BigBear.ai Stock: A Potential Investment Opportunity?

Table of Contents

BigBear.ai's Business Model and Services

BigBear.ai provides AI-powered solutions across various sectors, primarily focusing on government and commercial clients. Their offerings leverage cutting-edge artificial intelligence, machine learning, and data analytics to solve complex problems.

AI-Powered Solutions:

BigBear.ai's portfolio encompasses a range of services, including:

-

Data Analytics: They utilize advanced algorithms to analyze massive datasets, extracting valuable insights for improved decision-making across diverse industries. This includes predictive analytics, helping clients anticipate future trends and challenges.

-

Cybersecurity Solutions: BigBear.ai develops and deploys sophisticated AI-driven cybersecurity tools to protect sensitive information and infrastructure from increasingly sophisticated cyber threats. Their solutions involve threat detection, incident response, and vulnerability management.

-

Intelligence Services: Leveraging their AI expertise, BigBear.ai assists clients in gathering, analyzing, and interpreting complex intelligence data, enhancing national security and business decision-making. This involves predictive modeling and risk assessment.

-

Specific examples of successful projects remain largely undisclosed for security and competitive reasons, but the company’s reports showcase a focus on large, high-value contracts in the government and defense sectors. This highlights a potential strength of BigBear.ai, its focus on a high-margin market. BigBear.ai's unique selling proposition lies in its ability to integrate various AI technologies to provide comprehensive and tailored solutions to complex problems.

Financial Performance and Growth Prospects

Assessing the financial health of BigBear.ai is crucial for any potential investor. While detailed financial data fluctuates, analysis needs to consider revenue growth, earnings per share (EPS), profitability, and market capitalization.

Revenue and Earnings Analysis:

- While publicly available financial statements show variability, consistent revenue growth is a key indicator to watch. Significant contracts secured demonstrate strong growth potential.

- Profitability is another key factor. Analyze profit margins and compare them to industry averages. Understanding the company's path to profitability is crucial for long-term investment success.

- Market capitalization reflects the overall valuation of BigBear.ai. Changes in market capitalization may reflect market sentiment and investor confidence.

BigBear.ai's growth trajectory will depend on its ability to secure and deliver on large-scale contracts, expand into new markets, and successfully integrate acquisitions. Any significant partnerships or mergers and acquisitions will heavily impact the company's future financial performance.

Competitive Landscape and Market Position

The AI market is fiercely competitive, and understanding BigBear.ai's position within this landscape is critical.

Key Competitors:

BigBear.ai faces competition from established tech giants and numerous specialized AI companies. Identifying key competitors allows for a comprehensive analysis of BigBear.ai's competitive advantages and potential challenges. These competitors often specialize in specific AI sub-fields.

- Comparing BigBear.ai's strengths and weaknesses relative to its competitors, such as its focus on government contracts versus broader commercial applications, is essential for a balanced view.

- Assessing BigBear.ai's market share, even within its niche, is a crucial element of risk assessment.

- Potential threats from new entrants or disruptive technologies represent a significant challenge for all AI companies, including BigBear.ai. Staying ahead of technological advancements is critical for maintaining competitiveness.

Risks and Challenges for BigBear.ai Investors

Investing in BigBear.ai stock involves significant risks. Understanding these risks before investing is vital.

Potential Downside:

- Investment Risk: The stock market is inherently volatile, and BigBear.ai stock is no exception. Market fluctuations can cause rapid price swings, resulting in potential losses.

- Technological Risk: Rapid advancements in AI technology pose a threat. Competitors might develop superior solutions, making BigBear.ai's offerings obsolete.

- Financial Risk: The company's financial performance is subject to variability, influenced by contract wins, expenses, and broader market conditions. A downturn in the economy or government spending could significantly impact their business.

- Geopolitical Factors and Regulatory Hurdles: Government regulations and geopolitical instability can significantly impact BigBear.ai’s contracts and operations, presenting unforeseen challenges.

Conclusion

BigBear.ai operates in a high-growth sector with the potential for significant returns. However, investing in BigBear.ai shares involves substantial risk due to market volatility, competition, and the inherent uncertainties in the AI market. Its financial performance, while showing growth potential, needs close monitoring. The company's focus on a niche market and its reliance on large government contracts present both strengths and potential vulnerabilities. Conduct your own thorough due diligence before making any investment decisions regarding BigBear.ai stock. Remember to diversify your portfolio appropriately. Consider BigBear.ai shares as part of a wider investment strategy, taking into account your personal risk tolerance.

