BigBear.ai Stock Takes A Hit After Below-Expectations Q1 Report

Table of Contents

Q1 Earnings Miss Expectations – Key Metrics Underperform

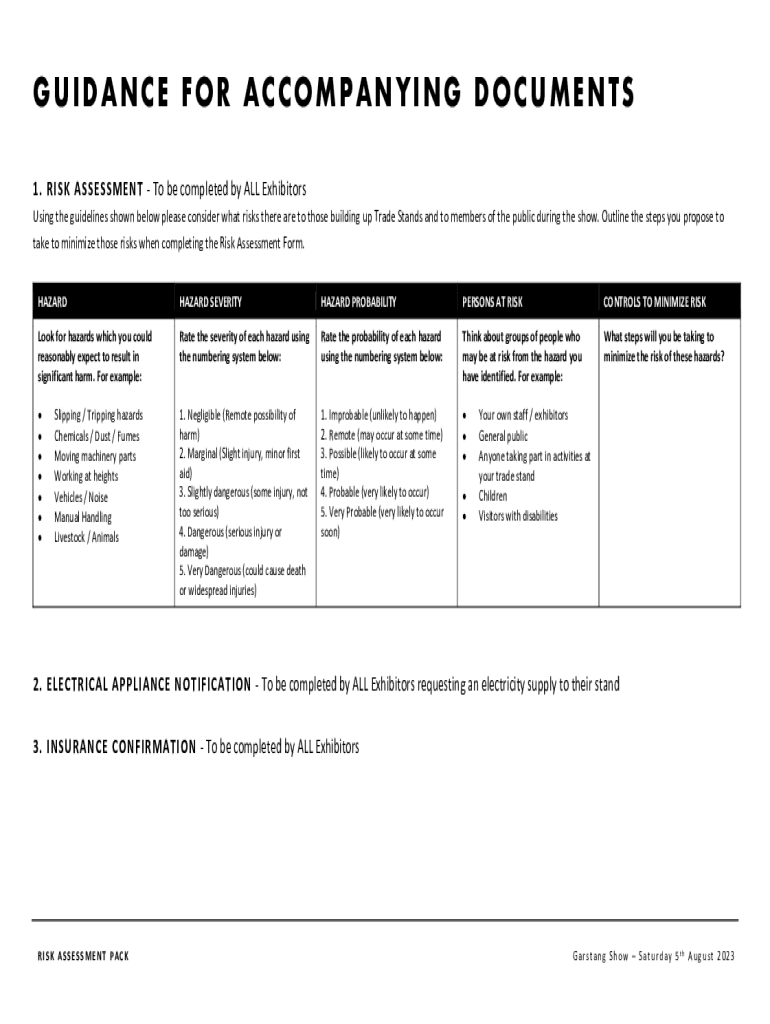

BigBear.ai's Q1 earnings report revealed a significant shortfall across key performance indicators, leading to widespread disappointment among investors. The company missed analyst predictions in several critical areas:

-

Revenue Shortfall: Revenue came in at $XX million, significantly below the projected $YY million, representing a ZZ% decrease compared to Q4 2023. This revenue shortfall is a major concern, indicating potential challenges in securing and delivering contracts.

-

EPS Miss: Earnings per share (EPS) fell short of expectations, with a reported EPS of $X compared to the anticipated $Y. This signifies a decline in profitability and raises questions about the company's financial health.

-

Contract Delays: A considerable number of anticipated contract wins were delayed, contributing significantly to the revenue shortfall. This suggests challenges in the sales pipeline and potential difficulties in navigating the complex government contracting process.

The reasons behind this underperformance are multifaceted. Potential causes include increased competition in the AI market, delays in securing government contracts, and possibly internal challenges related to operational efficiency or strategic execution. A deeper dive into the company's financial statements and management commentary is needed to fully understand the extent of these issues. A detailed breakdown of these factors, accompanied by relevant charts and graphs illustrating the revenue and EPS discrepancies, would provide a clearer picture.

