BigBear.ai Stock: What The Experts Say

Table of Contents

Financial Performance and Analyst Ratings

Analyzing BigBear.ai's financials is crucial for any potential investor. A thorough assessment of its revenue growth, profitability, and debt levels provides a clear picture of its financial health and stability. Examining key metrics like revenue growth, earnings per share (EPS), and debt-to-equity ratio allows investors to determine the company's financial strength. Let's review some key aspects:

-

Review of recent financial reports: Recent quarterly and annual reports should be carefully examined. Look for trends in revenue growth – is it accelerating, stagnating, or declining? Analyze profitability margins – are they improving or worsening? High debt levels can pose a significant risk, so paying close attention to the company's debt burden is essential. BigBear.ai's financial reports should be available on their investor relations website and through major financial news outlets.

-

Summary of analyst ratings and price targets: Reputable financial institutions regularly issue ratings and price targets for BigBear.ai stock. These ratings, ranging from "Buy" to "Sell," offer insights into the collective opinion of financial experts. For instance, while specific ratings can change rapidly, checking major financial news sources for recent updates will provide a current snapshot. Paying attention to the rationale behind these ratings is equally important as the rating itself.

-

Recent upgrades or downgrades: Any recent changes in analyst ratings require careful scrutiny. Understanding the reasoning behind an upgrade or downgrade is crucial. Did the company exceed expectations? Did unforeseen challenges arise? This analysis can provide valuable insights into the company's performance trajectory.

-

Comparison to competitors: BigBear.ai operates in a competitive landscape. Comparing its financial performance and growth trajectory to its main competitors helps contextualize its performance and identify its relative strengths and weaknesses. This comparative analysis can illuminate BigBear.ai's market position and its potential for future growth.

BigBear.ai's Business Model and Growth Strategy

Understanding BigBear.ai's business model and growth strategy is critical to assessing its long-term potential. The company’s core competency lies in leveraging artificial intelligence (AI) and data analytics to deliver advanced solutions across various sectors.

-

Core business and value proposition: BigBear.ai's core business focuses on providing advanced AI-powered solutions, leveraging its proprietary technologies and expertise. Its value proposition lies in its ability to process and analyze vast amounts of data to deliver actionable insights for its clients.

-

Key technologies and competitive advantages: A key element of the BigBear.ai analysis involves understanding its core technologies and how they differentiate it from its competitors. What makes its AI and data analytics capabilities unique? What intellectual property does it possess?

-

Market penetration and growth opportunities: The market for AI and data analytics is vast and rapidly expanding. Assessing BigBear.ai's market penetration and identifying potential growth opportunities within this expanding market is crucial. Where are the biggest growth opportunities for BigBear.ai? Which sectors offer the most promising potential?

-

Expansion plans, partnerships, and acquisitions: BigBear.ai's future growth will likely be shaped by its expansion plans, strategic partnerships, and potential acquisitions. Analyzing these strategic moves provides insights into its long-term vision and potential for growth. Understanding its M&A strategy is key to evaluating its future trajectory.

Risks and Challenges Facing BigBear.ai

While BigBear.ai presents exciting opportunities, investors must also carefully consider the inherent risks and challenges. A comprehensive BigBear.ai analysis needs to account for potential threats to its growth and profitability.

-

Competition: The AI and data analytics sector is highly competitive. Identifying BigBear.ai’s key competitors and assessing their relative strengths and weaknesses is paramount. How will BigBear.ai maintain its competitive edge?

-

Technological disruption: The rapid pace of technological change poses a significant risk. Will BigBear.ai's technologies remain competitive in the face of constant innovation? How adaptable is the company to new technologies?

-

Regulatory changes: Government regulations in the AI and data analytics sectors can significantly impact the company's operations. Understanding the regulatory landscape and its potential implications is crucial. What are the potential regulatory hurdles BigBear.ai faces?

-

Economic downturns: Economic downturns can negatively impact demand for BigBear.ai's services. How resilient is the company to economic fluctuations? What is its contingency plan for periods of economic instability?

Expert Opinions and Predictions for BigBear.ai Stock

The future performance of BigBear.ai stock is a subject of considerable debate among experts. Understanding these varying viewpoints is essential for informed investment decisions.

-

Compilation of expert opinions: Gathering opinions from various financial analysts and industry experts provides a more comprehensive picture. Look for reports and analyses from reputable sources, paying close attention to their reasoning and methodology.

-

Bullish and bearish viewpoints: Identify and understand the arguments for both bullish (positive) and bearish (negative) predictions. What are the key factors driving these differing perspectives?