Featured Posts

-

Paulina Gretzky As A Soprano Stunning Leopard Dress Photos

May 20, 2025

Paulina Gretzky As A Soprano Stunning Leopard Dress Photos

May 20, 2025 -

Huuhkajien Valmennus Uudet Suunnitelmat Mm Karsintoja Varten

May 20, 2025

Huuhkajien Valmennus Uudet Suunnitelmat Mm Karsintoja Varten

May 20, 2025 -

Best Wireless Headphones Key Improvements And Innovations

May 20, 2025

Best Wireless Headphones Key Improvements And Innovations

May 20, 2025 -

New Mexico Gop Arson Attack Examining The Role Of Abc Cbs And Nbc In News Reporting

May 20, 2025

New Mexico Gop Arson Attack Examining The Role Of Abc Cbs And Nbc In News Reporting

May 20, 2025 -

Backstage Buzz Why Tony Hinchcliffes Wwe Segment Didnt Work

May 20, 2025

Backstage Buzz Why Tony Hinchcliffes Wwe Segment Didnt Work

May 20, 2025

Latest Posts

-

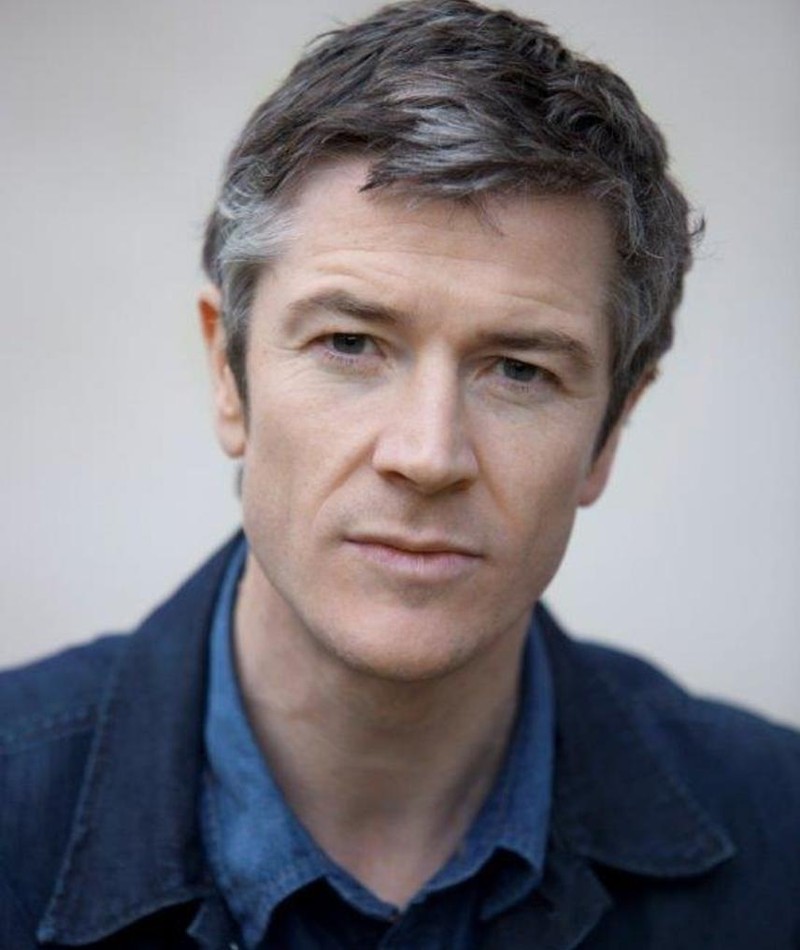

Barry Ward Cop Roles And The Challenges Of Typecasting

May 21, 2025

Barry Ward Cop Roles And The Challenges Of Typecasting

May 21, 2025 -

Irish Actor Barry Ward An Interview On Roles And Perceptions

May 21, 2025

Irish Actor Barry Ward An Interview On Roles And Perceptions

May 21, 2025 -

Barry Ward Discusses His Career From Cop Roles To Beyond

May 21, 2025

Barry Ward Discusses His Career From Cop Roles To Beyond

May 21, 2025 -

Barry Ward Interview The Irish Actor On Typecasting

May 21, 2025

Barry Ward Interview The Irish Actor On Typecasting

May 21, 2025 -

Echo Valley Images Offer Glimpse Into New Thriller With Sydney Sweeney And Julianne Moore

May 21, 2025

Echo Valley Images Offer Glimpse Into New Thriller With Sydney Sweeney And Julianne Moore

May 21, 2025