Investor Reaction and Market Sentiment

The immediate market reaction to BigBear.ai's Q1 report was swift and negative. The BigBear.ai stock price experienced a sharp decline, reflecting a significant loss of investor confidence. Trading volume spiked as investors reacted to the disappointing news, resulting in increased market volatility.

News articles and analyst reports highlighted growing investor concerns. Many analysts expressed disappointment with the Q1 results, citing the revenue shortfall and EPS miss as key factors driving the stock price decline. The overall market sentiment shifted decisively negative, with many investors selling off their BigBear.ai holdings. This sell-off created a downward pressure on the stock price, exacerbating the initial drop. The lack of positive news or clear guidance from BigBear.ai management further fueled the negative sentiment. While there was initial speculation about potential buying opportunities at the lower price point, the prevailing sentiment remained cautious.

BigBear.ai's Response and Future Outlook

In response to the disappointing Q1 results, BigBear.ai's management issued a statement acknowledging the shortfall and outlining planned strategies for improvement. The company highlighted its commitment to strengthening its sales pipeline, enhancing operational efficiency, and focusing on securing high-value contracts. Their future projections, however, remained somewhat cautious. The company's guidance for the next quarters suggests a slow but steady path to recovery, emphasizing a focus on profitability rather than aggressive revenue growth.

This cautious approach reflects the challenges BigBear.ai faces in navigating a competitive market. While the company’s long-term prospects in the growing AI sector remain promising, the path to recovery might be longer and more challenging than initially anticipated. Investors will be closely monitoring the company's performance in the coming quarters to assess the effectiveness of its turnaround plan and gauge the sustainability of its future growth.

Competition and Market Dynamics

BigBear.ai operates in a dynamic and intensely competitive AI market. Key competitors include established players with significant resources and a strong market presence. These competitors are constantly innovating and vying for the same government and commercial contracts, making the market highly competitive. Furthermore, evolving industry trends, including rapid advancements in AI technology and shifting government priorities, pose additional challenges for BigBear.ai. Analyzing the competitive landscape and understanding market dynamics is crucial to evaluate BigBear.ai's long-term potential.

BigBear.ai Stock: Analyzing the Fallout and What's Next

The Q1 report’s impact on BigBear.ai stock was significant, primarily due to missed earnings expectations, decreased investor confidence, and the challenging competitive landscape. The revenue shortfall and EPS miss are clear indicators of operational challenges that require immediate attention. However, it's important to maintain a balanced perspective. The long-term potential of BigBear.ai within the expanding AI market remains noteworthy, and the company's strategic responses will determine its future trajectory. Stay updated on the latest developments in BigBear.ai stock and its ongoing performance. Monitor future Q reports for further insights into the company's recovery and its ability to navigate the competitive AI market.

