BigBear.ai (BBAI): Growth Slowdown Prompts Analyst Downgrade – What's Next?

Table of Contents

Reasons Behind BigBear.ai's Growth Slowdown

BigBear.ai's recent performance has raised questions about its ability to maintain its growth momentum. Several key factors appear to be contributing to this slowdown.

Reduced Government Contract Wins

A significant contributor to BBAI's growth slowdown is a noticeable decline in securing new government contracts. The company relies heavily on these contracts for revenue, and a decrease in successful bids directly impacts its financial performance. The competitive landscape for AI and defense contracts is fiercely competitive, with established players and new entrants vying for limited funding.

- Increased Competition: The market for AI-powered solutions within the government sector is becoming increasingly saturated. BigBear.ai faces stiff competition from larger, more established technology firms with greater resources and brand recognition.

- Complex Bidding Processes: Securing government contracts often involves lengthy and complex bidding processes, requiring substantial resources and expertise. Any setbacks or inefficiencies in this process can significantly impact a company's ability to secure new contracts.

- Specific Contract Losses (if available): [Insert details of any publicly known contract losses and their financial impact here. For example: "The loss of the [Contract Name] contract, valued at [Dollar Amount], significantly impacted Q[Quarter] revenue."]. This section requires specific, publicly available information.

Keywords: Government contracts, BBAI revenue, competitive bidding, defense contracts, AI contracts.

Challenges in Scaling Operations

As BigBear.ai expands its operations to meet increasing demand and pursue new opportunities, it appears to be facing challenges in effectively scaling its business. This can manifest in several ways:

- Resource Allocation: Efficient allocation of resources – financial, human, and technological – is crucial for sustainable growth. Any inefficiencies in this area can hinder the company's ability to meet its objectives.

- Operational Bottlenecks: BigBear.ai may be experiencing bottlenecks in its operational processes, leading to delays and inefficiencies. Identifying and addressing these bottlenecks is vital for improving productivity and overall performance.

- Management of Rapid Growth: The rapid growth of the AI sector presents both opportunities and challenges. Effectively managing this rapid expansion requires strong leadership, efficient processes, and a robust organizational structure.

Keywords: BBAI scaling, operational efficiency, growth challenges, resource allocation.

Increased Competition in the AI Market

The AI market is rapidly evolving, with both established tech giants and innovative startups constantly pushing the boundaries of technological innovation. This intense competition presents significant challenges for BigBear.ai.

- Market Saturation: The increasing number of players in the AI market leads to market saturation, making it harder for companies to differentiate themselves and gain market share.

- Technological Advancements: Rapid technological advancements require companies to continuously adapt and innovate to stay competitive. Failing to keep up with these advancements can lead to obsolescence and loss of market share.

- Competitive Advantages: BigBear.ai needs to leverage its strengths – perhaps its focus on government contracts or specialized AI solutions – to maintain a competitive edge.

Keywords: AI competition, market share, technological advancements, competitive landscape.

Analyst Downgrade and Market Reaction

A recent analyst downgrade from [Analyst Firm Name] to [New Rating] sent ripples through the market. The firm cited [Reasons given by the analyst firm for the downgrade – cite the source]. This news immediately impacted BBAI stock price, causing a [Percentage] drop in share value and a [Description of trading volume changes, e.g., significant increase/decrease] in trading volume. Investor sentiment shifted towards [Describe the prevailing sentiment – cautious, negative, etc.], reflecting concerns about the company's future prospects.

Keywords: BBAI stock price, analyst rating, investor sentiment, market reaction, stock forecast.

What's Next for BigBear.ai (BBAI)? Potential Future Scenarios

While the current situation presents challenges, BigBear.ai's future isn't predetermined. Several scenarios are possible.

Potential for Recovery

BigBear.ai still possesses several potential avenues for recovery and future growth:

- New Contract Wins: Securing significant new government contracts could significantly boost revenue and investor confidence.

- Product Development and Innovation: Investing in research and development to create innovative AI solutions could attract new clients and expand market share.

- Strategic Partnerships: Collaborating with other companies in the AI sector could provide access to new technologies and markets.

Keywords: BBAI future outlook, recovery strategy, growth potential, stock rebound.

Risk Factors and Challenges

Despite the potential for recovery, several risk factors could further hinder BigBear.ai's growth:

- Continued Contract Losses: Failure to secure new contracts could lead to further revenue declines and stock price decreases.

- Increased Competition: The intense competition in the AI market remains a significant challenge.

- Economic Downturn: A broader economic slowdown could reduce government spending on technology and defense, impacting BBAI's revenue streams.

