BigBear.ai (BBAI) Stock Price Drop In 2025: Causes And Analysis

Table of Contents

Macroeconomic Factors Influencing BBAI Stock Performance in 2025

Several macroeconomic factors could significantly influence BBAI's stock performance in 2025. Understanding these external pressures is crucial for assessing the potential for a BBAI stock price drop.

Interest Rate Hikes and Inflation

Rising interest rates directly impact investor sentiment towards growth stocks like BBAI. Higher rates increase borrowing costs for companies, potentially slowing down expansion and reducing profitability. This makes investors less willing to pay a premium for future growth, leading to lower valuations for companies like BBAI.

- Impact on Investor Sentiment: Higher interest rates often shift investor preference towards more conservative, fixed-income investments. This can lead to a sell-off in riskier growth stocks, including AI companies.

- Inflation's Role: High inflation erodes purchasing power, potentially reducing consumer spending and impacting the adoption rate of AI-driven solutions. Lower demand for AI services can negatively affect BBAI's revenue and, consequently, its stock price.

- Federal Reserve Actions: The decisions made by the Federal Reserve regarding interest rate adjustments will directly influence the overall market environment and significantly impact the BBAI stock price. Aggressive rate hikes could trigger a broader market correction, negatively impacting BBAI.

Geopolitical Instability and its Impact on the Tech Sector

Geopolitical instability can create uncertainty in the global economy, affecting investment in technology sectors like AI. Conflicts, trade wars, or sanctions can disrupt supply chains, hinder international collaborations, and impact market access for companies like BBAI.

- Global Uncertainty: Political tensions and economic sanctions can create volatility in the stock market, increasing risk aversion among investors. This can lead to a decline in the BBAI stock price as investors seek safer investments.

- Supply Chain Disruptions: Geopolitical events can disrupt the supply chain for critical components used in AI technologies, leading to increased production costs and delays for BBAI.

- Trade Policies: Changes in international trade policies can impact BBAI's ability to operate globally, potentially limiting market access and reducing revenue streams.

Company-Specific Factors Contributing to a BBAI Stock Price Decline

Beyond macroeconomic forces, internal company-specific issues can also contribute to a BBAI stock price drop. These factors need careful consideration when evaluating the risk profile of BBAI stock.

Missed Earnings Expectations and Revenue Shortfalls

Failure to meet earnings expectations can trigger a significant sell-off in BBAI stock. Several scenarios could contribute to such shortfalls.

- Competitive Pressure: Intense competition from other AI companies could lead to reduced market share and lower-than-projected revenue for BBAI.

- Contract Challenges: Difficulties in delivering projects on time and within budget can result in revenue shortfalls and negatively impact investor confidence.

- Lower-Than-Projected Demand: A slowdown in the demand for BBAI's AI and data analytics services could also cause revenue shortfalls.

Leadership Changes and Management Turnover

Changes in leadership can create uncertainty and negatively impact investor confidence in BBAI. This is particularly true if the changes suggest a shift in company strategy or a lack of stability.

- Impact on Strategy: A change in leadership could lead to a reassessment of the company's strategy, potentially delaying projects or impacting investor perception of future growth potential.

- Organizational Restructuring: Internal restructuring and organizational changes can create temporary disruptions and may negatively impact operational efficiency and profitability.

- Key Personnel Departures: The loss of key personnel, especially those with crucial expertise, can severely affect BBAI's performance and innovation capabilities.

Technological Disruptions and Shifting Market Trends

Rapid technological advancements in the AI field could render BBAI's current offerings obsolete, threatening its market position and future profitability.

- Technological Obsolescence: The emergence of new, superior AI technologies could make BBAI's current products and services less competitive.

- Adaptability Challenges: BBAI's ability to adapt to evolving market demands and integrate new technologies will be crucial in maintaining its competitive edge.

- Competitive Innovations: Innovative offerings from competitors could disrupt BBAI’s market share and significantly affect their stock price.

Investor Sentiment and Market Speculation Surrounding BBAI

Investor sentiment and market speculation play a crucial role in determining the BBAI stock price. Negative news or perceptions can quickly lead to a sell-off.

Negative Analyst Ratings and Sell-Offs

Negative analyst ratings can significantly influence investor behavior. Large institutional investors might react to these ratings by selling off their BBAI holdings, triggering a price decline.

- Analyst Reports: Negative reports from reputable financial analysts can trigger a sell-off, causing a drop in the BBAI stock price.

- Institutional Investor Actions: Large institutional investors often react to negative news by divesting their holdings, further exacerbating any price decline.

- Social Media and News Coverage: Negative news coverage and social media sentiment can also impact investor perception and fuel sell-offs.

Overvaluation and Market Corrections

If BBAI's stock price was overvalued in the preceding period, a market correction could lead to a significant price decline.

- Overvaluation Risk: High-growth technology stocks, like BBAI, are sometimes susceptible to overvaluation during periods of strong market optimism.

- Market Corrections: Market corrections are common and can significantly impact high-growth stocks, leading to substantial price drops.

- Historical Precedents: Examining historical market corrections and their impact on similar high-growth technology companies can provide valuable insights into the potential severity of a BBAI stock price decline.

Conclusion

This analysis explored several factors that could hypothetically contribute to a decline in BigBear.ai (BBAI) stock price in 2025. These include macroeconomic headwinds, company-specific challenges, and shifting investor sentiment. Understanding these potential risks is crucial for informed investment decisions.

