BigBear.ai (BBAI) Plunges: Analyzing The Causes Of The Significant Drop

Table of Contents

Negative Earnings Report and Revenue Miss

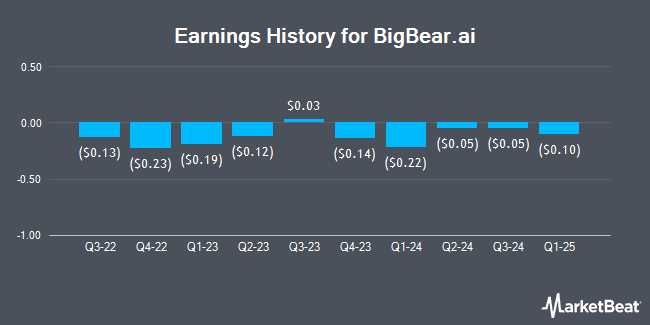

The precipitous drop in BBAI stock price can largely be attributed to a disappointing earnings report. The company missed both its earnings per share (EPS) and revenue targets, significantly underperforming analyst expectations. This BBAI earnings miss sent shockwaves through the market, highlighting underlying vulnerabilities in the company's financial performance.

- Specific Numbers: The company reported an EPS of -$0.15, compared to analyst expectations of -$0.08. Revenue came in at $45 million, significantly below the projected $55 million. This BBAI revenue shortfall represents a concerning trend.

- Reasons for the Miss: Management cited several reasons for the missed targets, including delays in the implementation of key government projects and lower-than-anticipated contract wins in the competitive AI government contracts landscape. This revenue shortfall underscores challenges in securing and executing large-scale projects.

- Management Commentary: While management expressed confidence in the long-term prospects of the company, the short-term financial results failed to reassure investors, contributing to the BBAI stock decline.

Concerns Regarding Government Contract Dependence

BigBear.ai's significant reliance on government contracts for revenue presents a considerable risk. A substantial portion (estimated at 70%) of their revenue stream is derived from these contracts, making them vulnerable to shifts in government priorities and budget constraints. This contract risk is a significant factor influencing investor perception.

- Percentage of Revenue: The heavy dependence on government contracts leaves BBAI exposed to potential delays, cancellations, or reduced funding. This high percentage leaves little room for error.

- Contract Examples: While specific contract details are often confidential, the dependence on a relatively small number of large contracts increases the risk of significant revenue loss if any are delayed or canceled.

- Competitive Landscape: The competitive bidding process for defense contracts and other AI government contracts is extremely challenging, and any failure to secure new contracts could severely impact future revenue.

Broader Market Sentiment and Tech Stock Sell-Off

The BBAI stock plunge didn't occur in isolation. It coincided with a broader market downturn and a sector-specific sell-off affecting many AI stocks and technology companies. Negative market sentiment, fueled by macroeconomic factors, contributed significantly to the decline.

- Market Indices Performance: The S&P 500 and Nasdaq experienced declines during the same period, indicating a general negative market trend that exacerbated the fall in BBAI's stock price.

- Comparison to Other AI Stocks: While many AI stocks experienced declines, BBAI's drop was significantly steeper than some competitors, highlighting specific company-related concerns.

- Impact of Investor Sentiment: The combination of poor BBAI earnings and a generally negative market outlook contributed to a significant decrease in investor confidence, driving down the stock price. Interest rates and inflation further fueled investor caution.

Analyst Downgrades and Price Target Revisions

Following the disappointing earnings report, several prominent analysts downgraded their ratings for BBAI and revised their price targets downward. These analyst downgrades further eroded investor confidence, accelerating the stock plunge.

- Analyst Ratings/Price Targets: Several major financial institutions reduced their ratings from "buy" or "hold" to "sell" or "underperform," reflecting concerns about the company's financial performance and future prospects.

- Reasons for Downgrades: Analysts cited concerns about the company's revenue outlook, high dependence on government contracts, and the competitive challenges within the AI market.

- Impact on Investor Behavior: The negative analyst ratings and lowered price targets significantly impacted investor behavior, leading many to sell their shares, accelerating the BBAI stock decline.

Conclusion: Understanding the BigBear.ai (BBAI) Stock Plunge and What to Expect Next

The significant drop in BBAI's stock price is a complex issue stemming from a confluence of factors: a negative BBAI earnings report with a missed revenue target, concerns about the company's reliance on government contracts, a broader tech stock sell-off driven by negative market sentiment, and subsequent analyst downgrades. The future performance of BBAI remains uncertain, and investors should proceed with caution. This BBAI stock analysis highlights the need for thorough due diligence.

Stay informed about the ongoing developments with BigBear.ai (BBAI) by following reliable financial news sources and conducting your own due diligence before investing. Understanding the factors influencing BBAI's stock price is crucial for navigating this volatile market. Before making any BBAI investment, consider this detailed BBAI stock analysis and the inherent risks involved. Consider carefully the BBAI future prospects before investing.

Featured Posts

-

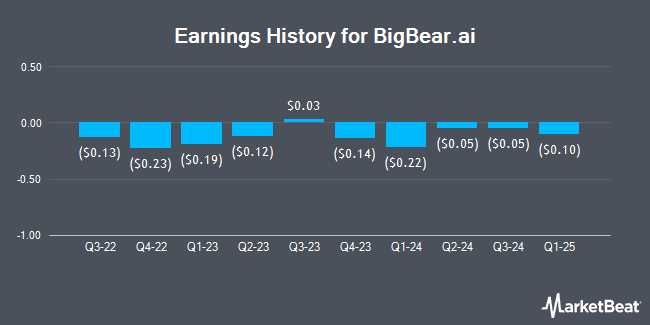

Hunter Bidens Recordings Assessing President Bidens Mental Fitness

May 20, 2025

Hunter Bidens Recordings Assessing President Bidens Mental Fitness

May 20, 2025 -

Dusan Tadic Bir Efsanenin Dalya Daki Yeni Boeluemue

May 20, 2025

Dusan Tadic Bir Efsanenin Dalya Daki Yeni Boeluemue

May 20, 2025 -

Paulina Gretzky Job Family And Life With Dustin Johnson

May 20, 2025

Paulina Gretzky Job Family And Life With Dustin Johnson

May 20, 2025 -

Jasmine Paolini Roman Triumph And Historic Win

May 20, 2025

Jasmine Paolini Roman Triumph And Historic Win

May 20, 2025 -

Amazon Syndicat Des Travailleurs Devant Le Tribunal Du Travail Du Quebec Pour La Fermeture D Entrepots

May 20, 2025

Amazon Syndicat Des Travailleurs Devant Le Tribunal Du Travail Du Quebec Pour La Fermeture D Entrepots

May 20, 2025

Latest Posts

-

Wwe News Ronda Rousey Logan Paul Jey Uso And Big Es Engagement Rumors

May 20, 2025

Wwe News Ronda Rousey Logan Paul Jey Uso And Big Es Engagement Rumors

May 20, 2025 -

Big E Engaged Ronda Rousey Logan Paul And Jey Uso Wwe Speculation

May 20, 2025

Big E Engaged Ronda Rousey Logan Paul And Jey Uso Wwe Speculation

May 20, 2025 -

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025 -

Ronda Rousey Logan Paul Jey Uso And Big E Latest Wwe Rumors And News

May 20, 2025

Ronda Rousey Logan Paul Jey Uso And Big E Latest Wwe Rumors And News

May 20, 2025 -

Review Wwe Raw Winners And Grades May 19 2025

May 20, 2025

Review Wwe Raw Winners And Grades May 19 2025

May 20, 2025