-

Potential scenarios: Consider different potential scenarios for BigBear.ai’s stock price in both the short-term and the long-term. Developing several potential future scenarios can offer investors a range of possible outcomes to consider.

Conclusion

This analysis of BigBear.ai stock, incorporating expert opinions and financial data, provides a nuanced view of its potential. While the company presents exciting prospects in the AI sector, investors should carefully consider the inherent risks before making investment decisions. Remember to conduct your own thorough due diligence. This BigBear.ai analysis should serve as a starting point, not the final word, in your investment evaluation.

Call to Action: Stay informed about the latest developments in BigBear.ai stock and continue your research to make informed investment decisions regarding BigBear.ai stock. Consider consulting a financial advisor before investing in any stock.

Featured Posts

-

Hegseth Announces New Us Missile System Deployment In The Philippines

May 20, 2025

Hegseth Announces New Us Missile System Deployment In The Philippines

May 20, 2025 -

Diner Exclusif Le Restaurant Rooftop Des Galeries Lafayette Biarritz Avant Son Ouverture A Pau

May 20, 2025

Diner Exclusif Le Restaurant Rooftop Des Galeries Lafayette Biarritz Avant Son Ouverture A Pau

May 20, 2025 -

Deconstructing On This Love Exploring The Lyrics And Themes Of Suki Waterhouses Song

May 20, 2025

Deconstructing On This Love Exploring The Lyrics And Themes Of Suki Waterhouses Song

May 20, 2025 -

Llm Siri Apples Challenges And Solutions

May 20, 2025

Llm Siri Apples Challenges And Solutions

May 20, 2025 -

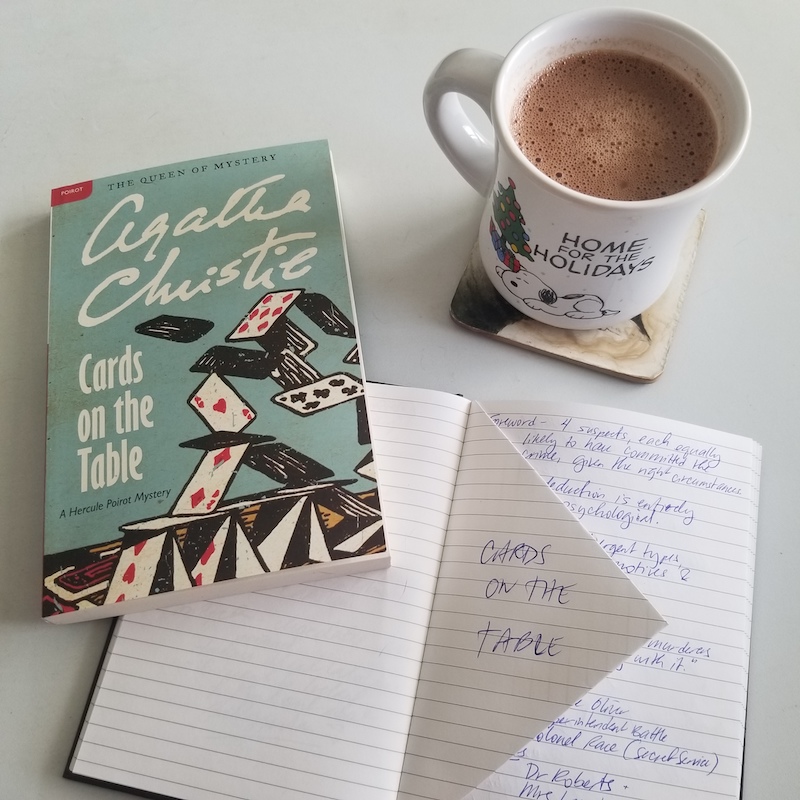

Agatha Christies Poirot A Comprehensive Guide

May 20, 2025

Agatha Christies Poirot A Comprehensive Guide

May 20, 2025

Latest Posts

-

El Regreso De Javier Baez Salud Y Rendimiento En El Campo

May 21, 2025

El Regreso De Javier Baez Salud Y Rendimiento En El Campo

May 21, 2025 -

Javier Baez Recuperacion Productividad Y Futuro En El Beisbol

May 21, 2025

Javier Baez Recuperacion Productividad Y Futuro En El Beisbol

May 21, 2025 -

Espn Insider Deconstructing The Boston Bruins Pivotal Offseason Strategy

May 21, 2025

Espn Insider Deconstructing The Boston Bruins Pivotal Offseason Strategy

May 21, 2025 -

Bruins Offseason Espn Highlights Key Decisions And Franchise Impact

May 21, 2025

Bruins Offseason Espn Highlights Key Decisions And Franchise Impact

May 21, 2025 -

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025