BigBear.ai Stock: Buy, Sell, Or Hold? A Detailed Look

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai is a leading provider of artificial intelligence (AI)-powered solutions for national security, intelligence, and commercial sectors. Their advanced data analytics and cybersecurity capabilities make them a key player in a rapidly evolving market. Understanding their business model is crucial for assessing BigBear.ai stock's potential.

Understanding BigBear.ai's Services:

BigBear.ai offers a suite of cutting-edge services, leveraging the power of AI and machine learning to solve complex problems. Their core offerings include:

- National security contracts: BigBear.ai provides critical support to government agencies, focusing on intelligence gathering, threat analysis, and mission support.

- Commercial data analytics solutions: They offer data-driven insights and solutions to businesses across various industries, helping them optimize operations and make better strategic decisions.

- Cybersecurity consulting: Their expertise in cybersecurity helps organizations protect their sensitive data and infrastructure from cyber threats.

Competitive Analysis:

BigBear.ai operates in a competitive landscape, facing established players like Palantir, CACI International, and Booz Allen Hamilton. While these competitors possess significant resources and market share, BigBear.ai differentiates itself through its focus on AI-driven solutions and its agility in adapting to emerging technologies. A thorough understanding of the competitive dynamics is vital when evaluating BigBear.ai stock.

- Palantir: A major competitor with a strong presence in government and commercial sectors.

- CACI International: A large, diversified government services company with overlapping capabilities.

- Booz Allen Hamilton: Another significant player in the government consulting and technology space.

Financial Performance and Valuation of BigBear.ai Stock

Analyzing the financial health of BigBear.ai is crucial for assessing the investment potential of its stock. Examining key financial metrics provides valuable insights into its growth trajectory and financial stability.

Revenue Growth and Profitability:

BigBear.ai's revenue growth, profitability, and debt levels are key indicators of its financial performance. Investors should review their quarterly and annual financial statements (available via the SEC's EDGAR database and the company's investor relations website) to track these metrics. Look for consistent revenue growth, improving profit margins, and manageable debt levels.

- Revenue growth in the last quarter: Analyze the percentage increase or decrease compared to the previous quarter and year.

- Net income (or loss): Determine the company's profitability and its trend over time.

- Debt levels: Assess the company's debt-to-equity ratio to gauge its financial risk.

Valuation Metrics:

Determining the intrinsic value of BigBear.ai stock requires examining key valuation metrics. These metrics help compare BigBear.ai’s valuation to its peers and the broader market.

- P/E ratio: A measure of how much investors are willing to pay for each dollar of earnings. Compare BigBear.ai's P/E ratio to industry averages.

- P/S ratio: A measure of how much investors are willing to pay for each dollar of sales. This is often used for companies with negative earnings.

- Market capitalization: Represents the total market value of the company's outstanding shares.

Risk Factors Associated with Investing in BigBear.ai Stock

Investing in BigBear.ai stock, like any investment, carries inherent risks. Understanding these risks is essential for making informed investment decisions.

Market Volatility and Uncertainty:

The stock market is inherently volatile, and BigBear.ai stock is no exception. The company operates in a competitive and rapidly changing industry, making its performance susceptible to market fluctuations.

- Loss of major contracts: Losing key government contracts could significantly impact revenue.

- Increased competition: The emergence of new competitors or the expansion of existing ones could erode market share.

- Economic downturn: A general economic slowdown could reduce demand for BigBear.ai's services.

Geopolitical Risks and Regulatory Changes:

BigBear.ai’s significant government contracts make it susceptible to geopolitical risks and regulatory changes. Changes in government policy or international relations could impact its business.

- Geopolitical instability: International conflicts or tensions could disrupt operations or reduce demand for its services.

- Regulatory changes: New regulations or changes in government procurement processes could affect the company's ability to win contracts.

BigBear.ai Stock Price Prediction and Analyst Opinions

While predicting future stock prices is inherently speculative, analyzing analyst opinions and technical indicators (with caution) can offer some insights.

Price Target Forecasts:

Several financial analysts provide price target forecasts for BigBear.ai stock. These forecasts should be considered alongside other factors and are not guarantees of future performance. It’s crucial to consult multiple sources and understand the underlying assumptions of these forecasts.

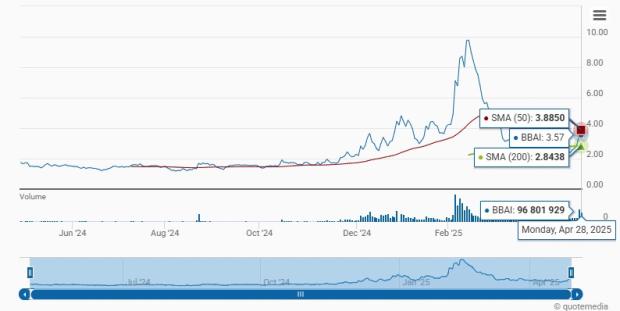

Technical Analysis (Optional):

Technical analysis, while not a foolproof method, can provide additional insights for experienced investors. Studying indicators such as moving averages and support/resistance levels might aid in understanding potential price movements. However, it's important to remember that technical analysis is not a predictive tool and should be used cautiously. (Disclaimer: The author is not a financial advisor and this analysis should not be considered financial advice).

