BigBear.ai: A Comprehensive Investment Analysis For 2024

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai operates in the rapidly expanding market for AI-driven solutions, focusing on mission-critical systems for various sectors. Understanding its business model and competitive positioning is crucial for any investment analysis.

Core Services and Technologies

BigBear.ai offers a suite of AI-powered services, leveraging cutting-edge technologies to deliver significant value to its clients. Its core offerings include:

- Advanced Data Analytics: BigBear.ai uses artificial intelligence and machine learning to analyze vast datasets, extracting actionable insights for clients in defense, intelligence, and commercial sectors. This includes predictive analytics, anomaly detection, and data visualization.

- Cybersecurity Solutions: The company provides advanced cybersecurity solutions, utilizing AI to proactively identify and mitigate threats. This includes threat intelligence, vulnerability management, and incident response.

- Mission-Critical Systems Integration: BigBear.ai integrates its AI capabilities into clients' existing systems, improving efficiency and decision-making processes. This involves system modernization, data integration, and AI-driven automation.

BigBear.ai’s technological advantage lies in its ability to combine sophisticated AI algorithms with deep domain expertise. This unique combination allows them to deliver highly customized solutions tailored to the specific needs of its clients.

Competitive Analysis

BigBear.ai faces competition from several established players and emerging startups in the data analytics and cybersecurity markets. Key competitors include companies specializing in similar AI-driven solutions.

- Strengths: BigBear.ai's strength lies in its strong government contracts, deep domain expertise, and highly customized AI solutions.

- Weaknesses: Potential weaknesses include dependence on government contracts and the risk of intense competition from larger, more established companies with broader resources.

- Challenges: The company faces the ongoing challenge of adapting to rapidly evolving AI technologies and maintaining a competitive edge in a dynamic market. Disruptive technologies and shifting market demands represent significant potential challenges.

Financial Performance and Future Projections

Analyzing BigBear.ai's financial performance and projecting its future trajectory is essential for any investment decision.

Revenue Growth and Profitability

BigBear.ai's historical financial data reveals a pattern of revenue growth, although profitability may fluctuate. Analyzing key financial metrics provides insight into the company's performance:

- Revenue Growth: Examine the year-over-year growth in revenue, highlighting significant trends and factors driving this growth. Include charts illustrating revenue trends over the past few years.

- Profit Margin: Track the gross and net profit margins, assessing the company’s efficiency and pricing strategies.

- Earnings Per Share (EPS): Analyze the EPS trend, reflecting the profitability on a per-share basis.

(Note: Actual financial data would be included here if available from public sources.)

Future Outlook and Valuation

Projecting BigBear.ai's future performance requires considering multiple factors, including market trends, competition, and the company's strategic initiatives.

- Market Capitalization: The current market capitalization provides a snapshot of the company's overall value.

- Price-to-Earnings Ratio (P/E): The P/E ratio provides a valuation metric reflecting market sentiment and growth expectations.

- Growth Potential: BigBear.ai's growth potential is largely dependent on its ability to secure new contracts, expand into new markets, and develop innovative AI solutions.

(Note: Detailed projections and valuation calculations would be included here based on available financial data and market analysis.)

Investment Risks and Opportunities

Investing in BigBear.ai involves both risks and opportunities. A thorough assessment is crucial.

Potential Risks

Several risk factors could negatively impact BigBear.ai's performance and investor returns:

- Market Risk: Volatility in the broader stock market could affect BigBear.ai's share price.

- Competition: Intense competition from established players and emerging startups could erode market share and profitability.

- Technological Disruption: Rapid technological advancements could render BigBear.ai's current technologies obsolete.

- Regulatory Changes: Changes in government regulations could impact the company's ability to operate and secure contracts.

- Geopolitical Risk: Global events and political instability could influence the demand for BigBear.ai's services.

Investment Opportunities

Despite the risks, several factors point to potential opportunities for investors:

- Growth in the AI Market: The AI market is experiencing significant growth, presenting substantial opportunities for BigBear.ai.

- Government Contracts: BigBear.ai's strong presence in the government sector provides a stable revenue stream.

- Technological Innovation: The company's focus on innovation and technological advancement positions it for future growth.

