examining their past investment decisions will help predict their future actions regarding Apple. Do they favor long-term holdings like Buffett, or do they prefer more active portfolio management?

- Speculation on their potential approach to Apple stock: It's plausible that they might maintain the core Apple position, aligning with Buffett’s strategy of long-term value investing. However, they might also adjust the portfolio's allocation, potentially diversifying into other sectors.

- Consideration of the possibility of a new investment team: Berkshire might also empower a new investment team, potentially leading to significant changes in investment strategy and portfolio composition.

Market Reactions and Apple Stock Volatility

Immediate Market Impact of Buffett's Retirement

Buffett's retirement will undoubtedly trigger market reactions, particularly impacting Apple's stock price. The announcement itself could create short-term volatility as investors reassess Berkshire Hathaway's future investment strategy.

- Discuss potential investor sentiment changes: Investor sentiment could shift depending on the clarity and perceived stability of the succession plan. Uncertainty could lead to selling pressure.

- Explore scenarios of increased or decreased selling pressure: Depending on investor confidence, there could be either a rush to sell or a period of wait-and-see.

- Mention the influence of news media and financial analysts: Media coverage and analyst opinions will heavily influence investor reactions, potentially exacerbating any volatility.

Long-Term Implications for Apple Stock Price

Beyond the immediate market reaction, Apple's long-term prospects remain largely independent of Berkshire Hathaway's involvement. Apple's continued innovation, strong brand loyalty, and expanding service revenue streams suggest continued growth.

- Apple's future product innovations and market position: Apple's ongoing innovation in various product categories, coupled with its strong brand recognition, will continue to influence its market performance.

- Analysis of competitive threats and market trends: Competition in the tech industry is fierce, so any analysis of Apple's stock should address emerging competitors and market shifts.

- Prediction of long-term growth potential for Apple: Despite challenges, Apple's long-term growth potential remains substantial, owing to its ecosystem and brand strength.

Alternative Investment Opportunities for Berkshire Hathaway

Diversification and Portfolio Adjustments

Following Buffett's retirement, Berkshire Hathaway might adjust its portfolio, potentially reducing its reliance on Apple. This diversification could involve expanding into new sectors or increasing investments in other existing holdings.

- Explore potential alternative investment areas: Berkshire might explore opportunities in renewable energy, healthcare, or other sectors with long-term growth potential.

- Discuss the potential impact on Berkshire's overall risk profile: Diversification is intended to lower the overall risk profile of the portfolio, reducing dependence on any single investment.

- Mention the importance of maintaining a balanced portfolio: Maintaining a balanced portfolio is crucial for long-term stability and to mitigate the impact of fluctuations in specific sectors.

Conclusion

The future of Berkshire Hathaway's Apple stock post-Buffett's retirement presents a complex scenario. The uncertainty surrounding succession planning, the potential for market reactions, and the possibility of portfolio adjustments all contribute to the challenges in predicting the outcome. However, Apple’s intrinsic strength and Berkshire Hathaway's disciplined investment approach suggest that the investment's long-term viability will likely endure.

Call to Action: Stay informed about the evolving situation surrounding Berkshire Hathaway's Apple stock and its future under new leadership. Continue researching the impacts of Buffett’s retirement on this significant investment to gain a deeper understanding of the implications for both companies and the broader market. Further exploration of Berkshire Hathaway's Apple stock is essential for informed investment decisions.

