BigBear.ai Faces Securities Fraud Lawsuit: What Investors Need To Know

Table of Contents

The Allegations Against BigBear.ai

The lawsuit against BigBear.ai centers on allegations of securities fraud, claiming the company misled investors through a series of deceptive actions. These allegations paint a picture of a company that may have knowingly misrepresented its financial health and business prospects to inflate its stock price. The plaintiff(s) – [Insert name(s) of plaintiff(s) and/or law firm, if known] – are seeking significant financial compensation for alleged losses resulting from this alleged fraudulent activity.

The core allegations revolve around several key areas:

- Allegation 1: [Specific detail, e.g., Inflated revenue figures reported in quarterly and annual financial statements, possibly through the improper recognition of revenue or the inclusion of non-revenue generating activities.] This allegedly violated Generally Accepted Accounting Principles (GAAP).

- Allegation 2: [Specific detail, e.g., Misrepresentation of key contracts and partnerships, exaggerating the size, scope, and potential profitability of agreements with clients.] This misled investors about the company's true market position and future prospects.

- Allegation 3: [Specific detail, e.g., Insider trading allegations, suggesting that certain executives may have sold shares based on non-public information about the company's true financial condition.] This raises serious concerns about corporate governance and ethical conduct.

These allegations, if proven, could have far-reaching consequences for BigBear.ai and its stakeholders.

Impact on BigBear.ai's Stock Price and Investor Confidence

The securities fraud lawsuit has already had a significant impact on BigBear.ai's stock price. Following the announcement, the stock experienced [Describe the immediate impact, e.g., a sharp decline]. This volatility reflects the uncertainty surrounding the company's future and the potential for substantial financial penalties.

The long-term impact on investor confidence is equally troubling. The allegations undermine trust in the company's management and its ability to accurately represent its financial performance. This can lead to:

- Short-term price volatility: Fluctuations in stock price as investors react to news and developments in the lawsuit.

- Long-term investor confidence erosion: A potential decline in investor interest, making it difficult for the company to raise capital or attract new investment.

- Potential for delisting: In extreme cases, severe financial repercussions could lead to BigBear.ai being delisted from stock exchanges.

[Insert chart or graph illustrating stock price fluctuations if available. Clearly label axes and source.]

Legal Ramifications and Potential Outcomes of the Lawsuit

The legal process surrounding this securities fraud lawsuit could be lengthy and complex. The potential outcomes are multifaceted:

- Settlement with financial penalties: BigBear.ai might choose to settle the lawsuit, agreeing to pay a significant sum to the plaintiff(s) to avoid a protracted and potentially more costly trial.

- Court ruling in favor of the plaintiff(s): A court ruling against BigBear.ai could result in substantial financial penalties, including damages to compensate investors for their losses.

- Dismissal of the lawsuit: It's possible the court could dismiss the lawsuit if the plaintiffs fail to present sufficient evidence to support their claims. However, this is less likely given the initial filing.

The financial implications for BigBear.ai could be substantial, potentially impacting its operations, profitability, and even its long-term viability. The legal processes involved will likely include discovery, depositions, and potentially a trial, extending the uncertainty for investors over an extended period.

Advice for BigBear.ai Investors

The current situation demands careful consideration from BigBear.ai investors. It's crucial to adopt a proactive approach to mitigate potential risks:

- Diversify your investment portfolio: Don't put all your eggs in one basket. Spreading your investments across different asset classes can help reduce your exposure to the risks associated with BigBear.ai.

- Monitor the legal proceedings closely: Stay informed about the developments in the lawsuit through official company statements, news reports, and SEC filings.

- Consult a financial advisor: Seek professional advice tailored to your individual circumstances to make informed decisions regarding your BigBear.ai investment.

Conclusion: Navigating the BigBear.ai Securities Fraud Lawsuit – Next Steps for Investors

The securities fraud lawsuit against BigBear.ai presents a significant challenge for investors. The allegations of misleading financial statements, misrepresentation of contracts, and potential insider trading have created substantial uncertainty and impacted the company's stock price and investor confidence. The potential legal outcomes range from financial penalties to a court ruling in favor of the plaintiffs, potentially impacting the company's future. It is crucial for investors to closely monitor the legal proceedings, diversify their portfolios, and seek professional financial advice to navigate this complex situation effectively. Stay informed about the developments in the BigBear.ai securities fraud lawsuit. Protect your investments by conducting thorough due diligence before investing in any company facing similar legal challenges.