Call to Action: While this is a hypothetical analysis of potential risks to BBAI stock, staying informed about macroeconomic trends, company performance, and market sentiment is critical for all investors. Continue researching BigBear.ai (BBAI) and other relevant AI stocks to make educated investment choices regarding BBAI and the broader AI market. Conduct thorough due diligence before making any investment decisions related to BBAI stock or any other security. Remember that investing in BBAI stock, or any stock, involves risk. This analysis is for informational purposes only and should not be considered investment advice.

Featured Posts

-

Ing Group 2024 Annual Report Form 20 F Released

May 21, 2025

Ing Group 2024 Annual Report Form 20 F Released

May 21, 2025 -

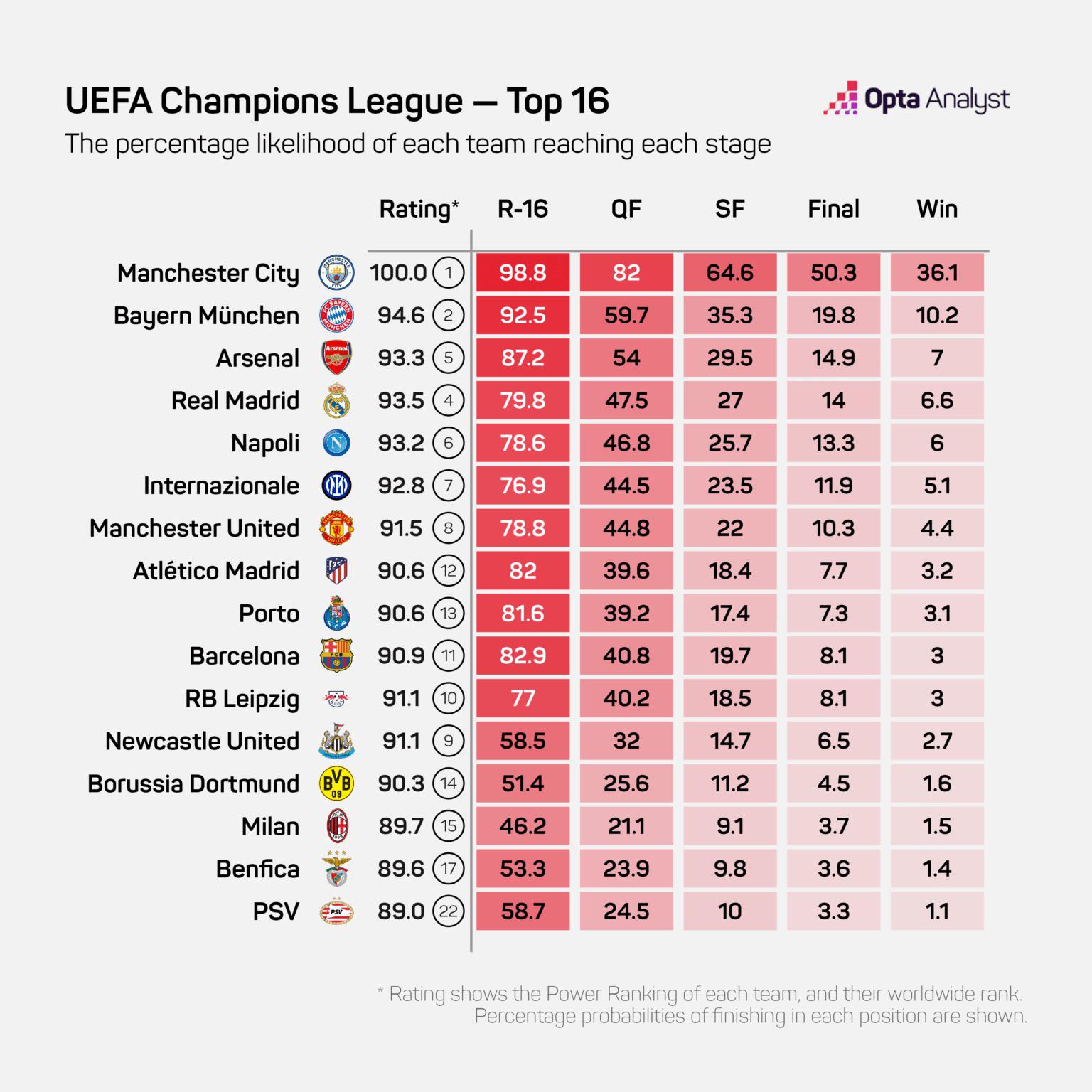

Champions League I Kroyz Azoyl Toy Giakoymaki Ston Teliko

May 21, 2025

Champions League I Kroyz Azoyl Toy Giakoymaki Ston Teliko

May 21, 2025 -

Clisson Hell City La Brasserie Ideale Avant Apres Le Hellfest

May 21, 2025

Clisson Hell City La Brasserie Ideale Avant Apres Le Hellfest

May 21, 2025 -

Exploring The Reasons Behind D Wave Quantum Qbts S Stock Rally

May 21, 2025

Exploring The Reasons Behind D Wave Quantum Qbts S Stock Rally

May 21, 2025 -

Daftar Juara Premier League 10 Tahun Terakhir And Peluang Liverpool Di Musim 2024 2025

May 21, 2025

Daftar Juara Premier League 10 Tahun Terakhir And Peluang Liverpool Di Musim 2024 2025

May 21, 2025

Latest Posts

-

1 3

May 22, 2025

1 3

May 22, 2025 -

Thlathy Jdyd Fy Tshkylt Mntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Thlathy Jdyd Fy Tshkylt Mntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

Almntkhb Alamryky Andmam Thlathy Jdyd Lawl Mrt

May 22, 2025

Almntkhb Alamryky Andmam Thlathy Jdyd Lawl Mrt

May 22, 2025 -

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

Bwtshytynw Ydm Thlathy Jdyd Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ydm Thlathy Jdyd Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025