Featured Posts

-

The Republican Party And Trump A Deal In The Making

May 25, 2025

The Republican Party And Trump A Deal In The Making

May 25, 2025 -

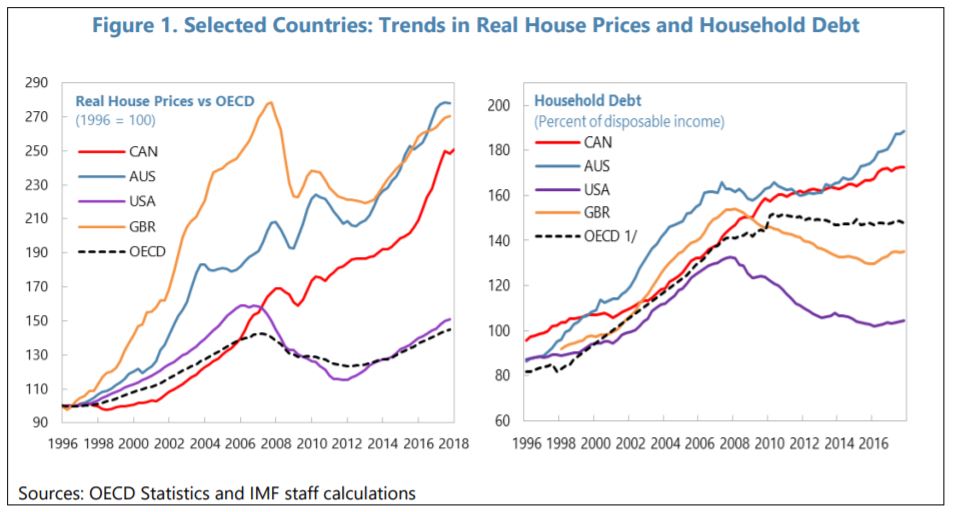

Housing Affordability And Market Stability A Look At Gregor Robertsons Proposals

May 25, 2025

Housing Affordability And Market Stability A Look At Gregor Robertsons Proposals

May 25, 2025 -

Black Lives Matter Plaza A Reflection On Protest And Public Space

May 25, 2025

Black Lives Matter Plaza A Reflection On Protest And Public Space

May 25, 2025 -

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 25, 2025

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 25, 2025 -

Analyzing The Amundi Dow Jones Industrial Average Ucits Etfs Net Asset Value Nav

May 25, 2025

Analyzing The Amundi Dow Jones Industrial Average Ucits Etfs Net Asset Value Nav

May 25, 2025

Latest Posts

-

