BigBear.ai (BBAI) Shares Drop On Weak Q1 Results

Table of Contents

Key Factors Contributing to BBAI's Q1 Earnings Miss

BigBear.ai's disappointing Q1 results stemmed from a confluence of factors, primarily a revenue shortfall and increased expenses, leading to significantly reduced profit margins. This created a negative impact on investor sentiment and consequently, the BBAI stock price.

Revenue Shortfall

BigBear.ai reported a substantial revenue shortfall compared to analyst expectations. While the company hasn't explicitly stated precise figures, early reports suggest a significant gap between projected revenue and actual results.

- Actual Revenue vs. Projected Revenue: Precise figures are pending official disclosures, but initial reports indicate a shortfall in the tens of millions of dollars.

- Percentage Difference: The percentage difference between projected and actual revenue is expected to be substantial, potentially in the double digits. This will be clarified once the full Q1 report is released and analyzed.

- Reasons Cited by the Company: The company attributed the shortfall to various factors, including delays in securing several large contracts and lower-than-anticipated demand in certain market segments. This highlights a need for BBAI to improve sales and contract fulfillment processes.

- Underperforming Segments: Reports suggest that the company’s government services segment specifically underperformed expectations, contributing significantly to the overall revenue miss.

Increased Expenses and Reduced Margins

The Q1 report also revealed a concerning increase in operating expenses compared to previous quarters, further squeezing profit margins. This eroded investor confidence in BBAI's financial management.

- Comparison of Q1 Expenses to Previous Quarters: A detailed breakdown of expenses will be provided in the official report, but early indications point to increases across several categories.

- Explanation of Rising Costs: The increase in expenses may be attributed to several factors, including increased R&D investments, higher salaries, and potentially increased marketing and sales efforts. Understanding these cost drivers is crucial for evaluating BBAI's long-term strategy.

- Impact on Profit Margins: The combination of lower revenue and higher expenses resulted in significantly reduced profit margins, impacting BBAI’s overall profitability and investor appeal.

- Cost-Cutting Measures: The company may need to implement aggressive cost-cutting measures to improve profitability in future quarters. The effectiveness of any such measures will be closely watched by investors.

Guidance for Future Quarters

BigBear.ai's lowered guidance for the remainder of the year further fueled the negative market reaction and the subsequent decline in the BBAI stock price. The revised outlook suggests the challenges faced in Q1 may persist throughout 2024.

- Revised Revenue Projections: The company is expected to significantly lower its full-year revenue projections, reflecting the difficulties encountered in Q1.

- Adjusted Earnings Per Share (EPS) Estimates: EPS estimates are also likely to be revised downwards, reflecting the impact of lower revenue and higher expenses.

- Factors Influencing Future Performance: The company's success in securing new contracts, improving operational efficiency, and managing costs will be crucial factors influencing its future performance. Success in these areas is critical to regaining investor confidence.

- Implications on Investor Confidence: The lowered guidance has undeniably negatively impacted investor confidence, contributing to the selling pressure on BBAI stock.

Market Reaction and Investor Sentiment

The market reacted swiftly and negatively to BigBear.ai's disappointing Q1 earnings, resulting in a sharp decline in the BBAI stock price.

Immediate Stock Price Drop

The announcement triggered an immediate and significant drop in BBAI's share price.

- Opening Price vs. Closing Price: The stock experienced a substantial percentage drop from its opening price to its closing price on the day of the earnings release.

- Trading Volume: Trading volume likely surged on the day of the announcement, indicating a high level of activity as investors reacted to the news.

- Comparison to Market Indices: The decline in BBAI's share price significantly outperformed the broader market indices, suggesting a specific negative sentiment towards the company. This will require further investigation. A chart would clearly illustrate this point.

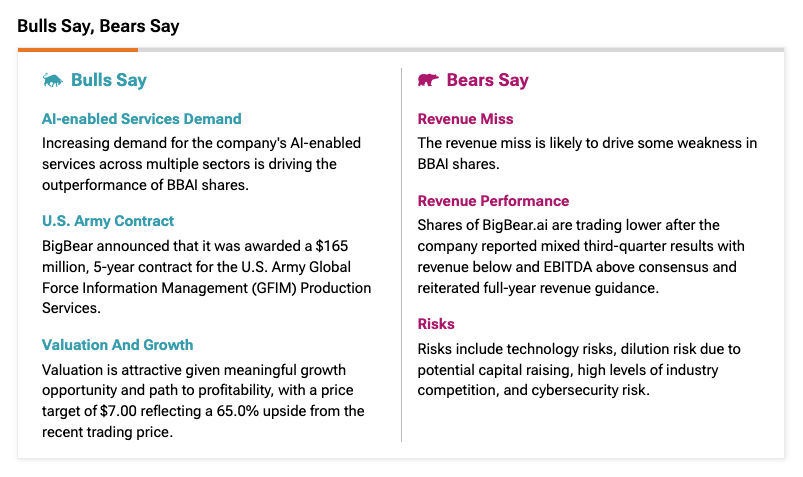

Analyst Reactions and Ratings

Financial analysts responded to the Q1 results with a mix of concern and disappointment.

