BigBear.ai (BBAI): Penny Stock Analysis And Investment Outlook

Table of Contents

BigBear.ai (BBAI) is a publicly traded company operating in the dynamic field of artificial intelligence (AI) and data analytics. Currently classified as a penny stock, BBAI offers investors a potentially high-reward, high-risk opportunity. This analysis aims to provide a thorough examination of BBAI's investment potential, considering key factors such as its business model, financial performance, inherent risks, and future growth prospects. We will examine the company's strengths and weaknesses to help you form your own informed opinion.

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai provides advanced AI-powered solutions and data analytics services to government and commercial clients. Their core business revolves around leveraging cutting-edge technologies to solve complex problems across various sectors. They specialize in delivering mission-critical solutions, using AI and machine learning to improve decision-making processes. Their target market includes defense, intelligence, and commercial enterprises seeking to gain a competitive edge through advanced data analysis. The competitive landscape is crowded with established players and innovative startups, requiring BBAI to constantly innovate and adapt. Profitability remains a key challenge, as the company focuses on growth and securing larger contracts.

- Key clients and contracts: BBAI has secured contracts with several government agencies and private sector clients, though the specifics may be limited due to confidentiality agreements. The size and longevity of these contracts are crucial to understanding BBAI's revenue stability.

- Recent technological advancements and partnerships: Tracking BBAI’s advancements in AI algorithms, data processing capabilities, and strategic partnerships is essential for evaluating their competitive position. New partnerships can significantly impact their revenue streams and market share.

- Market share and growth potential within the AI sector: The AI sector is experiencing explosive growth, presenting significant opportunities for BBAI. However, their ability to capture market share will depend heavily on their ability to differentiate themselves from competitors.

Financial Performance and Key Metrics of BBAI

Analyzing BBAI's financial performance requires a close examination of its quarterly and annual reports. Key financial metrics to consider include revenue growth, earnings per share (EPS), debt-to-equity ratio, and cash flow. Comparing these metrics to those of competitors provides valuable context. The company's financial health and stability directly influence its investment potential. A thorough understanding of these metrics will reveal much about BBAI's financial strength.

- Revenue growth trends: Analyzing revenue trends reveals the company's ability to generate sales and secure new contracts. Sustained revenue growth is a positive indicator.

- Profitability analysis: Profitability, or the lack thereof, is a critical factor to consider. Examining gross and net profit margins will indicate the efficiency of BBAI's operations and its ability to translate revenue into profit.

- Debt levels and solvency: High debt levels can be a significant risk factor. Analyzing the debt-to-equity ratio helps assess the company's financial stability and its ability to meet its obligations.

- Valuation metrics (P/E ratio, if applicable): Depending on profitability, the Price-to-Earnings ratio (P/E ratio) can provide insights into market valuation relative to earnings.