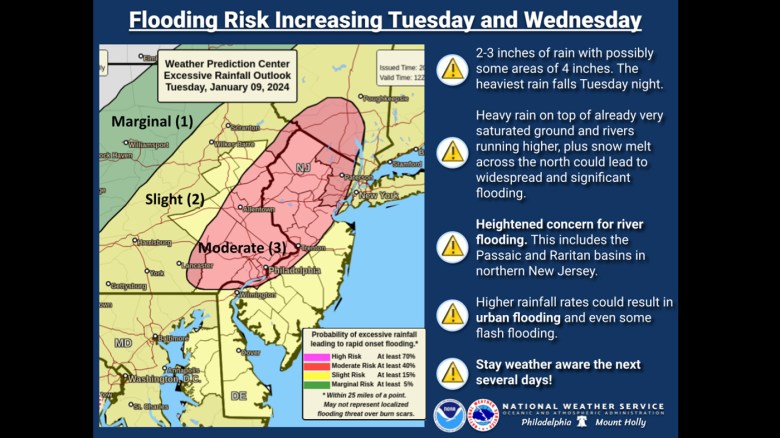

Southeast Pa Coastal Flood Advisory Issued For Wednesday

May 25, 2025

Southeast Pa Coastal Flood Advisory Issued For Wednesday

May 25, 2025 -

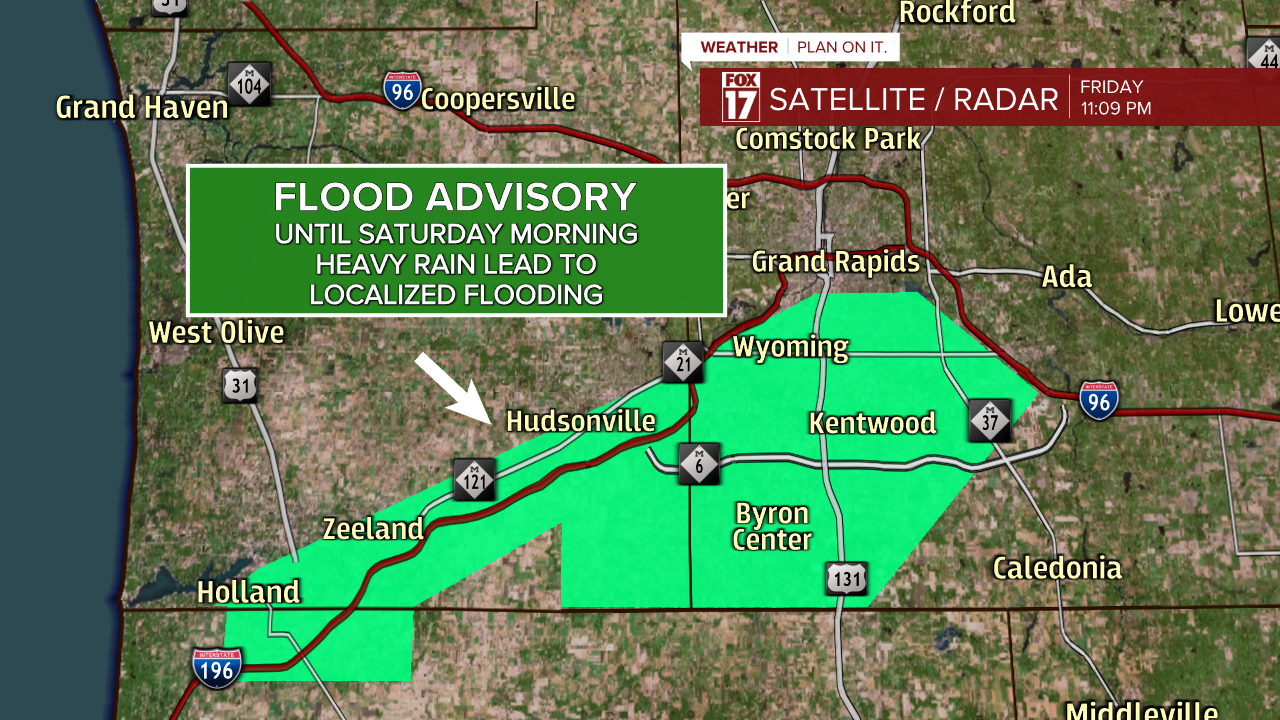

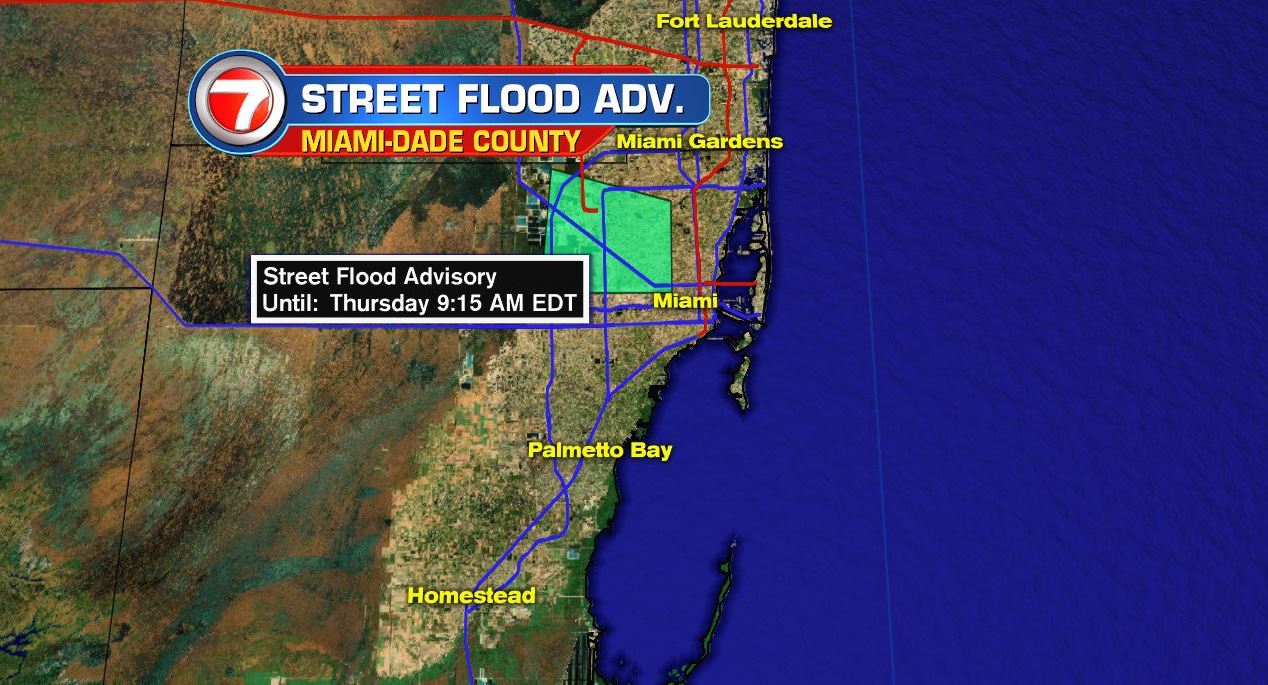

Important Information Flood Advisories In Effect For Miami Valley

May 25, 2025

Important Information Flood Advisories In Effect For Miami Valley

May 25, 2025 -

Coastal Flood Advisory Southeast Pa Wednesday

May 25, 2025

Coastal Flood Advisory Southeast Pa Wednesday

May 25, 2025 -

Miami Valley Flood Advisory What You Need To Know About The Severe Weather

May 25, 2025

Miami Valley Flood Advisory What You Need To Know About The Severe Weather

May 25, 2025 -

Current Flood Situation In Miami Valley Severe Weather Update And Advisories

May 25, 2025

Current Flood Situation In Miami Valley Severe Weather Update And Advisories

May 25, 2025