Berkshire Hathaway's Investment Boosts Japan Trading House Share Prices

Table of Contents

Berkshire Hathaway's Strategic Investment in Japanese Trading Houses

Berkshire Hathaway's investment strategy often focuses on long-term growth potential and undervalued assets. The decision to invest in five major Japanese trading companies – Itochu, Mitsubishi Corporation, Mitsui & Co., Sumitomo Corporation, and Marubeni Corporation – is no exception. This strategic move represents a significant commitment to these businesses and signals a strong vote of confidence in the Japanese economy.

- Investment Breakdown: While the exact amounts invested haven't been publicly disclosed in full detail for each company individually, Berkshire Hathaway acquired roughly 5% stakes in each of the five trading houses. This represents a substantial investment, totaling billions of dollars.

- Reasoning Behind the Investment: Analysts suggest several reasons for Berkshire Hathaway's decision. These include:

- Long-term Growth Potential: These trading houses are deeply entrenched in the global economy, handling a vast array of commodities and engaging in diverse businesses. Berkshire Hathaway sees potential for significant long-term growth in these established players.

- Undervalued Assets: Some analysts believe that the share prices of these trading houses were undervalued before Berkshire Hathaway's investment, presenting a compelling opportunity for long-term value appreciation.

- Diversification Strategy: The investment diversifies Berkshire Hathaway's portfolio, reducing reliance on any single sector or geographical region. The Japanese market, while mature, offers stability and potential for growth.

- Significance of the Investment: This investment isn't just about financial returns; it's a powerful statement about the confidence Berkshire Hathaway has in the Japanese economy and the potential of these trading houses to continue thriving in a competitive global market. It potentially signals a wave of further foreign investment into Japan.

- Future Collaborations: The partnership could pave the way for future collaborations between Berkshire Hathaway and these trading houses, potentially leading to synergistic business ventures and expanding both companies' global reach. Experts predict increased efficiency and market penetration as a result of this collaboration.

Impact on Share Prices of Japanese Trading Houses

The announcement of Berkshire Hathaway's investment immediately sent shockwaves through the stock market. The share prices of all five trading houses experienced a significant surge.

- Percentage Increase: Following the news, share prices increased substantially, with some seeing double-digit percentage gains within days. While the exact figures fluctuate, the impact was undeniable.

- Market Reaction and Trading Activity: The market reacted positively, demonstrating strong investor confidence. Trading volume increased significantly as investors rushed to acquire shares in these companies, further driving up their prices.

- Market Capitalization Impact: The increase in share prices translated directly into a considerable boost in the overall market capitalization of these companies, reflecting the significant market value added by Berkshire Hathaway's investment.

- Increased Investor Confidence: The investment by a renowned investor like Warren Buffett served as a strong endorsement, boosting investor confidence and attracting further investments. This positive sentiment is clearly reflected in the sustained share price growth.

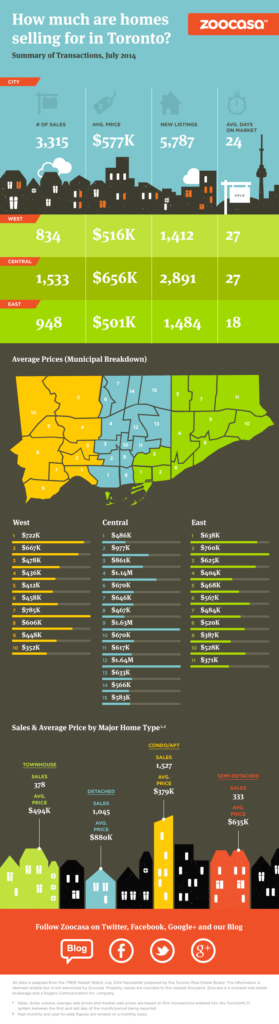

(Insert chart/graph here illustrating share price fluctuations before and after the investment)

Long-Term Implications for the Japanese Economy and Trading Houses

Berkshire Hathaway's investment carries significant long-term implications for both the Japanese economy and the future of its trading houses.

- Increased Foreign Investment: The move is likely to attract further foreign investment into Japan, boosting economic activity and stimulating growth. Other investors may view this as a positive sign, indicating the potential for profitable investments in the Japanese market.

- Global Trade Landscape: The strengthened position of these trading houses in the global market may lead to increased competitiveness for Japanese businesses on a worldwide scale, potentially leading to further economic expansion.

- Expansion and Diversification: With the influx of capital and a strategic partner like Berkshire Hathaway, these trading houses are better positioned to expand their operations and diversify their businesses, increasing their resilience and profitability.

- Long-Term Economic Growth: The investment could contribute to long-term economic growth in Japan by creating jobs, stimulating innovation, and boosting overall productivity within the sector and beyond. The effects on related industries could be considerable.

Conclusion

Berkshire Hathaway's significant investment in five major Japanese trading houses has led to a substantial increase in their share prices, signaling increased investor confidence in both the companies and the Japanese economy. This strategic move has far-reaching implications for the future of these trading houses and Japan's overall economic growth. The long-term effects of this investment are likely to be profound, impacting not only the companies directly involved but also the broader Japanese economy and global trade.

Call to Action: Stay informed about the unfolding impact of Berkshire Hathaway's investment on the Japanese trading houses. Keep track of share price movements and related news to better understand the evolving dynamics in this key sector of the Japanese economy. Follow the developments surrounding Berkshire Hathaway's investment in Japanese trading houses for insightful analysis and market predictions. Understanding this significant investment will be crucial for anyone interested in the future of the Japanese economy and global trade.

Featured Posts

-

Counting Crows Las Vegas Strip Concert Announced

May 08, 2025

Counting Crows Las Vegas Strip Concert Announced

May 08, 2025 -

Texas Football Sarkisian Addresses Key Injuries In Spring Practice

May 08, 2025

Texas Football Sarkisian Addresses Key Injuries In Spring Practice

May 08, 2025 -

Real Betis Forjando Su Historia Partido A Partido

May 08, 2025

Real Betis Forjando Su Historia Partido A Partido

May 08, 2025 -

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025 -

The Long Walk Movie Adaptation Is It Finally Here

May 08, 2025

The Long Walk Movie Adaptation Is It Finally Here

May 08, 2025