Conclusion

This investment analysis of BigBear.ai for 2024 highlights the company's potential as a key player in the rapidly growing AI market. While risks exist, the opportunities presented by its innovative technology and strong government contracts make it a compelling investment prospect. Remember to conduct thorough due diligence before making any investment decisions. Consider researching BigBear.ai stock further, reviewing its latest financial statements, and consulting a financial advisor to determine if BigBear.ai aligns with your investment strategy and risk tolerance. BigBear.ai presents a potentially attractive addition to a diversified investment portfolio for those interested in the future of AI.

Featured Posts

-

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025 -

Israel Lifts Food Restrictions On Gaza Strip

May 20, 2025

Israel Lifts Food Restrictions On Gaza Strip

May 20, 2025 -

Festival Da Cunha Em Manaus Maiara E Maraisa Se Apresentam 90 Gratuito

May 20, 2025

Festival Da Cunha Em Manaus Maiara E Maraisa Se Apresentam 90 Gratuito

May 20, 2025 -

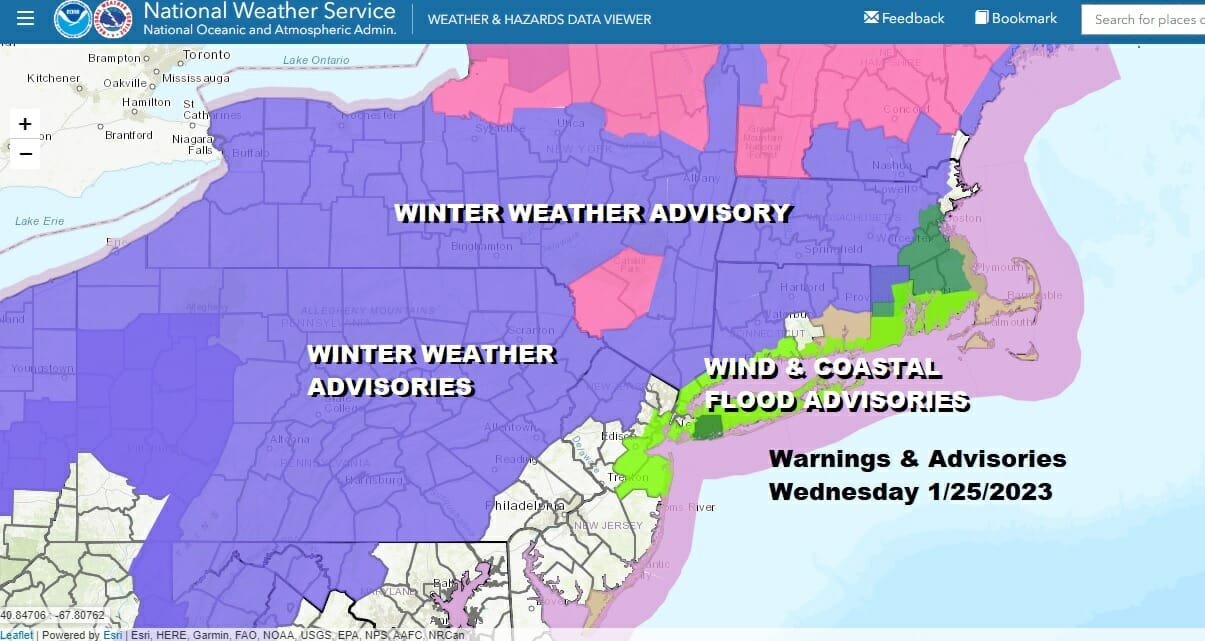