Conclusion:

BigBear.ai stock presents both opportunities and risks. The company's strong position in the AI and national security sectors offers growth potential, but market volatility, competition, and geopolitical uncertainties pose significant challenges. Based on the analysis of its business model, financial performance, and associated risks, [Insert Buy, Sell, or Hold Recommendation Here – and justify this recommendation based on the findings above]. Remember that this is just one perspective; thorough due diligence is essential before making any investment decisions concerning BigBear.ai stock.

Ultimately, the decision on whether to buy, sell, or hold BigBear.ai stock rests with you. Conduct thorough research and carefully consider the information presented before making any investment choices. Consult with a qualified financial advisor before making any investment decisions related to BigBear.ai stock or any other security.

Featured Posts

-

Sandylands U Tv Guide Your Complete Episode Guide

May 20, 2025

Sandylands U Tv Guide Your Complete Episode Guide

May 20, 2025 -

Wwe Raw Results May 19 2025 Winners And Match Grades

May 20, 2025

Wwe Raw Results May 19 2025 Winners And Match Grades

May 20, 2025 -

L Ia Au Service De L Ecriture Des Cours Inspires D Agatha Christie Succes Ou Echec

May 20, 2025

L Ia Au Service De L Ecriture Des Cours Inspires D Agatha Christie Succes Ou Echec

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025 -

Matchs Pro D2 Colomiers Contre Oyonnax Et Montauban Contre Brive

May 20, 2025

Matchs Pro D2 Colomiers Contre Oyonnax Et Montauban Contre Brive

May 20, 2025

Latest Posts

-

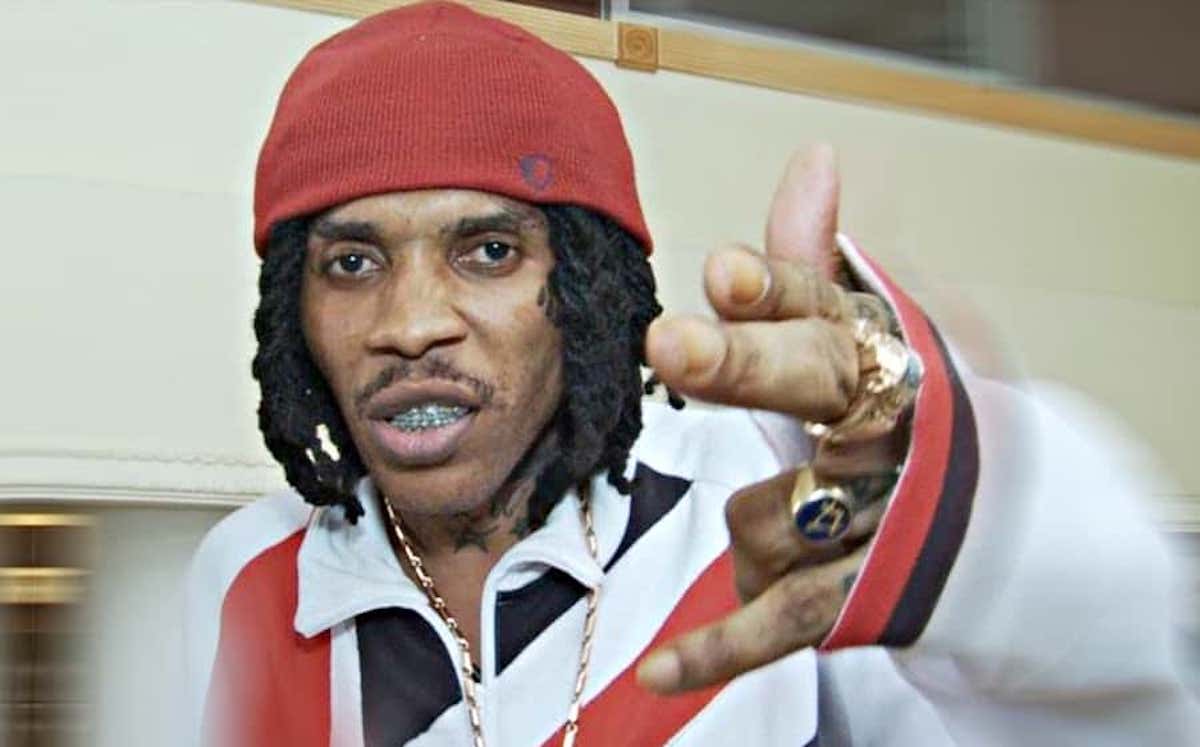

The Untold Story Vybz Kartel Addresses Prison Family And New Music

May 21, 2025

The Untold Story Vybz Kartel Addresses Prison Family And New Music

May 21, 2025 -

Exclusive Vybz Kartel On Prison Family And Upcoming Music

May 21, 2025

Exclusive Vybz Kartel On Prison Family And Upcoming Music

May 21, 2025 -

Vybz Kartel Breaks Silence Prison Freedom And His Future

May 21, 2025

Vybz Kartel Breaks Silence Prison Freedom And His Future

May 21, 2025 -

Vybz Kartel Speaks Prison Life Family And New Music

May 21, 2025

Vybz Kartel Speaks Prison Life Family And New Music

May 21, 2025 -

Vybz Kartel In New York A Landmark Concert Event

May 21, 2025

Vybz Kartel In New York A Landmark Concert Event

May 21, 2025