Risk Assessment for Investing in BBAI

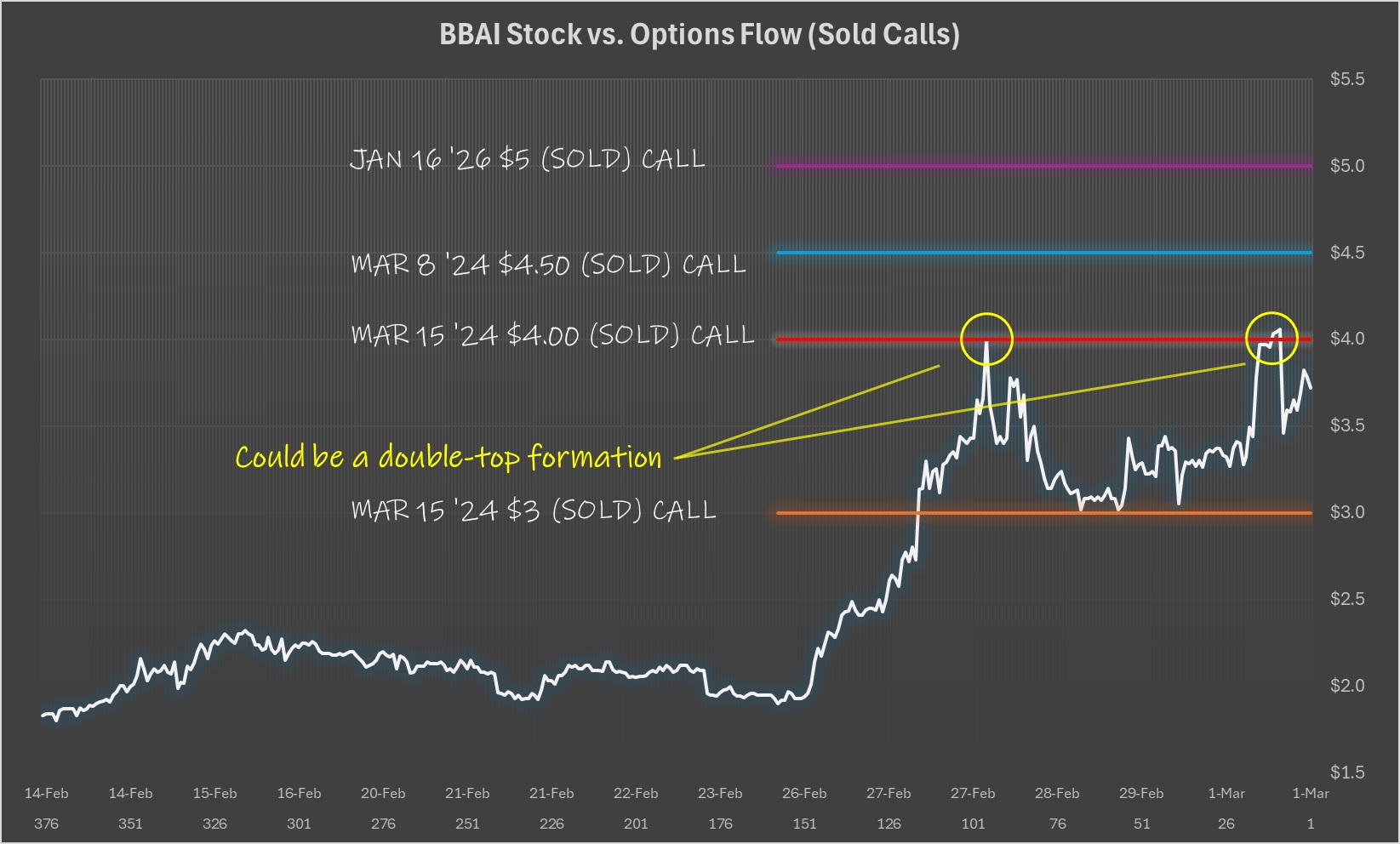

Investing in BBAI, as with any penny stock, carries significant risks. The stock price can be highly volatile, leading to substantial losses. Several factors contribute to this risk profile. Careful consideration of these risks is paramount before making any investment decisions.

- Market risks (overall market conditions): Broader market downturns can disproportionately impact penny stocks like BBAI.

- Company-specific risks (competition, management changes, etc.): Changes in management, intense competition, or failure to secure new contracts can significantly affect BBAI's performance.

- Financial risks (high debt, low profitability): High debt levels and low profitability increase the risk of financial distress.

- Regulatory risks (industry-specific regulations): Changes in regulations within the AI and data analytics sector could impact BBAI's operations.

BigBear.ai (BBAI) Investment Outlook and Potential

The investment outlook for BBAI is complex, presenting both significant upside potential and considerable downside risks. The company operates in a rapidly growing sector, offering potential for high returns if it successfully executes its business strategy and secures substantial contracts. However, the inherent volatility of penny stocks and the company's financial challenges warrant caution.

- Potential for high returns (if successful): Successful execution of its business plan could lead to substantial growth and a significant increase in stock price.

- Long-term growth prospects: The long-term growth prospects of the AI industry are positive, providing a favorable backdrop for BBAI's potential growth.

- Comparison to similar companies in the sector: Comparing BBAI to its competitors helps assess its relative strengths and weaknesses and its potential for future growth.

- Investment strategy suggestions (e.g., holding period, diversification): A diversified portfolio and a long-term investment horizon are recommended when considering penny stocks.

BigBear.ai (BBAI) Penny Stock Investment – Final Thoughts and Call to Action

This analysis of BigBear.ai (BBAI) highlights both its potential for significant growth in the burgeoning AI sector and the substantial risks associated with investing in a penny stock. The company's financial performance and ability to secure large, long-term contracts will be critical factors in determining its future success. While the potential rewards are considerable, the risks are equally significant. Remember, this is not financial advice.

Therefore, before making any investment decisions regarding BigBear.ai (BBAI) penny stock, it's crucial to conduct your own thorough due diligence. Consult with a qualified financial advisor, review financial statements meticulously, and research the competitive landscape extensively. This article serves as a starting point; revisit this analysis and check for updates as the company's performance and market conditions evolve. Remember, responsible investing in BBAI, or any penny stock, requires careful consideration of all available information.

Featured Posts

-

Panico Na Tijuca Incendio Em Escola Causa Alarme Entre Pais E Alunos

May 20, 2025

Panico Na Tijuca Incendio Em Escola Causa Alarme Entre Pais E Alunos

May 20, 2025 -

Ealm Ajatha Krysty Yewd Bfdl Aldhkae Alastnaey Nzrt Mstqblyt

May 20, 2025

Ealm Ajatha Krysty Yewd Bfdl Aldhkae Alastnaey Nzrt Mstqblyt

May 20, 2025 -

L Integrale Agatha Christie Biographie Et Analyse De Son Uvre

May 20, 2025

L Integrale Agatha Christie Biographie Et Analyse De Son Uvre

May 20, 2025 -

Early Chinese Gp Drama Hamilton And Leclercs Collision

May 20, 2025

Early Chinese Gp Drama Hamilton And Leclercs Collision

May 20, 2025 -

Huuhkajien Tulevaisuus Uusi Valmennus Ja Tie Mm Karsintoihin

May 20, 2025

Huuhkajien Tulevaisuus Uusi Valmennus Ja Tie Mm Karsintoihin

May 20, 2025

Latest Posts

-

Prokrisi Kroyz Azoyl O Giakoymakis Odigei Ston Teliko Champions League

May 20, 2025

Prokrisi Kroyz Azoyl O Giakoymakis Odigei Ston Teliko Champions League

May 20, 2025 -

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025 -

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Stin Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Stin Dimokratiki

May 20, 2025 -

Kathigites Dimotikoy Odeioy Rodoy Synaylia Stin Dimokratiki

May 20, 2025

Kathigites Dimotikoy Odeioy Rodoy Synaylia Stin Dimokratiki

May 20, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Programma And Leptomereies

May 20, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Programma And Leptomereies

May 20, 2025