- Quotes from Key Analysts: Many analysts expressed concerns about BBAI's revenue shortfall and lowered guidance, questioning the company's ability to meet its long-term targets.

- Changes in Price Targets: Several analysts lowered their price targets for BBAI stock, reflecting their reduced expectations for future performance.

- Buy/Sell/Hold Recommendations: Some analysts may have downgraded their recommendations from "buy" or "hold" to "sell" or "underperform," signaling a negative outlook for the stock.

Long-Term Implications for BBAI

The long-term implications of the weak Q1 results for BigBear.ai remain uncertain. The company’s response to this challenge will define the trajectory of the BBAI stock.

- Potential for Recovery: The potential for a recovery depends on BBAI's ability to address the underlying issues that contributed to the Q1 miss. Effective execution of strategic initiatives is critical here.

- Strategic Initiatives: BBAI's success will rely heavily on its strategic initiatives to improve revenue generation, manage costs, and enhance its competitive position in the AI industry.

- Competition Within the Industry: The company faces stiff competition within the rapidly evolving AI sector. Maintaining a competitive edge will be crucial for long-term success. Monitoring the competition will be key to predicting BBAI’s performance.

Conclusion

BigBear.ai's (BBAI) share price decline is primarily attributable to its weak Q1 earnings, characterized by a significant revenue shortfall, increased expenses, and lowered guidance for the remainder of the year. These factors have negatively impacted investor sentiment, leading to a substantial drop in the BBAI stock price. Investors should closely monitor BigBear.ai's (BBAI) performance and upcoming announcements to assess the long-term viability of the investment. Further research into BBAI's strategic initiatives and the competitive landscape of the AI industry is crucial for informed decision-making regarding BBAI stock. Stay updated on future developments in the BigBear.ai (BBAI) story and make sure to research thoroughly before investing in BBAI shares.

Featured Posts

-

Chinas Fury The Us Missile System Igniting Geopolitical Tensions

May 20, 2025

Chinas Fury The Us Missile System Igniting Geopolitical Tensions

May 20, 2025 -

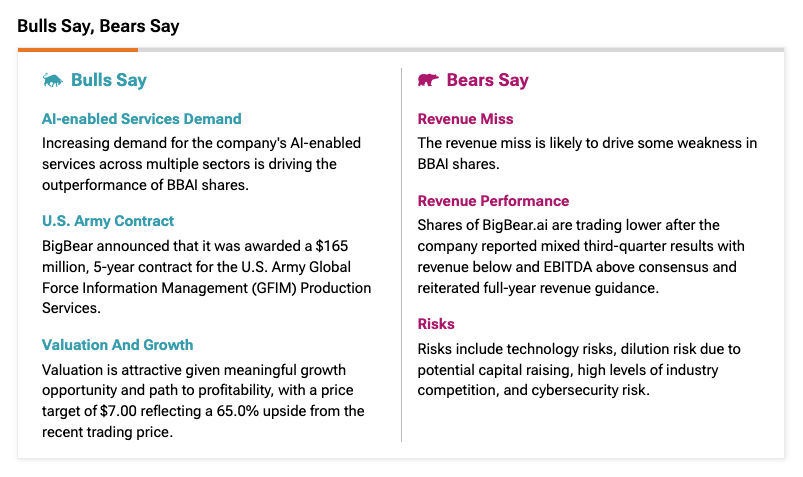

School Delays And Winter Weather Advisories What You Need To Know

May 20, 2025

School Delays And Winter Weather Advisories What You Need To Know

May 20, 2025 -

Robert P Burke Four Star Admiral Convicted Of Bribery

May 20, 2025

Robert P Burke Four Star Admiral Convicted Of Bribery

May 20, 2025 -

Wwe Raw May 19 2025 A Mixed Bag Of Matches And Moments

May 20, 2025

Wwe Raw May 19 2025 A Mixed Bag Of Matches And Moments

May 20, 2025 -

Cote D Ivoire Le 4eme Pont D Abidjan Tout Savoir Sur Son Budget Et Son Avancement

May 20, 2025

Cote D Ivoire Le 4eme Pont D Abidjan Tout Savoir Sur Son Budget Et Son Avancement

May 20, 2025

Latest Posts

-

Alleged Britains Got Talent Feud David Walliams Attacks Simon Cowell

May 20, 2025

Alleged Britains Got Talent Feud David Walliams Attacks Simon Cowell

May 20, 2025 -

The David Walliams Bgt Controversy Explained

May 20, 2025

The David Walliams Bgt Controversy Explained

May 20, 2025 -

Britains Got Talent David Walliams And Simon Cowells Public Feud Explodes

May 20, 2025

Britains Got Talent David Walliams And Simon Cowells Public Feud Explodes

May 20, 2025 -

David Walliams What Happened On Britains Got Talent

May 20, 2025

David Walliams What Happened On Britains Got Talent

May 20, 2025 -

Walliams Slams Cowell Amidst Britains Got Talent Dispute

May 20, 2025

Walliams Slams Cowell Amidst Britains Got Talent Dispute

May 20, 2025