School Delays And Winter Weather Advisories What You Need To Know

May 20, 2025

School Delays And Winter Weather Advisories What You Need To Know

May 20, 2025 -

Patra Lista Efimerion Iatron Gia To Savvatokyriako

May 20, 2025

Patra Lista Efimerion Iatron Gia To Savvatokyriako

May 20, 2025

Latest Posts

-

Little Britains Resurgence Understanding Gen Zs Appreciation

May 20, 2025

Little Britains Resurgence Understanding Gen Zs Appreciation

May 20, 2025 -

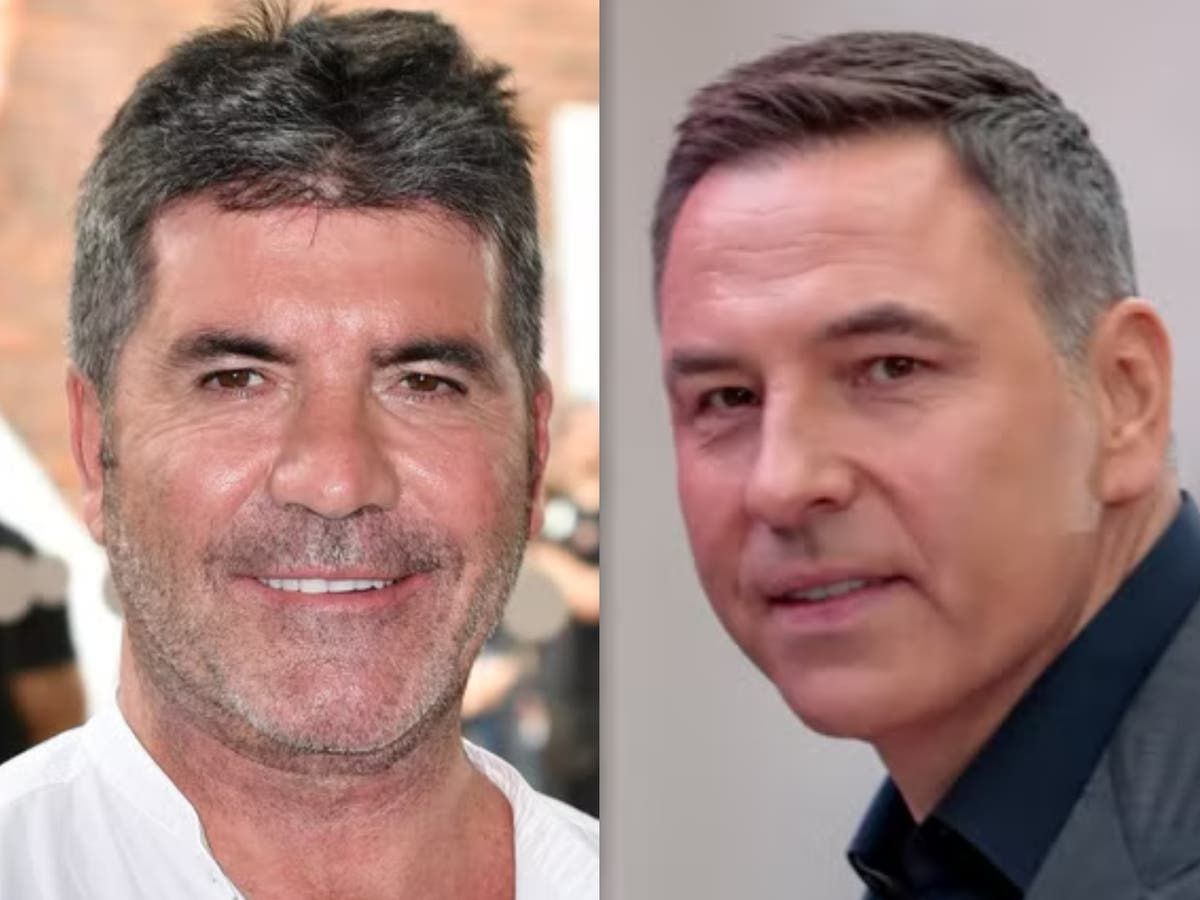

The David Walliams Simon Cowell Feud A Britains Got Talent Timeline

May 20, 2025

The David Walliams Simon Cowell Feud A Britains Got Talent Timeline

May 20, 2025 -

Why Gen Z Loves Little Britain Despite Its Cancellation

May 20, 2025

Why Gen Z Loves Little Britain Despite Its Cancellation

May 20, 2025 -

David Walliams And Simon Cowells Britains Got Talent Dispute Deepens

May 20, 2025

David Walliams And Simon Cowells Britains Got Talent Dispute Deepens

May 20, 2025 -

Is This The End David Walliams And Simon Cowells Britains Got Talent Rift

May 20, 2025

Is This The End David Walliams And Simon Cowells Britains Got Talent Rift

May 20, 2025