Biden's Economic Policies: Impact And Analysis Of Current Slowdown

Table of Contents

Inflation and Biden's Response

The Inflationary Pressures

Inflation has surged to levels unseen in decades. The Consumer Price Index (CPI) consistently showed alarming increases throughout 2021 and 2022, impacting household budgets significantly. Several factors fueled this inflationary pressure:

- Supply chain disruptions: The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to shortages and price hikes for various goods.

- Energy price shocks: The war in Ukraine dramatically increased energy prices, impacting transportation costs and overall inflation.

- Increased demand: Pent-up demand following the pandemic, coupled with robust government stimulus, further fueled price increases.

The impact on consumers is undeniable: rising costs for groceries, housing, and transportation erode purchasing power, squeezing household budgets and impacting consumer confidence. Comparing these inflation rates to previous administrations reveals a significant increase, demanding a closer look at the effectiveness of current policy responses.

Biden Administration's Anti-Inflation Measures

The Biden administration has implemented several measures to combat inflation, including:

- The American Rescue Plan: While intended as a COVID-19 relief package, its substantial spending contributed to increased demand and potentially exacerbated inflationary pressures.

- Infrastructure spending: The Bipartisan Infrastructure Law aims to boost long-term economic growth through investments in infrastructure, but its short-term impact on inflation remains a point of debate.

- Release of oil reserves: The administration released oil from the Strategic Petroleum Reserve to alleviate energy price increases, but its long-term effectiveness is questionable.

Analyzing the effectiveness of these measures is complex. While some argue that the infrastructure investments will lead to long-term economic benefits, others point to the potential for increased inflation in the short term due to increased government spending. The effectiveness of these policies in curbing inflation remains a subject of ongoing debate among economists.

The Impact of Infrastructure Spending

The Bipartisan Infrastructure Law

The Bipartisan Infrastructure Law represents a significant investment in America's infrastructure, allocating billions of dollars to improve roads, bridges, public transportation, broadband internet, and the electric grid. The projected long-term benefits are substantial:

- Job creation: The bill is expected to create millions of jobs in construction and related industries.

- Economic growth: Investments in infrastructure are anticipated to boost economic productivity and competitiveness.

- Improved efficiency: Modernized infrastructure will reduce transportation costs and improve the efficiency of supply chains.

Short-Term Economic Effects

However, the short-term economic effects of this massive infrastructure spending are complex and debated:

- Increased inflation: The increased government spending could potentially contribute to further inflation in the short term.

- Government debt: The bill adds to the national debt, raising concerns about long-term fiscal sustainability.

- Potential for crowding out private investment: The increased government borrowing could potentially crowd out private investment, hindering private sector growth.

Supply Chain Issues and Their Role

Analysis of Existing Supply Chain Bottlenecks

Persistent supply chain bottlenecks continue to contribute significantly to the economic slowdown and inflation. These bottlenecks are characterized by:

- Port congestion: Major ports around the world face significant congestion, delaying the delivery of goods.

- Shipping container shortages: A shortage of shipping containers further exacerbates delays and increases transportation costs.

- Labor shortages: Many industries face labor shortages, impacting production capacity and delivery times.

Government Initiatives to Address Supply Chain Problems

The Biden administration has implemented several initiatives to alleviate supply chain problems, including:

- Investment in port infrastructure: Investments are intended to improve port efficiency and reduce congestion.

- Efforts to reduce port congestion: Various strategies aim to streamline port operations and reduce bottlenecks.

- Incentives for domestic manufacturing: Policies are aimed at encouraging domestic production and reducing reliance on overseas suppliers.

However, the effectiveness of these initiatives remains to be seen, given the complexity of global supply chains and the persistent challenges posed by geopolitical events.

The Role of Global Economic Factors

International Economic Uncertainty

Global economic uncertainty significantly impacts the US economy. Factors such as:

- The war in Ukraine: The conflict has disrupted global energy markets and increased commodity prices, fueling inflation.

- Global energy crisis: The energy crisis exacerbates inflationary pressures and adds uncertainty to economic forecasts.

- Global supply chain disruptions: Global supply chain disruptions stemming from the pandemic and geopolitical events add to economic instability.

These factors create a challenging external environment for the US economy, making it harder to achieve sustained economic growth.

Comparison to other economies

Comparing the US economy to other major economies reveals a mixed picture. While many countries face similar challenges, the specific impact of Biden's economic policies and the unique circumstances of the US economy necessitate careful consideration when drawing international comparisons. Analyzing data on GDP growth, inflation rates, and unemployment across different countries provides context and highlights the relative performance of the US under the current administration's policies.

Conclusion: Evaluating Biden's Economic Policies and the Path Forward

In conclusion, the impact of Biden's economic policies on the current economic slowdown is multifaceted and complex. While the infrastructure investments hold the promise of long-term economic benefits, the short-term inflationary pressures and the challenges posed by global economic uncertainty cannot be ignored. The effectiveness of the administration's anti-inflation measures remains a subject of ongoing debate. A balanced assessment acknowledges both the potential for future growth fostered by infrastructure improvements and the current challenges presented by inflation and global instability. Continued monitoring and analysis of Biden's economic policies are crucial to understand their long-term consequences. We encourage further research and engagement with your representatives to ensure informed discussions and policy improvements regarding Biden's economic policies and their impact on the US economy.