Keywords: BBAI risk factors, challenges, stock decline, downside risk.

Conclusion: BigBear.ai (BBAI) and the Path Forward

The recent analyst downgrade and growth slowdown at BigBear.ai highlight the challenges faced by companies operating in the dynamic AI and government contracting sectors. While the potential for recovery exists through new contract wins, product innovation, and strategic partnerships, significant risks remain, including intense competition and potential economic headwinds. Monitoring BBAI's performance and the evolving AI market landscape is crucial for investors. Conduct your own thorough research, stay informed about BBAI stock, and carefully consider the risks before investing. Remember to consult with a financial advisor before making any investment decisions. For further information, refer to [Link to BBAI investor relations page] and [Link to reputable financial news source].

Remember to replace bracketed information with specific, verifiable data. Always conduct thorough research and cite your sources accurately.

Featured Posts

-

Financial Challenges How To Overcome Lack Of Funds And Build Wealth

May 21, 2025

Financial Challenges How To Overcome Lack Of Funds And Build Wealth

May 21, 2025 -

Looney Tunes Animated Short A 2025 Collaboration With Cartoon Network Stars

May 21, 2025

Looney Tunes Animated Short A 2025 Collaboration With Cartoon Network Stars

May 21, 2025 -

Wintry Mix Of Rain And Snow Impacts And Precautions

May 21, 2025

Wintry Mix Of Rain And Snow Impacts And Precautions

May 21, 2025 -

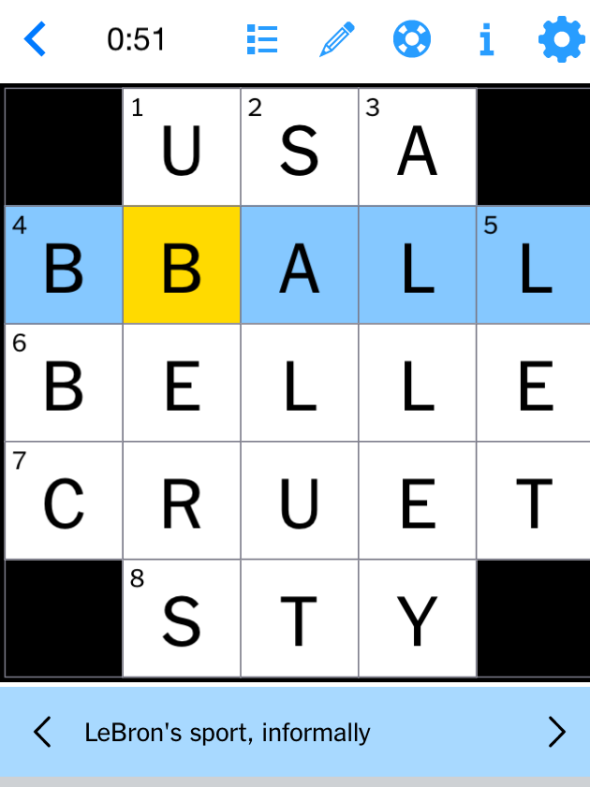

Nyt Mini Crossword April 26 2025 Complete Solution Guide

May 21, 2025

Nyt Mini Crossword April 26 2025 Complete Solution Guide

May 21, 2025 -

Huuhkajien Yllaettaevae Avauskokoonpano Kaellman Ja Kaksi Muuta Ulos

May 21, 2025

Huuhkajien Yllaettaevae Avauskokoonpano Kaellman Ja Kaksi Muuta Ulos

May 21, 2025

Latest Posts

-

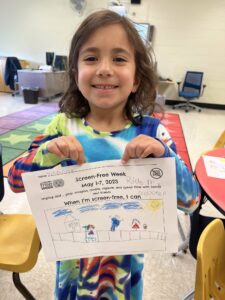

A Successful Screen Free Week Tips For Parents

May 22, 2025

A Successful Screen Free Week Tips For Parents

May 22, 2025 -

See Vapors Of Morphine Low Rock Show In Northcote Next Month

May 22, 2025

See Vapors Of Morphine Low Rock Show In Northcote Next Month

May 22, 2025 -

Screen Free Week With Kids A Practical Guide

May 22, 2025

Screen Free Week With Kids A Practical Guide

May 22, 2025 -

Northcote Concert Vapors Of Morphines Low Rock Performance

May 22, 2025

Northcote Concert Vapors Of Morphines Low Rock Performance

May 22, 2025 -

Watch Looney Tunes And Cartoon Network Stars In A New 2025 Animated Short

May 22, 2025

Watch Looney Tunes And Cartoon Network Stars In A New 2025 Animated Short

May 22, 2025