Featured Posts

-

Cote D Ivoire Impact Du Diletta Sur Les Activites Portuaires D Abidjan

May 20, 2025

Cote D Ivoire Impact Du Diletta Sur Les Activites Portuaires D Abidjan

May 20, 2025 -

Haekkinen On Schumacher F1 Future Still Possible

May 20, 2025

Haekkinen On Schumacher F1 Future Still Possible

May 20, 2025 -

Wayne Gretzky And The Canada Us Relationship Examining The Impact Of Trumps Policies

May 20, 2025

Wayne Gretzky And The Canada Us Relationship Examining The Impact Of Trumps Policies

May 20, 2025 -

Two Decades Of Influence Justices Alito And Roberts Impact

May 20, 2025

Two Decades Of Influence Justices Alito And Roberts Impact

May 20, 2025 -

Suki Waterhouses Full Circle Met Gala Appearance A Fashion Statement

May 20, 2025

Suki Waterhouses Full Circle Met Gala Appearance A Fashion Statement

May 20, 2025

Latest Posts

-

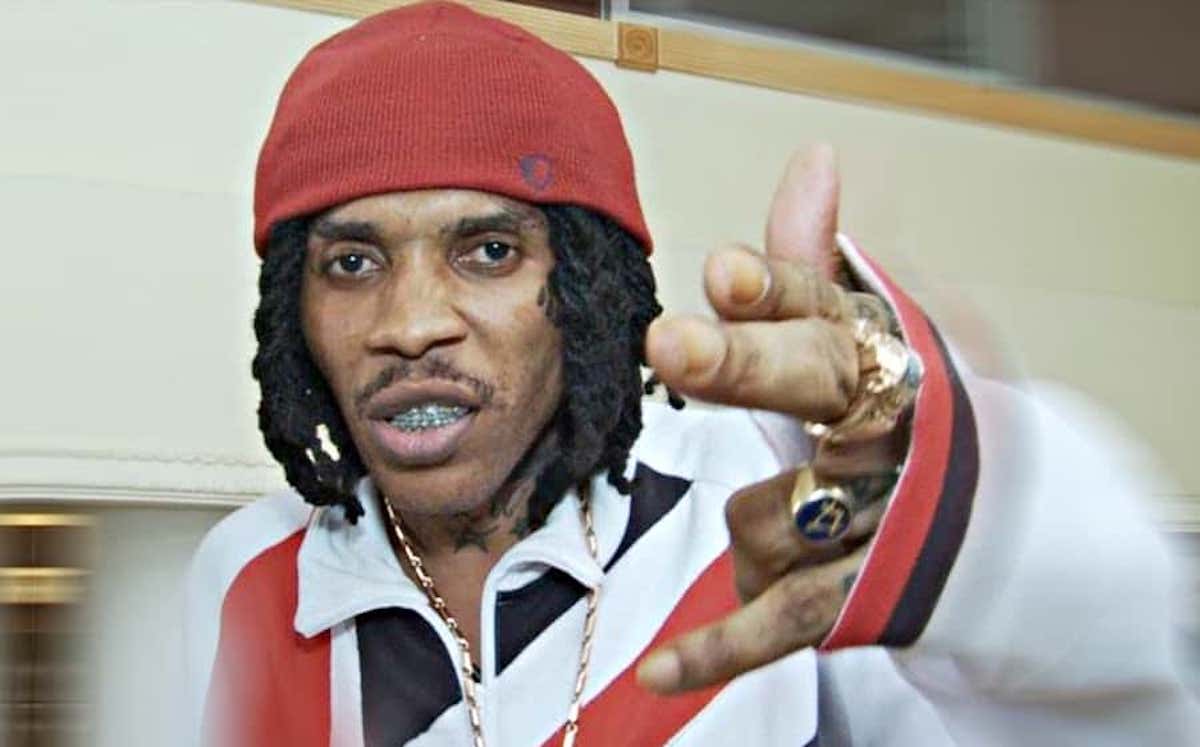

The Untold Story Vybz Kartel Addresses Prison Family And New Music

May 21, 2025

The Untold Story Vybz Kartel Addresses Prison Family And New Music

May 21, 2025 -

Exclusive Vybz Kartel On Prison Family And Upcoming Music

May 21, 2025

Exclusive Vybz Kartel On Prison Family And Upcoming Music

May 21, 2025 -

Vybz Kartel Breaks Silence Prison Freedom And His Future

May 21, 2025

Vybz Kartel Breaks Silence Prison Freedom And His Future

May 21, 2025 -

Vybz Kartel Speaks Prison Life Family And New Music

May 21, 2025

Vybz Kartel Speaks Prison Life Family And New Music

May 21, 2025 -

Vybz Kartel In New York A Landmark Concert Event

May 21, 2025

Vybz Kartel In New York A Landmark Concert Event

May 21, 2025