Featured Posts

-

Manchester United Pays Tribute To Poppy Atkinson 10 Killed In Kendal Pitch Accident

May 03, 2025

Manchester United Pays Tribute To Poppy Atkinson 10 Killed In Kendal Pitch Accident

May 03, 2025 -

Smart Rings And Fidelity A New Era Of Relationship Trust

May 03, 2025

Smart Rings And Fidelity A New Era Of Relationship Trust

May 03, 2025 -

Falling Asset Levels At Schroders Impact Of Q1 Stock Market Shifts

May 03, 2025

Falling Asset Levels At Schroders Impact Of Q1 Stock Market Shifts

May 03, 2025 -

Is David Tennant Returning To The Max Harry Potter Series

May 03, 2025

Is David Tennant Returning To The Max Harry Potter Series

May 03, 2025 -

Cangkang Telur Manfaat Kreatif Untuk Pertanian Dan Peternakan

May 03, 2025

Cangkang Telur Manfaat Kreatif Untuk Pertanian Dan Peternakan

May 03, 2025

Latest Posts

-

Nc Supreme Court Race Gop Candidate Appeals Latest Orders

May 03, 2025

Nc Supreme Court Race Gop Candidate Appeals Latest Orders

May 03, 2025 -

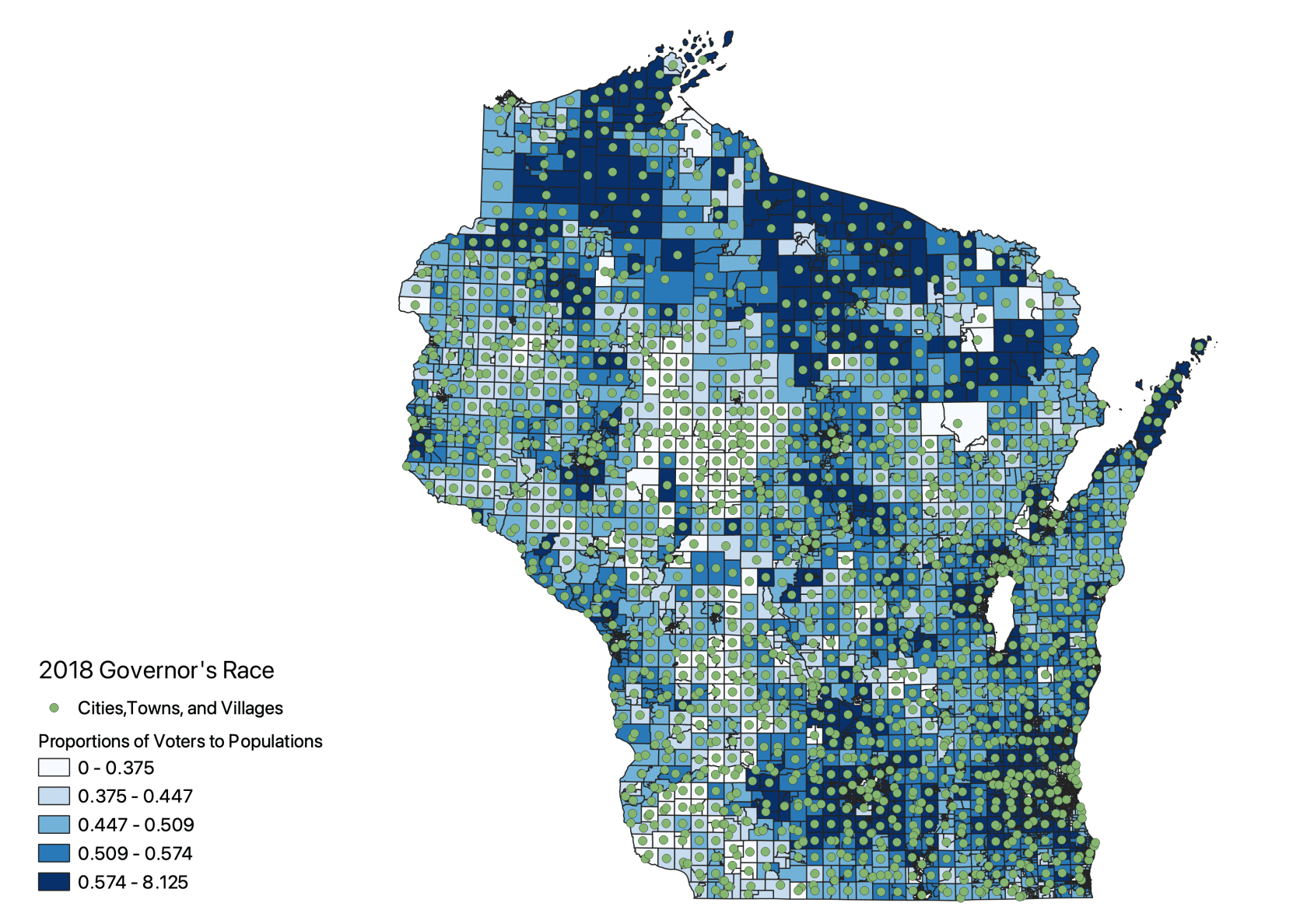

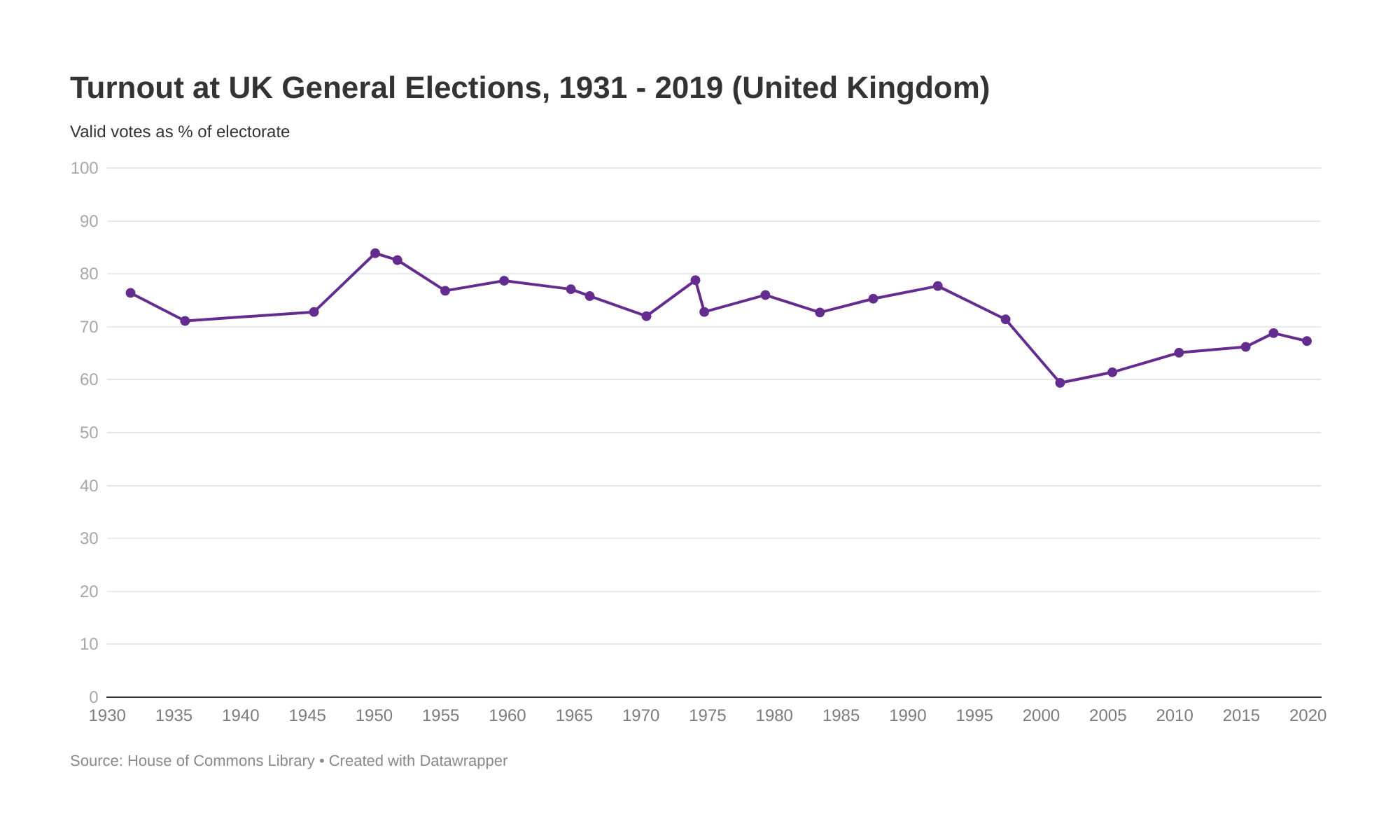

Analyzing Voter Turnout In Florida And Wisconsin Understanding The Political Landscape

May 03, 2025

Analyzing Voter Turnout In Florida And Wisconsin Understanding The Political Landscape

May 03, 2025 -

Gop Candidates Nc Supreme Court Appeal What It Means

May 03, 2025

Gop Candidates Nc Supreme Court Appeal What It Means

May 03, 2025 -

Florida And Wisconsin Election Results What The Turnout Reveals

May 03, 2025

Florida And Wisconsin Election Results What The Turnout Reveals

May 03, 2025 -

Npps 2024 Election Loss Abu Jinapors Perspective

May 03, 2025

Npps 2024 Election Loss Abu Jinapors Perspective

May 03, 2025