Featured Posts

-

Climate Related Financial Risks And Your Home Mortgage Application

May 21, 2025

Climate Related Financial Risks And Your Home Mortgage Application

May 21, 2025 -

Gambling On Disaster The Los Angeles Wildfire Betting Phenomenon

May 21, 2025

Gambling On Disaster The Los Angeles Wildfire Betting Phenomenon

May 21, 2025 -

Occasionmarkt Bloeit Abn Amro Rapporteert Aanzienlijke Verkoopstijging

May 21, 2025

Occasionmarkt Bloeit Abn Amro Rapporteert Aanzienlijke Verkoopstijging

May 21, 2025 -

Your Guide To Sandylands U On Television

May 21, 2025

Your Guide To Sandylands U On Television

May 21, 2025 -

Racial Slur Allegations Prompts Wnba Investigation Of Angel Reese Incident

May 21, 2025

Racial Slur Allegations Prompts Wnba Investigation Of Angel Reese Incident

May 21, 2025

Latest Posts

-

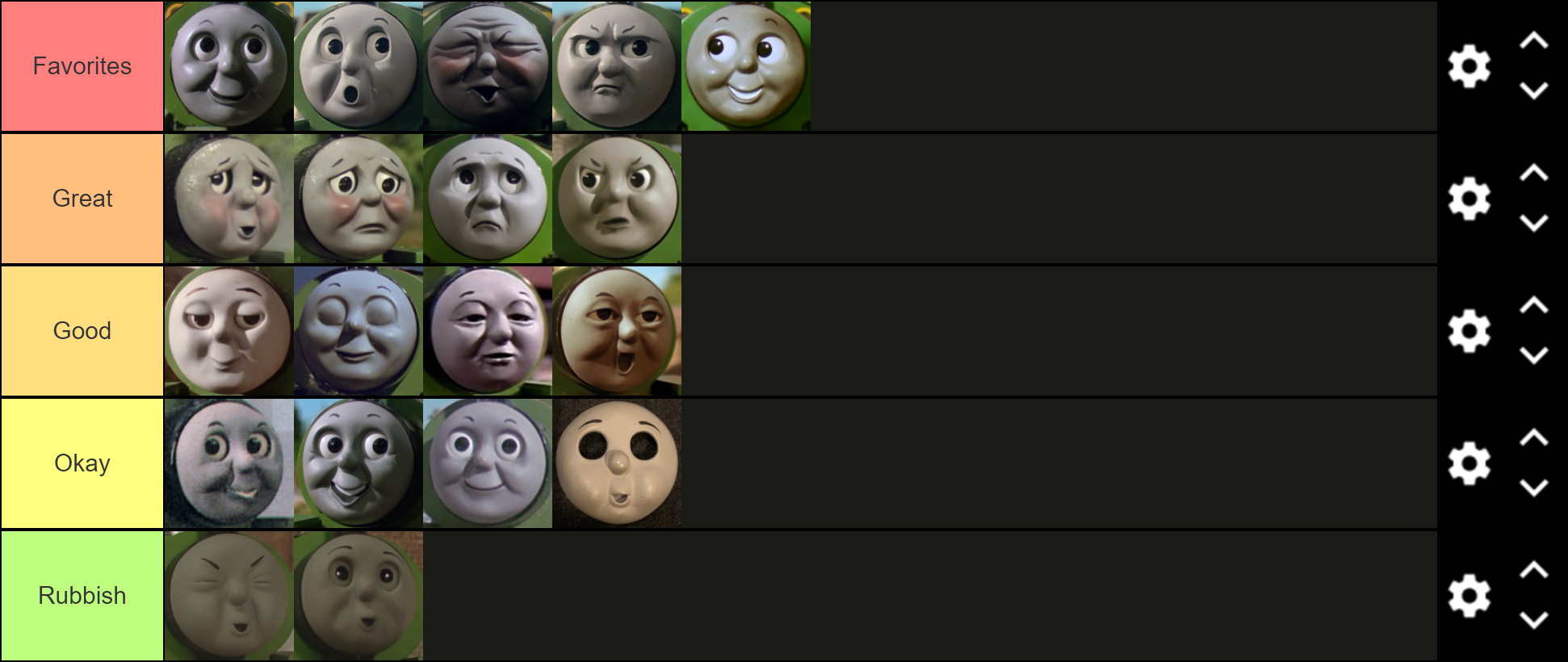

Fut Birthday 2024 Ultimate Team Player Tier List And Ratings

May 22, 2025

Fut Birthday 2024 Ultimate Team Player Tier List And Ratings

May 22, 2025 -

Ea Fc 24 Fut Birthday Top Tier Player Cards And Team Building Guide

May 22, 2025

Ea Fc 24 Fut Birthday Top Tier Player Cards And Team Building Guide

May 22, 2025 -

Athena Calderones Rome Milestone Details Of The Grand Event

May 22, 2025

Athena Calderones Rome Milestone Details Of The Grand Event

May 22, 2025 -

A Look Inside Athena Calderones Extravagant Roman Celebration

May 22, 2025

A Look Inside Athena Calderones Extravagant Roman Celebration

May 22, 2025 -

Ea Fc 24 Fut Birthday Player Tier List Best Cards To Use

May 22, 2025

Ea Fc 24 Fut Birthday Player Tier List Best Cards To Use

May 22, 2025